NZ Dollar Recovers Despite RBNZ Rate Cut

February 18 2025 - 7:34PM

RTTF2

The New Zealand recovered from recent weakness against other

major currencies in the Asian session on Wednesday, despite the

Reserve Bank of New Zealand cut its interest rate by 50 basis

points as inflation remained near the mid-point of the target

band.

The Monetary Policy Committee of the Reserve Bank of New

Zealand, led by Governor Adrian Orr, decided to lower the rate to

3.75 percent from 4.25 percent.

Policymakers observed that inflation remained near the mid-point

of the 1-3 percent target band.

"If economic conditions continue to evolve as projected, the

Committee has scope to lower the OCR further through 2025," the

bank said.

Meanwhile, the investors remain cautious amid lingering worries

of a global trade war and geopolitical issues as they tracking

reports from Ukraine peace talks. A meeting between Russian and

U.S. officials raised hopes of an end to the three-year war in

Ukraine.

U.S. President Donald Trump has earlier in the day threatened to

impose tariffs of around 25 percent on automobile, semiconductor

and pharmaceutical imports, which could affect most Asian

regions.

Traders cautiously awaited the Federal Open Market Committee

(FOMC) meeting minutes, due later in the day, for clues on the U.S.

interest rate outlook.

In the Asian trading today, the NZ dollar rose to a 2-day high

of 87.03 against the yen, from a recent 1-week low of 86.17. The

kiwi may test resistance around the 89.00 region.

In economic news, data from the Ministry of Finance showed that

Japan posted a merchandise trade deficit of 2.758 trillion yen in

January. That missed forecasts for a shortfall of 2.104 trillion

yen following the 132.5 billion yen surplus in December.

Exports gained 7.2 percent on year to 7.863 trillion yen, shy of

expectations for an increase of 7.9 percent following the 2.8

percent gain in the previous month.

Imports surged an annual 16.7 percent to 10.622 trillion yen

versus forecasts for an increase of 9.7 percent and up from 1.7

percent a month earlier.

Data from the Cabinet Office showed that the total value of core

machinery orders in Japan was down a seasonally adjusted 1.2

percent on month in December, coming in at 889.3 billion yen. That

missed forecasts for an increase of 0.4 percent following the 3.4

percent gain in November.

On a yearly basis, orders rose 4.3 percent - again shy of

expectations for an increase of 5.9 percent following the 10.3

percent spike in the previous month.

Against the euro and the U.S. dollar, the kiwi edged up to

1.8261 and 0.5721 from a recent 5-day lows of 1.8395 and 0.5678,

respectively. If the kiwi extends its uptrend, it is likely to find

resistance around 1.81 against the euro and 0.58 against the

greenback.

The kiwi advanced to 1.1118 against the Australian dollar, from

a recent near 3-month low of 1.1175. On the upside, 1.09 is seen as

the next resistance level for the kiwi.

In economic news, data from the Australian Bureau of Statistics

showed that Australia's wage price index was up 0.7 percent on

quarter in the fourth quarter of 2024. That missed expectations for

an increase of0.8 percent, which would have been unchanged from the

previous quarter.

On a yearly basis, wages climbed 3.2 percent - matching

forecasts and slowing from the 3.5 percent in the three months

prior.

Looking ahead, U.K. consumer and producer prices for January are

due to be released at 2:00 am Et in the pre-European session.

In the European session, the European Central Bank is scheduled

to issue euro area current account data for December at 4:00 am ET.

The current account surplus is forecast to rise to EUR 30.2 billion

from EUR 27 billion in November.

In the New York session, U.S. MBA mortgage approvals data, U.S.

building permits and housing starts, both for January and U.S.

Redbook report are slated for release.

At 2:00 pm ET, the Federal Open Market Committee (FOMC) meeting

minutes of its latest monetary policy meeting held on January

28-29, 2025, where the interest rates were kept unchanged at 4.25

percent to 4.5 percent.

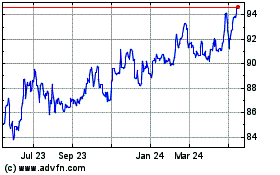

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Jan 2025 to Feb 2025

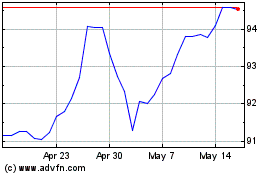

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Feb 2024 to Feb 2025