XRP Surges To $0.74, Reaching Its Highest Price Since Mid-March: Here’s Why

November 13 2024 - 6:30AM

NEWSBTC

Over the past nine days, XRP has experienced a significant rally,

climbing from $0.4957 on November 4 to a peak of $0.7407 today on

Binance—a surge of over 50% at one point. Approximately 30% of this

ascent occurred within the last 48 hours. However, following this

rapid rise, XRP saw a sharp correction, retreating by -12% to $0.65

as of press time. These are the key reasons for the rally: #1 XRP

Funding Rates and Social Dominance Spike One of the primary drivers

behind the XRP price surge appears to be heightened social media

activity and shifts in funding rates. On-chain analytics firm

Santiment noted via X that the XRP community “has erupted with

excitement and discussions related to crypto’s #7 market cap,” with

over 4% of all coin discussions currently related to XRP following

its 45% breakout over an eight-day span. The firm emphasized that

surpassing $0.74, XRP’s year-high back in March, will largely

depend on “FOMO staying at bay, and funding rates on large

exchanges like Binance not getting too weighed down by longs.”

Related Reading: XRP Price Patterns And 2024 Election Spark Talk Of

A New Rally Santiment’s analysis highlighted that the ratio of

Binance XRP long versus short positions has reached its highest

point since March 31, indicating strong bullish sentiment among

traders. They also observed that previous spikes in social

dominance, such as those at the beginning of August, served as

perfect top signals, suggesting that the current surge in social

discussions could precede a market correction. Conversely,

Santiment also pointed out that the previous social spike marked a

bottom signal. #2 Gensler Resignation This Week? Speculation about

potential regulatory changes is also influencing XRP’s market

dynamics under the Trump administration. Pro-crypto lawyer James

“MetaLawMan” Murphy shared an intriguing timeline via X, drawing

parallels between US presidential elections and the resignations of

SEC chairs. Related Reading: Could XRP Explode After US Elections?

Data Hints At Massive 60,000% Rally He noted that after the 2016

and 2020 elections, SEC chairs Mary Jo White and Jay Clayton

announced their resignations shortly after the results. Murphy

suggested that with the 2024 election, there could be expectations

for current SEC Chair Gary Gensler to resign, posting, “Hey Gary

Gensler, we’re waiting.” Time to say Goodbye Gary! Nov. 8, 2016:

Trump elected Nov. 14, 2016: Mary Jo White (SEC Chair) announces

her resignation Nov. 3, 2020: Biden elected Nov. 16, 2020: Jay

Clayton announces resignation Nov. 5, 2024: Trump elected Nov. __,

2024: Hey @GaryGensler, we’re waiting — MetaLawMan (@MetaLawMan)

November 12, 2024 This speculation is particularly significant for

the XRP community because of the ongoing legal battle between

Ripple and the SEC. President-elect Donald Trump has explicitly

stated his intention to remove Gensler from his position on his

first day in office, citing the need for a more crypto-friendly SEC

chairman—a statement he made at the Bitcoin 2024 conference. Ripple

CEO Brad Garlinghouse has shown strong support for this potential

change, urging Trump to appoint replacements more favorable to the

crypto industry, such as Chris Giancarlo, Brian Brooks, or Dan

Gallagher. Garlinghouse highlighted the need for regulatory

clarity, especially concerning digital assets like Ethereum and

XRP. The speculation among some Ripple supporters is that Gensler’s

removal could lead to a more favorable outcome for Ripple,

potentially through the SEC dropping its appeal in the case. The

market seems to be reacting to this speculation, with investors

possibly trying to front-run the news in anticipation of a

settlement or regulatory shift. At press time, XRP traded at $0.65.

Featured image created with DALL.E, chart from TradingView.com

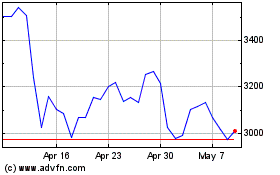

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025