- Fundraising of €5.5 million through the issue of 83,924,897 New

Shares

- Sanyou (HK) International Medical Holding Co., limited

strengthens its stake and now owns 74.56% of the capital and voting

rights of the Company

Regulatory News:

IMPLANET (Euronext Growth: ALIMP, FR0013470168, eligible for

PEA-PME equity savings plans), (the “Company”), a medical

technology company specialized in implants for orthopedic surgery

and the distribution of technological medical equipment, announces

the success of the capital increase in cash with preferential

subscription rights for shareholders announced on January 4, 2024

(the "Capital Increase"). This operation raised €5.5 million

through the issue of 83,924,897 new shares ("New Shares") at

a unit price of €0.0655, corresponding to the closing price on

January 3, 2024 (€0.0655), prior to the setting of the issue price

by Implanet's Board of Directors.

The gross income from the Capital Increase, which amounts to

€5.5 million, will enable the Company, in accordance with the press

release of January 4, 2024, to:

- Ensure the financing of the Company's anticipated cash

requirements over the next 12 months (the financial resources

available to the Company, at the date of this press release, do not

cover its forecast 12-month requirements) and to meet its financial

commitments. Based on current business assumptions and anticipated

commercial developments with Sanyou Medical, the Company estimates

that the net proceeds of the current issue of €5.3 million will

provide it with a financial visibility of more than 12 months1

;

- Ensure the commercial development of the Company's medical

devices around three main axes:

- deploy the commercial and technological partnership with Sanyou

Medical for the joint development of a new European range of hybrid

posterior fixation systems;

- Initiate distribution of the JAZZ® platform in China (the

world's largest spine market by volume) with Sanyou Medical;

- distribute high-tech medical equipment in Europe, such as the

ultrasonic medical scalpel from SMTP Technology Co.

Results of the Capital Increase with preferential

subscription rights for shareholders

The Capital Increase was the subject of a global demand of

83,924,897 New Shares at a unit price of €0.0655, with a ratio of

19 New Shares for 8 existing shares held, for a total requested

amount of €5,497,080.75, representing 86.10 % of the amount of the

initial offer (€6,384,842.536).

Subscriptions are distributed this way:

- 46,086,780 New Shares on an irreducible basis, representing

54.91 of the issued New Shares;

- 36,632,431 New Shares on a reducible basis, representing 43.65

% of the issued New Shares. The service rate for reducible

applications is 100%;

- 1,205,686 New Shares on a voluntary basis.

In accordance with its subscription commitment and following the

approval of the Chinese authorities on December 28, 2023, Sanyou

Medical, which held 16,841,069 Implanet shares (representing 41.03%

of the share capital), subscribed for 39,997,527 New Shares on an

irreducible basis and 36,338,350 New Shares on a reducible basis

for a total amount of €4,999,999.9435, representing a total of

76,335,877 New Shares (or 90.96% of the New Shares issued).

Sanyou Medical's subscription was fully subscribed.

Following the operation, Sanyou Medical now holds 74.56% of

Implanet's capital and voting rights.

Sanyou Medical will thus cross the threshold of 50% of the

Company's capital and voting rights, which is the threshold

required to launch a mandatory tender offer.

As a reminder, Sanyou Medical obtained a waiver from the

Autorité des Marchés Financiers (AMF) from the obligation to file a

mandatory tender offer if its share capital exceeds 50%,

post-operation based on article 234-9 paragraph 2 of the AMF's

general regulations ("Subscription to the capital increase of a

company in financial difficulty, subject to approval by the general

meeting of its shareholders").

Sanyou Medical also requested to benefit from the majority of

directorships on the Company's Board of Directors as from the

completion of the Capital Increase.

Finally, the stake of a shareholder who held 1% of the Company's

capital prior to the Capital Increase and who did not subscribe to

it has been reduced to 0.328%.

Settlement-delivery of the New Shares

Following settlement-delivery on February 6, 2024, Implanet's

share capital will amount to €1,249,684.84, comprising 124,968,484

shares with a par value of €0.01 each.

Application will be made for the New Shares to be admitted to

trading on Euronext Growth in Paris on the same day, on the same

quotation line as the existing shares (ISIN code FR0013470168 –

ticker ALIMP).

Impact of the Capital Increase on the shareholder

structure

The following table shows the breakdown of share capital after

completion of the Capital Increase:

After the operation

Number of shares

% of capital and voting

rights

(non-diluted basis)

Founders and historical investors

4,316

0.00%

Sanyou (HK) International Medical Holding

CO Limited

93,176,946

74.56%

Other financial investors

2,623,966

2.10%

Corporate officers, employees and

consultants

571,159

0.46%

Other individual shareholders

681,969

0.55%

Floating

27,910,128

22.33%

Total

124,968,484

100.00%

Impact of the issue on the shareholder's situation

Impact of the issue on shareholders' equity per share

(calculated on the basis of consolidated shareholders' equity

(Group share) as shown in the financial statements as of June 30,

2023, excluding interim losses, and on the basis of the 41,043,587

shares comprising the Company's share capital at that date) would

be as follows:

Equity per share (in euros)

Non-diluted basis*

Diluted basis for the exercise of

all existing instruments**

Before issuance of the New Shares

resulting from this Capital Increase

0.1041

0.1418

After the issue of 83,924,897 New Shares

resulting from this Capital Increase

0.0782

0.0907

*: Consolidated shareholders' equity amounted to €4,273,000 as

of June 30, 2023.

The stake of a shareholder who held 1% of the Company's capital

prior to the Capital Increase and who did not subscribe to it is as

follows:

Shareholder stake (in %)

Non-diluted basis

Diluted basis for the exercise of

all existing instruments**

Before issuance of the New Shares

resulting from this Capital Increase

1.000

0.994

After the issue of 83,924,897 New Shares

resulting from this Capital Increase

0.328

0.328

**: In the event of the exercise of all outstanding warrants,

BSPCE and share subscription options, whether exercisable or not,

i.e. 1,581,627 BSPCE, 136,000 share subscription options and

506,898 warrants, the exercise of which would lead to the creation

of 254,907 new shares.

Reminder of the other terms of the Capital Increase

In accordance with the provisions of Articles L.411-2-1 ,1° of

the French Monetary and Financial Code and 211-2 of the General

Regulations of the Autorité des Marchés Financiers (AMF), the

present issue will not give rise to a Prospectus approved by the

AMF, as it represents a total offering of less than €8,000,000, it

being specified that no similar offer has been made by the Company

over the past twelve months.

The offer was made on the basis of the 1st and 2nd resolutions

adopted by the Extraordinary General Meeting on November 16, 2023,

and by the Board of Directors of Implanet on January 4, 2024, which

decided on the principle of the Capital Increase with preferential

subscription rights and its implementation.

A notice to shareholders concerning this operation will be

published on January 12, 2024, in the Bulletin des Annonces Légales

et Obligatoires (BALO).

Resumption of the option to exercise the right to receive

shares in the Company

The rights of holders of stock options, business creator share

subscription warrants and share subscription warrants allocated or

issued by the Company, which had been suspended by decision of the

Board of Directors on February 4, 2024 from January 12, 2024 (0:01

a.m., Paris time) until and including the date of

settlement-delivery of the New Shares, will be restored as from the

date of settlement-delivery of the New Shares, i.e. February 6,

2024 (11:59 p.m., Paris time).

The rights of holders of stock options, warrants and warrants

allocated or issued by the Company who have not exercised their

right to the allocation of shares in the Company by January 12,

2024 (00:00 Paris time) will be preserved in accordance with legal

and regulatory provisions.

Risk factors

The Company draws attention to the risk factors relating to the

Company and its business set out in Chapter 4 "Risk factors" of the

Company's 2017 Reference Document filed with the AMF on April 16,

2018, under number D.18-0337, in the full-year financial report on

December 31, 2022 and in the half-yearly financial report on June

30, 2023.

As of December 31, 2023, the Company had cash of €0.25 million.

Based on current cash forecasts, the Company points out that this

level of cash will enable it to be financed until February 2024.

Based on current business assumptions and anticipated commercial

developments with Sanyou Medical, the Company estimates that the

net proceeds of the current Capital Increase of €5.3 million will

give it financial visibility of more than 12 months.

The other main risk factors relating to the forthcoming capital

increase are set out below:

- the volatility and liquidity of the Company's shares could

fluctuate significantly;

- sales of the Company's shares could occur on the market and

adversely affect the Company's share price;

- following the Capital Increase, the Company's main shareholder

holds 74.56% of the Company's capital and voting rights;

- the Company's shareholders could suffer potentially significant

dilution as a result of any future capital increases.

Partners of the operation

Atout Capital Advisor for this operation

Bird&Bird Legal advisor

Upcoming financial publication

- 2023 Full-Year Results, on March 5, 2024, after

market

About Sanyou Medical

Founded in 2005, Shanghai Sanyou Medical Co, Ltd. is a company

dedicated to the R&D, manufacturing and sales of innovative and

independent orthopedic products. The main products of Shanghai

Sanyou are spinal and trauma implants. Shanghai Sanyou is one of

the few companies with the ability to make original innovations

based on clinical requirements in the field of spinal implants in

China.

The Company has established a complete product development

system with world-class R&D equipment and project management

systems to ensure that its products are advanced, effective and

reliable. By the end of January 2021, Shanghai Sanyou Medical had

received 22 Class III medical device registration certificates and

131 patents, including 28 Chinese invention patents, 98 Chinese

utility model patents, 1 US utility patent, 1 Australian invention

patent, 1 Japanese invention patent, 1 German utility model patent

and 1 Chinese design patent.

About IMPLANET

Founded in 2007, IMPLANET is a medical technology company that

manufactures high-quality implants for orthopedic surgery and

distributing medical technology equipment. Its activity revolves

around a comprehensive innovative solution for improving the

treatment of spinal pathologies (JAZZ®) complemented by the product

range offered by Orthopaedic & Spine Development (OSD),

acquired in May 2021 (thoraco-lumbar screws, cages and cervical

plates). Implanet’s tried-and-tested orthopedic platform is based

on the traceability of its products. Protected by four families of

international patents, JAZZ® has obtained 510(k) regulatory

clearance from the Food and Drug Administration (FDA) in the United

States, the CE mark in Europe and ANVISA approval in Brazil. In

2022, IMPLANET entered into a commercial, technological and

financial partnership with SANYOU MEDICAL, China's second largest

medical device manufacturer. IMPLANET employs 43 staff and recorded

a consolidated revenue of €7.4 million in 2023. Based near Bordeaux

in France, IMPLANET opened a US subsidiary in Boston in 2013.

IMPLANET is listed on the Euronext Growth market in Paris.

For further information, please visit

www.Implanet.com.

Disclaimer

This press release contains forward-looking statements about

Implanet and its activity. Implanet estimates that these

forward-looking statements are based on reasonable assumptions.

However, no assurance can be given that the forecasts expressed in

these forward-looking statements will materialize, as they are

subject to risks, including those described in Implanet's reference

document filed with the Autorité des marchés financiers (AMF) on

April 16, 2018 under number D.18-0337, as well as in the annual

financial report for December 31, 2022 and the half-year financial

report for June 30, 2023, which are available on the Company's

website (www.implanet-invest.com), and to changes in economic

conditions, financial markets and the markets in which Implanet

operates. The forward-looking statements contained in this press

release are also subject to risks that are unknown to Implanet or

that Implanet does not currently consider material. The occurrence

of some or all of these risks could cause Implanet's actual

results, financial condition, performance or achievements to differ

materially from those expressed in the forward-looking statements.

Implanet does not undertake any obligation to update any

forward-looking information or statements, except as required by

applicable law, in particular articles 223-1 et seq. of the general

regulations of the Autorité des marchés financiers.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

common shares in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful in the absence of

registration or approval under the securities laws of such state or

jurisdiction.

The distribution of this press release may be subject to

specific regulations in certain countries. Persons in possession of

this document are required to inform themselves about and to

observe any such local restrictions.

This press release constitutes a promotional communication and

not a prospectus within the meaning of Regulation (EU) 2017/1129 of

the European Parliament and of the Council of June 14, 2017 (as

amended the "Prospectus Regulation").

With respect to member states of the European Economic Area

other than France (the "Member States"), no action has been or will

be taken to permit a public offering of the securities that would

require the publication of a prospectus in any of these Member

States. Consequently, the securities cannot and will not be offered

in any Member State (other than France), except in accordance with

the exemptions provided for in Article 1(4) of the Prospectus

Regulation, or in other cases not requiring the publication by

Implanet of a prospectus under the Prospectus Regulation and/or the

regulations applicable in those Member States. This press release

does not constitute an offer of securities to the public in the

United Kingdom.

This press release may not be published, distributed or

disseminated in the United States (including its territories and

possessions). This press release does not constitute an offer or

solicitation to buy, sell or subscribe for any securities in the

United States. The securities mentioned in this press release have

not been registered under the U.S. Securities Act of 1933, as

amended (the "Securities Act"), or any applicable state or federal

securities laws, and may not be offered or sold in the United

States absent registration under the Securities Act, except

pursuant to an applicable exemption from, or in a transaction not

subject to, registration under the Securities Act. Implanet does

not intend to register the offering in whole or in part in the

United States under or pursuant to the Securities Act or to conduct

a public offering in the United States.

This press release may not be distributed directly or indirectly

in the United States, Canada, Australia or Japan.

Lastly, this press release may be drafted in either French or

English. In the event of any discrepancies between the two texts,

the French version shall prevail.

_______________________ 1 The Company reminds that the interim

financing in the form of dry bonds from which it benefited in

October 2023, subject to two tranches, representing a nominal

amount of €1,300,000, subscribed at 77% of the nominal value of the

bond, will have to be repaid at the latest within five business

days following the completion of the Capital Increase (press

release of October 11, 2023).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240202513949/en/

IMPLANET Ludovic Lastennet, CEO David Dieumegard, CFO

Tél. : +33 (0)5 57 99 55 55 investors@Implanet.com

NewCap Investor Relations Nicolas Fossiez Tél.: +33 (0)1

44 71 94 94 Implanet@newcap.eu

NewCap Media Relations Arthur Rouillé Tél.: +33 (0)1 44

71 94 94 Implanet@newcap.eu

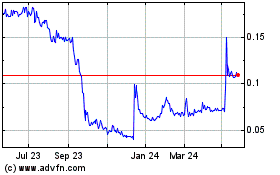

Implanet (EU:ALIMP)

Historical Stock Chart

From Feb 2025 to Mar 2025

Implanet (EU:ALIMP)

Historical Stock Chart

From Mar 2024 to Mar 2025