Bitcoin’s Price Dip Triggers Alert On NVT Golden Cross—Here’s What To Watch For

November 26 2024 - 10:30PM

NEWSBTC

Bitcoin price correction from its recent all-time high has sparked

speculation within the crypto community, with many questioning if

the bull run remains intact and what the next price move might be.

Currently, BTC trades at a price below the $95,000 mark, down by

nearly 7% from its all-time high above $99,000 recorded on November

22. Related Reading: Bitcoin Leverage Remains High – Data Reveals

Selling Pressure Above $93K BTC NVT Golden Cross Outlook Amid the

ongoing pullback in its price, a CryptoQuant analyst known as

Darkfost shared insights on the market’s current state, focusing on

a key on-chain metric: the NVT Golden Cross. This metric, which

evaluates the relationship between market capitalization and

transaction volume, recently turned positive. However, Darkfost

cautioned against interpreting this shift as inherently bullish. He

noted that while the current NVT Golden Cross value is low and

doesn’t pose significant risks, traders should keep an eye on it to

avoid potential market pitfalls. Notably, the NVT Golden Cross,

quantifying whether Bitcoin’s market cap is outpacing its

transaction volume, could be a leading indicator for market trends.

According to Darkfost, if the metric climbs to 2.2, it could

suggest that Bitcoin’s valuation exceeds its transactional utility.

In such cases, Darkfost noted that the market might witness a

“reversion to the mean,” signalling potential opportunities for

short positions. The CryptoQuant analyst added: This scenario could

lead to the beginning of a ranging pattern, which might create a

favorable environment for altcoins to perform. Bitcoin Performance

Outlook As Bitcoin trades at $93,196 at the time of writing, down

by 3.3% in the past day, analysts have turned to their respective

sources to assess what is happening with Bitcoin. The crypto market

has experienced significant volatility, with roughly 191,493

traders liquidated in the past 24 hours, accounting for $571.80

million in total liquidations, according to CoinGlass data.

IntoTheBlock, a renowned market intelligence platform, has recently

suggested a major fundamental reason Bitcoin is facing a

correction. In a post uploaded on X earlier today, the platform

reveals that “elevated funding rates” which signal “excessively

leveraged positions” contribute to the ongoing decline in BTC’s

price. IntoTheBlock pointed out that the good news is that “funding

rates have largely normalized,” indicating that the “leverage flush

may have run its course.” Related Reading: Bitcoin Realized Profit

Hits ATH At $443 Million – Local Top Or Continuation? Meanwhile,

from a technical perspective, Bitcoin might be gearing up for a

reversal. Renowned crypto analyst Ali recently took to his X

account to reveal that the TD Sequential for BTC is now presenting

a “buy signal.” The TD Sequential presents a buy signal on the

#Bitcoin $BTC hourly chart, while a bullish divergence forms

against the RSI, which could help #BTC rebound to $95,000 –

$96,000! Join me in this trade by signing up to @coinexcom using my

referral link https://t.co/73n8mW9Y5p. pic.twitter.com/lKozxI8JVP —

Ali (@ali_charts) November 26, 2024 Featured image created with

DALL-E, Chart from TradingView

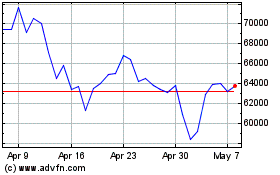

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024