Commodity Currencies Rise On Upbeat Crude Oil Prices

November 19 2024 - 9:49PM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars strengthened against their major currencies in

the Asian session on Wednesday, as the crude oil prices rose amid

concerns about escalating tensions between the U.S. and Russia over

the war in Ukraine after Russian President Vladimir Putin updated

the nuclear doctrine.

West Texas Intermediate Crude oil futures for December rose

$0.23 or about 0.3 percent at $69.39 a barrel.

Putin has signed a decree amending the country's nuclear

doctrine after President Joe Biden gave Ukraine permission to

attack Russian Bryansk region using U.S.-made long-range missiles.

Kremlin has warned that it would consider a nuclear strike if it

was subject to a conventional missile assault supported by a

nuclear power.

Shortly before the Kremlin updated its nuclear weapons doctrine,

Ukraine reportedly used U.S.-made long-range missiles to attack a

Russian military facility in the Bryansk border region.

In economic news, the People's Bank of China left its benchmark

lending rates unchanged, as it monitors the impact of recent policy

adjustments. The PBoC maintained its one-year loan prime rate at

3.10 percent. Likewise, the five-year LPR, the benchmark for

mortgage rates, was retained at 3.60 percent.

The bank had cut its both LPRs by 25 basis points each in

October.

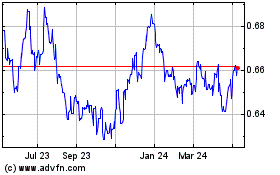

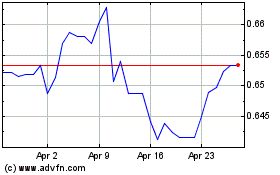

In the Asian trading today, the Australian dollar rose to 1-week

highs of 0.6544 against the U.S. dollar and 101.33 against the yen,

from yesterday's closing quotes of 0.6531 and 101.00, respectively.

If the aussie extends its uptrend, it is likely to find resistance

around 0.67 against the greenback and 103.00 against the yen.

Against the euro and the NZ dollar, the aussie edged up to

1.6209 and 1.1056 from yesterday's closing quotes of 1.6220 and

1.1045, respectively. The aussie may test resistance around 1.61

against the euro and 1.11 against the kiwi.

The NZ dollar rose to a 1-week high of 0.5922 against the U.S.

dollar and a 5-day high of 91.68 against the yen, from yesterday's

closing quotes of 0.5912 and 91.41, respectively. If the kiwi

extends its uptrend, it is likely to find resistance around 0.61

against the greenback and 92.00 against the yen.

Against the euro, the kiwi edged up to 1.7912 from a recent low

of 1.7940. The kiwi may test resistance around the 1.76 region.

The Canadian dollar rose to a 1-week high of 1.3951 low of

1.3967 against the U.S. dollar and a 5-day high of 111.12 against

the yen, from recent lows of 1.3967 and 110.81, respectively. If

the loonie extends its uptrend, it is likely to find resistance

around 1.36 against the greenback and 113.00 against the yen.

Against the euro and the Australian dollar, the loonie edged up

to 1.4783 and 0.9107 from recent lows of 1.4804 and 0.9130,

respectively. The loonie is likely to find resistance around 1.47

against the euro and 0.90 against the aussie.

Looking ahead, U.S. mortgage approvals data and U.S. EIA crude

oil data are due to be released in the New York session.

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Nov 2024 to Dec 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Dec 2023 to Dec 2024