Bitcoin Price Almost Hits $98,000: Key Reasons Behind The Rally

November 21 2024 - 10:30AM

NEWSBTC

Bitcoin has reached a new all-time high, surging to $97,852 on

Binance. The cryptocurrency is up 5% in the last 24 hours and has

gained an impressive 43% over the past 16 days since November 5.

The momentum shows no signs of slowing as BTC price continues its

steady ascent. Several key factors are driving this remarkable

rally: #1 US Strategic Bitcoin Reserve Trade Following Donald

Trump’s victory in the US presidential election, market sentiment

has shifted significantly. The initial “Trump trade” has evolved

into the “US Bitcoin Reserve Trade,” fueled by speculation that

President-elect Trump may establish a Strategic Bitcoin Reserve

(SBR). This follows his pledge at the Bitcoin 2024 conference in

Nashville. Industry insiders like David Bailey, CEO of BTC Inc and

a Trump campaign advisor, and Dennis Porter, CEO of Satoshi Act

Fund, have hinted at the possibility of the SBR becoming a reality.

Both have urged that the SBR be established within the first 100

days of Trump’s presidency through an executive order. They warn of

the United States potentially falling behind in the global race to

accumulate BTC. Related Reading: Countries Are Already Buying

Bitcoin ‘In Huge Volumes’, Says Novogratz Bailey revealed on

November 9, “There is at least one nation-state that has been

actively acquiring Bitcoin and is now a top 5 holder. Hopefully, we

hear from them soon.” He emphasized his certainty with a meme,

indicating his information is based on knowledge rather than

speculation. Mike Novogratz, CEO of Galaxy Digital, confirmed in a

recent interview with Bloomberg TV that “countries are already

buying BTC in huge volumes.” The “US Bitcoin Reserve Trade” is

expected to continue until Trump’s inauguration on January 20. It

remains to be seen whether Trump will follow through on his

promises, potentially moving over 208,000 BTC confiscated by law

enforcement into the reserve or even adopting Senator Cynthia

Lummis’ Bitcoin Act proposal to purchase 1 million BTC over five

years. #2 Potential Appointment Of A ‘Crypto Czar’ A leak on

Wednesday suggests that President-elect Trump’s team is in

discussions about creating a new White House position dedicated

solely to Bitcoin and crypto policy. Sources familiar with the

transition efforts indicate that candidates are being vetted for

this role. If established, it would be the first-ever Bitcoin and

crypto-specific White House position, underscoring the influence

the nascent industry stands to wield in the incoming

administration. It is unclear whether the role will be a senior

White House staff position or a “crypto czar” overseeing policy and

regulation across the federal government. Crypto industry advocates

are pushing for the role to have a direct line to Trump – a massive

news for the entire industry. #3 Launch Of Bitcoin ETF Options The

introduction of Bitcoin ETF options has had a significant impact on

the market. BlackRock’s iShares BTC Trust (IBIT) ETF options,

launched on November 19, 2024, saw an unprecedented $1.9 billion in

notional exposure on their first day of trading. Bloomberg ETF

expert James Seyffart stated, “Final tally of IBIT’s 1st day of

options is just shy of $1.9 billion in notional exposure traded via

354k contracts. 289k were Calls & 65k were Puts. That’s a ratio

of 4.4:1. These options were almost certainly part of the move to

the new Bitcoin all-time highs today.” Related Reading: US Bitcoin

Reserve Will Push Price Above $1 Million, Expert Predicts Jeff

Park, Head of Alpha Strategies at Bitwise Invest, recently

highlighted the game-changing nature of Bitcoin ETF options: With

the approval by the SEC to list and trade Bitcoin ETF options, we

are on the verge of witnessing the most extraordinary upside ‘vol’

of ‘vol’ in financial history. For the first time, Bitcoin’s

notional value will be ‘fractionally banked’ with ETF options. This

marks the most monumental advancement possible for the crypto

market. Park explained that Bitcoin ETF options provide a regulated

market where the Options Clearing Corporation (OCC) protects

clearing members from counterparty risks, allowing Bitcoin’s

synthetic notional exposure to grow exponentially. He emphasized

that this could lead to an explosive recursive effect on Bitcoin’s

price due to unique volatility characteristics and the “volatility

smile.” If there were one thing to read today re the game-changing

nature of Bitcoin ETF options, read (and bookmark) this one for

2025 – it’s going to be wild. pic.twitter.com/On2DmUsbHX — Jeff

Park (@dgt10011) September 20, 2024 #4 Surge In Spot Market And

Bitcoin ETFs The latest rally has also been driven by significant

activity in the spot market. Heavy spot bids have propelled the

price higher, with yesterday’s BTC ETF inflows being a crucial

factor. Inflows amounted to $773.4 million, with BlackRock

contributing $626.5 million, Fidelity $133.9 million, Bitwise $9.2

million, and ARK Invest $3.8 million. Over the past three days, US

spot Bitcoin ETFs have purchased a staggering $1.856 billion worth

of Bitcoin. Good morning, Yesterday’s Bitcoin ETF flows were

positive for $773.4 million. Blackrock did $626.5 million, Fidelity

$133.9 million. (BTC the mini-ETF is still missing data) Price

slowly climbing higher from $92K up to $97k now. Shitcoins are

getting slaughtered. source:… pic.twitter.com/WMYIj7WiYj —

WhalePanda (@WhalePanda) November 21, 2024 The total net asset

value of US Bitcoin spot ETFs has exceeded $100 billion. Twelve

Bitcoin ETFs, including those from BlackRock and Fidelity, were

issued in January and have reached this milestone in just ten

months. At press time, BTC traded at $96,920. Featured image

created with DALL.E, chart from TradingView.com

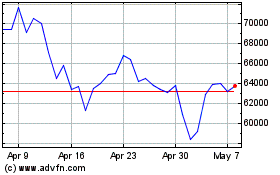

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024