Curve Founder Michael Egorov Clears Aave Loan, Reduces Total Debt To $42.7 Million

September 27 2023 - 4:30PM

NEWSBTC

Michael Egorov, founder of Curve Finance, has settled his loan on

the Aave Protocol and cut his total debt to $42.7 million.

Egorov’s DeFi debt profile was revealed on August 1 following a

Curve Finance hack that extracted $73.5 million worth of assets

across various liquidity pools. As expected, the exploit

caused a significant decline in the price of CRV, with the Curve

governance token losing over 24% of its value in a single day,

based on data from CoinMarketCap. This fall in CRV’s market price

brought much attention to Egorov’s multiple debt positions.

According to a report by blockchain research firm Delphi Digital,

it was revealed that the Curve Finance founder owed around $100

million across several DeFi protocols. Interestingly, these loans

were collateralized by 427.5 million CRV tokens, representing 47%

of the entire CRV circulating supply. Therefore, the

dwindling price of CRV presented a threat of liquidation, which

could have been dangerous to the entire DeFi ecosystem.

Related Reading: Curve Finance Announces $1.85 Million Bounty For

Stable Pool Exploiter Michael Egorov Closes Debt Profile On Aave

Protocol According to a report on Wednesday by the on-chain

analytics platform Lookonchain, Micheal Egorov has now cleared his

debt on the Aave protocol. The report stated that the Curve

Founder deposited 68 million CRV, worth $35.5 million, on DeFi

lending protocol Silo before proceeding to borrow $10.77 million

worth of the stablecoin crvUSD. After that, Egorov swapped the

crvUSD tokens for USDT and finalized the repayment of his debt on

the Aave Protocol. Related Reading: Curve Finance Exploiter

Returns 61,000 ETH After Protocol’s Stern Warning Egorov’s Current

Debt Profile Based on more data from Lookonchain, Michael

Egorov’s total debt now stands at $42.7 million spread across 4

lending protocols: Fraxlend, Silo, Inverse Finance, and Cream

Finance. In detail, the Curve Finance founder has his largest debt

on Silo, where he owes 17.14 million crvUSD backed by 105.8 million

CRV, worth $55.3 million. On Fraxlend, Egorov owes 13.08 million

FRAX, collateralized by 68.7 million CRV, valued at $35.94

million. While on Inverse Finance, Michael Egorov has an

outstanding debt of 10 million DOLA, backed by 66.18 million CRV,

worth $34.5 million. The Curve Finance founder’s lowest debt can be

found on Cream Finance, which comprises 2.02 million USDT and

506,000 USDC, secured by 13 million CRV, valued at $6.8

million. Altogether, Egorov’s $42.7 million debt is backed by

253.67 million CRV, worth $132.53 million, representing 28.87% of

the total CRV circulating supply. CRV trades at $0.516 when

writing, with a 2.99% gain on the last day. Meanwhile, the token’s

daily trading volume is down by 0.73%, valued at $33.85 million.

CRV ranks as the 70th largest cryptocurrency with a market cap

value of $452.87 million. CRV trading at $0.5161 on the hourly

chart | Source: CRVUSDT chart on Tradingview.com Featured image

from Entrepreneur, chart from Tradingview

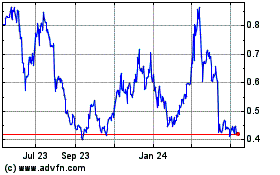

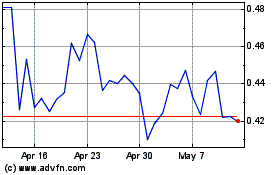

Curve DAO Token (COIN:CRVUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Curve DAO Token (COIN:CRVUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024