Euro Slides Against Majors

November 19 2024 - 1:49AM

RTTF2

The euro weakened against other major currencies in the European

session on Tuesday, as traders are worried that protectionist

policies by President-elected Donald Trump could disrupt the

Eurozone's growth potential.

Trump stated throughout his campaign that all economies will

suffer from the increased import duties imposed by the United

States, but the European Union (EU) will be particularly hard hit.

In the election campaign, Trump advocated imposing tariffs of 10-20

percent on all imports and 60 percent on goods from China.

Fears about the European Central Bank will lower interest rates

by 25 or 50 basis points (bps) at its December meeting has

intensified, due to concerns about Trump's foreign policy.

Rising geopolitical tensions in the wake of Ukraine's use of

Western missiles against Russia, which has led to allegations that

the Kremlin is threatening a nuclear retaliation, also weighed on

the currency.

In economic news, data from the European Central Bank showed

that the euro area current account surplus increased in September

on a rebound in primary income. The current account surplus totaled

EUR 37 billion in September, up from EUR 35 billion in the previous

month. The surplus was forecast to fall to EUR 27.0 billion.

Data from Eurostat showed that the harmonized index of consumer

prices posted an annual growth of 2.0 percent, as initially

estimated. Inflation stood at 1.7 percent in September. Core

inflation that excludes energy, food, alcohol and tobacco, remained

unchanged at 2.7 percent in October, in line with the flash

estimate.

In the European trading now, the euro fell to 4-day lows of

1.0524 against the U.S. dollar and 0.8333 against the pound, from

early highs of 1.0601 and 0.8362, respectively. The euro may test

support around 1.04 against the greenback and 0.81 against the

pound.

Against the Swiss franc and the yen, the euro slid to nearly a

3-1/2-month low of 0.9304 and a 1-1/2-month low of 161.50 from

early highs of 0.9362 and 163.81, respectively. If the euro extends

its downtrend, it is likely to find support around 0.92 against the

franc and 160.00 against the yen.

Against Australia, the New Zealand and the Canadian dollars, the

euro slipped to a 1-week low of 1.6217, a 6-day low of 1.7906 and a

5-day low of 1.4766 from early highs of 1.6300, 1.8016 and 1.4858,

respectively. The next possible downside target is seen around 1.60

against the aussie, 1.76 against the kiwi and 1.46 against the

loonie.

Looking ahead, Canada CPI data for October, U.S. building

permits and housing starts for October and U.S. Redbook reports are

slated for release in the New York session.

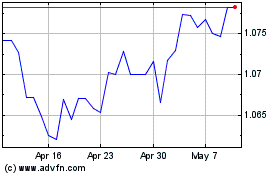

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Oct 2024 to Nov 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Nov 2023 to Nov 2024