Worldline - Q3 2023 revenue - Press Release

Q3 2023 revenueQ3 2023

revenue: € 1,182 million, +4.8%

organicallyMerchant Service up +7.6%1

Power24: acceleration of our

post-integrationtransformation

ambition€ 200 million run-rate expected cash costs

savings in 2025 with fast ramp-up during

20242

Updated 2023 objectives reflecting market

conditions6% to 7% organic revenue

growthStable OMDA in absolute value (or margin

decrease of c. 150 bps) vs. 20223

30-35% OMDA conversion to FCF

2024: focus on growth & OMDA

improvement4Revenue growth

acceleration as of H2 2024c.€100m OMDA improvement

as soon as 2024

Paris La Défense, 25 October 2023 –

Worldline [Euronext: WLN], a global leader in payment services,

today announces its revenue for the third quarter of

2023.

Gilles Grapinet, CEO of Worldline,

said: “After a solid start of the year, we now enter into

a second semester where the macro environment deteriorates, in

particular in Germany. This evolution is reflected in our third

quarter performance despite satisfactory commercial developments in

Merchant Services. In this context, we decided to update our 2023

objectives.

To reinforce Worldline competitiveness and

structural mid-term profile and successfully face this temporarily

challenging environment, we announce Power24, our planned

post-integration transformation ambition . We target €200m run-rate

cash costs savings in 2025, with a fast ramp-up in 2024.

In 10 years, Worldline has created one of the

largest payment companies in Europe, benefitting from a unique

value proposition based on cutting edge technology, strong market

positions and powerful distribution channels alongside leading

banking partners. As we are reaching the completion of Ingenico

integration, we are ready to enter into a new phase of our company

journey ready to unleash the power of our combined assets, and to

make Worldline more agile to boost its growth potential. More than

ever, we are convinced by the unique and structural opportunity

that the European and wider digital payment market represent.”

Q3 2023 revenue by Global Business

Line

|

in € million |

|

Q3 2023 |

Q3 2022* |

Organic Growth |

|

Merchant services |

|

868 |

807 |

+7.6% |

|

Financial services |

|

232 |

239 |

-2.9% |

|

Mobility & e-transactional Services |

|

81 |

81 |

-0.2% |

|

Worldline |

|

1,182 |

1,128 |

+4.8% |

* at constant scope and exchange rates

Worldline’s Q3 2023 revenue reached €

1,182 million, representing a +4.8% organic

growth. This was mainly driven by Merchant Services at

+7.6% organically (+10.0% excluding Germany), impacted by temporary

headwinds. Financial Services was down -2.9%, due to delays of new

signing contracts as expected. Finally, Mobility &

e-Transactional Services was broadly stable supported by a good

commercial dynamics in Trusted e-Ticketing activity while not yet

fully benefitting from the ramp-up of new signed contracts.

Macroeconomics deterioration in some of our

core geographies and termination of some of our specific merchants’

relationships

During the third quarter of 2023, some of our

core geographies, in particular the German market, have shown

macroeconomics slowdown. In effect, consumers have started to

allocate more of their spendings to non-discretionary verticals

rather than discretionary ones, impacting our growth and

profitability.

In light of an increase cybercrime in general,

newly emerging fraudulent patterns and accelerating trend of

reinforced regulatory guidelines and market constraints, we have

tightened our risk appetite policy. Consequently, we have

terminated in an orderly manner some specific merchants’

relationships whose associated costs and potential risks did not

match our revised requirements. The scope of such online merchants

could represent a maximum of c. € 130 million in run rate 2023

revenues, of which c.€ 30 million impacting H2 2023 and c. € 100

million mostly in H1 2024 impacting comparison basis.

Merchant Services

Merchant Services’ revenue in

Q3 2023 reached € 868 million, representing an

organic growth of +7.6%. This performance was

based on c.7% growth in transaction volumes, with macroeconomic

slowdown impacting consumer spendings patterns in particular in

Germany. The revenue dynamism has also been impacted by the

implementation of our [revised risk appetite framework]. By

division, the growth was mainly led by:

- Commercial Acquiring: Good overall

high single-digit growth with almost all geographic regions

contributing, but impacted by the termination of some of our

existing merchants’ relationships based on our [revised risk

appetite framework].

- Payment Acceptance: Double digit

growth mainly fueled by the solid performance of Digital Commerce

division, particularly thanks to the new customers signed the

previous quarters such as Lufthansa and Pearson.

- Digital

Services: Globally stable, with Germany impacted by macroeconomic

headwinds.

During the third quarter of the year, commercial

activity in Merchant Services materialized in numerous wins for

both Instore Omnichannel and Online X-Border activities, with among

others, S+M, 934, Nopayn, SNCF, Alsa, Goethe Institut, and Gamers

Outlet.

Financial Services

Q3 2023 revenue reached

€ 232 million, or a -2.9% organic

growth. The organic decline occurred despite good

underlying growth in the account payment activity, offset by delays

in pipeline execution within issuing business mainly. The

performance by division was the following:

- Card-based payment processing

activities (Issuing Processing and Acquiring Processing altogether:

Contraction in growth driven by delays of new signings in most of

the geographies.

- Account Payments: Solid growth with

strong activity in Germany.

- Digital

Banking: Growth improving with a good momentum in Belgium and

France.

During the third quarter on the commercial

front, Financial Services signed an agreement with Commerzbank to

extend their cooperation in the field of instant payments,

including the realization of Swiss instant payments.

Mobility & e-Transactional Services

Revenue in Mobility & e-Transactional

Services reached € 81 million, stable

organically, with a positive underlying growth mainly led

by good volumes in e-ticketing activity while not currently

benefitting from the ramp-up in new contract signed. The

performance by division was the following:

- Trusted Digitization: Broadly

stable driven by new projects signed in France and volumes

development on electronic bracelets and & energy subsidies

activities.

- e-Ticketing: Double-digit growth

driven by increasing projects activity (Network Rail, Lennon) as

well as increasing volumes on rail ticketing solutions in the UK.

- Finally,

e-Consumer & Mobility: Organic decline mainly due to lower

volumes on existing contract and despite contribution of the new

contracts signed in Iberia and in France.

Commercial activity in Mobility &

e-Transactional Services recorded two key wins, in particular with

the signature of a contract with Drägerwerk (International company

in the industry of medical and safety technology) for the delivery

of a Smart Remote Service offering to connect and secure their

worldwide deployments remotely. Another significant achievement was

the signing of a 3-year agreement with Irish Rail company to

provide train management and planning solutions that will enable

them to enhance their fleet management capability in readiness for

their transition to a Traffic Management System.

Power24: acceleration of our

post-integration transformation

Given this challenging environment, we announce

Power24, our planned post-integration transformation ambition to

reinforce Worldline competitiveness and enhance our operational

efficiency. It will focus on product transformation, technology

optimization, organization improvement and sourcing

streamlining.

Power24 is expected to deliver c. € 200 million

run-rate cash costs savings in 2025, with a fast ramp-up in 2024.

The overall implementation costs should be c. € 250 million.

2023 objectives updated reflecting market

conditions

- Revenue organic

growth: +6% to +7%

- OMDA: Stable OMDA in

absolute value (or margin decrease of c. 150 bps) vs. 20225

- Free cash

flow: 30% to 35% OMDA conversion rate

In parallel, the Group will be focused on

pursuing its deleveraging trajectory maintaining a strong balance

sheet.

2024: focus on OMDA improvement and prepare

growth reacceleration

In 2024, the Group will be focus on its OMDA and

expect c. € 100 million improvement versus 2023.

Our 2024 trajectory will be adjusted with the

publication of our 2024 objectives in February 2024, to take into

account in particular the market context and Power24.

Appendices

RECONCILIATION OF Q3 2022 STATUTORY REVENUE

WITH Q3 2022 REVENUE AT CONSTANT SCOPE AND EXCHANGE

RATES

For the analysis of the Group’s performance,

revenue for Q3 2023 is compared to Q3 2022 revenue at constant

scope and exchange rates as presented below per Global Business

Lines:

| |

|

Revenue |

| |

|

|

|

|

|

| In €

million |

|

Q3 2022 |

Scope effect** |

Exchange rates effects |

Q3 2022* |

|

Merchant Services |

|

828 |

-1,3 |

-20,1 |

807 |

| Financial Services |

|

241 |

-0,0 |

-1,5 |

239 |

| Mobility & e-Transactional

Services |

|

89 |

-8,0 |

-0,1 |

81 |

|

Worldline |

|

1 158 |

-9,3 |

-21,6 |

1 128 |

| * At constant scope and

september 2023 YTD average exchange rates |

|

|

|

|

|

| ** At December 2022 YTD

average exchange rates |

|

|

|

|

|

* at constant scope and September 2023 YTD average

exchange rates** at December 2022 YTD average exchange rates

Exchanges rates effect in Q3 were mainly due to

depreciation of Australian Dollar and Turkish Lira while scope

effects are mainly related to the disposal of Mobility &

e-Transactional Services activities in Latin America and the

impacts of the disposal of TSS.

2022 ESTIMATED PRO FORMA

For the analysis of the Group’s organic

performance, revenue and Operating Margin before Depreciation and

Amortization (OMDA) in 2023 are compared with 2022 revenue and OMDA

at constant scope and exchange rates. FY 2022 estimated pro forma

is presented below (per Global Business Lines):

| |

|

2022 estimated proforma |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q1* |

|

Q2** |

|

H1** |

|

Q3*** |

|

Q4*** |

|

H2*** |

|

FY |

|

H1** |

H2*** |

FY |

|

H1** |

H2*** |

FY |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

OMDA |

OMDA |

OMDA |

|

OMDA% |

OMDA% |

OMDA |

|

Merchant Services |

|

672,9 |

|

748,5 |

|

1 421,4 |

|

807,1 |

|

826,1 |

|

1 633,3 |

|

3 054,7 |

|

339 |

502 |

842 |

|

23,9% |

30,7% |

27,6% |

|

Financial Services |

|

223,3 |

|

235,2 |

|

458,4 |

|

239,1 |

|

259,2 |

|

498,3 |

|

956,7 |

|

129 |

154 |

283 |

|

28,1% |

31,0% |

29,6% |

| Mobility & e-Transactional

Services |

|

83,7 |

|

87,5 |

|

171,2 |

|

81,4 |

|

88,7 |

|

170,1 |

|

341,3 |

|

22 |

24 |

45 |

|

12,6% |

14,1% |

13,3% |

| Corporate costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-32 |

-29 |

-61 |

|

-1,6% |

-1,3% |

-1,4% |

|

Worldline |

|

979,9 |

|

1 071,2 |

|

2 051,1 |

|

1 127,6 |

|

1 174,1 |

|

2 301,6 |

|

4 352,7 |

|

457 |

651 |

1 109 |

|

22,3% |

28,3% |

25,5% |

* at constant scope and september 2023 YTD

average exchange rates

Main components of the scope effects on 2022

estimated pro forma:

- ANZ added contribution of 3 months

(integrated for 9 months in 2022 reported)

- Eurobank added contribution of 6

months (integrated for 6 months in 2022 reported)

- Disposal of Mobility &

e-Transactional Services activities in Latin America for 11 months

(excluded for 1 month in 2022 reported)

- Impacts of the

disposal of TSS

FORTHCOMING EVENTS

- February 28,

2024 FY

2023 results

INVESTOR RELATIONS

Laurent MarieE

laurent.marie@worldline.com

Guillaume DelaunayE

guillaume.delaunay@worldline.com

COMMUNICATION

Sandrine van der GhinstE

sandrine.vanderghinst@worldline.com

Hélène CarlanderE

helene.carlander@worldline.com

ABOUT WORLDLINE

Worldline [Euronext: WLN] helps businesses of

all shapes and sizes to accelerate their growth journey – quickly,

simply, and securely. With advanced payments technology, local

expertise and solutions customised for hundreds of markets and

industries, Worldline powers the growth of over one million

businesses around the world. Worldline generated a 4.4 billion

euros revenue in 2022. worldline.com

Worldline’s corporate purpose (“raison d’être”)

is to design and operate leading digital payment and transactional

solutions that enable sustainable economic growth and reinforce

trust and security in our societies. Worldline makes them

environmentally friendly, widely accessible, and supports social

transformation.

FOLLOW US

DISCLAIMER

This document contains forward-looking

statements that involve risks and uncertainties, including

references, concerning the Group's expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviors. Any forward-looking

statements made in this document are statements about Worldline’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Worldline’s plans, objectives, strategies, goals, future events,

future revenues or synergies, or performance, and other information

that is not historical information. Actual events or results may

differ from those described in this document due to a number of

risks and uncertainties that are described within the 2021

Universal Registration Document filed with the French Autorité des

marchés financiers (AMF) on April 25, 2022 under the filling

number: D.22-0342, and its Amendment filed on July 29, 2022 under

the filling number: D. 21-0342-A01.

Revenue organic growth and Operating Margin

before Depreciation and Amortization (OMDA) improvement are

presented at constant scope and exchange rate. OMDA is presented as

defined in the 2021 Universal Registration Document. All amounts

are presented in € million without decimal. This may in certain

circumstances lead to non-material differences between the sum of

the figures and the subtotals that appear in the tables. 2023

objectives are expressed at constant scope and exchange rates and

according to Group’s accounting standards.

Worldline does not undertake, and specifically

disclaims, any obligation or responsibility to update or amend any

of the information above except as otherwise required by law.

This document is disseminated for information

purposes only and does not constitute an offer to purchase, or a

solicitation of an offer to sell, any securities in the United

States or any other jurisdiction. Securities may not be offered or

sold in the United States unless they have been registered under

the U.S. Securities Act of 1933, as amended (the “U.S. Securities

Act”) or the securities laws of any U.S. state, or are exempt from

registration. The securities that may be offered in any transaction

have not been and will not be registered under the U.S. Securities

Act or the securities laws of any U.S. state and Worldline does not

intend to make a public offering of any such securities in the

United States.

1 +10.0% excluding Germany2 Up to €250m

implementation costs expected3 2022 OMDA proforma4 Based on

unchanged macroeconomic conditions5 2022 OMDA proforma

- 20231025 - Worldline - Q3 2023 revenue - Press Release

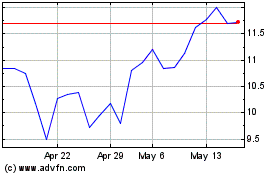

Worldline (EU:WLN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Worldline (EU:WLN)

Historical Stock Chart

From Feb 2024 to Feb 2025