Swiss Franc Weakens Against Most Majors

December 16 2024 - 8:51AM

RTTF2

The Swiss franc declined against its most major counterparts in

the New York session on Monday, as investors awaited an expected

interest rate cut by the Federal Reserve later this week.

The Fed is expected to lower interest rates by 25 basis points

when it concludes its meeting on Wednesday.

U.S. reports on retail sales, GDP, PCE, existing home sales and

consumer sentiment are also scheduled this week.

The Fed is likely to signal that rate cuts will continue,

although there is uncertainty about easing path through 2025.

Data from the Federal Statistical Office said the producer and

import prices in Switzerland dropped by 0.6 percent month-on-month

in November, declining for the third straight month, following a

0.3 percent drop in September.

Producer and import prices decreased by 1.5 percent year-on-year

in November, easing from a 1.8 percent drop in the previous

month.

The franc fell to more than a 3-week low of 0.8948 against the

greenback and a 4-day low of 1.1349 against the pound, from an

early 4-day high of 0.8898 and a 5-day high of 1.1251,

respectively. The currency is seen finding support around 0.91

against the greenback and 1.16 against the pound.

The franc touched 0.9399 against the euro, its lowest level

since November 8. The next possible support for the franc is seen

around the 0.95 level.

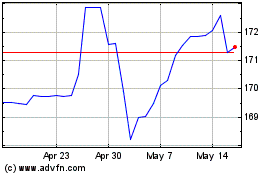

In contrast, the franc rose to a 4-day high of 172.89 against

the yen. Immediate resistance for the currency is seen around the

174.00 level.

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Nov 2024 to Dec 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Dec 2023 to Dec 2024