U.S. Dollar Lower Against Majors

March 17 2016 - 12:50AM

RTTF2

The U.S. dollar declined against its major rivals in early

European deals on Thursday, as the U.S. treasury yields dropped in

reaction to the Fed statement indicating slower pace of interest

rate hike, due to fragile economic recovery in the U.S. and

lingering worries over soft global growth.

The Federal Reserve decided to keep interest rate unchanged on

Wednesday and signaled only two quarter-point hikes by the end of

2016, rather than four projected at its December meeting, taking

into account an appreciating dollar, the absence of inflation

pressures and the negative impact of the global financial

turmoil.

Investors now await U.S. reports on weekly jobless claims,

leading economic indicators and Philadelphia-area manufacturing

activity for further clues about the health of the world's largest

economy.

The benchmark yield on U.S. 10-year treasury note fell 1.87

percent, while that of 2-year equivalents were lower by 0.83

percent. Yields move inversely to bond prices.

The currency ended lower yesterday, as the Fed left rates

unchanged, while slashing its rate outlook. The currency lost 1.03

percent against the euro, 1.07 percent against the franc, 0.52

percent against the yen and 0.77 percent for the day.

The greenback showed mixed performance in Asian deals. While the

currency held steady against the franc and the euro, it fell

against the yen. Against the pound, it rose.

In European trading, the greenback fell to 0.9722 versus the

franc, its lowest level since February 12, while touching near a

5-week low of 1.1296 against the euro. The next possible downside

target for the greenback is seen around 0.96 against the franc and

1.135 against the euro.

The greenback slipped to more than a 3-week low of 111.48

against the yen and a 3-day low of 1.4311 against the pound,

compared to Wednesday's closing values of 112.53 and 1.4258,

respectively. Continuation of the greenback's downtrend may see it

find support around 111.00 against the yen and 1.44 against the

pound.

Extending early slide, the greenback declined to 0.7650 against

the aussie, its lowest since June 2015. This is a 1.3 percent

decline from yesterday's closing quote of 0.7549. The greenback is

seen finding support around the 0.78 region.

The greenback that ended yesterday's trading at 0.6719 against

the kiwi slid to a 2-1/2-month low of 0.6831. On the downside, 0.70

is likely seen as the next support level for the greenback.

Looking ahead, Eurozone trade data for January and CPI data for

February are due to be released shortly.

The Bank of England will announce its interest rate decision at

8:00 am ET. Economists expect the bank to retain interest rates

unchanged at 0.50 percent and asset purchase target at GBP 375

billion.

In the New York session, Canada wholesale sales data for

January, U.S. weekly jobless claims for the week ended March 12,

U.S. current account data for the fourth quarter, Federal Reserve

Bank of Philadelphia manufacturing index for March and U.S. leading

indicators for February are slated for release.

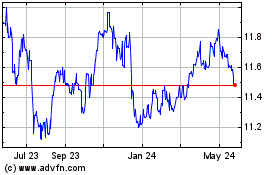

Euro vs NOK (FX:EURNOK)

Forex Chart

From Mar 2025 to Apr 2025

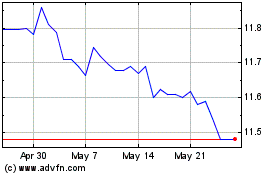

Euro vs NOK (FX:EURNOK)

Forex Chart

From Apr 2024 to Apr 2025