This Bitcoin Signal Aligns With Price Tops, CryptoQuant Analyst Reveals

March 08 2025 - 2:00AM

NEWSBTC

The community analyst at the on-chain analytics firm CryptoQuant

has pointed out how this Bitcoin indicator has been aligning with

price tops. Bitcoin Binance Whale To Exchange Flow Shows An

Interesting Pattern In a new post on X, CryptoQuant community

analyst Maartunn has talked about the trend in the Bitcoin Exchange

Whale Inflow for the cryptocurrency exchange Binance. The “Exchange

Whale Inflow” here refers to an on-chain metric that measures the

total amount of the asset that the whale entities are transferring

to a given centralized exchange. Related Reading: Bitcoin Bullish

Signal: $900 Million In BTC Leaves Exchanges When the value of this

indicator is high, it means the whales are depositing a large

number of tokens to the platform. Such a trend can be a sign that

these large entities are looking to sell, which can be a bearish

sign for the asset’s price. On the other hand, the metric being low

suggests this cohort may be accumulating or just not planning to

distribute, which can naturally be a bullish sign for BTC. Now,

here is the chart shared by the analyst, that shows the trend in

the 30-day sum of the Bitcoin Exchange Whale Inflow for Binance

over the last couple of months: As displayed in the above graph,

the 30-day Bitcoin Exchange Whale Inflow for Binance has recently

witnessed a sharp climb, which suggests large deposits to the

platform have been on the rise. Maartunn has discovered a pattern

related to what usually happens whenever the metric shows a trend

like this one. From the chart, it’s visible that spikes in the

indicator have come around tops in the cryptocurrency’s price. This

relationship hasn’t been exact, but it’s true that BTC has

witnessed some kind of peak shortly before or shortly after a

strong surge in the Binance Exchange Whale Inflow. Related Reading:

This Bitcoin Price Range Could Be The Bulls’ Final Defense Line,

Report Says Whales are the largest of investors in the sector and

Binance is the largest exchange, so it makes sense that the

combined behavior related to the two would have noticeable

implications for Bitcoin. Following the recent increase, the 30-day

Binance Exchange Whale Inflow has reached a value of $7.3 billion,

which is the highest that it has been in around three months. It

now remains to be seen whether these high deposits would have a

similar effect on the asset as before or not. BTC Price Bitcoin has

continued to display volatility in both directions during the last

few days as its price has been wobbling up and down, with neither

bulls nor bears gaining control. At present, the asset is trading

around $89,500. Featured image from Dall-E, CryptoQuant.com, chart

from TradingView.com

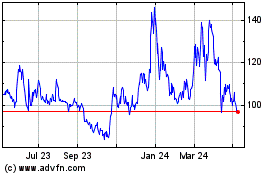

Quant (COIN:QNTUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

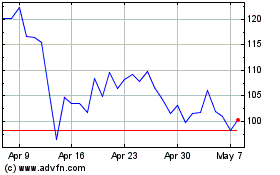

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025