Bonduelle - 2024-2025 First Half Year Financial Results: The

Bonduelle Group posts growth in both its current operating income

and its branded activities. Bonduelle confirms its annual

objectives

BONDUELLE

Head office: "La Woestyne" - 59173 Renescure -

France

Bonduelle a French S.C.A (Partnership limited by Shares) with a

capital of 57 102 699,50 euros

Registered under number : 447 250 044 (Dunkerque Commercial and

Companies Register)

2024-2025 First Half Year Financial

Results

(July 1 - December 31, 2024)

The Bonduelle Group posts growth in both

its current operating income and its branded

activities

Bonduelle confirms its annual

objectives

For this 1st half of the 2024-2025

fiscal year, the Bonduelle Group posted a strong growth of +17.8%

on a like-for-like basis(1) of its current operating

income which amounted to 48 million euros at current exchange rates

and 47.8 million euros at constant exchange rates compared with

40.6 million euros the previous fiscal year.

Over the period from July 1 to December 31,

2024, the Bonduelle Group’s sales for the 1st half year

of fiscal year 2024-2025 amounted 1,119.4 million euros compared

with 1,139.2 million euros for the 1st half of previous

fiscal year, -1.5% on a like-for-like basis(1) and -1.7%

on reported figures, currency trends having a marginal impact over

business activity’s evolution (-0.2%).

In value, the clear +1.9% growth in branded

activities over the period confirms the strategic importance of

brand development, as announced in the group’s “Transform to win”

transformation plan last October. It contrasts with the marked

decline in the private label segment: -6.9%.

Despite a slight downturn in business activity

over the 1st half year and an expected negative impact

on profitability in the 2nd half year due to the poor

agricultural harvest in Russia, the Bonduelle Group confirms its

annual objectives.

In accordance with IFRS 5, the income statements

related to the packaged salad activity in France and Germany, whose

planned disposal was announced on August 29, 2024 are gathered in

the income statement of the reported financial statements under the

heading “net income from discontinued operations”.

Message from Xavier Unkovic - Chief

Executive Officer:

Our transformation is underway! We have embarked

on an ambitious 3-year transformation of the group, called

“Transform to win”; based on solid fundamentals: a modern corporate

mission that puts positive impact at the heart of the business

activity, flagship brands and our strong connection with the

agricultural sector. The year 2025 marks the beginning of the

transition phase, a key milestone in preparing for the rebound and

acceleration of our performance in the coming years.

The 2024-2025 1st half year is

already posting clear results over the five strategic pillars which

represent the solid foundations of the group’s transformation

between now and 2027. The roadmap is clear and our teams are fully

committed to reaching our objectives. We are gearing up for a

spring full of activations, communication on our brands and our

innovations, which are key factors in our transformation. In the

United States, Bonduelle Americas returned to growth for the first

time in four years, confirming the relevance of our strategic

choices, while in Europe, the reorganisation of our business

portfolio is improving at a good pace. Our operations are pursuing

their focus on operational excellence, and we are working on the

efficiency of our organizations while implementing our strategies.

Finally, more than ever, we are reaffirming our ambition to deploy

a sustainable business model and are moving towards a 100% B

CorpTM group certification by the end of the year.

*******

The 2024-2025 half year financial statements

were approved by the General Partner, then reviewed by the

Supervisory Board of March 05, 2025 and have been subject to a

limited review by the Statutory Auditors.

Key figures

|

(in millions of euros) |

1st half

year

2024-2025 |

1st half

year

2023-2024 |

Variation |

|

Sales |

1,119.4 |

1,139.2 |

-1.7% |

|

Current operating income |

48.0 |

40.6 |

+18.3% |

|

Current operating margin |

4.3% |

3.6% |

+70 bps |

|

Net income from continuing operations |

17.2 |

6.4 |

+167.5% |

|

Consolidated net income |

-5.0 |

4.5 |

-211.6% |

|

Gearing(2) |

1.23 |

0.95 |

|

Sales

The Bonduelle Group’s sales for the

1st half year of fiscal year 2024-2025 amounted 1,119.4

million euros compared with 1,139.2 million euros for the

1st half of previous fiscal year, -1.5% on a

like-for-like basis(1) and -1.7% on reported

figures.

Activity by Geographical

Region

Total consolidated sales

(in millions of euros) |

1st half

year

2024-2025 |

1st half

year

2023-2024 |

Variation

reported figures |

Variation

Like-for-like

basis(1) |

|

Europe Zone |

672.3 |

712.6 |

-5.6% |

-5.8% |

|

Non-Europe Zone |

447.1 |

426.6 |

4.8% |

5.8% |

|

Total |

1,119.4 |

1,139.2 |

-1.7% |

-1.5% |

Activity by Operating

Segments

Total consolidated sales

(in millions of euros) |

1st half

year

2024-2025 |

1st half

year

2023-2024 |

Variation

reported figures |

Variation

Like-for-like

basis(1) |

|

Canned |

554.7 |

594.7 |

-6.7% |

-6.4% |

|

Frozen |

150.4 |

148.9 |

1.0% |

0.9% |

|

Fresh processed |

414.3 |

395.6 |

4.7% |

5.1% |

|

Total |

1,119.4 |

1,139.2 |

-1.7% |

-1.5% |

Europe Zone

The Europe Zone, which accounts for 60.1% of the

business activity over the period, posted for the whole

1st half year an overall evolution of -5.6% on reported

figures and -5.8% on a like-for-like basis(1), mostly

due to the significant sales drop in private label canned

activities, caused by delays in contracted volumes deliveries by

major customers.

The fresh processed activities maintained in the

portfolio (packaged salads activity in Italy and prepared segment

in France and Italy) posted solid growth over the 1st

half year, especially in Bonduelle branded products, in retail and

food service.

Non-Europe Zone

The Non-Europe Zone, which accounts for 39.9% of

the business activity over the period, posted for the

1st half year, an overall evolution of +4.8% on reported

figures and +5.8% on a like-for-like basis(1).

In North America, the return to growth for the

first time in four years was driven by the solid increase in retail

sales of complete meal solutions and salad kits; a growth which

accelerated further in Quarter 2 over branded products and

innovations.

In the Eurasia region, CIS countries and Russia

posted solid growth fueled by the Bonduelle and Globus brands.

Operating income

For the 1st half of fiscal year

2024-2025, the Bonduelle Group’s current operating income stands at

48 million euros at current exchange rates and 47.8 million euros

at constant exchange rates, compared with 40.6 million euros the

previous fiscal year.

This corresponds to a +17.8% increase in current

operating income on a like-for-like basis(1). The

current operating margin stands at 4.3% on both like-for-like

basis(1) and reported figures, given the slight impact

of exchange rates over the period.

In the Europe Zone, good agro-industrial

performances only partially offset the downturn in volumes, in

particular the delay in private label sales (-22.2% in canned and

frozen segments).

In the Non-Europe Zone, the growth momentum in

branded activities enabled a return to a positive profitability: on

one hand, in the United States with an improvement in current

operating income driven by new contracts, a good dynamic in brands

and better harvests than last fiscal year, and on the other hand,

the Eurasia region posting an increase in branded products

sales.

After taking into account non-recurring items of

-3.1 million euros over the period, following the logistical

optimizations in the United States, the Bonduelle Group’s operating

income reaches 44.9 million euros on reported figures, compared

with 35.7 million euros for the 1st half of previous

fiscal year representing an increase over the period of +25.8% on

reported figures.

Net income from continuing

operations

Net financial income amounted to -17.8 million

euros, compared to -17 million euros at the end of previous half

year. The posted interest expense for the period went from -15.3

million euros to -14.7 million euros, mainly due to lower

indebtedness in high-interest currencies (Hungarian forint, Russian

ruble).

The group average financing rate declined over

the period and is now at 4.12%. The foreign exchange result is

negative for the half year (-1.2 million euros, mainly due to the

weakening of the ruble), compared with -0.2 million euros for the

same period last year.

Tax expense came to 12.7 million euros, compared

with 13.3 million euros in the 1st half of the previous

fiscal year, the effective tax rate (46.7%), although improving,

remains distorted by the non-activated losses from the North

American fresh activities.

Net income from associates amounts to 2.8

million euros corresponding to the share of income from Nortera

Foods accounted for under the equity method.

After taking into account financial income, tax

expense and income from associates, Bonduelle Group’s net income

from continuing operations for the 2024-2025 1st half

year amounted to 17.2 million euros compared with 6.4 million euros

the previous fiscal year, representing 1.5% of sales.

Net income from discontinued

operations

In accordance with IFRS 5, contributions from

activities being discontinued are gathered under the heading “net

income from discontinued operations”. Thus, for the 1st

half year, items under this heading amounted to -22.3 million

euros, of which: -2.6 million euros as current operating income for

the period, non-recurring items including the provision for the

Saint-Mihiel redundancy plan and the Genas voluntary redundancy

plan for a total of 20 million euros, 5.7 million euros in tax and

financial income restatements , the impairment of 4 million euros

in goodwill related to the packaged salad activity in Germany, and

fees related to the divest of these activities.

After taking into account net income from

discontinued operations, the Bonduelle Group's consolidated net

income for the 1st half of the 2024-2025 fiscal year

amounted to -5 million euros, compared with +4.5 million euros the

previous fiscal year.

Financial situation

Net financial debt (excluding IFRS 16 and after

taking IFRS 5 into account) stood on December 31, 2024 at 664

million euros against 649 million euros at December 31 of the

previous fiscal year. After taking IFRS 16 into account, debt stood

at 755.5 million euros (versus 716.5 million euros at December 31

of the previous fiscal year), and the debt-to-equity ratio

(gearing(2)) was 1.23, compared with 0.95 at the same

period last year.

Good summer harvests, in particular in Nord

Picardie (France), and sales delay of private label products in

Europe have a direct effect on the increase in inventories and

therefore in the group's working capital requirement, while

pointing out that the seasonal nature of the business activity

(summer agricultural harvests) results in a high level of debt at

December 31, which is not representative of average debt or end of

fiscal year debt level.

Other significant information

Plan to sell its packaged salad activity

in France and Germany

The Bonduelle Group announced, on August 29,

2024, several projects designed to protect the company’s long-term

future.

Regarding the planned downsizing of Bonduelle

Frais France, an agreement has been reached with employee

representatives bodies on one hand, the terms and conditions of

employee support in view of the effective closure of the

Saint-Mihiel plant on February 28, 2025 and on the other hand, the

implementation of the voluntary redundancy plan for the Genas head

office.

Work is in progress on the disposal of our

packaged salad activities in France and Germany, with a view to

lifting the conditions precedent.

In the meantime, exceptional expenses related to

the implementation of the 2 plans mentioned above, have been

recognized in the 1st half year financial statements as

described in the paragraph related to the net income from

discontinued operations.

Outlook

Despite the slight downturn of business activity

in the 1st half year and the impact of difficult

harvests in Russia which will have a particular impact over the

2nd half year, the Bonduelle Group is pursuing its

transformation and confirms its annual objectives of stable sales

and recurring operating income on a like-for-like

basis(1).

(1) at constant currency

exchange rate and scope of consolidation basis. Net sales in

foreign currency over the given period are translated into the rate

of exchange for the comparable period. The impact of business

acquisitions (or gain of control) and divestments is restated as

follows

- For businesses acquired (or gain of control) during the

current period, net sales generated since the acquisition date is

excluded from the organic growth calculation;

- For businesses acquired (or gain of control) during the

prior fiscal year, net sales generated during the current period up

until the first anniversary date of the acquisition is

excluded;

- For businesses divested (or loss of control) during the

prior fiscal year, net sales generated in the comparative period of

the prior fiscal year until the divestment date is

excluded;

- For businesses divested (or loss of control) during the

current fiscal year, net sales generated in the period commencing

12 months before the divestment date up to the end of the

comparative period of the prior fiscal year is excluded.

(2) net financial debt /

equity - Inc. IFRS 16

Alternative performance indicators:

the group presents in its financial notices performance indicators

not defined by accounting standards. The main performance

indicators are detailed in the financial reports available on

www.bonduelle.com

Next financial events:

- 1st Half Year Results

presentation: March

6, 2025

- 2024-2025 Quarter 3 FY Sales:

May 6, 2025 (after

market closing)

- 2024-2025 Fiscal Year Sales:

August 1, 2025

(after market closing)

- 2024-2025 Annual Results:

September 26, 2025

(after market closing)

- Annual Results presentation:

September 29,

2025

Find the complete Half Year results

on www.bonduelle.com

About the Bonduelle

Group

We want to inspire the transition toward a

plant-rich diet, to contribute to people’s well-being and planet

health. We are a French family business with 10,409 full-time

equivalent employees and we have been innovating with our farming

partners since 1853. Our ready-to-use products are cultivated on

69,035 hectares and sold in nearly 100 countries, with sales of

2,371.8 million euros (data as of June 30, 2024)

Our 4 flagship brands are: BONDUELLE, READY

PAC FOODS, CASSEGRAIN and GLOBUS.

Bonduelle is listed on Euronext Paris

compartment B

Euronext indices: CAC MID & SMALL – CAC FOOD PRODUCERS –

CAC ALL SHARES

Bonduelle is part of the Gaïa non-financial performance index

and employees shareholder index (I.A.S.)

Code ISIN: FR0000063935 - Code Reuters: BOND.PA - Code

Bloomberg: BON FP

- 2024-2025 First Half Year Financial Results

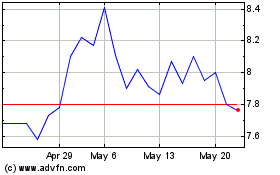

Bonduelle (EU:BON)

Historical Stock Chart

From Feb 2025 to Mar 2025

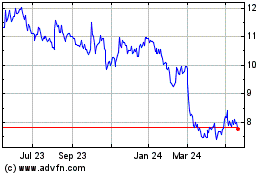

Bonduelle (EU:BON)

Historical Stock Chart

From Mar 2024 to Mar 2025