XRP Whales Loading Up – Data Reveals Buying Activity

December 20 2024 - 11:00PM

NEWSBTC

XRP has faced a sharp downturn over the past few days, shedding

over 23% of its value since Tuesday. This steep correction has

mirrored the broader market’s turbulence, intensifying negative

sentiment around XRP. However, notable developments are emerging

beneath the surface of this bearish price action. Related Reading:

Bitcoin Data Reveals No Significant Panic Selling In The Market –

Shakeout Or Trend Shift? Key on-chain data from Santiment reveals

that whales are taking advantage of the dip. In the last 24 hours

alone, these large holders have accumulated an additional 110

million XRP, demonstrating significant confidence in the asset’s

long-term prospects. Historically, whale activity during negative

sentiment often signals strategic positioning for future gains.

This accumulation trend suggests that whales are undeterred by

short-term price fluctuations, focusing instead on XRP’s potential

in the coming months. As retail traders grow increasingly cautious

amidst the recent drop, the actions of these large holders

highlight a different perspective. While the immediate outlook for

XRP remains uncertain, the notable whale activity is a bullish

indicator for the long run. Whether this signals a bottom or simply

positions XRP for a broader recovery remains to be seen, but it is

clear that big players are looking beyond the current market

turbulence. XRP Holding Key Levels XRP is currently trading 28%

below its multi-year high of $2.90, but it has managed to stay

above a critical support level at $1.90. This zone, regarded as the

bulls’ last line of defense, has proven resilient amid recent

market volatility. Holding above this level is essential to

maintaining the bullish structure that has characterized XRP’s

recent price action. Adding to the optimism, key metrics from

Santiment, shared by crypto analyst Ali Martinez, reveal that XRP

whales have accumulated actively during the pullback. Over the last

24 hours, these large holders have purchased an additional 110

million XRP, underscoring their confidence in the asset’s long-term

potential. Historically, whale activity during price dips often

signals preparation for a recovery. The next step for XRP to regain

momentum is to push above critical supply levels that have

previously stalled upward moves. A breakout above these zones could

trigger a swift rally, bringing XRP closer to its multi-year high.

Related Reading: On-Chain Metrics Reveal Cardano Whales Are ‘Buying

The Dip’ – Details The strong support at $1.90 and continued whale

accumulation suggest a positive outlook for the weeks ahead.

However, maintaining current levels and overcoming resistance will

be crucial for XRP to capitalize on this potential and reignite its

bullish trajectory. Technical Levels To Watch XRP is trading

at $2.06, reflecting a loss of momentum after failing to reclaim

the crucial $2.60 level. This inability to push higher has left the

market uncertain, with XRP holding above the critical $1.90 low.

For now, these levels suggest the asset could enter a prolonged

period of range-bound trading, oscillating between $1.90 and $2.60

in the coming days. However, market sentiment remains fragile, and

this indecision could tilt toward the bearish side if the overall

mood doesn’t improve. With XRP trading just above the

psychologically significant $2 mark, a continued lack of bullish

momentum might lead to a significant selloff. If bears take

control, the lack of strong support below $2 could pave the way for

a deeper correction, eroding recent gains. Related Reading: Bitcoin

Stuck Between $99K And $102K – Analyst Explains Macro Situation For

XRP to break free from this indecisive phase, a clear reclaim of

the $2.60 level is necessary to restore confidence among bulls.

Until then, traders and investors are likely to exercise caution,

closely monitoring price movements and sentiment shifts to gauge

the next directional move. Without a decisive breakout, the price

may face mounting pressure, risking a more pronounced downturn if

support at $1.90 fails. Featured image from Dall-E, chart from

TradingView

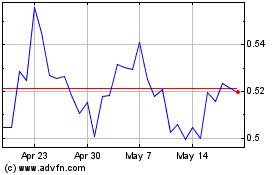

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024