Bitcoin ETFs Reach $3 Billion Inflows In October, Retail Investors Lead The Charge – Report

October 27 2024 - 2:30PM

NEWSBTC

Bitcoin ETFs ended last week on another positive note with $997.70

million in net inflows and demand reaching its highest level in six

months. Undoubtedly, these ETFs have marked the turning point for

Bitcoin and other cryptocurrencies since the beginning of the year,

as it opened up the cryptocurrency to inflows from every

side. Related Reading: Against All Odds: Solana (SOL) Breaks

Past $176 In 3-Month Push Interestingly, data has shown that retail

investors are responsible for most of the demand for Spot Bitcoin

ETFs, accounting for 80% of the total assets under management.

Bitcoin ETFs Changing The Narrative According to Bloomberg data,

Bitcoin ETFs have dominated the ETF landscape in 2024, claiming the

top four positions for inflows among all ETFs launched this year.

Specifically, out of the 575 ETFs introduced thus far, 14 of the

top 30 are new funds focusing on Bitcoin or Ethereum. The standout

performer is the BlackRock IBIT fund, which has attracted over $23

billion in year-to-date inflows. Last week was another example of

the positive performance in Spot Bitcoin ETFs, despite the coin’s

consolidation below the $68,000 price level. According to flow data

from SosoValue, weekly inflows started on a positive note on

Monday, October 21, with $294.29 million entering the funds and

ended the week with $402.08 million in inflows on Friday, October

25. Interestingly, Spot Bitcoin ETFs now hold about 938,700

BTC in 10 months since launch and are steadily approaching the 1

million BTC mark. Although these ETFs have opened doors for

institutional investors, a recent report from crypto exchange

Binance indicates that retail investors are the primary drivers of

this surge in demand, accounting for 80% of the holdings in Spot

BTC ETFs. Originally intended to provide institutional investors

access to BTC, Spot Bitcoin ETFs have now become the preferred

choice for many individual investors looking to take advantage of

the regulatory clarity they offer. Nonetheless, there has been a

steady demand from the institutional side, with institutional

holdings rising by 30% since Q1. Among institutional investors,

investment advisers have emerged as the fastest-growing party, with

their holdings increasing by 44.2% to reach 71,800 BTC this

quarter. What’s Next For Spot Bitcoin ETFs? Thanks to the rapid

growth of Bitcoin exchange-traded funds, an impressive 1,179

institutions, including financial giants such as Morgan Stanley and

Goldman Sachs, have joined the crypto’s cap table in less than a

year. For comparison, Gold ETFs were only able to attract 95

institutions in their first year of trading. Related Reading:

Whales Hit All-Time High Bitcoin Holdings At 670,000 – What Does

This Mean For BTC? This upward trajectory of institutional

investments in Bitcoin is poised to continue into the foreseeable

future, which bodes well for the overall price outlook of Bitcoin.

As these ETFs attract more institutional capital, they are likely

to produce second-order effects like increased BTC dominance,

improved market efficiency, and reduced volatility that could

significantly benefit the cryptocurrency ecosystem. At the time of

writing, Bitcoin is trading at $67,100. Featured image from

Reuters, chart from TradingView

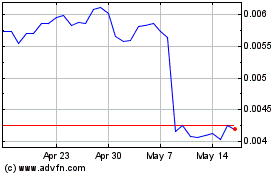

Four (COIN:FOURRUSD)

Historical Stock Chart

From Sep 2024 to Oct 2024

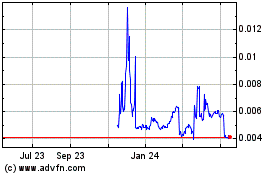

Four (COIN:FOURRUSD)

Historical Stock Chart

From Oct 2023 to Oct 2024