ABN AMRO Bank posts net profit of EUR 397 million in Q4 2024

February 12 2025 - 12:00AM

UK Regulatory

ABN AMRO Bank posts net profit of EUR 397 million in Q4 2024

ABN AMRO Bank posts net profit of EUR 397 million in Q4

2024

12 February 2025

Q4 Key messages

- Good finish to the year: Q4 net

profit of EUR 397 million, supported by continued high net interest

income and fee income

- Strong result in 2024: Net profit of

EUR 2.4 billion and a return on equity of 10.1%

- Continued mortgage portfolio growth:

Increase of EUR 1.1 billion in Q4 and full-year growth of over

EUR 5 billion, supported by an increase in clients

- Net interest income (NII) further

improved: Q4 benefited from higher Treasury result,

resulting in NII of EUR 6.5 billion for the full year. Expected NII

for 2025 between EUR 6.2 and 6.4 billion

- Continued fee growth: Fee income

increased compared to the previous quarter, resulting in fee growth

for the year of over 7%, driven by better performance in all client

units

- Costs remain under control: Costs

for the full year, excluding large incidentals, in line with

guidance at EUR 5.3 billion. For 2025, costs are expected to be

broadly flat

- Solid credit quality: Impairments of

EUR 9 million in Q4, reflecting increases in individually

provisioned client files. Net impairment releases of EUR 21 million

for the year

- Strong capital position: Basel III

CET1 ratio of 14.5% and Basel IV CET1 ratio estimated at a similar

level

- Final dividend of EUR 0.75 per share

proposed

Robert Swaak, CEO:

“ABN AMRO delivered another strong full-year result, with a net

profit of EUR 2.4 billion for 2024 and a return on equity of over

10%. The year saw further growth in our net interest income and fee

income. With the Dutch mortgage market rebounding during 2024, we

managed to increase our market share for new production from 16% to

19%. In 2024, we also managed to grow the corporate loan book in

our transition themes; digital, new energies and mobility. Our

underlying cost base was in line with our guidance of EUR 5.3

billion and our solid credit quality led to net impairment

releases. We continued to execute on our strategy of being a

personal bank in the digital age. Furthermore, our sustainability

efforts were rewarded with our return to the S&P Global Dow

Jones Sustainability Index Europe.

With almost half the global population holding elections, 2024

was an exceptional year. We expect that the geopolitical

ramifications and economic impact of these elections will be felt

in the coming years. The ECB lowered interest rates a number of

times as inflation subsided and Eurozone GDP growth was slow. The

growth of the Dutch economy was muted during 2024 due to lower

exports and business investments, while inflation remained elevated

compared to the European average. Domestic demand grew driven by an

increase in wages and house prices increased by almost 9% during

the year.

We were again able to grow our mortgage book in the fourth

quarter with EUR 1.1 billion. Our corporate loan book decreased in

Q4 largely reflecting more active capital allocation and steering.

We transferred credit risk on a portfolio of corporate loans and

decided to materially reduce our international Asset Based Finance

activities in Germany and the United Kingdom.

Our fourth quarter financial results were solid, with a net

profit of EUR 397 million. Net interest income increased to EUR

1,668 million, reflecting a strong Treasury result. Fee income

increased again this quarter, up 11% on the same quarter last year,

with all client units contributing to the growth. Underlying costs

rose during the fourth quarter, as was expected given the

additional vacancies that were filled.

Our solid credit quality and benign economic circumstances led

to another quarter of very limited impairments of EUR 9 million.

Risk-weighted assets decreased by EUR 3.0 billion, largely

reflecting business developments including capital steering and

data quality improvements. These factors, combined with the

increase of CET1 capital during the quarter, resulted in the Basel

III capital ratio rising to 14.5%. We made progress with the

implementation of Basel IV and now estimate the Basel IV capital

ratio to be at a similar level as our Basel III capital ratio. We

will provide an update on the outcome of our capital assessment

when publishing our Q2 results.

In 2020, we launched our current strategy: A personal bank in

the digital age. Since then, we have made significant progress on

the three strategic pillars that define the crucial focus areas for

creating value for our key stakeholder groups; clients,

shareholders, colleagues and society as a whole.

We have continued investing in our customer experience, focusing

on attractive segments where we can grow by bringing convenience

into the daily lives of our clients and expertise where it matters.

We are making a significant investment in Germany with the intended

acquisition of Hauck Aufhäuser Lampe, a private bank with a long

standing history, positioning ABN AMRO as a leading private bank in

the German market. Our Dutch retail bank provides all services and

products through online channels, supported by a network of 25

retail branches. For those clients that need active support with

daily banking tasks, we doubled our ‘Help with Banking’ advisers to

200 during the year. We are continuing our efforts to improve our

client services and product offering which is reflected in our

improved Net Promoter Score (NPS) compared to last year within all

client units. We also launched our new brand promise ‘For every new

beginning’ to appeal to the entrepreneurial spirit of our clients

and highlight the expertise that we can offer. We have welcomed the

10 millionth active user of Tikkie, our payment request

application. Its success has even led to the word ‘tikkie’ being

included in the Dutch dictionary. More and more businesses are now

turning to Tikkie for invoicing, solidifying our leading position

in peer-to-peer payments.

We have continued embedding sustainability in our operations and

the asset volume of client loans with a sustainability component

(including mortgages and corporate loans) and ESG & impact

investments rose from 34% to 37% in 2024. We remain focused on the

decarbonisation of our loan portfolio. Additional targets for

passenger cars, mortgages, as well as the upstream and midstream

part of our oil and gas portfolio will be disclosed in our

integrated annual report. Related to our aim to halt and reverse

biodiversity loss, we have added insurance products for

farmers who reduce their use of chemical pesticides. Other

developments in the fourth quarter included the Sustainable Impact

Fund’s acquisition of a stake in Urban Mine, a leader in

sustainable construction and concrete recycling, and the pilot

launch of the Human Rights Remedy Mechanism, which allows

individuals to raise concerns about human rights violations linked

to our corporate clients.

During 2024, we continued to allocate significant resources to

making our bank future proof. We maintained our leading position in

cyber resilience, as evidenced by external parties like BitSight.

We added further use cases of Gen-AI in the fourth quarter with the

introduction of an AI chatbot for Tikkie and a voicebot for

incoming calls from our credit card clients. This will further

build on our digital product experience and client contact, for

which we are already externally recognised as the digital leader in

the Dutch banking sector.

There are multiple complex and demanding projects running in

parallel in relation to changes in the regulatory environment, and

we made significant progress across the board during the year. We

are in the final phase of simplifying our model landscape while at

the same time finalising the implementation of Basel IV.

Furthermore, we are continuously refining our AML processes, and

are implementing CSRD and other sustainability-related regulations

in our reporting. These programmes will continue to impact parts of

our organisation, despite the investments in additional change

capacity that we made during the year.

In January 2025, we announced that Marguerite Bérard is the

intended new CEO of ABN AMRO. Following regulatory approval, she

will be appointed by the Supervisory Board after being introduced

to the AGM in April. I am very pleased with the nomination of

Marguerite. In the short time that I have had the pleasure of

getting to know her, I have become impressed by her inspiring

personality and deep knowledge of the banking sector. I am

confident that she will successfully lead the bank forward,

building on the strong foundations that we have in place.

As I look back, I am proud of what ABN AMRO has achieved and I

value the dedication and commitment that clients, shareholders and

colleagues have shown to this iconic Dutch institution. I am

confident that ABN AMRO will continue banking for better, for

generations to come.

Key figures and indicators

(in EUR millions) |

Q4 2024 |

Q4 2023 |

Change |

Q3 2024 |

Change |

| Operating

income |

2,240 |

2,041 |

10% |

2,253 |

1% |

|

Operating expenses |

1,614 |

1,462 |

10% |

1,334 |

21% |

|

Operating result |

626 |

580 |

8% |

920 |

-32% |

| Impairment

charges on financial instruments |

9 |

-83 |

|

-29 |

|

|

Income tax expenses |

220 |

117 |

88% |

259 |

-15% |

|

Profit/(loss) for the period |

397 |

545 |

-27% |

690 |

-42% |

|

|

|

|

|

|

| Cost/income

ratio |

72.0% |

71.6% |

|

59.2% |

|

| Return on

average Equity |

6.2% |

9.5% |

|

11.6% |

|

| CET1

ratio1 |

14.5% |

14.3% |

|

14.1% |

|

This press release is published by ABN

AMRO Bank N.V. and contains inside information within the

meaning of article 7 (1) to (4) of Regulation (EU) No 596/2014

(Market Abuse Regulation).

Note to editors, not for publication:

For more information, please contact

ABN AMRO Press Office: Jarco de Swart, E-mail:

pressrelations@nl.abnamro.com, phone number: +31 (0)20 6288900.

ABN AMRO Investor Relations: John Heijning, E-mail:

investorrelations@nl.abnamro.com, phone number +31 (0)20

6282282.

1 Capital ratio for Q3 2024 are pro-forma, including

50% of the net profit. For more information about the ratio, please

refer to the Capital management section in our quarterly

report.

- 20250212 ABN AMRO Bank posts net profit of EUR 397 million in

Q4 2024

- ABN AMRO Quarterly report Q4 2024

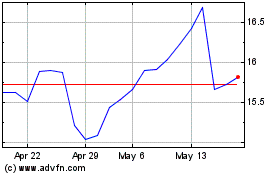

ABN AMRO Bank N.V (EU:ABN)

Historical Stock Chart

From Jan 2025 to Feb 2025

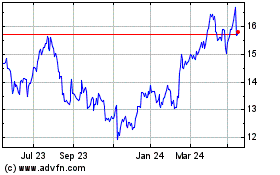

ABN AMRO Bank N.V (EU:ABN)

Historical Stock Chart

From Feb 2024 to Feb 2025