Bitcoin Retail lnvestors Remain Cautious Despite Price Gain – Details

October 26 2024 - 3:30PM

NEWSBTC

Following its bearish start to October, Bitcoin has since shifted

momentum, rising as high as $69,000 in the last two weeks. Despite

this significant price rally, Bitcoin retail investors remain

hesitant to engage the market. In its weekly crypto report on

Friday, blockchain analytics firm CryptoQuant shared an interesting

insight into this low retail activity in the Bitcoin market.

Related Reading: Bitcoin Price To See 70%+ Powerful Bull Wave To

Push It Over $100,000, How High Can It Go? Bitcoin Retail

Investors’ Holding Grows At Historically Slow Pace – Report

According to CryptoQuant, retail investors’ holdings have grown by

18,000 BTC valued at $1.2 billion over the last four months

reaching a total new value of 1.753 million BTC worth $112.7

billion. While this development demonstrates a rising market

interest by these small investors, the analytic firm notes the pace

of accumulation is significantly slow compared to historical data

as retail investors only acquired a net 1,000 BTC valued at $66.31

million, in the last 30 days. Notably, the retail investor

accumulation rate has been on a consistent decline since May 2023,

when their holdings rose by 27,000 BTC worth $1.79 billion

Therefore, CryptoQuant reports that these Bitcoin individual

investors have only increased their investments by 30,000 BTC

valued at $1.99 billion in 2024, which pales in comparison to the

whale investors whose holdings have grown by 173,000 BTC worth

$11.50 billion in the same period. During periods of price

gain, low retail investor activity as discussed above can be

concerning as it represents decreased market liquidity or even a

lack of market confidence in the asset’s ability to sustain its

current bullish trajectory. Alternatively, this lack of

interest from small-scale investors also presents positive

indications. For example, CryptoQuant reports that low retail

activity includes these small investors holding onto their Bitcoin

rather than selling. The analytics firm notes that Bitcoin transfer

to exchange in January 2023 has decreased from a daily average of

2,700 BTC to 1,400 BTC in 2024, thus there is reduced selling

pressure on the token. In addition, transfer activity among

retail investors remains low, with transaction volume dropping to

$326 million on September 21, the lowest level recorded since 2020.

While reduced transfer activity may indicate limited market

volatility, CryptoQuant states that low retail activity has

historically preceded significant price gains for Bitcoin. Bitcoin

Price Overview At the time of writing, Bitcoin trades at 66,896

following a 1.11% decline in the last day due to reports of an

alleged investigation into Tether, the issuer of stablecoin USDT,

and conflict in the Middle East. However, Bitcoin’s daily trading

volume is up by 34.29% and is valued at $42.10 billion. Related

Reading: Bitcoin As National Reserve Asset: Key Insights From

Forbes On Central Banks Interest Featured image from Shuttershock,

chart from Tradingview

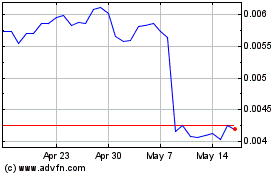

Four (COIN:FOURRUSD)

Historical Stock Chart

From Sep 2024 to Oct 2024

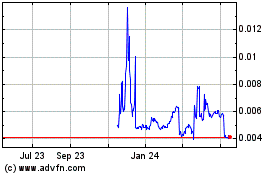

Four (COIN:FOURRUSD)

Historical Stock Chart

From Oct 2023 to Oct 2024