Market Slip Drags Injective Down 16% Despite Ongoing Developments

August 30 2024 - 6:00AM

NEWSBTC

With the market resuming its bearishness today, August 30th,

Injective continues to slip and slide. According to CoinGecko, INJ

took a nose dive by 16% which slashed any hopes of a short-term

recovery. Related Reading: Crypto Crash: $320 Million Wiped Out As

Bitcoin And Ethereum Nosedive Although the token’s performance

leaves much to be desired, developments on-chain continue to

unfold, cementing Injective’s position within the community.

Several developments hold the bay against the bears, but the

question of when will INJ and the market recover remains.

Injective Announces Release Of Web-Based IDE: Remix Web In a

recent X post, Injective announced the release of the Remix Web

IDE, an IDE that is entirely web-based providing developers the

flexibility needed to develop powerful on-chain applications. To

access the tool, simply visit the website and start building.

1/3 Exciting news! 🎉 Announcing the launch of the Remix Web IDE

plugin for Injective. This web-based IDE is a gamechanger for the

ecosystem, enabling developers to write, test, and deploy smart

contracts right from their browser.https://t.co/t7NWnhtelc —

Injective 🥷 (@injective) August 26, 2024 This revolutionary take on

development lowers the bar in building within the Injective

ecosystem and provides an example for other networks to follow.

According to the blog, the web plugin also has code templates,

providing newbies on the platform to create and deploy applications

and smart contracts seamlessly. According to Shayan, the

Developer Relations Manager at Injective Labs, one of the biggest

struggles of developers is properly installing software dedicated

to coding. As a developer, one of the most frustrating things

is having to properly download software before being able to even

write a single line of code. That’s why the new Remix IDE plugin is

such a huge breakthrough. No more headaches dealing with making

sure you have the latest… https://t.co/Xzb05mX7hb — Shayan

(@0xShayan) August 27, 2024 “That’s why the new Remix IDE plugin is

such a huge breakthrough. No more headaches dealing with making

sure you have the latest versions of Rust or Go installed, whether

you’ve selected the ARM or x86 binaries, etc,” said Shayan in his

recent X post. The flexibility afforded by this recent

addition to the platform means a new era of development for

Injective with both new and experienced developers building

on-chain apps and smart contracts on the platform.

Helios-Injective Collabathon To Set New Heights On Web3 Finance

Another development that piqued the interest of both investors and

developers is Injective’s partnership with Helios, a

Staking-as-a-Service provider, that is already a part of the

former’s network as a validator. According to Helios’s blog

post, the “Collabathon” will feature seasoned developers on both

sides with a single goal of solving cross-chain identity

verification, a challenge which, according to Helios, “will empower

projects to confirm singular wallet ownership across multiple

chains, enhancing interoperability and user experience.” The 10-day

Collabathon will occur next week, September 2nd. Related

Reading: XRP Gains Ground: 20% Of Institutional Investors Embrace

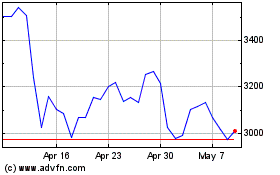

The Crypto INJ Revisits $18.02 For Upside Potential As of

this writing, INJ’s trajectory puts it just below $18.02. This

revisit of a crucial price ceiling might trigger a rally soon.

However, this possibility is hinged on the market’s uncertain

movement, which currently screams hawkish. With this in mind,

INJ does have the potential to regain ground in the medium term

given that the market flips bullish in the same timeframe. The

token’s relative strength index indicates low volatility in the

market as both bulls and bears gather momentum for a breakthrough.

In the long term, INJ bulls can target $23.37 to regain lost

momentum. However, investors and traders should still exercise

caution as the broader market may swing downward depending on the

overall sentiment. Featured image from Pexels, chart from

TradingView

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024