Press Release - SMCP 2024 FY Results

2024 Results

Press release - Paris, February 27th, 2025

Sequential improvement, with sales at

+1.9% in Q4 (+4.7% excl. China), leads to a limited decrease of FY

sales at -1.5% (+2.3% excl. China)

A strict control of costs, inventories and Capex supports a

strong cash generation and a debt reduction of €49m

- Q4

2024 Sales at €334m, increasing by +1.9% on an organic

basis vs Q4 2023 Sales at €326m; positive sales performance of

+4.7% excluding China

- 2024

Sales at €1,212m, decreasing by -1.5% on an

organic1 basis vs. 2023 Sales (€1,231m)

- Organic growth

in all regions excluding China, where consumption remains

challenging

- Sequential

improvement during the year with a return to growth in Q4

- China

strategic roadmap underway, with a first important step in network

optimisation

- Strict

full-price strategy with a two-point decrease of average in-season

discount rate vs 2023

-

Adjusted EBIT at €53m (4.4% of

sales) from €79m in 2023, impacted by challenging market

conditions, in particular in China, and by restructuring costs,

partially offset by cost reduction plans

- Net

income at -€24m, including -€31m of

non-recurring accounting impairment impacts with no effect on cash

(€8m excluding these effects). Strong improvement of net

result in H2 (€4m) vs. same period in 2023 (-€3m) and vs

H1 2024 (-€28m)

-

Continued financial discipline with a strict

control of inventories and investments, resulting in an important

free-cash-flow generation of €49m and a decrease in net debt of the

same amount, to reach €237m

- Pursuit of the

mid-term action plan to return to profitable

growth: network optimisation, mainly in China, implementation of

efficiency actions to support profitability, and disciplined cash

management

-

Pursuit of network optimization

with 68 net closures, to reach 1,662 POS in the world at the end of

2024. This includes a network optimisation plan in Asia and for

Claudie Pierlot in Europe, alongside openings through partnership

in key markets

Commenting on those results, Isabelle

Guichot, CEO of SMCP, stated: “The Group recorded a

quarter-on-quarter improvement in trends, returning to growth by

year-end, driven by positive momentum across all regions except

China. This performance was achieved thanks to the resilience of

Sandro and Maje, which gained market shares, particularly in

Europe, the initial benefits of store network optimization in

China, and the continued implementation of a strict discount

strategy. While our action plan had a short-term impact on

profitability, it is beginning to bear fruit, with stronger effects

expected in 2025 and full impact in 2026. We have maintained strict

financial discipline, with tight control over our balance sheet,

enabling strong free cash flow generation and a very significant

debt reduction. In 2025, we will continue executing our action

plan, focusing on strengthening profitable growth, optimizing our

global footprint, improving efficiency and agility, and maintaining

disciplined management to support profitability and financial

strength. I would like to thank our teams for their daily

commitment, which allows the Group to move forward with resilience.

I am confident that all the initiatives we are implementing will

further enhance the desirability and competitive positioning of our

brands.”

FINANCIAL INDICATORS

|

€m |

FY

2023 |

FY

2024 |

Reported

change |

|

Sales |

1 230.5 |

1 211.7 |

-1.5% |

| Adjusted

EBITDA |

236.4 |

216.4 |

-8.4% |

| Adjusted

EBIT |

79.5 |

53.0 |

-33.3% |

| Net

Income |

11.2 |

-23.6 |

- |

| FCF |

14.4 |

48.9 |

+238% |

| Net Debt |

286.3 |

237.2 |

-17.1% |

SALES

|

€m |

Q4

2023 |

Q4

2024 |

Organic

change |

Reported

change |

|

FY

2023 |

FY

2024 |

Organic

change |

Reported

change |

|

Sales by region |

|

|

|

|

|

|

|

|

|

|

France |

111.7 |

117.5 |

+5.2% |

+5.2% |

|

413.2 |

417.8 |

+1.1% |

+1.1% |

|

EMEA ex. France |

103.2 |

109.4 |

+5.1% |

+6.0% |

|

388.8 |

403.2 |

+3.1% |

+3.7% |

|

America |

50.4 |

53.0 |

+4.9% |

+5.1% |

|

173.4 |

182.8 |

+5.7% |

+5.4% |

|

Asia Pacific |

60.5 |

54.0 |

-12.1% |

-10.8% |

|

255.2 |

207.9 |

-17.7% |

-18.5% |

| Sales

by brand |

|

|

|

|

|

|

|

|

|

|

Sandro |

162.6 |

167.5 |

+2.4% |

+3.0% |

|

601.4 |

605.1 |

+0.6% |

+0.6% |

|

Maje |

121.6 |

126.4 |

+3.3% |

+3.9% |

|

462.5 |

458.3 |

-0.8% |

-0.9% |

|

Other brands2 |

41.6 |

40.0 |

-4.1% |

-3.8% |

|

166.6 |

148.2 |

-11.2% |

-11.0% |

|

TOTAL |

325.8 |

333.8 |

+1.9% |

+2.5% |

|

1,230.5 |

1,211.7 |

-1.5% |

-1.5% |

SALES BREAKDOWN BY REGION

In France, sales reached €418m,

an organic increase of +1.1% compared to 2023. Sales in the second

semester were initially impacted by the organization of the Olympic

Games during the summer, which disrupted business, particularly in

Paris. However, consumption recovered in the fourth quarter (+5.2%

vs Q4 2023), driven by an increase in traffic and a rise in

tourism, leading to a return to like-for-like growth. The network

increased slightly, with two net openings during the year.

In EMEA, sales reached €403m,

an organic increase of +3.1% compared to 2023, mainly driven by

like-for-like growth (+4.1%), which is positive in nearly all

retail markets. Growth has been supported by an increase in traffic

and the full-price strategy. The performance was particularly good

in corners. Retail partners also registered good results during the

year, notably in the Middle East.

The network recorded 19 net closures during the year (reflecting

Claudie Pierlot’s network optimisation strategy).

In America, sales reached

€183m, an organic increase of 5.7% compared to 2023. Sales

maintained a consistent and solid growth level throughout the year.

In a highly promotional context, the Group maintained a strict

discount policy (improvement of discount rate by more than two

points vs 2023). In the US, like-for-like sales grew, particularly

in B&M. In Mexico, sales recorded a strong performance

throughout the year. The network increased with 11 net openings

during the year.

In APAC, sales reached €208m,

an organic decrease of -17.7% vs 2023. In China, sales were

significantly impacted throughout the year by a persistent decline

in traffic and by the network optimisation, in line with the

Group’s strategy (65 closures). The action plan also aims to renew

with sales growth in the country by working on brands’ desirability

and retail excellence in B&M and clienteling. In the rest of

the region, sales remained resilient in several markets (Singapore,

Vietnam, Malaysia and Thailand).

2024 CONSOLIDATED RESULTS

Adjusted EBITDA reached

€216m in 2024 (Adjusted EBITDA margin of 18% of sales),

compared with €236m in 2023 (19% of sales).

Management gross margin ratio

(74.4%) increased compared to 2023 (73.8%), supported by a strict

full-price strategy.

Total Opex (store costs4F4F3 and

general and administrative expenses) are impacted by initial

one-off costs linked to the implementation of our action plan. Cost

reduction partly mitigated the effects of inflation and volumes

decrease. Due to the decline in sales, Opex absorption as a

percentage of sales decreased by 2 points.

Depreciation and amortization amounted

to -€163m in 2024, increasing vs 2023 (-€157m). Excluding

IFRS 16, depreciation and amortization represent 4.2% of sales in

2024 (3.8% in 2023).

As a result, Adjusted EBIT

reached €53m in 2024 compared with €79m in 2023.

Adjusted EBIT margin is 4.4% in 2024 (6.5% in 2023).

Other non-current expenses

reached -€35m, increasing compared to 2023

(-€26m); they include stores and goodwill impairment, with no

effect on cash.

Financial expenses

reached -€32m in 2024 vs -€28M in 2023 (including

-€12m of interests on rental debt vs -€11m in 2023). Interest

expenses on financial debt increased (-€18m in 2024 vs -€16m in

2023), due to market interest rates and spreads which remained at a

relatively high level throughout 2024.

Taking into account an income

tax of -€7m in 2024 (-€11m in 2023),

Net income - Group share stands at -€24m (€11m in

2023). Net result excluding the effect of non-recurring, non-cash

entries (net of income tax) is at €8m.

2024 BALANCE SHEET AND NET FINANCIAL DEBT

The Group maintained a strict control

over its inventories and investments during the year.

Inventories went down from €282m at year-end 2023 to €260m at

year-end 2024.

Capex investments as a percentage of sales decreased, representing

3.4% of sales in 2024 (4.5% in 2023).

Net financial debt stands at

€237m as of December 31st, 2024, vs €286m a year earlier. Net

debt/EBITDA ratio stands at 2.57x. The gap vs contractual level of

2.5x was waived by the pool of banks on December 18th,

2024.

CONCLUSION AND PERSPECTIVES

2024 was a transitional year in terms of

profitability, but strict financial discipline resulted in strong

cash generation, leading to a significant reduction in debt:

- Resilient sales

improving quarter after quarter, despite network optimization and a

strict full-price strategy;

- Action plan

generating, as expected, short-term costs before delivering its

full benefits;

- Rigorous

execution of cash protection measures, resulting in strong free

cash flow generation and a reduction in net debt.

Despite a complex environment, the strength of

the Group’s brands and its business model allowed it to gain market

share against competitors.

In 2025, the Group will continue its action

plan, which is built around four pillars:

- Get back to

growth and gain market share;

- Leverage global

exposure and diversified geographic footprint;

- Increase

agility and leverage latest innovations to improve efficiency and

profitability;

- Maintain

financial discipline to drive higher profitability and a strong

financial structure.

Cost optimizations, coupled with growth

acceleration initiatives, are expected to contribute to the

mid-term targets of an adjusted EBIT margin of around 10% and free

cash flow generation of 50 million euros.

The year 2025 is part of this trajectory. Given

that 2024 was still affected by a difficult consumption trend, the

target of an adjusted EBIT margin of approximately 10% is expected

to be reached in the second half of 2026 (with an adjusted EBIT

margin improvement in 2025, followed by an acceleration in 2026).

Additionally, the Group confirms its target of 50 million euros in

free cash flow generation by 2026.

OTHER INFORMATION

Consolidated accounts

approvement

The Board of Directors held a meeting today and

approved the consolidated accounts for 2024. The limited review

procedures have been completed by the auditors and the related

report is being issued.

FINANCIAL CALENDAR

April 29, 2025 – Q1 Sales publication

June 12th, 2025 – Annual Shareholding

Meeting

A conference call and

a webcast with investors and analysts will be held today by CEO

Isabelle Guichot and CFO Patricia Huyghues Despointes, from 6:00

p.m. (Paris time). Related slides will also be available on the

website (www.smcp.com), in the Finance section.

FINANCIAL INDICATORS NOT DEFINED IN

IFRS

The Group uses certain key financial and

non-financial measures to analyze the performance of its business.

The principal performance indicators used include the number of its

points of sale, like-for-like sales growth, Adjusted EBITDA and

Adjusted EBITDA margin, Adjusted EBIT and Adjusted EBIT margin.

Number of points of

sale

The number of the Group’s points of sale

comprises total retail points of sale open at the relevant date,

which includes (i) directly-operated stores, including

free-standing stores, concessions in department stores,

affiliate-operated stores, factory outlets and online stores, and

(ii) partnered retail points of sale.

Organic sales

growth

Organic sales growth refers to the performance

of the Group at constant currency and scope, i.e. excluding the

acquisition of Fursac.

Like-for-like sales

growth

Like-for-like sales growth corresponds to retail

sales from directly operated points of sale on a like-for-like

basis in a given period compared with the same period in the

previous year, expressed as a percentage change between the two

periods. Like-for-like points of sale for a given period include

all of the Group’s points of sale that were open at the beginning

of the previous period and exclude points of sale closed during the

period, including points of sale closed for renovation for more

than one month, as well as points of sale that changed their

activity (for example, Sandro points of sale changing from Sandro

Femme to Sandro Homme or to a mixed Sandro Femme and Sandro Homme

store).

Like-for-like sales growth percentage is presented at constant

exchange rates (sales for year N and year N-1 in foreign currencies

are converted at the average N-1 rate, as presented in the annexes

to the Group's consolidated financial statements as of December 31

for the year N in question).

Adjusted EBITDA and adjusted EBITDA

margin

Adjusted EBITDA is defined by the Group as

operating income before depreciation, amortization, provisions, and

charges related to share-based long-term incentive plans (LTIP).

Consequently, Adjusted EBITDA corresponds to EBITDA before charges

related to LTIP. Adjusted EBITDA is not a standardized accounting

measure that meets a single generally accepted definition. It must

not be considered as a substitute for operating income, net income,

cash flow from operating activities, or as a measure of liquidity.

Adjusted EBITDA margin corresponds to adjusted EBITDA divided by

net sales.

Adjusted EBIT and adjusted EBIT

margin

Adjusted EBIT is defined by the Group as earning

before interests, taxes, and charges related to share-based

long-term incentive plans (LTIP). Consequently, Adjusted EBIT

corresponds to EBIT before charges related to LTIP. Adjusted EBIT

margin corresponds to Adjusted EBIT divided by net sales.

Management Gross

margin

Management gross margin corresponds to the sales

after deducting rebates and cost of sales only. The accounting

gross margin (as appearing in the accounts) corresponds to the

sales after deducting the rebates, the cost of sales and the

commissions paid to the department stores and affiliates.

Retail Margin

Retail margin corresponds to the management

gross margin after taking into account the points of sale’s direct

expenses such as rent, personnel costs, commissions paid to the

department stores and other operating costs.

Net financial debt

Net financial debt represents the net financial

debt portion bearing interest. It corresponds to current and

non-current financial debt, net of cash and cash equivalents and

net of current bank overdrafts.

METHODOLOGY NOTE

Unless otherwise indicated, amounts are

expressed in millions of euros and rounded to the first digit after

the decimal point. In general, figures presented in this press

release are rounded to the nearest full unit. As a result, the sum

of rounded amounts may show non-material differences with the total

as reported. Note that ratios and differences are calculated based

on underlying amounts and not based on rounded amounts.

DISCLAIMER: FORWARD-LOOKING STATEMENTS

Certain information contained in this document

includes projections and forecasts. These projections and forecasts

are based on SMCP management's current views and assumptions. Such

forward-looking statements are not guarantees of future performance

of the Group. Actual results or performances may differ materially

from those in such projections and forecasts as a result of

numerous factors, risks and uncertainties, including the impact of

the current COVID-19 outbreak. These risks and uncertainties

include those discussed or identified under Chapter 2 “Risk factors

and internal control” of the Company’s Universal Registration

Document filed with the French Financial Markets Authority

(Autorité des Marchés Financiers - AMF) on 5 April 2024 and

available on SMCP's website (www.smcp.com).

This document has not been independently verified. SMCP makes no

representation or undertaking as to the accuracy or completeness of

such information. None of the SMCP or any of its affiliate’s

representatives shall bear any liability (in negligence or

otherwise) for any loss arising from any use of this document or

its contents or otherwise arising in connection with this

document.

APPENDICES

Breakdown of point of sales by region

|

Number of DOS |

2023 |

Q1-24 |

Q2-24 |

Q3-24 |

FY-24 |

|

Q4-24

variation |

2024

variation |

| |

|

|

|

|

|

|

|

|

| Par

région |

|

|

|

|

|

|

|

|

| France |

470 |

473 |

475 |

468 |

473 |

|

+5 |

+3 |

| EMEA |

411 |

410 |

406 |

395 |

395 |

|

- |

-16 |

| Amérique |

176 |

177 |

180 |

173 |

178 |

|

+5 |

+2 |

| Asie

Pacifique |

316 |

304 |

280 |

270 |

247 |

|

-23 |

-69 |

| |

|

|

|

|

|

|

|

|

| Par

marque |

|

|

|

|

|

|

|

|

| Sandro |

591 |

586 |

579 |

565 |

564 |

|

-1 |

-27 |

| Maje |

490 |

488 |

479 |

472 |

468 |

|

-4 |

-22 |

| Claudie

Pierlot |

210 |

209 |

201 |

190 |

185 |

|

-5 |

-25 |

| Fursac |

82 |

81 |

82 |

79 |

76 |

|

-3 |

-6 |

|

Total DOS |

1,373 |

1,364 |

1,341 |

1,306 |

1,293 |

|

-13 |

-80 |

|

Number of POS |

2023 |

Q1-24 |

Q2-24 |

Q3-24 |

FY-24 |

|

Q4-24

variation |

2024

variation |

| |

|

|

|

|

|

|

|

|

| Par

région |

|

|

|

|

|

|

|

|

| France |

471 |

473 |

475 |

468 |

473 |

|

+5 |

+2 |

| EMEA |

555 |

549 |

546 |

531 |

536 |

|

+5 |

-19 |

| Amérique |

215 |

218 |

221 |

216 |

226 |

|

+10 |

+11 |

| Asie

Pacific |

489 |

479 |

459 |

451 |

427 |

|

-24 |

-62 |

| |

|

|

|

|

|

|

|

|

| Par

marque |

|

|

|

|

|

|

|

|

| Sandro |

775 |

767 |

764 |

749 |

755 |

|

+6 |

-20 |

| Maje |

640 |

636 |

628 |

622 |

621 |

|

-1 |

-19 |

| Claudie

Pierlot |

233 |

234 |

226 |

215 |

209 |

|

-6 |

-24 |

| Fursac |

82 |

82 |

83 |

80 |

77 |

|

-3 |

-5 |

|

Total POS |

1,730 |

1,719 |

1,701 |

1,666 |

1,662 |

|

-4 |

-68 |

|

o/w partners |

357 |

355 |

360 |

360 |

369 |

|

+9 |

+12 |

CONSOLIDATED FINANCIAL STATEMENTS

|

INCOME STATEMENT (M€) |

2023 |

2024 |

| |

|

|

|

Sales |

1,230.5 |

1,211.7 |

|

Cost of sales |

-455.3 |

-448.4 |

|

Gross margin |

775.2 |

763.3 |

|

|

|

|

| Other

operating income and expenses |

-259.1 |

-257.7 |

| Personnel

costs |

-279.7 |

-289.2 |

| Depreciation,

amortization, and impairment |

-156.9 |

-163.5 |

|

Share-based Long-Term Incentive Plan |

-3.0 |

-1.8 |

|

Current operating income |

76.5 |

51.2 |

|

|

|

|

|

Other non-current income and expenses |

-25.9 |

-35.2 |

|

Operating profit |

50.5 |

16.0 |

|

|

|

|

| Financial

income and expenses |

-0.8 |

-1.8 |

|

Cost of net debt |

-27.1 |

-30.6 |

|

Financial income |

-27.9 |

-32.4 |

|

|

|

|

|

Profit/(loss) before tax |

22.6 |

-16.4 |

| Income tax

expense |

-11.4 |

-7.2 |

|

Net profit/(loss) for the period |

11.2 |

-23.6 |

|

Basic Group share of net earnings per share (EUR) |

0.15 |

-0.31 |

| Diluted Group

share of net earnings per share (EUR) |

0.14 |

-0.31 |

|

BALANCE SHEET - ASSETS (€m) |

As of Dec. 31, 2023 |

As of Dec 31, 2024 |

|

|

|

Goodwill |

626.7 |

604.3 |

|

|

|

Trademarks, other intangible & right-of-use assets |

1,120.4 |

1,139.1 |

|

|

|

Property, plant and equipment |

83.1 |

79.7 |

|

|

|

Non-current financial assets |

18.5 |

16.8 |

|

|

|

Deferred tax assets |

32.0 |

29.6 |

|

|

|

Non-current assets |

1,880.7 |

1,869.6 |

|

|

|

Inventories and work in progress |

281.8 |

260.2 |

|

|

|

Accounts receivables |

68.2 |

69.0 |

|

|

|

Other receivables |

69.2 |

50.8 |

|

|

|

Cash and cash equivalents |

50.9 |

48.5 |

|

|

|

Current assets |

470.1 |

428.5 |

|

|

|

|

|

|

|

|

|

Total assets |

2,350.8 |

2,298.1 |

|

|

|

|

|

|

BALANCE SHEET - EQUITY & LIABILITIES (€m) |

As of Dec. 31, 2023 |

As of Dec 31, 2024 |

|

|

|

Total Equity |

1,180.1 |

1,163.1 |

|

|

|

Non-current lease liabilities |

305.7 |

343.5 |

|

|

|

Non-current financial debt |

223.5 |

158.7 |

|

|

|

Other financial liabilities |

0.1 |

0.6 |

|

|

|

Provisions and other non-current liabilities |

0.7 |

4.9 |

|

|

|

Net employee defined benefit liabilities |

4.9 |

4.6 |

|

|

|

Deferred tax liabilities |

166.9 |

163.9 |

|

|

|

Non-current liabilities |

701.8 |

676.2 |

|

|

|

Trade and other payables |

161.9 |

143.4 |

|

|

|

Current lease liabilities |

106.6 |

100.7 |

|

|

|

Bank overdrafts and short-term financial borrowings and debt |

113.6 |

126.4 |

|

|

|

Short-term provisions |

1.3 |

1.6 |

|

|

|

Other current liabilities |

85.5 |

86.7 |

|

|

|

Current liabilities |

468.9 |

458.8 |

|

|

|

|

|

|

|

|

|

Total Equity & Liabilities |

2,350.8 |

2,298.1 |

|

|

|

CASH FLOW STATEMENT (€m) |

2023

published |

2023

restated |

2024 |

| Cash from

operations before changes in working capital |

236.4 |

232.0 |

214.7 |

| Changes in

working capital |

-3.7 |

-3.7 |

29.3 |

| Income tax

expense |

-16.9 |

-16.9 |

-10.1 |

|

Net cash flow from operating activities

* |

215.8 |

211.4 |

233.9 |

| Capital

expenditure |

-55.6 |

-51.3 |

-38.9 |

| Others |

-6.1 |

-6.1 |

0.0 |

|

Net cash flow from investing activities

* |

-61.7 |

-57.3 |

-38.8 |

| Treasury

shares purchase program |

-2.4 |

-2.4 |

-0.4 |

| Change in

borrowings and debt |

-43.6 |

-43.6 |

-55.5 |

| Net interests

paid |

-16.3 |

-16.3 |

-18.9 |

| Other

financial income and expenses |

-0.8 |

-0.8 |

-0.3 |

| Reimbursement

of rent lease |

-128.2 |

-128.2 |

-127.5 |

|

Net cash flow from financing activities |

-191.3 |

-191.2 |

-202.6 |

| Net foreign

exchange difference |

-0.5 |

-0.5 |

0.5 |

|

Change in net cash |

-37.7 |

-37.7 |

-7.0 |

‘* Change in the presentation of proceeds from asset

disposals

Réconciliation entre indicateurs de performance

opérationnelle comptable et de gestion

|

GROSS MARGIN (€m) – excluding IFRS 16 |

2023 |

2024 |

| Gross

margin (as appearing in the accounts) |

775.2 |

763.3 |

| Readjustment

of the commissions and other adjustments |

132.7 |

137.8 |

|

Management Gross margin |

907.9 |

901.1 |

| Direct costs

of point of sales |

-552.0 |

-562.9 |

| Retail

margin |

355.9 |

338.2 |

|

OPERATING PROFIT (€m) |

2023 |

2024 |

|

Adjusted EBITDA |

236.4 |

216.4 |

| Depreciation.

amortization. and impairment |

-156.9 |

-163.5 |

|

Adjusted EBIT |

79.5 |

53.0 |

| Allocation of

LTIP |

-3.0 |

-1.8 |

|

EBIT |

76.5 |

51.2 |

|

Other non-recurring income and expenses |

-25.9 |

-35.2 |

|

OPERATING PROFIT |

50.5 |

16.0 |

|

FCF (€m) |

2023

published |

2023

restated |

2024 |

| Cash from

operations before changes in working capital |

236.4 |

232.0 |

214.7 |

| Change in

working capital |

-3.7 |

-3.7 |

29.3 |

| Income

tax |

-16.9 |

-16.9 |

-10.1 |

|

Net cash flow from operating activities

* |

215.8 |

211.4 |

233.9 |

| Capital

expenditure (operating and financial) |

-55.6 |

-51.3 |

-38.9 |

| Reimbursement

of rent lease |

-128.2 |

128.2 |

-127.5 |

| Interest &

Other financial |

-17.1 |

-17.1 |

-19.2 |

| Other &

FX |

-0.5 |

-0.5 |

0.5 |

|

Free cash-flow |

14.4 |

14.4 |

48.9 |

‘* Change in the presentation of proceeds from asset

disposals

|

NET FINANCIAL DEBT (€m) |

As of Dec. 31. 2023 |

As of Dec 31. 2024 |

| Non-current

financial debt & other financial liabilities |

-223.6 |

-159.3 |

| Bank

overdrafts and short-term financial liability |

-113.6 |

-126.4 |

| Cash and cash

equivalents |

50.9 |

48.5 |

|

Net financial debt |

-286.3 |

-237.2 |

| adjusted

EBITDA (excl. IFRS) – 12 months |

112.4 |

92.2 |

|

Net financial debt / adjusted EBITDA |

2.55x |

2.57x |

ABOUT SMCP

SMCP is a global leader in the accessible luxury

market with four unique Parisian brands: Sandro. Maje. Claudie

Pierlot and Fursac. Present in 49 countries. the Group comprises a

network of over 1.600 stores globally and a strong digital presence

in all its key markets. Evelyne Chetrite and Judith Milgrom founded

Sandro and Maje in Paris. in 1984 and 1998 respectively. and

continue to provide creative direction for the brands. Claudie

Pierlot and Fursac were respectively acquired by SMCP in 2009 and

2019. SMCP is listed on the Euronext Paris regulated market

(compartment A. ISIN Code FR0013214145. ticker: SMCP).

CONTACTS

|

INVESTORS/PRESS

|

|

|

| |

|

|

|

SMCP

|

BRUNSWICK |

|

Amélie Dernis +33 (0) 1 55 80 51

00 |

Hugues Boëton +33 6 79 99 27 15 |

|

amelie.dernis@smcp.com |

Tristan Roquet Montegon +33 6 37 00 52 57 |

|

|

smcp@brunswickgroup.com |

1 Organic growth | All references in this document

to the “organic sales performance” refer to the performance of the

Group at constant currency and scope

2Claudie Pierlot et Fursac

3 Excluding IFRS 16

- SMCP - Press Release - 2024 FY Results

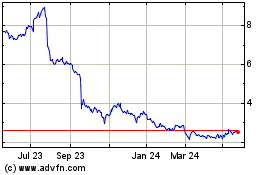

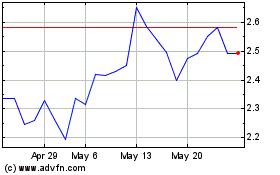

SMCP (EU:SMCP)

Historical Stock Chart

From Feb 2025 to Mar 2025

SMCP (EU:SMCP)

Historical Stock Chart

From Mar 2024 to Mar 2025