Solvay third quarter 2024 results

November 06 2024 - 12:00AM

UK Regulatory

Solvay third quarter 2024 results

Press release - Regulated information published on November 6,

2024, at 7:00 a.m. CET

Sound financial performance with acceleration

of costs savings

Confirmation of the full year 2024 EBITDA and FCF

guidance

Highlights

- Net sales in Q3 2024

amounted to €1,156 million, up +3.9% organically versus Q3 2023,

with a positive impact from volumes for the third consecutive

quarter, while prices were down year on year.

- Underlying EBITDA in Q3

2024 was stable at €259 million (-0.3% year on year organically),

with a moderate negative Net pricing being offset by positive

volume impact. EBITDA margin reached 22.4%.

- Structural cost savings

initiatives delivered €77 million in the first nine months of

2024.

- Underlying net profit from

continuing operations was €108 million in Q3 2024 vs. €157 million

in Q3 2023.

- Free Cash Flow1

amounted to €74 million in Q3 2024 (€320 million in 9M), from the

solid EBITDA performance, while Capex ramped up to €84

million in Q3 2024 (€192 million in 9M).

- ROCE was 17.3% in Q3

2024.

- Underlying Net Debt stood

at €1.5 billion, implying a leverage ratio of 1.5x.

- The Board of Directors validated

an interim dividend of €0.97 gross per share, payable on

Jan. 22, 2025.

- 2024 Outlook: Solvay

confirms its EBITDA and Free Cash Flow1 guidance for

2024, and expects the underlying EBITDA to be at the high end of

the “-10% to -15%” organic growth range.

| |

Third quarter |

Nine Months |

| Underlying (in €

million) |

2024 |

2023 |

% yoy |

% organic |

2024 |

2023 |

% yoy |

% organic |

| Net

sales |

1,156 |

1,120 |

+3.2% |

+3.9% |

3,552 |

3,749 |

-5.3% |

-5.4% |

|

EBITDA |

259 |

286 |

-9.7% |

-0.3% |

796 |

1,008 |

-21.0% |

-11.1% |

|

EBITDA margin |

22.4% |

25.6% |

-3.2pp |

- |

22.4% |

26.9% |

-4.5pp |

- |

|

FCF1 |

74 |

167 |

-55.7% |

- |

320 |

553 |

-42.1% |

- |

|

ROCE |

|

|

|

|

17.3% |

N/A |

n.m |

- |

Note: 2023 figures were restated to reflect the changes

mentioned in the Financial

performance introduction.

Philippe Kehren, Solvay CEO

“The evolution of our business in the third

quarter was in line with our expectations. The first half of the

year benefitted from opportunistic sales and restocking effects,

while, as anticipated, we have not observed any improvement in the

third quarter of 2024. Despite these market conditions, our

financial performance demonstrates resilience and our ability to

maintain solid profits. This has been achieved thanks to the

acceleration of cost-saving initiatives and the unwavering

commitment of our employees.

I am also very proud of our most recent energy transition

project in Green River (US). Just a few months after exiting coal,

this new step further strengthens Green River’s position as a U.S.

benchmark for sustainable soda ash production and marks a key step

in reducing our global carbon footprint.

Looking ahead to the fourth quarter, we expect the trends of the

first nine months to continue, with some potential seasonal effects

toward year-end.

As we prepare for 2025, we are ready to adapt to evolving market

conditions while focusing on our transformation journey and

operational efficiency.”

2024 outlook

Solvay expects the trends of the first nine

months to continue into the last quarter of 2024, with some

potential seasonality effects around year-end.

In that context, Solvay confirms its full year

underlying EBITDA guidance of “-10% to -15%” organic growth (or

€975 million to €1,040 million, at a 1.10 EUR/USD exchange rate),

and expects to be at the high-end of the range. This is supported

by the resilience of its businesses and the cost savings that will

exceed the target of €80 million for the full year, as the company

has been able to accelerate initiatives that were expected to start

in 2025.

Solvay keeps its guidance of Free Cash Flow1 for 2024

at above €300 million, as Capex in the last quarter should further

accelerate and reach €300 million to €350 million in 2024.

Financial calendar

- Link to Solvay’s financial

calendar

Details of analysts and investors conference call

- Time: November 6, 2024 - 2pm

CET

- Registration: register to the

webcast here.

Contacts

| Media relations |

Investor relations |

Peter Boelaert

+32 479 30 91 59

Laetitia Van Minnenbruggen

+32 484 65 30 47

Valérie Goutherot

+33 6 77 05 04 79

media.relations@solvay.com |

Boris Cambon-Lalanne

+32 471 55 37 49

Geoffroy d’Oultremont

+32 478 88 32 96

Vincent Toussaint

+33 6 74 87 85 65

investor.relations@solvay.com |

About Solvay

Solvay, a pioneering chemical company with a

legacy rooted in founder Ernest Solvay's pivotal innovations in the

soda ash process, is dedicated to delivering essential solutions

globally through its workforce of over 9,000 employees. Since 1863,

Solvay harnesses the power of chemistry to create innovative,

sustainable solutions that answer the world’s most essential needs

such as purifying the air we breathe and the water we use,

preserving our food supplies, protecting our health and well-being,

creating eco-friendly clothing, making the tires of our cars more

sustainable and cleaning and protecting our homes. Solvay’s

unwavering commitment drives the transition to a carbon-neutral

future by 2050, underscoring its dedication to sustainability and a

fair and just transition. As a world-leading company with €4.9

billion in net sales in 2023, Solvay is listed on Euronext Brussels

and Paris (SOLB). For more information about Solvay, please visit

solvay.com or follow Solvay on Linkedin.

Safe harbor

This press release may contain forward-looking

information. Forward-looking statements describe expectations,

plans, strategies, goals, future events or intentions. The

achievement of forward-looking statements contained in this press

release is subject to risks and uncertainties relating to a number

of factors, including general economic factors, interest rate and

foreign currency exchange rate fluctuations, changing market

conditions, product competition, the nature of product development,

impact of acquisitions and divestitures, restructurings, products

withdrawals, regulatory approval processes, all-in scenario of

R&I projects and other unusual items. Consequently, actual

results or future events may differ materially from those expressed

or implied by such forward-looking statements. Should known or

unknown risks or uncertainties materialize, or should our

assumptions prove inaccurate, actual results could vary materially

from those anticipated. The Company undertakes no obligation to

publicly update or revise any forward-looking statements.

1 Free Cash Flow (FCF) here is the free cash to

Solvay shareholders from continuing operations.

- Press release

- Financial report

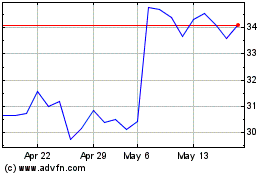

Solvay (EU:SOLB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Solvay (EU:SOLB)

Historical Stock Chart

From Feb 2024 to Feb 2025