Swiss Franc Falls Amid Risk Appetite

June 26 2024 - 2:40AM

RTTF2

The Swiss franc weakened against other major currencies in the

European session on Wednesday amid risk appetite, as a rebound in

tech stocks on Wall Street overnight outweighed hawkish comments

from Federal Reserve officials.

Investors also shrugged off the results of a closely watched

survey that showed German consumer confidence is set to deteriorate

in July as the economy struggles to gain momentum.

After rising for four straight months, the consumer climate

index dropped unexpectedly to -21.8 in July from -21.0 in June, the

survey published jointly by GfK and the Nuremberg Institute for

Market Decisions showed. The score was forecast to climb to

-19.4.

Amid much uncertainty about the interest-rate outlook, investors

braced for the release of key U.S. inflation reading, due later

this week for further direction.

The Swiss franc traded steady against its major rivals in the

Asian session today.

In the European trading now, the Swiss franc fell to near 2-week

lows of 0.9601 against the euro and 1.1378 against the pound, from

early highs of 0.9574 and 1.1349, respectively. If the franc

extends its downtrend, it is likely to find support around 0.98

against the euro and 1.16 against the pound.

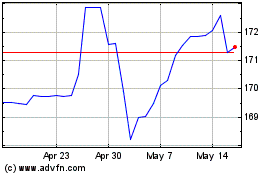

Against the U.S. dollar and the yen, the franc slipped to a

2-week low of 0.8981 and a 2-day low of 178.12 from early highs of

0.8946 and 178.64, respectively. On the downside, 0.91 against the

greenback and 175.00 against the yen are seen as the next support

levels for the franc.

Looking ahead, U.S. weekly mortgage approvals data, new home

sales data for May and U.S. EIA weekly crude oil data, Canada

manufacturing and wholesale sales data and Swiss National Bank's

quarterly bulletin are slated for release in the New York

session.

CHF vs Yen (FX:CHFJPY)

Forex Chart

From May 2024 to Jun 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jun 2023 to Jun 2024