Press release30 May 2024 - N°

09

SCOR successfully sponsors a new

catastrophe bond, Atlas Capital DAC Series 2024-1

SCOR has successfully sponsored a new

catastrophe bond (“cat bond”), Atlas Capital DAC Series 2024-1,

which will provide the Group with multi-year risk transfer capacity

of USD 175 million to protect itself against named storms in the US

and earthquakes in the US and Canada. The risk period for Atlas

Capital DAC Series 2024-1 will run from 1 June 2024 to 31 May 2027.

The transaction has received the approval of the Irish regulatory

authorities. The cat bond offering integrates ESG related

considerations to support investors' due diligence.

The cat bond was priced on 24 May 2024 and

issued on 30 May 2024. Atlas Capital DAC Series 2024-1 was well

received and benefited from high investor demand. GC Securities1

acted as Sole Structuring Agent and Sole Bookrunner for the deal.

Willkie Farr and Walkers advised SCOR as legal counsels.

Atlas Capital DAC Series 2024-1 is an aggregate,

index-based trigger cat bond issued by Atlas Capital DAC, a

multi-arrangement special purpose vehicle approved in Ireland under

Solvency II. This vehicle was created in 2023 for the Series 2023-1

cat bond issuance, and it may be utilized by the Group to sponsor

cat bonds covering various perils in both L&H and P&C. The

benefits of this vehicle were visible this year, as it allowed for

a faster and more cost-effective issuance process.

The size of the Series 2024-1 issuance is in

line with the Group’s cat exposures and with its retrocession

strategy under the Forward 2026 strategic plan, which identifies

risk partnerships – including capital market solutions like cat

bonds – as one of the Group’s levers for value creation.

François de Varenne, Group CFO and

Deputy CEO of SCOR, comments: “SCOR is pleased to sponsor

a new cat bond this year, securing multi-year protection against

peak natural perils from the ILS market. We are delighted by the

strong investor demand, as cat bonds remain an integral part of

SCOR’s capital protection under the Forward 2026 strategic plan. We

are also very pleased with the efficiency gains made by reusing

Atlas Capital DAC for a second year.”

*

*

*

|

SCOR, a leading global reinsurer As a

leading global reinsurer, SCOR offers its clients a diversified and

innovative range of reinsurance and insurance solutions and

services to control and manage risk. Applying “The Art &

Science of Risk”, SCOR uses its industry-recognized expertise and

cutting-edge financial solutions to serve its clients and

contribute to the welfare and resilience of society. The

Group generated premiums of EUR 19.4 billion in 2023 and serves

clients in around 160 countries from its 35 offices worldwide.

For more information, visit: www.scor.com |

Media Relations Alexandre Garciamedia@scor.com

Investor RelationsThomas

Fossardtfossard@scor.com Follow us

on LinkedIn |

| All

content published by the SCOR group since January 1, 2024, is

certified with Wiztrust. You can check the authenticity of this

content at wiztrust.com. |

*

*

*

Forward-looking statements

This press release may include forward-looking

statements, assumptions, and information about SCOR’s financial

condition, results, business, strategy, plans and objectives,

including in relation to SCOR’s current or future projects.

These statements are sometimes identified by the

use of the future tense or conditional mode, or terms such as

“estimate”, “believe”, “anticipate”, “expect”, “have the

objective”, “intend to”, “plan”, “result in”, “should”, and other

similar expressions.

It should be noted that the achievement of these

objectives, forward-looking statements, assumptions and information

is dependent on circumstances and facts that arise in the

future.

No guarantee can be given regarding the

achievement of these forward-looking statements, assumptions and

information. These forward-looking statements, assumptions and

information are not guarantees of future performance.

Forward-looking statements, assumptions and information (including

on objectives) may be impacted by known or unknown risks,

identified or unidentified uncertainties and other factors that may

significantly alter the future results, performance and

accomplishments planned or expected by SCOR.

In particular, it should be noted that the full

impact of the inflation and geopolitical risks including but not

limited to the Russian invasion and war in Ukraine on SCOR’s

business and results cannot be accurately assessed.

Therefore, any assessments, any assumptions and,

more generally, any figures presented in this press release will

necessarily be estimates based on evolving analyses, and encompass

a wide range of theoretical hypotheses, which are highly

evolutive.

These points of attention on forward-looking

statements are all the more essential that the adoption of IFRS 17,

which is a new accounting standard, results in significant

accounting changes for SCOR.

Information regarding risks and uncertainties

that may affect SCOR’s business is set forth in the 2023 Universal

Registration Document filed on 20 March 2024, under number

D.24-0142 with the French Autorité des marchés financiers (AMF)

posted on SCOR’s website www.scor.com.

In addition, such forward-looking statements,

assumptions and information are not “profit forecasts” within the

meaning of Article 1 of Commission Delegated Regulation (EU)

2019/980.

SCOR has no intention and does not undertake to

complete, update, revise or change these forward-looking

statements, assumptions and information, whether as a result of new

information, future events or otherwise.

Disclaimer

This communication does not constitute or form

part of any offer or invitation to sell or issue or any

solicitation of any offer to purchase or subscribe for the

securities mentioned herein in any jurisdiction. The securities

mentioned herein have not been, and will not be, registered under

the Securities Act, and may not be offered or sold in the United

States except pursuant to an exemption from the registration

requirements of the Securities Act. Atlas Capital DAC and the

securities mentioned are not and will not be registered under the

U.S. Investment Company Act of 1940, as amended.

Rule 144A offerings are offerings of securities

conducted on a private placement basis for the purposes of the U.S.

Securities Act of 1933, as amended (the “Securities Act”) and that

limit initial distribution and secondary sales of the securities to

entities that are Qualified Institutional Buyers as defined in Rule

144A under the Securities Act. The offering of securities in a Rule

144A offering does not require registration of the issuer or the

securities with the U.S. Securities Exchange Commission.

Catastrophe bond transactions provide sponsoring

insurers and reinsurers protection against catastrophe risks

through the release to the sponsor of a portion or the whole

principal amount upon the occurrence of pre-defined events (namely

triggers). Triggers can be determined in different ways: an

industry loss trigger provides for payment once the losses to the

industry generated by specific natural events (typically) are

higher than a certain specified amount provided for in the terms of

the transaction

.

1 GC Securities is a division of MMC Securities LLC, a US

registered broker-dealer and member of FINRA/NFA/SIPC.

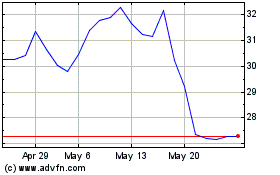

Scor (EU:SCR)

Historical Stock Chart

From Oct 2024 to Nov 2024

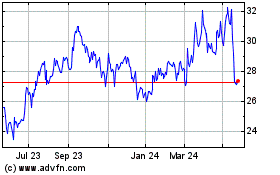

Scor (EU:SCR)

Historical Stock Chart

From Nov 2023 to Nov 2024