Bitcoin Price Action Falls Flat | BTCUSD Analysis October 18, 2022

October 18 2022 - 4:30PM

NEWSBTC

In this episode of NewsBTC’s daily technical analysis

videos, we are once again examining a possible expanded flat

correction in Bitcoin. Once the correction has completed, the bull

market could resume. Take a look at the video below: VIDEO: Bitcoin

Price Analysis (BTCUSD): October 18, 2022 In addition to the video

highlights listed below the video, we also analyze BTCUSD using the

Ichimoku, Bollinger Bands, SuperTrend, TD Sequential, and other

technical tools. Related Reading: A Bullish Week In Bitcoin On The

Way? BTCUSD Analysis October 17, 2022 Three Strikes: BTCUSD

Rejected From 50-Day Moving Average BTCUSD daily price action was

once again rejected from the 50-day moving average. This is the

third rejection since September, making the 50MA a critical line in

the sand to pass before any chance of further upside. Zooming out

and comparing the 50MA and its behavior around the 2018 bear market

bottom, we can see that breaking through it is the key to bulls

regaining control on daily timeframes. Given the close

proximity of the 100-day moving average in yellow, the next target

would be the red, 200-day moving average located at around $26K. If

Bitcoin can break the 50-MA and 100-MA, $26K is next | Source:

BTCUSD on TradingView.com Bitcoin CME Futures Paints Near-Perfect

Expanded Flat Pattern The BTC CME Futures line chart causes the

price action over the last 18 months to nearly perfectly fill out

an expanded flat pattern. An expanded flat features a higher

high at the top of the B wave, followed by a lower low as the C

wave terminates. The C wave is an impulse wave down made up of 5

total sub-waves. The BTC CME chart begins with a bear market. The

primary count would suggest the expanded flat correction formed in

wave 4 and there is still a wave 5 ahead. In Elliott Wave

Theory, one way to possibly project the peak of where wave 5 will

terminate, is to find the inverse Fibonacci extension of wave

C. At the 1.272 extension, Bitcoin would reach $90,000, while

if the 1.618 golden ratio extension is tapped, the top would be

over $137,000 per BTC. Could this be the correction that has cut

down crypto prices? | Source: BTCUSD on TradingView.com Related

Reading: Bitcoin Price Bounces After CPI Dump | BTCUSD Analysis

October 13, 2022 Will The Crypto Winter Conclude With A Touch Of

The Log Growth Curve? Although given the macro sentiment, the risk

of recession, and the fact each floor in crypto has fallen out

again and again, this is not an unusual place for Bitcoin to bottom

out. Bitcoin price continues to grind along the logarithmic growth

curve. All price action throughout the entire history of

cryptocurrencies has been contained within this narrowing

curvature. Why would it suddenly stop now? BTC is brushing against

the bottom of the log curve | Source: BTCUSD on TradingView.com

Learn crypto technical analysis yourself with the NewsBTC Trading

Course. Click here to access the free educational program. Follow

@TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram

for exclusive daily market insights and technical analysis

education. Please note: Content is educational and should not

be considered investment advice. Featured image from

iStockPhoto, Charts from TradingView.com

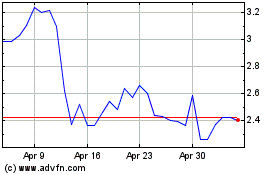

Waves (COIN:WAVESUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Waves (COIN:WAVESUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Waves (Cryptocurrency): 0 recent articles

More Waves News Articles