Wall Street’s Ethereum Short Bets Explode – Should Investors Worry?

February 10 2025 - 2:45AM

NEWSBTC

In a dramatic shift, hedge funds appear to be ramping up short

positions in Ethereum at a rate not seen before, sparking questions

on whether the second‐largest cryptocurrency by market

capitalization could be facing troubled waters—or if something else

is at play. According to renowned analysts from the Kobeissi Letter

(@KobeissiLetter), short positioning in Ethereum “is now up +40% in

ONE WEEK and +500% since November 2024.” Their findings, shared on

X, argue that “never in history have Wall Street hedge funds been

so short of Ethereum, and it’s not even close,” prompting the

question: “What do hedge funds know is coming?” Massive Ethereum

Short Squeeze Coming? The Kobeissi Letter’s thread highlights an

extreme divergence between Ethereum’s price action and futures

positioning among hedge funds. They point to an especially volatile

period on February 2, when Ethereum plunged by 37% in just 60 hours

as trade war headlines emerged, wiping out more than a trillion

dollars from the crypto market “in HOURS.” Related Reading:

Ethereum Stuck Below $2,800 Resistance – Bulls Need A Higher Low To

Recover The analysts note how ETH inflows were robust during

December 2024—even as hedge funds were reportedly boosting short

exposure. According to the Kobeissi Letter: “In just 3 weeks, ETH

saw +$2 billion of new funds with a record breaking weekly inflow

of +$854 million. However, hedge funds are betting ETH’s surge and

limiting breakouts.” They also underscore spikes in Ethereum

trading volume, particularly on January 21 (Inauguration Day) and

around the February 3 crash. Despite the historically high inflows,

Ethereum’s price has “failed to recover the gap lower even as one

week has passed,” and currently trades “~45% below its record high

set in November 2021.” One of the biggest unknowns remains why

hedge funds are so dedicated to shorting ETH. The analysts write:

“Potential reasons range from market manipulation, to harmless

crypto hedges, to bearish outlook on Ethereum itself. However, this

is rather strange as the Trump Administration and new regulators

have favored ETH. Largely due to this extreme positioning, Ethereum

has significantly underperformed Bitcoin.” Related Reading:

Ethereum Trades Inside A Multi-Year Bullish Pennant – Analyst Sees

A Breakout Above $4K The Kobeissi Letter concludes its thread by

drawing attention to Bitcoin’s outperformance and poses the

question of whether a short squeeze could be in the making: Could

Ethereum be setting up for a short squeeze? This extreme

positioning means big swings like the one on February 3rd will be

more common. Since the start of 2024, Bitcoin is up ~12 TIMES as

much as Ethereum. Is a short squeeze set to close this gap?”

Glassnode’s CryptoVizArt Fires Back Not everyone in the crypto

analytics sphere is convinced that the tidal wave of Ethereum short

positions signals a bearish outlook. Senior researcher at

Glassnode, CryptoVizArt.₿ (@CryptoVizArt), took to X to challenge

the alarmist takes circulating on social media: “Barchart is

screaming, ‘Largest ETH short in history!’ and crypto Twitter is

running around like headless chickens. Seriously, if you fell for

this clickbait headline, it’s time to up your game. Let’s set the

record straight.” In a detailed thread, CryptoVizArt points out

that the widely shared chart on hedge fund short positions likely

represents only one subset of the market (e.g., “Leveraged Funds /

Hedge Funds/CTAs”) and does not account for other significant

market participants such as asset managers, non‐reportable traders,

and on‐chain holders. They add that similar “massive shorts” were

seen in Bitcoin futures as well, yet BTC outperformed ETH during

the same period. Furthermore, CryptoVizArt emphasizes that CME

Ether futures are just one sliver of global crypto derivatives.

Liquidity on platforms like Binance, Bybit, OKX, as well as

on‐chain positions and spot markets, offer a broader view than any

one exchange’s data might suggest. “One group’s net short ≠ the

entire market is net short. Hedge positions ≠ purely bearish bets.”

Their final note: much of the positioning could be part of

“non‐directional strategies—such as cash‐and‐carry,” which are

neutral strategies used to lock in arbitrage gains and are not

simply a direct bet against ETH. At press time, ETH traded at

$2,629. Featured image created with DALL.E, chart from

TradingView.com

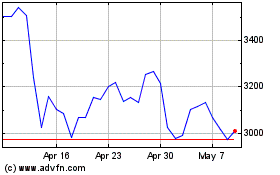

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025