Antipodean Currency's Slide Amid Risk Aversion

November 13 2024 - 9:21PM

RTTF2

The Antipodean currencies such as the Australia and the New

Zealand dollars weakened against their major currencies in the

Asian session on Thursday, as traders fretted about the impact of

U.S. President-elect Donald Trump's proposed tariffs on inflation

and interest rates. The U.S. dollar also strengthened against major

currencies in the region.

There is some uncertainty about the likelihood of future rate

cuts after U.S. consumer price inflation data came in line with

estimates. CME Group's FedWatch Tool is currently indicating an

82.3 percent chance of another quarter point rate cut in December

but a 60.2 percent chance rates will then be left unchanged in

January.

In economic news, the unemployment rate in Australia came in at

a seasonally adjusted 4.1 percent in October, the Australian Bureau

of Statistics said on Thursday - unchanged from the previous month

and in line with expectations. The Australian economy added 15,900

jobs, which missed forecasts for an increase of 25,200 jobs

following the addition of 64,100 in September.

Full-time employment increased by 9,700 to 10,037,700 people,

while part-time employment increased by 6,200 to 4,499,800 people.

The participation rate was 67.1 percent, shy of expectations for

67.2 percent - which would have been unchanged. Monthly hours

worked increased to 1.972 billion.

In the Asian trading today, the Australian dollar fell to nearly

a 3-1/2-month low of 0.6460 against the U.S. dollar, more than a

2-month low of 0.9053 against the Canadian dollar and a 1-week low

of 1.6318 against the euro, from yesterday's closing quotes of

0.6485, 0.9076 and 1.6286, respectively. If the aussie extends its

downtrend, it is likely to find support around 0.63 against the

greenback, 0.88 against the loonie and 1.65 against the euro.

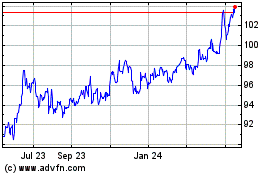

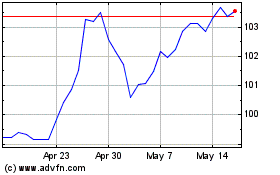

Against the yen, the aussie edged down to 100.73 from

yesterday's closing value of 100.81. The aussie may test support

near the 99.00 region.

The NZ dollar fell to nearly a 3-1/2-month low of 0.5854 against

the U.S. dollar, from yesterday's closing value of 0.5879. The next

possible downside support for the kiwi is seen around the 0.57

region.

Against the euro and the Australian dollar, the kiwi dropped to

3-day lows of 1.8007 and 1.1049 from yesterday's closing quotes of

1.7958 and 1.1025, respectively. If the kiwi extends its downtrend,

it is likely to find support around against the 1.83 against the

euro and 1.11 against the aussie.

The kiwi edged down to 91.29 against the yen, from Wednesday's

closing value of 91.39. On the downside, 89.00 is seen as the next

support level for the kiwi.

The U.S. dollar rose to more than a 1-year high of 1.0534

against the euro and more than a 3-month high of 1.2673 against the

pound, from yesterday's closing quotes of 1.0563 and 1.2703,

respectively. If the greenback extends its uptrend, it is likely to

find resistance around 1.03 against the euro and 1.25 against the

pound.

Against the yen and the Swiss franc, the greenback climbed to

nearly a 4-month high of 156.15 and 0.8879 from Wednesday's closing

quotes of 155.45 and 0.8859, respectively. The greenback is likely

to find resistance around 158.00 against the yen and 0.89 against

the franc.

The greenback advanced to nearly a 4-1/2-year high of 1.4020

against the Canadian dollar, from yesterday's closing value of

1.3996. On the upside, 1.41 is seen as the next resistance level

for the greenback.

Looking ahead, Eurozone flash GDP estimate for the third quarter

and industrial production figures for September are due to be

released in the European session.

At 7:30 am ET, the European Central Bank publishes the account

of the monetary policy meeting of the Governing Council held on

October 16 and 17. At the meeting, the bank had reduced the key

interest rates by 25 basis points.

In the New York session, U.S. jobs data for October, PPI for

October and U.S. EIA crude oil data are slated for release.

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Nov 2024 to Dec 2024

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Dec 2023 to Dec 2024