Bitcoin Bullish Signal: $900 Million In BTC Leaves Exchanges

March 07 2025 - 3:30AM

NEWSBTC

On-chain data shows the exchanges have witnessed net Bitcoin

outflows through the latest volatility, a sign that could be

positive for BTC’s price. Bitcoin Exchange Netflow Has Been

Negative Recently According to data from the market intelligence

platform IntoTheBlock, Bitcoin has been leaving exchanges recently.

The on-chain metric of relevance here is the “Exchange Netflow,”

which measures the net amount of BTC entering into or exiting out

of the wallets associated with all centralized exchanges. When the

value of the indicator is positive, it means the investors are

making net deposits of the cryptocurrency into these platforms. As

one of the main reasons why holders transfer their tokens to

exchanges is for selling-related purposes, this kind of trend can

have a bearish impact on the BTC price. Related Reading: This

Bitcoin Price Range Could Be The Bulls’ Final Defense Line, Report

Says On the other hand, the metric being under the zero mark

suggests the outflows are overwhelming the inflows. Generally,

investors take their coins off into self-custody when they plan to

hold into the long term, so such a trend can prove to be bullish

for the asset. Now, here is a chart that shows the trend in the

Bitcoin Exchange Netflow over the past week or so: As is visible in

the above graph, the Bitcoin Exchange Netflow saw a spike into the

positive region on the 27th of last month, but the metric has since

remained in the negative region. This trend has maintained despite

the fact that the asset has been observing volatility in both

directions recently. Thus, it would appear that the investors are

still bullish on the cryptocurrency. “Despite the recent market

fear, traders have shown conviction in BTC, withdrawing nearly $900

million worth of Bitcoin from exchanges in the past 7 days,” notes

the analytics firm. While exchange inflows can be bearish when it

comes to volatile assets like BTC, the same doesn’t hold true in

the case of stablecoins, digital assets that have their value tied

to fiat. Usually, investors who hold these coins eventually plan to

invest into the volatile side of the market. Once they feel the

time has come, they deposit into the exchanges to swap to the

tokens of their choice, thus providing a buying pressure to their

prices. Related Reading: Litecoin Whale Deposits 500,000 LTC To

Binance: Price Decline To Extend? As such, an increase in

stablecoin inflows can be a positive sign for Bitcoin and other

cryptocurrencies. This trend has recently been developing in the

sector, as an analyst has pointed out in a CryptoQuant Quicktake

post. As displayed in the above chart, the Binance Stablecoin

Exchange Reserve, a metric that keeps track of the total amount of

these fiat-tied tokens sitting in the wallets of the Binance

platform, has jumped to a new all-time high (ATH) recently. BTC

Price Bitcoin has been unable to sustain recovery as its price has

once again dipped to $88,600. Featured image from Dall-E,

CryptoQuant.com, chart from TradingView.com

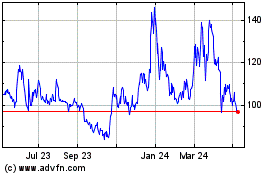

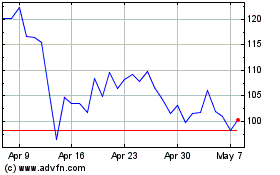

Quant (COIN:QNTUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025