Bitcoin Realized Losses Spike 3 Times The Weekly Average – Healthy Correction Or Downturn?

December 20 2024 - 8:00PM

NEWSBTC

Bitcoin has faced its first major correction since early November,

dropping 13% from its all-time high of $108,364. This sudden

pullback has sent shockwaves across the crypto market, shifting

sentiment from extreme bullishness to uncertainty and even fear.

The sell-off has been particularly brutal for altcoins, many of

which are bleeding hard as Bitcoin struggles to regain momentum.

Related Reading: On-Chain Metrics Reveal Cardano Whales Are ‘Buying

The Dip’ – Details Key metrics from CryptoQuant highlight the

gravity of the situation, with realized losses totaling $28.9

million—an alarming 3.2 times higher than the weekly average. This

spike in realized losses suggests that some investors exit

positions as the market recalibrates after weeks of aggressive

upward movement. The big question now is whether this is simply a

healthy correction in an otherwise bullish trend or the start of a

larger downtrend. Traders are closely watching Bitcoin’s ability to

hold critical support levels and the behavior of altcoins, which

often amplify Bitcoin’s price movements. For now, the market

remains at a crossroads, with the coming days likely to reveal

whether Bitcoin can recover and resume its uptrend—or if this

correction signals a more prolonged period of weakness. Bitcoin

Facing Selling Pressure Bitcoin is under significant selling

pressure after two days of aggressive bearish activity, marking a

pivotal moment for the market. The sudden sentiment shift has

caused many analysts and investors to turn cautious, with some

flipping bearish as Bitcoin’s recent trend begins to lose momentum.

This correction has left the market questioning whether the current

price movement is a natural pause or a precursor to deeper losses.

Top analyst Axel Adler recently shared insights on X, supported by

compelling on-chain data, highlighting that realized losses have

surged to $28.9 million. This figure is 3.2 times higher than the

weekly average, indicating heightened selling activity. Adler’s

analysis underscores that while the sell-off might seem alarming,

it’s consistent with a healthy market correction, especially

following Bitcoin’s remarkable rally to $108,300. Adler notes that

the current dip should not trigger panic but instead serve as a

moment of patience for long-term holders. He emphasized that now is

a time to HODL unless additional bearish signals emerge to suggest

a more prolonged downtrend. Corrections like this often provide the

market with the necessary fuel for the next leg up, as weaker hands

exit and strong hands position themselves strategically. Related

Reading: Solana Holds Monthly Support As Network Activity Grows –

Time For A Breakout? Price action remains critical, with investors

watching closely to determine whether this correction solidifies a

strong foundation for future growth or signals further downside.

BTC Holding Bullish Structure (For Now) Bitcoin is trading at

$94,400 following three consecutive days of aggressive selling

pressure. Despite the apparent bearish sentiment gripping the

market, BTC has managed to maintain its footing above the key

support level of $92,000. This support is crucial as it clearly

defines the ongoing uptrend. Holding above this level suggests

resilience and sets the stage for a potential strong bounce if

buyers regain control in the coming sessions. While the recent

price action reflects uncertainty, the decline has not been as

severe as the market sentiment indicates. Negative emotions have

driven many traders to adopt a cautious stance, but BTC’s ability

to stay above $92,000 shows underlying strength in the market

structure. Related Reading: ONDO Exchange Inflows Grow – Volatility

Ahead? However, sentiment remains a critical market driver.

Restoring confidence will be essential for Bitcoin to reclaim

higher levels and resume its bullish momentum. If sentiment does

not improve and prices continue to drop, the risk of a deeper

correction becomes more likely. Losing the $92,000 support could

pave the way for a retest of lower levels, potentially causing

additional volatility. Featured image from Dall-E, chart from

TradingView

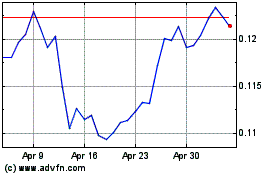

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024