Goldman Sachs Embraces Crypto With Three New Initiatives In The Pipeline

July 10 2024 - 10:00PM

NEWSBTC

To capitalize on the growing interest in the crypto industry,

banking giant Goldman Sachs is preparing to enter the tokenization

sector, with three offerings expected to launch later this

year. Goldman Sachs Aims To Capitalize On Tokenization Trend

According to a Fortune report, Mathew McDermott, Global Head of

Digital Assets at Goldman Sachs, revealed the bank’s intentions to

expand its crypto offerings, focusing on the tokenization

sector. Tokenization involves issuing “real-world assets,”

such as money market funds and real estate holdings on public

blockchains such as Ethereum or Solana, leading the bank to plan to

launch three tokenization projects by the end of the year in

partnership with major clients, including its first project in the

United States. Related Reading: Floki Inu To Build Schools In

India, FLOKI Price Seen Hitting $17 While other financial

institutions, such as BlackRock, launched its first tokenized fund

on the Ethereum blockchain in March, McDermott emphasized that

success depends on creating products that investors want. To that

end, Goldman Sachs recently hosted a digital asset summit in London

attended by more than 500 clients. During the Summit, McDermott

emphasized the importance of providing investors with these

solutions that can “fundamentally” change asset management

strategies, stating, “There’s no point in doing it just for the

sake of it. According to the report, Goldman Sachs’ views on crypto

differ within the institution. McDermott acknowledged that varying

perspectives are expected within an institution of their

size. While Sharmin Mossavar-Rahmani, CIO for Goldman Sachs,

voiced skepticism about crypto as an investment asset class,

McDermott emphasized the bank’s active involvement in crypto from

an institutional perspective, including trading cash-settled crypto

derivatives on behalf of clients and their participation in the

recently approved ETF markets. Crypto Opportunities Ahead Of US

Presidential Election As BlackRock successfully launched its

treasury fund, BUIDL, on the Ethereum blockchain, it has garnered

significant attention; McDermott noted that Goldman Sachs primarily

targets institutional clients and intends to work exclusively with

private blockchains due to “regulatory constraints.” Although

McDermott refrained from disclosing specific details about the

upcoming tokenization projects set to debut this year, he revealed

that one project would focus on the US fund complex. At the same

time, another would center around debt issuance in Europe. Related

Reading: Ethereum Rising, 2 Million Addresses Will Be In Money If

$3,200 Is Broken Looking ahead, with the US presidential election

and the potential for a shift in the government’s regulatory stance

on crypto on the horizon, McDermott believes that Goldman Sachs’

opportunities in the space could expand further. This could include

activities like holding spot crypto assets and exploring execution

and sub-custody services, subject to approval. As of this writing,

the largest cryptocurrency on the market, Bitcoin (BTC), was

trading at $57,580, presenting a slight decrease of 0.5% in the

24-hour time frame, aiming to consolidate above this level.

Featured image from DALL-E, chart from TradingView.com

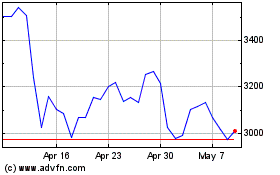

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024