ABN AMRO Bank posts net profit of EUR 674 million in Q1 2024

May 15 2024 - 12:00AM

ABN AMRO Bank posts net profit of EUR 674 million in Q1 2024

ABN AMRO Bank posts net profit of EUR 674 million in Q1

2024 Q1 - Key messages of the quarter

- Very strong result with a net profit of EUR 674 million, driven

by net interest income, fee income and low cost of risk

- Business momentum remained good; our mortgage loan book grew by

EUR 0.8 billion and our corporate loan book by EUR 0.3 billion. We

were market leader in mortgages in Q1

- Continued strong net interest income as we continued to benefit

from the current interest rate environment

- Fee income higher, driven by good performance in all client

units

- Credit quality remains solid; impairments of EUR 3 million

reflecting net additions for individual files and an improved

macroeconomic outlook

- Strong capital position with Basel III CET1 ratio of 13.8% and

Basel IV CET1 ratio around 14%

- Third share buyback programme of EUR 500 million finalised in

May

- Our new brand promise ‘For every new beginning’ reflects how we

help our clients to move forward with every new beginning, building

on our entrepreneurial spirit and expertise

Robert Swaak, CEO:

The Dutch economy continues to show resilience. Uncertainties

remain as geopolitical developments continue to pose a risk to the

growth and inflation outlook, which may also affect interest rate

developments. Demand for credit remains good and both our mortgage

and corporate loan books grew. We were market leader in new

mortgage production, with a market share of 19% supported by

competitive pricing and the continuous improvement of the customer

journey. House prices are almost back to the record levels of 2022

and sentiment is improving. We expect house prices to increase

further, while the tight supply on the housing market will continue

to limit the number of transactions. Energy labels are increasingly

influencing house prices and we have extended the term of our

mortgages for financing sustainable home improvements from 15 to 30

years to better support our clients in making their homes more

sustainable. In the first quarter of 2024 we delivered a very

strong performance, with a net profit of EUR 674 million. The

resulting return on equity (ROE) was 11.6%. Net interest income was

strong at EUR 1,589 million as we continued to benefit from the

current interest rate environment. Fee income was higher at EUR 469

million, as all client units performed better compared with both

last year and last quarter. Costs came down 11% in comparison with

the first quarter of 2023 as regulatory levies were lower, while

staff costs for data capabilities, digitalisation and regulation

programmes remained high. We expect full-year costs for 2024 to be

around EUR 5.3 billion due to higher staff costs in the second half

of the year.

Credit quality remains solid and impairments in Q1 were EUR 3

million as net additions for individual files, mainly at Corporate

Banking, were almost fully offset by the improved macroeconomic

outlook and a decrease in management overlays. Risk-weighted assets

increased by EUR 4 billion, mainly reflecting model-related add-ons

and seasonal business developments. Our capital position remains

strong, with a fully-loaded Basel III CET1 ratio of 13.8% and a

Basel IV CET1 ratio around 14%. We continue to focus on the

optimisation of our capital position and are fully committed to

generating and returning surplus equity to shareholders in

combination with targeted growth. In early May we finalised our

third share buyback programme, which had been announced in

February. Last month marked the beginning of 200 years of ABN AMRO,

as our oldest predecessor, the Netherlands Trading Society

(Nederlandsche Handel-Maatschappij), was established in April 1824.

Over the years, we have often led the field with innovative

products and have supported various global enterprises from their

infancy. In 1928 we opened a Women’s Bank for women who wanted to

handle their own banking and in 1948 we launched a travelling bank

branch in the form of a bus that drove around in new

neighbourhoods. Today we continue to build on this entrepreneurial

spirit and expertise, always centred around our clients. Our new

brand promise ‘For every new beginning’, which we launched in

March, projects our history into the future. We promise our clients

to help them move forward with every new beginning, big or small.

To ensure we live up to our promise, we are accelerating our

journey towards becoming a personal bank in the digital age with a

clear licence to grow. We continue to consolidate the bank's

foundations by transforming our application processes and improving

our model and data landscape, while streamlining our operations to

become more effective and remain competitive. Our cost discipline

remains important, and I am fully committed to our strategic

targets. I would like to welcome Caroline Oosterloo-Van ‘t Hoff,

who will take on the role of Chief Risk Officer on an interim basis

while we are in the process of appointing a successor to Tanja

Cuppen. Our staff are the backbone of our bank, showing tremendous

flexibility and determination to serve our clients. I would like to

thank them for making us the bank we are. Our clients are crucial

to us, and I realise that their trust is our most important asset.

We do not take that for granted.

| ABN AMRO

Press Office Jarco de Swart Senior Press

Officerpressrelations@nl.abnamro.com+31 20 6288900 |

ABN AMRO

Investor RelationsJohn Heijning Head of Investor Relations

investorrelations@nl.abnamro.com+31 20 6282282 |

|

Key figures and indicators (in EUR

millions) |

Q1 2024 |

Q1 2023 |

Change |

Q4 2023 |

Change |

| Operating

income |

2,197 |

2,142 |

3% |

2,041 |

8% |

|

Operating expenses |

1,257 |

1,406 |

-11% |

1,462 |

-14% |

|

Operating result |

940 |

736 |

28% |

580 |

62% |

| Impairment

charges on financial instruments |

3 |

14 |

|

-83 |

|

|

Income tax expenses |

263 |

199 |

32% |

117 |

125% |

|

Profit/(loss) for the period |

674 |

523 |

29% |

545 |

24% |

| |

|

|

|

|

|

| Cost/income

ratio |

57.2% |

65.6% |

|

71.6% |

|

| Return on

average Equity |

11.6% |

9.6% |

|

9.5% |

|

| CET1

ratio |

13.8% |

15.0% |

|

14.3% |

|

This press release is published by ABN AMRO Bank N.V.

and contains inside information within the meaning of article 7 (1)

to (4) of Regulation (EU) No 596/2014 (Market Abuse

Regulation).

- Quarterly Q1 Report 2024 ABN AMRO

- 20240515 ABN AMRO Bank posts net profit of EUR 674 million in

Q1 2024

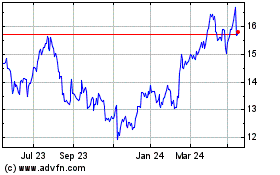

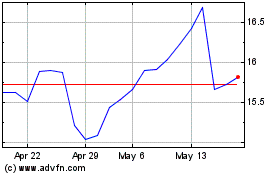

ABN AMRO Bank N.V (EU:ABN)

Historical Stock Chart

From Jan 2025 to Feb 2025

ABN AMRO Bank N.V (EU:ABN)

Historical Stock Chart

From Feb 2024 to Feb 2025