Bitcoin Faces Threat Of Falling To $63,000 Despite Rising Odds For Trump’s Election Victory

November 05 2024 - 1:00AM

NEWSBTC

As the United States braces for the outcome of the closely

contested presidential election between former President Donald

Trump and Vice President Kamala Harris, Bitcoin (BTC) has

experienced a price drop, now hovering around the $68,000

mark. BTC Faces Key Support Levels Bitcoin has struggled to

surpass its all-time high of $73,700, a level achieved in March

following the approval of exchange-traded funds (ETFs) that invest

in the cryptocurrency. Despite several attempts to breach this

mark, Bitcoin has faced resistance, leading to a current price

correction. Should it fail to maintain its position above $68,000,

it may revisit the $66,600 support level, with a further drop

potentially taking it down to $63,000—an important threshold in the

near term. Related Reading: Bitcoin Price Forecast: What To

Expect In The Final 24 Hours Before US Election Despite the current

price challenges, many analysts maintain a bullish outlook for

Bitcoin. Crypto analyst Ali Martinez notes that the days following

past US presidential elections have historically shown volatility

for Bitcoin; however, the overall trend has remained upward.

This analysis suggests that if this pattern holds true in the

current election cycle, Bitcoin might retest its previous highs

with potential for price discovery above the milestone reached 8

months ago. In addition, Martinez highlights a recent buy signal

from the TD Sequential indicator on the 12-hour chart, suggesting

that a rebound could be imminent, potentially allowing Bitcoin to

challenge the $73,000 resistance level again. Bitcoin To Hit

$100,000 Regardless Of Election Outcome Analyst Miles Deutscher on

the other hand, asserts that Bitcoin is on a trajectory toward

$100,000, regardless of the November 5 election outcome. However,

he anticipates that a Trump victory could further elevate Bitcoin’s

price ceiling, with speculative targets ranging from $200,000 to

$300,000. Deutscher further believes that this bullish

sentiment extends to altcoins like Ethereum, which may also benefit

from a BTC rally in the last part of the year. The analysis comes

as Trump has expressed strong support for the crypto industry, even

suggesting the potential use of Bitcoin as a strategic national

reserve asset to address the country’s substantial national debt,

currently estimated at $35 trillion. Many believe that a

Trump administration could bode well for bitcoin’s future growth,

with increased adoption and exposure from pension funds and

institutions looking to diversify their portfolios, as seen in the

current resurgence of Bitcoin ETFs. Related Reading: Ethereum

Risk-To-Reward Ratio Is ‘Too Good To Pass Up’ – Top Analyst Sets

$6,000 Target In contrast, Kamala Harris’s position on

cryptocurrency has been less clear. While she has not articulated a

robust plan for the digital asset sector, experts predict a shift

from the current Biden administration’s regulatory scrutiny led by

the US Securities and Exchange Commission (SEC). At the

moment, the difference on crypto betting site Polymarket gives

Trump a nearly 60% chance of beating Harris in the coming hours. On

the other hand, traditional polls show an even race between the two

candidates, but with Trump winning every single swing state for the

election. Featured image from DALL-E, chart from

TradingView.com

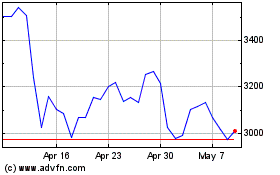

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024