BIC: Q4 & Full Year 2024 Results

Clichy, France – February 18, 2025

FOURTH QUARTER & FULL YEAR 2024

RESULTS

Solid net sales performance in Q4 at

+4.4%1.

Full Year growth at

+0.8%1

Robust aEBIT margin at 15.6% and Free Cash Flow at

€271m

Solid growth in Q4, with net sales

increasing 4.4%1. FY

2024 net sales of €2,197 million, up

0.8%1 with continued

strong performance across Europe, Latin America and Middle East and

Africa

-

Human Expression: FY net sales of €814 million,

increasing 0.7%1, driven by good performance in Europe

and Middle East and Africa. Q4 growth was +2.8%1.

-

Flame for Life: FY net sales of €810 million,

decreasing 1.8%1, due to challenging consumption trends

in North America, balanced by strong growth across the rest of the

Group. Quarterly sequential improvement leading to Q4 net sales

growth of +4.1%1.

-

Blade Excellence: FY net sales of €543 million,

increasing 5.0%1, with robust performance across Europe,

Brazil and Middle East and Africa. Q4 growth was

+6.7%1.

Strong 2024 adjusted EBIT of €343

million, growing +3.0% year-on-year, adjusted EBIT

margin of 15.6%, +90 basis points

2024 adjusted EPS growth for

the 5th consecutive year at 6.15 euros

(+8% year-on-year)

Outstanding Free Cash Flow generation at

€271 million during 2024 (+9% year-on-year)

Acquisition of Tangle Teezer in December

2024, a market-leading, fast-growing and profitable

detangling haircare company, in line with BIC’s Horizon

ambitions

2025 Outlook: the Group expects

net sales growth between +4% and +6% at constant currency, adjusted

EBIT margin at the same level as 2024, at 15.6%, above BIC’s

Horizon target, and Free Cash Flow above €240 million

Shareholders’ remuneration:

-

Proposed ordinary dividend of 3.08 euros per

share2 for fiscal year 2024, up 8%

year-on-year, representing an estimated amount of €127 million

- Share

Buyback program of up to €40m to be executed in 2025

Key Group financial figures

|

in million euros |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

Net Sales |

526.1 |

517.5 |

2,263.3 |

2,196.6 |

|

Change as reported |

(0.1) % |

(1.6) % |

+1.3% |

(2.9) % |

|

Change on a constant currency basis

excl. Argentina |

+2.4% |

+4.4% |

+3.7% |

+0.8% |

|

Change on a constant currency basis |

+15.9% |

+2.9% |

+9.2% |

+3.1% |

|

|

|

|

|

|

|

Adjusted EBIT |

72.7 |

70.7 |

333.1 |

343.1 |

|

Adjusted EBIT Margin |

13.8% |

13.7% |

14.7% |

15.6% |

|

|

|

|

|

|

|

Group EPS |

€1.05 |

€0.65 |

€5.30 |

€5.10 |

|

Adjusted Group EPS |

€1.23 |

€1.40 |

€5.70 |

€6.15 |

|

|

|

|

|

|

|

Free Cash Flow (before acquisitions and

disposals) |

106.5 |

74.5 |

248.7 |

270.8 |

|

Net Cash Position |

385.4 |

189.3 |

385.4 |

189.3 |

Gonzalve Bich, BIC’s Chief Executive Officer

commented:

“2024 was a year of execution excellence,

building on the remarkable progress we have made since the launch

of our Horizon Strategic Plan. As we enter the final chapter of our

5-year Horizon journey, I am extremely proud of our

accomplishments, particularly the fact that we have delivered an

average annual growth rate of more than 5% through the period, in

line with our original mid-single digit growth ambition.

Throughout 2024, we demonstrated resilience

in the face of a volatile macroeconomic environment. Our dedicated

team members globally rose to the occasion, achieving strong

results through disciplined execution, innovation, and the

successful promotion of our products. Our consumer-focused

marketing campaigns sparked growth across diverse and targeted

regions.

This solid commercial execution in 2024,

coupled with our high level of operational excellence, meant that

our financial ratios outpaced our expectations for the year. We

achieved a solid adjusted EBIT margin at 15.6%, we grew adjusted

earnings per share for the fifth year in a row, and Free Cash Flow

generation remained robust.

We ended the year by laying the foundation

for greater value creation for all our stakeholders with the

promising acquisition of Tangle Teezer.”

2025 Outlook3

In line with BIC’s Horizon Plan mid-single digit

growth trajectory, net sales are expected to grow

between 4% and 6% at constant currency in

2025.

Adjusted EBIT margin is

expected to be at the same level as 2024, at

15.6%, above BIC’s Horizon target.

Free Cash Flow is expected to

be above €240 million.

Key highlights

| in million

euros |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

Net Sales |

526.1 |

517.5 |

2,263.3 |

2,196.6 |

|

Gross Profit |

271.6 |

256.1 |

1,148.1 |

1,102.7 |

|

Gross Profit margin |

51.6% |

49.5% |

50.7% |

50.2% |

|

EBITDA |

102.3 |

85.5 |

422.8 |

410.5 |

|

EBIT |

64.2 |

33.7 |

320.5 |

289.7 |

|

EBIT margin |

12.2% |

6.5% |

14.2% |

13.2% |

|

Non-recurring items4 |

8.5 |

37.0 |

12.6 |

53.4 |

|

Adjusted EBIT |

72.7 |

70.7 |

333.1 |

343.1 |

|

Adjusted EBIT margin |

13.8% |

13.7% |

14.7% |

15.6% |

Net sales

Q4 2024 net sales were up 4.4% at

constant currency excl. Argentina, driven by robust growth

in Europe, Brazil and Middle East and Africa, particularly in the

Blade Excellence and Flame for Life divisions. Performance in North

America continued to improve sequentially in Q4.

Full Year 2024 net sales were up 0.8% at

constant currency excl. Argentina with solid performance

across Europe, Latin America and Middle East and Africa, partially

offset by challenging market trends and lower consumption in North

America, notably during the first half.

Gross profit

Q4 2024 gross profit margin

decreased by 2.1 points to 49.5%. Excluding the

fair value adjustment on the Power Purchase Agreement in France and

on the Virtual Power Purchase Agreement in Greece5,

Q4 2024 gross profit margin increased 40 basis points

to 52.0%, driven by favorable price and mix, currency

fluctuations and manufacturing efficiencies. This was partially

offset by an increase in raw material costs.

Full Year 2024 gross profit

margin decreased by 50 basis points at 50.2%.

Excluding the special bonus6 and the fair value

adjustment on the Power Purchase Agreement in France and on the

Virtual Power Purchase Agreement in Greece, FY 2024 gross

profit margin increased 40 basis points to 51.1%, driven

by favorable price and mix, manufacturing efficiencies and positive

currency fluctuations. This was partially offset by unfavorable

fixed cost absorption and higher raw material costs.

Adjusted EBIT margin

Q4 2024 adjusted EBIT margin

was stable year-on-year at 13.7%, mainly

attributable to favorable price and mix, currency fluctuations,

manufacturing efficiencies and lower brand support, offset by

higher operating and other expenses.

FY 2024 adjusted EBIT margin was up

90 basis points, at 15.6%, driven by favorable price

and mix, manufacturing efficiencies, positive currency

fluctuations, as well as lower brand support investments versus

last year.

Key components of the change in adjusted

EBIT margin

| Key

components of the change in adjusted EBIT margin

(in points) |

Q1 2024 vs.

Q1 2023 |

Q2 2024 vs.

Q2 2023 |

Q3 2024 vs.

Q3 2023 |

Q4 2024 vs.

Q4 2023 |

2024

vs.

2023 |

- Change in Gross Profit(5)(6)

|

+0.5 |

+0.8 |

(0.1) |

+0.4 |

+0.4 |

|

|

(0.1) |

- |

+1.0 |

+0.9 |

+0.5 |

- Operating expenses and other expenses

|

(1.4) |

+0.1 |

+2.8 |

(1.4) |

- |

|

Total change in Adjusted EBIT margin |

(1.0) |

+0.9 |

+3.7 |

(0.1) |

+0.9 |

Net income and earnings per share (EPS)

|

in million euros |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

EBIT |

64.2 |

33.7 |

320.5 |

289.7 |

|

Finance revenue/costs |

(3.5) |

6.9 |

(7.5) |

7.9 |

|

Income before Tax |

60.6 |

40.6 |

313.0 |

297.6 |

|

Net Income Group share |

45.1 |

27.0 |

226.5 |

212.0 |

|

Adjusted Net Income Group Share |

52.7 |

58.3 |

243.4 |

255.6 |

|

Adjusted Group Earnings per share (in euros) |

1.23 |

1.40 |

5.70 |

6.15 |

|

Group Earnings per share (in euros) |

1.05 |

0.65 |

5.30 |

5.10 |

Full Year 2024 finance revenue was 7.9

million euros compared to a cost of 7.5 million euros last

year, mainly due to favorable impact of the fair value adjustments

to financial assets denominated in US Dollar against the Brazilian

Real. Full Year 2024 effective tax rate was 28.8%

vs. 27.6% in FY 2023.

Change in net cash position

| Change

in net cash position (in million euros) |

2023 |

2024 |

|

Net Cash position (beginning of period) |

359.9 |

385.4 |

|

Net cash from operating activities |

+353.3 |

+357.7 |

- Of which operating cash flow

|

+469.2 |

+471.0 |

- Of which change in working capital

|

(27.4) |

+17.7 |

|

|

(88.5) |

(131.1) |

|

Capital expenditures |

(104.6) |

(86.9) |

|

Free Cash Flow (before acquisition and

disposals) |

248.7 |

270.8 |

|

Dividend payment |

(110.2) |

(178.0) |

|

Share buyback program8 |

(116.2) |

(55.7) |

|

Acquisitions |

- |

(201.3) |

|

Other items |

+3.2 |

(31.9) |

|

Net Cash position (end of period) |

385.4 |

189.3 |

Full year 2024 Operating Cash flow was

471 million euros. Free Cash Flow (before acquisitions and

disposals) was 271 million euros.

Shareholders’ remuneration for full year

2024

- A total dividend

amount of €178 million euros, or €4.27 per share comprised of:

- An ordinary

dividend of €2.85 per share was paid on June 12, 2024.

- An extraordinary

dividend of €1.42 per share was paid on September 18, 2024.

- €55.7 million in

share buybacks were completed by Société BIC in 2024. This includes

€40 million of share buyback for cancellation and €15.7 million of

free shares to be granted (long term incentives). 907,577 shares

were purchased at an average price of €61.36 per share.

Update on BIC’s Horizon Strategic Plan

During 2024, the Group continued to roll

out its 2025 Horizon strategic ambitions:

- In December, BIC acquired

Tangle Teezer a market-leading, premium detangling

haircare company, supporting BIC’s Horizon strategy by gaining

exposure to a scaled, fast-growing and profitable business with

meaningful upside potential. As part of BIC, Tangle Teezer is well

positioned to reach further scale and gain market-leading positions

in BIC’s key regions. Tangle Teezer’s expertly designed products,

combined with BIC’s unique commercial and supply chain capabilities

will continue to drive long-term profitable growth.

- BIC continued to focus on

Revenue Growth Management by streamlining the

Group’s portfolio to better meet consumer needs and optimize

product mix. In 2024, this resulted in an 11% reduction in SKUs,

leading to a total of 40% SKU reduction since 2019. BIC also

continued to improve its net sales per SKU ratio by 15% in 2024. It

almost doubled since 2019, with newly created products positively

contributing.

- BIC pursued its strong commercial

execution through the launch of impactful advertising

campaigns which yielded tremendous results. In the US

and Europe, BIC continued its long-lasting partnership with Snoop

Dogg and Martha Stewart to promote its iconic utility pocket

lighter EZ Reach. In Human Expression, BIC launched several

campaigns during the Back-to-School season such as “Go Make

WOW” for BIC Kids in Europe, and a 4-Color campaign “A pen

for every side of you” featuring Charlie Puth in the US. In

Blade Excellence, BIC partnered in Brazil with famous TV

personality Lo Bosworth for the digital campaign “Tickle your

senses”, promoting the new added-value Soleil Escape female

shaver.

- eCommerce was a

key growth driver with core ecommerce sales increasing double

digits at constant currency. This growth was fueled by all three

divisions in key regions, particularly North America, Europe and

Latin America. Best-performing products online included the

mechanical pencil in the US, the iconic 4-Color pen and the

added-value Flex 5 Hybrid shaver in Europe.

Operational Trends by

Division

Human Expression

|

in million euros |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

Volumes in million units |

- |

- |

6,073 |

5,999 |

|

% Change |

- |

- |

(6.9) % |

(1.2) % |

|

Net Sales |

170.9 |

161.7 |

845.9 |

813.9 |

|

Change as reported |

(2.7) % |

(5.4) % |

+0.8% |

(3.8) % |

|

Change on a constant currency basis

excluding Argentina |

(1.6) % |

+2.8% |

+2.8% |

+0.7% |

|

Change on a constant currency basis |

+20.2% |

(1.1) % |

+10.2% |

+2.9% |

|

|

|

|

|

|

|

Adjusted EBIT |

(0.0) |

(1.6) |

60.5 |

61.5 |

|

Adjusted EBIT Margin |

(0.0) % |

(1.0) % |

7.2% |

7.6% |

Full Year 2024 Human Expression net

sales were up 0.7% at constant currency excl. Argentina.

In Q4, net sales were up

2.8%.

In Europe, net sales growth was

up by mid-single digits in 2024. Performance came from key

countries such as France, Poland, the Netherlands and Spain, all

boosted by distribution gains notably in the discounters’ channel.

BIC’s widespread advertising campaigns such as “A pen for every

side of you” and “Go make WOW” during the

Back-to-School season also contributed to market share gains such

as in France (+1.4 pts9). The iconic Ball Pen and

4-Color products were key contributors to growth, the latter

benefiting from its successful decors such as the Olympics and

Pastel.

In North America, despite

challenging consumption trends, BIC’s historical stationery

segments in the US including ball pens, highlighters and mechanical

pencils performed well, contributing to solid growth in Q4. Growth

was also strong across the discounters and e-commerce channels, the

latter growing double digit, fueled by a solid Back-to-School

season in the US. However, the overall net sales performance in the

region was negatively impacted by soft results in the Digital

Writing and Skin Creative segments.

In Latin America, net sales

grew low-single digits in Mexico, driven by both ball pens as well

as the value-added coloring segment. This was more than offset by

the negative performance in Brazil, impacted by a competitive

trading environment notably in the modern mass market, as well as a

softer Back-to-School season.

In Middle East and Africa, net

sales grew double digit fueled by distribution gains in Western

Africa and a solid Back-to-school sell-in performance in South

Africa. Performance came notably from the ball pen and the marking

segments as well as Lucky Stationery pens in Nigeria.

In Q4 2024, Human Expression adjusted

EBIT margin declined 1 point at -1.0%, due to higher

raw material and electricity costs, operating and other expenses as

well as net sales negative operating leverage. This was partially

offset by favorable product mix, currency fluctuations and lower

brand support.

In 2024, the adjusted EBIT margin

increased 40 basis points to 7.6%, driven by positive

currency fluctuations, favorable price and mix, as well as lower

operating and other expenses and brand support. This was partially

offset by unfavorable fixed cost absorption and higher raw material

and electricity costs.

Flame for Life

|

in million euros |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

Volumes in million units |

- |

- |

1,603 |

1,536 |

|

% Change |

- |

- |

(2.7) % |

(4.2) % |

|

Net Sales |

217.1 |

216.2 |

851.5 |

809.8 |

|

Change as reported |

(1.1) % |

(0.5) % |

(2.3) % |

(4.9) % |

|

Change on a constant currency basis

excluding Argentina |

+1.7% |

+4.1% |

(0.3) % |

(1.8) % |

|

Change on a constant currency basis |

+7.8% |

+3.0% |

+3.3% |

(0.9) % |

|

|

|

|

|

|

|

Adjusted EBIT |

69.0 |

74.0 |

290.4 |

269.3 |

|

Adjusted EBIT Margin |

31.8% |

34.2% |

34.1% |

33.3% |

Full Year 2024 Flame for Life net

sales were down 1.8% at constant currency excl. Argentina.

In Q4, net sales were up

4.1%.

In Europe, full year net sales

increased high single digit, fueled by most countries. Performance

was driven by added-value products, as illustrated by the growth of

premium lighters such as Djeep and the BIC EZ Reach utility pocket

lighter. Additionally, solid commercial execution drove growth

through further distribution gains in both the modern mass market

and at discounters, notably in Germany, the Netherlands and across

Eastern Europe.

In North America, full year net

sales growth was negative, however performance improved

sequentially throughout the year leading to low-single digit growth

in the fourth quarter. In 2024, the US total lighter market was

down by 5.0% in value10, negatively impacted by lower

consumption trends, particularly during the first half. BIC

continued to outpace the market in value (+0.4 pts) driven by the

ongoing success of its value-added products such as the BIC EZ

Reach lighter, supported by the world-famous advertising campaign

with Snoop Dogg and Martha Stewart.

In Latin America, performance

was robust in Brazil with double digit growth, fueled by both

pocket and utility lighters, in addition to the continued ramp-up

of EZ Reach. This was supported by additional distribution gains,

solid in-store execution and digital media campaigns.

In Middle East and Africa, net

sales performance was solid with mid-single digit growth, driven by

strong execution and distribution gains, notably in Nigeria and

North Africa.

In Q4 2024, Flame for Life adjusted EBIT

margin increased 2.4 points to

34.2%, mainly driven by favorable price and mix as well as

lower operating and other expenses.

In 2024, the adjusted EBIT

margin was 33.3%, compared to 34.1% last year, mainly

due to higher raw material costs, unfavorable fixed cost absorption

and negative net sales operating leverage.

Blade Excellence

|

in million euros |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

Volumes in million units |

- |

- |

2,428 |

2,474 |

|

% Change |

- |

- |

+3.3% |

+1.9% |

|

Net Sales |

129.4 |

130.3 |

536.8 |

543.3 |

|

Change as reported |

+4.4% |

+0.6% |

+8.0% |

+1.2% |

|

Change on a constant currency basis

excluding Argentina |

+8.6% |

+6.7% |

+11.6% |

+5.0% |

|

Change on a constant currency basis |

+24.3% |

+7.9% |

+17.8% |

+9.7% |

|

|

|

|

|

|

|

Adjusted EBIT |

21.9 |

22.5 |

68.4 |

100.6 |

|

Adjusted EBIT Margin |

16.9% |

17.3% |

12.7% |

18.5% |

Full Year 2024 Blade Excellence net

sales were up 5.0% at constant currency excl. Argentina.

In Q4, net sales were up

6.7%.

In Europe, net sales grew high

single digit with robust performance across key countries such as

Greece, Spain and the Netherlands, driven by innovation such as the

Men Hybrid Flex range and the BIC Soleil Escape Women shaver. BIC

strong value for money proposition continues resonating with

consumers in an inflationary environment and BIC successfully

outpaced the market, with share gains in 7 out of 11 countries,

becoming the number 2 player in the wet shave

market11.

In North America, net sales

were negatively impacted by challenging market trends (the market

was down 3.1% in value in 202412) and aggressive

competition, particularly in the Women’s segment. BIC’s market

share was stable, supported by strong growth in Men where it gained

share in value (+1 pt) with added-value products such as Flex

5 Hybrid as well as distributions gains.

In Latin America, net sales

grew double digit driven by BIC’s successful trade-up strategy in

Brazil and Mexico, with further distribution gains in the 3-blade

segment, including the Soleil and Flex 3 ranges.

In Middle East and Africa, net

sales grew double digit, driven by solid execution and distribution

gains. The Flex and Soleil brands were key contributors to growth,

notably in the Middle East and North Africa regions.

In Q4 2024, Blade Excellence adjusted

EBIT margin was up 40 basis points to 17.3%, versus

16.9% in Q4 2023, driven by favorable currency

fluctuations, price and mix as well as lower operating and

other expenses. This was partially offset by higher raw material

and electricity costs.

In 2024, adjusted EBIT

margin reached 18.5%, improving by 5.8 points

compared to 12.7% in FY 2023, with a strong gross profit margin

improvement driven by favorable price and mix, fixed cost

absorption as well as manufacturing efficiencies. This significant

improvement was also driven by lower operating and other expenses

as well as lower brand support.

BIC Sustainable Development journey

As part of its ongoing Sustainable Development

journey, BIC made progress in 2024 advancing its goals and taking

further steps to reduce its overall carbon footprint.

|

|

2025 targets |

2024 achievements |

|

Fostering sustainable innovation in

BIC®

products |

100% reusable, recyclable or compostable plastic packaging |

85% reusable, recyclable, or compostable plastics in BIC's products

packaging |

|

Acting against climate change |

100% renewable electricity |

92% renewable electricity |

|

Committing to a safe work environment |

Zero lost-time incidents across all operations |

81% of total BIC sites reached a zero lost-time incident level |

|

Proactively involving suppliers |

Work responsibly with its strategic suppliers to ensure the most

secure, innovative, and efficient sourcing |

95% of strategic suppliers have integrated the responsible

purchasing program |

|

Improving lives through education |

Improve learning conditions for an estimated 250 million

children globally |

Estimated number of children with improved learning conditions: 210

million (cumulative since 2018) |

Governance

-

BIC announced on December 11th, 2024,

preparations for CEO Gonzalve Bich succession by September

30th, 2025.

-

Sébastien Drecq was appointed in October 2024 as Director

representing the employees to the Board of Directors of Société

BIC, replacing Pascal Chevallier who resigned on August

31st, 2024.

Other events

-

BIC announced on December 11th, 2024, the acquisition of

Tangle Teezer, a premium detangling haircare company.

-

As of January

1st, 2025,

BIC will no longer report its full financial results for each

quarter of the year. The full financial results will be

communicated twice a year, for the first half and for the full year

results publication. For the first and third quarters, BIC will

report and comment only on net sales performance.

Appendix

Net sales by geography

Q4 net

sales by geography

(in million euros) |

Q4 2023 |

Q4 2024 |

% As reported |

% at constant currency |

% On a comparative basis |

|

Group |

526.1 |

517.5 |

(1.6) % |

+2.9% |

+4.4% |

|

Europe |

141.3 |

149.9 |

+6.0% |

+7.0% |

+7.0% |

|

North America |

198.7 |

196.4 |

(1.2) % |

(1.9) % |

(1.9) % |

|

Latin America |

128.4 |

107.4 |

(16.3) % |

+1.4% |

+8.1% |

|

Middle East and Africa |

29.2 |

36.3 |

+24.3% |

+29.5% |

+29.5% |

|

Asia and Oceania (including India) |

28.4 |

27.5 |

(3.3) % |

(3.5) % |

(3.5) % |

FY net

sales by

geography

(in million euros) |

FY 2023 |

FY 2024 |

% As reported |

% at constant currency |

% On a comparative basis |

|

Group |

2,263.3 |

2,196.6 |

(2.9) % |

+3.1% |

+0.8% |

|

Europe |

665.9 |

697.8 |

+4.8% |

+6.8% |

+6.8% |

|

North America |

882.9 |

818.6 |

(7.3) % |

(7.2) % |

(7.2) % |

|

Latin America |

461.7 |

424.9 |

(8.0) % |

+14.6% |

+4.1% |

|

Middle East and Africa |

154.2 |

162.5 |

+5.4% |

+15.8% |

+15.8% |

|

Asia and Oceania (including India) |

98.6 |

92.8 |

(5.9) % |

(4.7) % |

(4.7) % |

Net sales by division

Q4 net

sales by division

(in million euros) |

Q4 2023 |

Q4 2024 |

% As reported |

FX impact (in points) |

Change in Perimeter (in points) |

Argentina impact (in points) |

% On a comparative basis |

|

Group |

526.1 |

517.5 |

(1.6) % |

(2.5) % |

(0.0) % |

(3.5) % |

+4.4% |

|

Stationery- Human Expression |

170.9 |

161.7 |

(5.4) % |

(2.1) % |

(0.0) % |

(6.1) % |

+2.8% |

|

Lighters- Flame for Life |

217.1 |

216.2 |

(0.5) % |

(2.5) % |

(0.0) % |

(2.1) % |

+4.1% |

|

Shavers- Blade Excellence |

129.4 |

130.3 |

+0.6% |

(3.5) % |

(0.0) % |

(2.6) % |

+6.7% |

|

Other Products |

8.6 |

9.4 |

+9.1% |

+0.1% |

(0.0) % |

(0.0) % |

+9.0% |

FY net

sales by division

(in million euros) |

FY 2023 |

FY 2024 |

% As reported |

FX impact (in points) |

Change in Perimeter (in points) |

Argentina impact (in points) |

% On a comparative basis |

|

Group |

2,263.3 |

2,196.6 |

(2.9) % |

(2.2) % |

(0.0) % |

(1.5) % |

+0.8% |

|

Stationery- Human Expression |

845.9 |

813.9 |

(3.8) % |

(2.4) % |

(0.0) % |

(2.1) % |

+0.7% |

|

Lighters- Flame for Life |

851.5 |

809.8 |

(4.9) % |

(1.8) % |

(0.0) % |

(1.3) % |

(1.8) % |

|

Shavers- Blade Excellence |

536.8 |

543.3 |

+1.2% |

(2.9) % |

(0.0) % |

(0.9) % |

+5.0% |

|

Other Products |

29.1 |

29.7 |

+2.2% |

(0.0) % |

(0.0) % |

(0.0) % |

+2.2% |

Impact of Change in Perimeter and Currency Fluctuations

on Net Sales

| Impact

of Change in Perimeter and Currency Fluctuations on Net Sales

(excludes ARS) (in %) |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

Perimeter |

- |

(0.0) |

+0.2 |

(0.0) |

|

Currencies |

(4.5) |

(2.5) |

(3.1) |

(2.2) |

|

of which USD |

(2.0) |

+0.4 |

(1.1) |

+0.0 |

|

of which BRL |

+0.1 |

(1.6) |

+0.1 |

(0.7) |

|

of which MXN |

+0.5 |

(0.7) |

+0.5 |

(0.2) |

|

of which NGN |

(0.6) |

(0.6) |

(0.4) |

(0.8) |

|

of which TRY |

(0.4) |

(0.2) |

(0.4) |

(0.5) |

|

of which RUB and UAH |

(1.0) |

(0.2) |

(0.8) |

(0.2) |

|

Sensitivity to Net Sales and Income Before Tax (IBT) of

USD-EUR fluctuation (in %) |

FY 2023 |

FY 2024 |

|

+/- 5% change in USD impact on Net Sales |

1.9 |

1.9 |

|

+/- 5% change in USD impact on IBT |

0.8 |

0.3 |

EBIT by division

| EBIT by

division (in million euros) |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

Group |

64.2 |

33.7 |

320.5 |

289.7 |

|

Margin |

12.2% |

6.5% |

14.2% |

13.2% |

|

Stationery- Human Expression |

(6.1) |

(22.8) |

51.1 |

33.6 |

|

Margin |

(3.6) % |

(14.1) % |

6.0% |

4.1% |

|

Lighters- Flame for Life |

67.6 |

72.9 |

288.6 |

262.5 |

|

Margin |

31.1% |

33.7% |

33.9% |

32.4% |

|

Shavers- Blade Excellence |

21.1 |

7.7 |

67.3 |

82.5 |

|

Margin |

16.3% |

5.9% |

12.5% |

15.2% |

|

Other Products |

0.7 |

(0.5) |

(1.0) |

(3.8) |

|

Unallocated costs |

(19.1) |

(23.6) |

(85.5) |

(85.1) |

Adjusted EBIT by division

|

Adjusted EBIT by division (in million euros) |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

Group |

72.7 |

70.7 |

333.1 |

343.1 |

|

Margin |

13.8% |

13.7% |

14.7% |

15.6% |

|

Stationery- Human Expression |

(0.0) |

(1.6) |

60.5 |

61.5 |

|

Margin |

(0.0) % |

(1.0) % |

7.2% |

7.6% |

|

Lighters- Flame for Life |

69.0 |

74.0 |

290.4 |

269.3 |

|

Margin |

31.8% |

34.2% |

34.1% |

33.3% |

|

Shavers- Blade Excellence |

21.9 |

22.5 |

68.4 |

100.6 |

|

Margin |

16.9% |

17.3% |

12.7% |

18.5% |

|

Other Products |

0.9 |

(0.5) |

(0.8) |

(3.8) |

|

Unallocated costs |

(19.1) |

(23.6) |

(85.5) |

(84.6) |

Condensed Profit & Loss

|

Condensed Profit and Loss (in million euros) |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

Net Sales |

526.1 |

517.5 |

2,263.3 |

2,196.6 |

|

Cost of goods |

254.5 |

261.4 |

1,115.2 |

1,093.9 |

|

Gross profit |

271.6 |

256.1 |

1,148.1 |

1,102.7 |

|

Administrative & net other operating expenses/ (gain) |

207.4 |

222.4 |

827.6 |

813.0 |

|

EBIT |

64.2 |

33.7 |

320.5 |

289.7 |

|

Finance revenue/costs |

(3.5) |

6.9 |

(7.5) |

7.9 |

|

Income before tax |

60.6 |

40.6 |

313.0 |

297.6 |

|

Income tax expense |

(15.6) |

(13.6) |

(86.5) |

(85.6) |

|

Net Income Group Share |

45.1 |

27.0 |

226.5 |

212.0 |

|

Group Earnings per Share (in euros) |

1.05 |

0.65 |

5.30 |

5.10 |

|

Average number of shares outstanding (net of treasury shares) |

42,740,269 |

41,561,522 |

42,740,269 |

41,561,522 |

Balance Sheet

|

Balance Sheet (in million euros) |

December 31, 2023 |

December 31, 2024 |

|

Assets |

- Property, plant & equipment

|

623.4 |

610.0 |

|

|

1.0 |

0.7 |

- Goodwill and intangible assets

|

382.3 |

557.1 |

|

|

151.0 |

157.0 |

|

Non-current assets |

1,157.7 |

1,324.8 |

|

|

558.0 |

538.6 |

- Trade and other receivables

|

403.5 |

456.4 |

|

|

40.6 |

52.4 |

- Other current financial assets and derivative instruments

|

19.8 |

6.3 |

- Cash and cash equivalents

|

467.7 |

456.0 |

|

Current assets |

1,489.6 |

1,509.7 |

|

Total Assets |

2,647.3 |

2,834.5 |

|

Liabilities & Shareholders' Equity |

|

Shareholders' equity |

1,846.6 |

1,793.3 |

|

|

46.8 |

167.5 |

- Other non-current liabilities

|

167.6 |

189.1 |

|

Non-current liabilities |

214.4 |

356.6 |

|

|

144.7 |

172.9 |

|

|

109.4 |

167.4 |

- Other current liabilities

|

332.2 |

344.3 |

|

Current liabilities |

586.3 |

684.6 |

|

Total Liabilities & Shareholders' Equity |

2,647.3 |

2,834.5 |

Working Capital and Cash Flow

|

Working Capital (in million euros) |

FY 2023 |

FY 2024 |

|

Total Working Capital |

560.0 |

556.0 |

|

|

558.0 |

538.6 |

- Of which, trade and other receivables

|

403.5 |

456.4 |

- Of which, Trade and other payables

|

(144.7) |

(172.9) |

|

Cash Flow Statement (in million euros) |

FY 2023 |

FY 2024 |

|

Group Net income |

226.5 |

212.0 |

- Amortization and provisions

|

138.2 |

132.0 |

- Other non cash transactions

|

104.5 |

127.0 |

|

Cash Flow from operations |

469.2 |

471.0 |

- (Increase)/decrease in net current working capital

|

(27.4) |

17.7 |

|

|

(88.5) |

(131.1) |

|

Net cash from operating activities (A) |

353.3 |

357.7 |

|

|

(104.6) |

(86.9) |

|

|

(0.0) |

(201.3) |

|

|

(9.5) |

4.5 |

|

Net cash from investing activities (B) |

(114.1) |

(283.7) |

|

|

(110.2) |

(178.0) |

- Borrowings/(Repayments)/(Loans)

|

32.5 |

177.9 |

|

|

(116.2) |

(55.7) |

|

|

1.8 |

(17.5) |

|

Net cash from financing activities (C) |

(192.1) |

(73.3) |

|

Net increase/ (decrease) in cash and cash equivalents net

of bank overdrafts (A+B+C) |

47.2 |

0.7 |

|

Opening cash and cash equivalents net of bank

overdrafts |

415.2 |

467.7 |

- Net increase / decrease in cash and cash equivalents net of

bank overdrafts (A+B+C)

|

47.2 |

0.7 |

|

|

5.3 |

(12.4) |

|

Closing cash and cash equivalents net of bank

overdrafts |

467.7 |

456.0 |

Reconciliation with Alternative Performance

Measures

|

Adjusted EBIT Reconciliation (in million

euros) |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

EBIT |

64.2 |

33.7 |

320.5 |

289.7 |

|

Lucky Stationary and Rocketbook earnout (2023) |

- |

- |

(0.5) |

- |

|

Special team member bonus13 |

- |

- |

- |

+7.8 |

|

Acquisition costs |

+0.8 |

+4.3 |

+1.9 |

+4.3 |

|

US supply chain relocation plan |

- |

- |

+3.5 |

- |

|

Restructuring expenses |

+3.3 |

- |

+3.3 |

+5.8 |

|

Virtual Power Purchase Agreement in Greece and Power Purchase

Agreement in France 14 |

- |

+12.8 |

- |

+15.6 |

|

Unfavorable French pensions |

+4.4 |

- |

+4.4 |

- |

|

Inkbox impairment15 |

- |

+19.9 |

- |

+19.9 |

|

Adjusted EBIT |

72.7 |

70.7 |

333.1 |

343.1 |

|

Adjusted Group EPS Reconciliation (in euros) |

Q4 2023 |

Q4 2024 |

FY 2023 |

FY 2024 |

|

Group EPS |

1.05 |

0.65 |

5.30 |

5.10 |

|

Lucky Stationary and Rocketbook earnout (2023) |

- |

- |

(0.01) |

- |

|

Argentina hyperinflationary accounting (IAS29) |

+0.03 |

(0.04) |

+0.12 |

(0.04) |

|

Special team member bonus13 |

- |

- |

- |

+0.14 |

|

Acquisition costs |

+0.01 |

+0.08 |

+0.03 |

+0.08 |

|

US supply chain relocation plan |

- |

- |

+0.06 |

- |

|

Restructuring expenses |

+0.06 |

- |

+0.06 |

+0.10 |

|

Virtual Power Purchase Agreement in Greece and Power Purchase

Agreement in France14 |

- |

+0.24 |

+0.06 |

+0.29 |

|

Unfavorable French pensions |

+0.08 |

- |

+0.08 |

- |

|

Inkbox impairment15 |

- |

+0.48 |

- |

+0.48 |

|

Adjusted Group EPS |

1.23 |

1.40 |

5.70 |

6.15 |

|

Net cash reconciliation (in million euros) |

December 31, 2023 |

December 31, 2024 |

|

Cash and cash equivalents (1)16 |

477.3 |

459.2 |

|

Current borrowings (2) |

(91.9) |

(149.9) |

|

Non-current borrowings (3) |

- |

(120.0) |

|

Net Cash Position (1) - (2) – (3) |

385.4 |

189.3 |

Share Buyback Program

Société BIC

|

Number of shares acquired

|

Average weighted price (in €)

|

Amount (in €m)

|

|

|

|

|

January 2024 |

- |

- |

- |

|

|

February 2024 |

- |

- |

- |

|

|

March 2024 |

216,251 |

65.50 |

14.2 |

|

|

April 2024 |

81,948 |

66.00 |

5.4 |

|

|

May 2024 |

11,353 |

65.37 |

0.7 |

|

|

June 2024 |

159,340 |

56.84 |

9.1 |

|

|

July 2024 |

80,502 |

56.22 |

4.5 |

|

|

August 2024 |

80,831 |

58.11 |

4.7 |

|

|

September 2024 |

203,793 |

61.13 |

12.5 |

|

|

October 2024 |

- |

- |

- |

|

|

November 2024 |

66,382 |

63.10 |

4.2 |

|

|

December 2024 |

7,177 |

62.66 |

0.4 |

|

|

Total |

907,577 |

61.36 |

55.7 |

|

Capital and Voting Rights

As of December 31, 2024, the total number of issued shares of

Société BIC is 41,621,162 shares, representing:

- 59,846,577

voting rights

- 59,417,857

voting rights excluding shares without voting rights

Total number of treasury shares held at the end

of December 2024: 428,720.

Glossary

- Organic

change or Comparative basis: At constant currencies and

constant perimeter. Figures at constant perimeter exclude the

impact of acquisitions and/or disposals that occurred during the

current year and/or during the previous year, until their

anniversary date. All Net Sales category comments are made on a

comparative basis. Organic change excludes Argentina Net

Sales.

- Constant

currency basis: Constant currency figures are calculated

by translating the current year figures at prior year monthly

average exchange rates.

-

EBITDA: EBIT before Depreciation, Amortization

(excluding amortization of right of use under IFRS 16 standard) and

impairment.

- Adjusted

EBIT: Adjusted means excluding normalized items.

- Adjusted

EBIT margin: Adjusted EBIT as a percentage of Net

Sales.

- Net Cash

from operating activities: Cash generated from principal

activities of the entity and other activities that are not

investing or financing activities.

- Free

Cash Flow: Net cash flow from operating activities less

capital expenditures (capex). Free cash flow does not include

acquisitions and proceeds from the sale of businesses.

- Net cash

position: Cash and cash equivalents + Other current

financial assets - Current borrowings - Non-current borrowings

(except financial liabilities following IFRS 16 implementation)

Société BIC consolidated financial

statements as of December 31, 2024, were approved by the Board of

Directors on February 18, 2025. A presentation related to this

announcement is also available on the BIC website

(www.bic.com). The Group's Statutory Auditors

have largely completed their audit procedures on these consolidated

financial statements and the audit report relating to the

certification of these financial statements will be issued upon

completion of the procedures required for the filing of the

Universal Registration Document. This document contains

forward-looking statements. Although BIC believes its expectations

are based on reasonable assumptions, these statements are subject

to many risks and uncertainties. A description of the risks borne

by BIC appears in the section, "Risk Management" in BIC's 2023

Universal Registration Document (URD) filed with the French

financial markets authority (AMF) on March 28, 2024.

About BIC

A global leader in stationery, lighters, and

shavers, BIC brings simplicity and joy to everyday life. For 80

years, BIC’s commitment to delivering high-quality, affordable, and

trusted products has established BIC as a symbol of reliability and

innovation. With a presence in over 160 countries, and over 13,000

team members worldwide, BIC’s portfolio includes iconic brands and

products such as BIC® 4-Color™, BodyMark®, Cello®, Cristal®,

Inkbox®, BIC Kids®, Lucky™, Rocketbook®, Tattly®, Tipp-Ex®,

Wite-Out®, Djeep®, EZ Load™, EZ Reach®, BIC® Flex™, Soleil®,

Tangle Teezer® and more. Listed on Euronext Paris and included

in the SBF120 and CAC Mid 60 indexes, BIC is also recognized for

its steadfast commitments to sustainability and education. For

more, visit www.corporate.bic.com and to see BIC’s

full range of products visit

www.bic.com. Follow BIC

on LinkedIn, Instagram,

YouTube and TikTok.

BIC's Q4 and FY 2024 earnings conference

call and webcast will be hosted by Gonzalve Bich, CEO, and

Chad Spooner, CFO on Wednesday, February 19, 2025, at 8:30

AM CET:

- To participate to the webcast:

https://channel.royalcast.com/landingpage/bic/20250219_1/

- To participate to the conference

call:

| From France: |

+33 (0) 1 70 37

71 66 |

| From the UK: |

+44 (0) 33 0551

0200 |

| From the USA: |

+1 786 697 3501 |

| Vocal access

code: |

BIC

|

Contacts

Brice Paris

VP Investor Relations

+33 6 42 87 54 73

brice.paris@bicworld.com

Investor Relations

investors.info@bicworld.com

|

Bethridge

Toovell

VP Global Communications

+1 917 821 4249

bethridge.toovell@bicworld.com

Isabelle de Segonzac

Image 7, Press Relations contact

+33 6 89 87 61 39

isegonzac@image7.fr

|

Agenda

All dates to be confirmed

|

First Quarter 2025 Net Sales |

April 23, 2025

(post market close) |

|

Annual General Meeting |

May 20, 2025 |

|

First Half 2025 Results |

July 30, 2025 |

|

Third Quarter 2025 Net Sales |

October 28, 2025 |

1 at constant currency excluding Argentina

2 Payable in June 2025, subject to May 20th

2025 AGM approval– Based on 41,621,162 shares as of December 31

2024 excluding treasury shares

3 This outlook does not reflect possible impacts from

the fluid trading environment, particularly changes in US

tariffs

4 see page 13 for detail of non-recurring items

5 BIC signed a Virtual Power Purchase Agreement in

November 2022 in Greece and a Physical Power Purchase Agreement in

November 2023, as part of its Sustainability strategy

6 Special bonus that was paid in Q4 to team members who

have not been granted shares under our regular long term incentive

plans

7 Others include income tax paid and pensions

contribution

8 Includes in 2024 €40.0 million of share buyback for

cancellation and €15.7 million of free shares to be granted (long

term incentives)

9 IRI Year to date as of December, 2024

10 IRI Year to date as of December, 2024: estimated

total lighter measured market (c.70% total market coverage)

11 NielsenIQ (France, Spain, Italy, Poland, Romania,

Greece, Portugal, Sweden, Norway, Denmark), Circana (UK); Value

sales Year to Date as of November 2024

12 IRI Year to Date as of December, 2024

13 Special bonus that was paid in Q4

to team members who have not been granted shares under our regular

long term incentive plans

14 BIC signed a Virtual Power Purchase Agreement in

November 2022 in Greece and a Physical Power Purchase Agreement in

November 2023, as part of its Sustainability strategy

15 Non-cash item related to an

impairment test made in December, due to lower-than-expected

performance in 2024 following challenging market conditions

16 Including other current financial assets (€3.2m for

2024 and €9.6m for 2023)

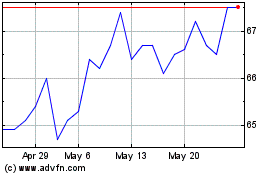

Societe BIC (EU:BB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Societe BIC (EU:BB)

Historical Stock Chart

From Feb 2024 to Feb 2025