Van Lanschot Kempen: net profit €84.3 million, with net AuM inflows at €13.7 billion in 2022

February 23 2023 - 12:30AM

Van Lanschot Kempen: net profit €84.3 million, with net AuM inflows

at €13.7 billion in 2022

Amsterdam/’s-Hertogenbosch, the Netherlands, 23 February

2023

- Net profit

€84.3

million (2021:

€143.8

million),

decline partly related to

one-off charge related to the

accelerated acquisition of the

remaining 30%-stake in

Mercier Vanderlinden

- Commission income and interest income both

increased by 6%

- Net AuM inflows at

Private Clients:

€2.0

billion; Wholesale &

Institutional Clients:

€11.6

billion

- Client assets:

€124.2

billion (2021:

€131.2

billion) and

AuM:

€107.8

billion (2021:

€115.6

billion)

- Strong capital ratio

of

20.6%

(2021: 23.7%),

decrease attributable to higher capital

requirements for residential mortgage loans and a

€1.50

per share capital return in

December 2022

- 2022 dividend proposed at

€1.75

per share (2021:

€2.00

per share)

- Intention to return

excess capital of

€2.00

per share in the second

half of 2023, subject to

regulatory approval

Maarten Edixhoven,

Chair of the Management Board, said: “We are

looking back on an eventful year in which the war in Ukraine,

energy insecurity and inflation left marks on society at large and

our clients. Negative market performances in virtually all asset

classes left no investor untouched. We nevertheless achieved high

net inflows in assets under management (AuM) and increased savings.

I’m grateful to our clients for their confidence in us and would

also like to thank my colleagues for their personal and

entrepreneurial approach in the past year, helping our clients in

these turbulent times.

“In 2022, we enhanced our financial and sustainability

objectives as well as our capital strategy. Profitable growth, both

organically and via acquisitions, remains our focus, while

maintaining a capital-light balance sheet. We’re proud to have

added two major Dutch clients to our fiduciary management

activities and shortly before year-end we announced the acquisition

of the remaining 30% stake in Mercier Vanderlinden, a further

strengthening of our position in Belgium. As part of this

transaction, Mercier Vanderlinden’s managing partners will obtain a

significant stake in Van Lanschot Kempen, anchoring our shareholder

base in our second home market.

“What really pleases me is that over 70% of our colleagues now

hold shares in Van Lanschot Kempen, a clear sign of their

engagement. I’m also proud that we’ve managed to retain and attract

talent in a tight labour market. And on that note, I consider the

addition of the Robeco Retail Nederland team to Evi van Lanschot a

real boon. On 2 February 2023, we announced that we would enter

into a strategic partnership with Robeco and acquire their online

investment platform with €4.7 billion in AuM. We look forward to a

great partnership and expect to complete the transaction in June

2023.”

Client assets

and AuMNet AuM inflows amounted

to €13.7 billion and negative market performance was €21.5 billion,

resulting in a decrease in total AuM of €107.8 billion (2021:

€115.6 billion). Client savings rose to €12.7 billion (2021:

€11.7 billion) and total client assets were €124.2 billion (2021:

€131.2 billion).

2022

resultsFull-year net profit amounted to €84.3

million (2021: €143.8 million). The decrease can mainly be

explained by high results on participating interests in 2021 and

one-off charges related to the acquisition of the remaining 30%

stake in Mercier Vanderlinden in 2022.

Commission income rose 6% to €407.8 million (2021: €385.5

million) on the back of higher average AuM levels. Interest income

was up 6% to €162.7 million (2021: €153.6 million), reflecting the

interest rate hikes the European Central Bank (ECB) embarked on in

the second half of the year. In 2022, operating expenses rose to

€438.2 million (2021: €409.9 million), fuelled by higher staff

costs. The increase mostly reflects an increase in FTE to 1,780

(2021: 1,654), including at the IT and compliance functions and at

the teams responsible for investment solutions. Moreover, after the

acquisition of the initial 70% stake in July 2021, Mercier

Vanderlinden’s operating expenses were now recognised for the full

calendar year.

PERFORMANCE

REPORT/PRESENTATION/WEBCAST

For a detailed discussion of Van Lanschot Kempen’s results and

balance sheet, please refer to our performance report and

presentation on the 2022 full-year results at

vanlanschotkempen.com/results. In a conference call on 23 February

at 9.00 am CET, we will discuss our 2022 full-year results in

greater detail. This may be viewed live at

vanlanschotkempen.com/results and played back at a later date.

ADDITIONAL

INFORMATION For additional

information, go to

vanlanschotkempen.com/financial.FINANCIAL

CALENDAR4 May 2023

Publication of 2023 first-quarter

trading update25 May 2023

Annual General Meeting29 May 2023

Ex-dividend date6 June

2023 2022

dividend pay date 24 August 2023

Publication of 2023 half-year results2 November

2023 Publication of

2023 third-quarter trading updateMedia

Relations: +31 20 354 45 85;

mediarelations@vanlanschotkempen.comInvestor

Relations: +31 20 354 45 90;

investorrelations@vanlanschotkempen.com

About Van Lanschot KempenVan

Lanschot Kempen is a wealth manager active in Private Banking,

Investment Management and Investment Banking, with the aim of

preserving and creating wealth, in a sustainable way, for both its

clients and the society of which it is part. As a sustainable

wealth manager with a long-term focus, Van Lanschot Kempen

proactively seeks to prevent negative impact for all stakeholders

and to create positive long-term financial and non-financial value.

Listed at Euronext Amsterdam, Van Lanschot Kempen is the

Netherlands’ oldest independent financial services company, with a

history dating back to 1737. To fully leverage the potential of the

Van Lanschot Kempen organisation for its clients, it provides

solutions that build on the knowledge and expertise across its

entire group and on its open architecture platform. Van Lanschot

Kempen is able to meet the needs of its clients by offering them

access to the full range of its products and services across all

its businesses.

For more information, please visit vanlanschotkempen.com

Important legal information and cautionary note on

forward-looking statements This press release may contain

forward-looking statements and targets on future events and

developments. These forward-looking statements and targets are

based on the current insights, information and assumptions of Van

Lanschot Kempen’s management about known and unknown risks,

developments and uncertainties. Forward-looking statements and

targets do not relate strictly to historical or current facts and

are subject to such risks, developments and uncertainties which by

their very nature fall outside the control of Van Lanschot Kempen

and its management. Actual results, performances and circumstances

may differ considerably from these forward-looking statements and

targets.

Van Lanschot Kempen cautions that forward-looking statements and

targets in this press release are only valid on the specific dates

on which they are expressed, and accepts no responsibility or

obligation to revise or update any information, whether as a result

of new information or for any other reason.

Van Lanschot Kempen’s annual accounts are prepared in accordance

with International Financial Reporting Standards, as adopted by the

European Union (“IFRS-EU”). In preparing the financial information

in this press release, except as described otherwise, the same

accounting principles are applied as in the 2022 Van Lanschot

Kempen consolidated annual accounts. The figures in this press

release have not been audited. Small differences are possible in

the tables due to rounding. Percentages are calculated based on

unrounded figures.

This press release does not constitute an offer or solicitation

for the sale, purchase or acquisition in any other way or

subscription to any financial instrument and is not a

recommendation to perform or refrain from performing any

action.

Elements of this press release contain information about Van

Lanschot Kempen NV within the meaning of Article 7(1) to (4) of EU

Regulation No. 596/2014.

This press release is a translation of the Dutch language

original and is provided as a courtesy only. In the event of any

disparities, the Dutch language version will prevail. No rights can

be derived from any translation thereof.

- Van Lanschot Kempen press release

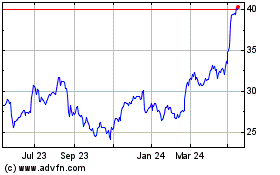

Van Lanschot Kempen NV (EU:VLK)

Historical Stock Chart

From Feb 2025 to Mar 2025

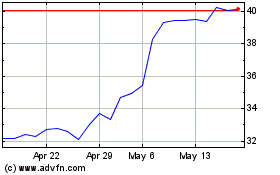

Van Lanschot Kempen NV (EU:VLK)

Historical Stock Chart

From Mar 2024 to Mar 2025