PrimeXBT: What does the rest of the trading year have in store for Cryptocurrency?

October 29 2024 - 8:02AM

NEWSBTC

PrimeXBT: What does the rest of the trading year have in store for

Cryptocurrency? By Matthew Hayward, Senior Market Analyst at

PrimeXBT Traditionally, the fourth quarter and October have been

strong months for cryptocurrencies, particularly Bitcoin. However,

this year, the gains have been less impressive than in previous

years. Currently, Bitcoin has increased by over 5% this month,

providing a glimmer of optimism. So, what has caused this

underwhelming performance, and why haven’t we seen the expected

rally? Reflecting on early October, a series of announcements and

shifts in the economic landscape contributed to Bitcoin’s initial

decline, setting a challenging tone for the month. Analysing the

infographic below shows that, during a “bull market,” the fourth

quarter has historically been a period of significant growth for

Bitcoin. With just two months left in the quarter, will Bitcoin

maintain its upward momentum? Source: Crypto Rover Current price

movements influenced by political uncertainty Several key events

demand attention from both political and economic perspectives. On

the political front, the upcoming U.S. elections are in focus, with

recent polls indicating a surge in Trump’s popularity. While the

final results remain uncertain until election day, past trends show

that Trump’s campaigns have often driven positive momentum in both

traditional and cryptocurrency markets. He has also voiced support

for advancing cryptocurrency adoption if re-elected, sparking

questions about whether this could drive broader acceptance in the

sector. Looking more closely at the infographic below, we can see

that the timing of Bitcoin cycles alongside U.S. election cycles

has generally resulted in a net positive impact on Bitcoin’s price

following elections. Source: Crypto Rover Ongoing uncertainty in

the macroeconomic landscape In September, the Federal Reserve made

a significant move by reducing interest rates by 0.5%, marking a

substantial shift after an extended period of stability. This bold

rate cut takes us back to the last major interest rate cut, where

the FED also cut interest rates by 0.5%, which took place right

before the stock market crash that triggered the 2008 financial

crisis. Source: Reuters Following the announcement of the interest

rate decision, Non-Farm Payroll data came in significantly higher

than expected, contrasting with previous reports. The Federal

Reserve had previously emphasised its intent to support the labour

market, and as the elections approach, it appears to be succeeding.

However, the question remains: how substantial will next year’s

revisions be if these results are indeed inflated? Could inflation

continue to rise in the future? In the light of the Federal

Reserve’s 0.5% interest rate reduction and unexpectedly strong job

reports, attention has turned to inflation concerns. The Fed

reiterates lowering inflation to its 2% target; however, traders

are now concerned about the potential risk of inflation increasing

following the rate cut. Recent CPI figures showed a slight uptick,

landing at 2.4%, just below the previous month’s rate of 2.5%.

Should inflation continue to rise while U.S. GDP data remains

stagnant or decreases, the economy could face the threat of

“stagflation.” Source: Reuters Could an economic downturn be

looming ahead? Historically, Bitcoin and the broader cryptocurrency

market have yet to face a prolonged period of major economic

uncertainty. Since Bitcoin’s launch in the late 2000s, it has

existed solely in the post-2008 financial crisis environment. This

brings up an important question: how might the risk of a potential

“Black Swan” event impact its price trends and disrupt established

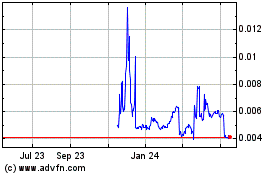

cycle theories? Source: Seekingalpha What impact do these

developments have on cryptocurrencies and the broader markets? As

cryptocurrency adoption increases and more institutional investors

enter the market, traditional indicators are likely to have a

greater influence on trading strategies for risk assets like

cryptocurrencies. The two charts below illustrate how the markets

are anticipating these data releases and their impact on Bitcoin’s

price movements. Notably, prior to the interest rate cut, the price

of Bitcoin began to rise sharply. This is because, in an

environment of interest rate cuts, risk assets like

cryptocurrencies typically perform better. The charts demonstrate

how this positive sentiment was already reflected in the pricing,

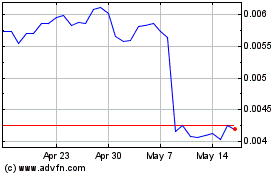

leading to an upward movement following the announcement. In the

second scenario, we can see that the latest CPI data release was

not favourable for the pricing of risk assets, as uncertainty grew

regarding the possibility of rising inflation. If inflation were to

start increasing, the chart below illustrates how the market was

already pricing in a negative reaction to that data release. How to

Trade Key Economic and Political Events with PrimeXBT As economic

uncertainties increase, new trading opportunities may emerge.

PrimeXBT stands out as a premier cryptocurrency and CFD broker,

offering a robust trading platform for buying, selling, and storing

cryptocurrencies. The platform grants access to more than 100

popular markets, including Crypto Futures, Copy Trading, and CFDs

across Cryptocurrencies, Forex, Indices, and Commodities. Users can

trade with both fiat and cryptocurrency funds, making it a flexible

option for adapting to the changing macroeconomic environment.

PrimeXBT enables trading by lowering barriers to entry and

providing secure, user-friendly access to financial markets. The

platform provides top-tier trading conditions and innovative tools,

making it easier for both novice and seasoned traders to explore a

diverse array of investment opportunities. Trade key events with

PrimeXBT Disclaimer: The content provided here is for informational

purposes only and is not intended as personal investment advice.

Past performance is not a reliable indicator of future results. The

financial products offered by the Company are complex and come with

a high risk of losing money rapidly due to leverage. Virtual assets

are inherently volatile and subject to significant value

fluctuations, which could result in substantial gains or losses.

These products may not be suitable for all investors. Before

engaging, you should consider whether you understand how these

leveraged products work and whether you can afford the high risk of

losing your money. PrimeXBT does not accept clients from Restricted

Jurisdictions as indicated in its website.

Four (COIN:FOURRUSD)

Historical Stock Chart

From Sep 2024 to Oct 2024

Four (COIN:FOURRUSD)

Historical Stock Chart

From Oct 2023 to Oct 2024