true

to update the S-3 filed

0001635077

0001635077

2024-09-19

2024-09-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

Table of Contents

As filed with the Securities and Exchange Commission

on September

19, 2024

Registration No. 333-281999

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-3/A

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Aclarion, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

8071 |

47-3324725 |

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial

Classification Code Number) |

(I.R.S. Employer

Identification Number) |

8181 Arista Place,

Suite 100

Broomfield, Colorado 80021

(833) 275-2266

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

John Lorbiecki

Chief Financial Officer

Aclarion, Inc.

8181 Arista Place,

Suite 100

Broomfield, Colorado

80021

(833) 275-2266

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send a copy of all communications to:

James H. Carroll, Esq.

Carroll Legal LLC

1449 Wynkoop Street, Suite 507

Denver, CO 80202

(303) 888-4859

Approximate date of commencement proposed sale

to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The information in

this prospectus is not complete and may be changed. We may not sell the securities until the Registration Statement filed with the Securities

and Exchange Commission, of which this prospectus is a part, is effective. This prospectus is not an offer to sell these securities and

is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| Preliminary Prospectus |

Subject to Completion, Dated September

19, 2024 |

ACLARION, INC.

$50,000,000

COMMON STOCK

PREFERRED STOCK

WARRANTS

SUBSCRIPTION RIGHTS

DEBT SECURITIES

UNITS

We may offer and sell from

time to time, in one or more series, any one of the following securities of our company, for total gross proceeds of up to $50,000,000:

| · | common stock; |

| | | |

| · | preferred stock; |

| | | |

| · | warrants to purchase common stock, preferred stock, debt securities, other securities or any combination

of those securities; |

| | | |

| · | subscription rights to purchase common stock, preferred stock, debt securities, other securities or any

combination of those securities; |

| | | |

| · | secured or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness

which may be senior debt securities, senior subordinated debt securities or subordinated debt securities, each of which may be convertible

into equity securities; or |

| | | |

| · | units comprised of, or other combinations of, the foregoing securities. |

We may offer and sell these

securities separately or together, in one or more series or classes and in amounts, at prices and on terms described in one or more offerings.

We may offer securities through underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents or

directly to purchasers. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for

that offering. For general information about the distribution of securities offered, please see “Plan of Distribution” in

this prospectus.

Each time our securities

are offered, we will provide a prospectus supplement containing more specific information about the particular offering and attach it

to this prospectus. The prospectus supplements may also add, update or change information contained in this prospectus.

This prospectus may not

be used to offer or sell securities without a prospectus supplement which includes a description of the method and terms of this offering.

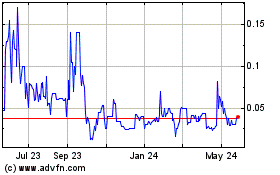

Our

common stock is quoted on the Nasdaq Capital Market under the symbol “ACON.” The last reported sale price of our common stock

on the Nasdaq Capital Market on September 18, 2024 was $0.1760 per share. The aggregate market value of our outstanding common stock

held by non-affiliates is $3,268.45 based on 10,044,728 shares of outstanding common stock, of which 18,885 shares are held by non-affiliates,

and a per share price of $0.3256, which was the closing sale price of our common stock as quoted on the Nasdaq Capital Market on July

23, 2024.

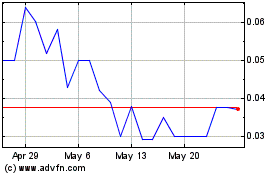

Our

IPO warrants are quoted on the Nasdaq Capital Market under the symbol “ACONW.” The last reported sale price of our IPO warrants

on the Nasdaq Capital Market on September 18, 2024 was $0.04 per warrant.

Pursuant to General Instruction

I.B.6 of Form S-3, in no event will we sell securities pursuant to this prospectus with a value of more than one-third of the aggregate

market value of our common stock held by non-affiliates in any twelve-month period, so long as the aggregate market value of our common

stock held by non-affiliates is less than $75,000,000. In the event that subsequent to the date of this prospectus, the aggregate market

value of our outstanding common stock held by non-affiliates equals or exceeds $75,000,000, then the one-third limitation on sales shall

not apply to additional sales made pursuant to this prospectus unless we again become subject to General Instruction I.B.6. We have not

offered any securities pursuant to General Instruction I.B.6 of Form S-3 during the twelve calendar months prior to and including the

date of this prospectus.

We have received deficiency

letters from The Nasdaq Stock Market LLC (“Nasdaq”) that we are not in compliance with Nasdaq’s (i) minimum bid price

requirement of at least $1.00 per share (the “Bid Price Requirement”) and (ii) requirement to have at least $2,500,000 in

stockholders’ equity (the “Stockholders’ Equity Requirement”).

On April 8, 2024, we

received a written notice from Nasdaq indicating that we were not in compliance with the Bid Price Requirement set forth in Nasdaq Listing

Rule 5550(a)(2) for continued listing on the Nasdaq Capital Market (the “Bid Price Notice”). The Bid Price Notice did not

result in the immediate delisting of our common stock from the Nasdaq Capital Market. The Bid Price Notice indicated that we would be

provided 180 calendar days (or until October 7, 2024) in which to regain compliance. If at any time during this 180 calendar day period

the bid price of our common stock closes at or above $1.00 per share for a minimum of ten consecutive business days, the Nasdaq staff

(the “Staff”) will provide us with written confirmation of compliance and the matter will be closed. In the event we do not

regain compliance with Rule 5550(a)(2) prior to the expiration of the initial 180 calendar day period, and if it appears to the Staff

that we will not be able to cure the deficiency, or if we are not otherwise eligible, the Staff will provide us with written notification

that our securities are subject to delisting from the Nasdaq Capital Market. At that time, we may appeal the delisting determination

to a Nasdaq hearings panel (the “Panel”).

On August 22, 2024, we

received a written notice from Nasdaq indicating that we were not in compliance with the Stockholders’ Equity Requirement. In our

quarterly report on Form 10-Q for the period ended June 30, 2024, we reported stockholders’ equity of $1,642,177, and, as a result,

did not satisfy Listing Rule 5550(b)(1). Accordingly, the Staff had determined to delist our common stock from Nasdaq. Nasdaq’s

letter provided us until August 29, 2024 to request an appeal of this determination.

We have appealed these

matters to the Panel. The hearing request stays any suspension or delisting action pending the conclusion of the hearing process and

the expiration of any additional extension period granted by the Panel following the hearing. We have an appeal hearing scheduled on

October 10, 2024 before the Panel to appeal the delisting notice from the Staff. While the appeal process is pending, the suspension

of trading of our common stock will be stayed. Our common stock will continue to trade on Nasdaq until the hearing process concludes

and the Panel issues a written decision.

We intend to take all

reasonable measures available to regain compliance under the Nasdaq Listing Rules and remain listed on Nasdaq. We are currently evaluating

our available options to resolve the deficiency and regain compliance with the Stockholders’ Equity Requirement.

Our receipt of these

letters from Nasdaq does not affect our business, operations or reporting requirements with the Securities and Exchange Commission.

If we decide to seek a listing

of any preferred stock, purchase contracts, warrants, subscriptions rights, depositary shares, debt securities or units offered by this

prospectus, the related prospectus supplement will disclose the exchange or market on which the securities will be listed, if any, or

where we have made an application for listing, if any.

Investing in our securities

is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page

5 and the risk factors in our most recent Annual Report on Form 10-K, which is incorporated by reference herein, as well as in any other

recently filed quarterly or current reports and, if any, in the relevant prospectus supplement. We urge you to carefully read this prospectus

and the accompanying prospectus supplement, together with the documents we incorporate by reference, describing the terms of these securities

before investing.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ___________, 2024.

TABLE OF CONTENTS

Page

About

This Prospectus

This prospectus is part of

a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf”

registration process. Under this shelf registration process, we may offer and sell, either individually or in combination, in one or more

offerings, any of the securities described in this prospectus, for total gross proceeds of up to $50,000,000. This prospectus provides

you with a general description of the securities we may offer. Each time we offer securities under this prospectus, we will provide a

prospectus supplement to this prospectus that will contain more specific information about the terms of that offering. We may also authorize

one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus

supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change any of the

information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus.

We urge you to read carefully

this prospectus, any applicable prospectus supplement and any free writing prospectuses we have authorized for use in connection with

a specific offering, together with the information incorporated herein by reference as described under the heading “Incorporation of Documents by Reference,” before investing in any of the securities being offered. You should rely only on the information contained

in, or incorporated by reference into, this prospectus and any applicable prospectus supplement, along with the information contained

in any free writing prospectuses we have authorized for use in connection with a specific offering. We have not authorized anyone to provide

you with different or additional information. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances

and in jurisdictions where it is lawful to do so.

The information appearing

in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the

front of the document and any information we have incorporated by reference is accurate only as of the date of the document incorporated

by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing

prospectus, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those

dates.

This prospectus contains

summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for

complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred

to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this

prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find Additional Information.”

This prospectus contains,

or incorporates by reference, trademarks, tradenames, service marks and service names of Aclarion, Inc.

Cautionary

Note Regarding Forward Looking Statements

This prospectus and any accompanying

prospectus or prospectus supplement and the documents incorporated by reference herein and therein may contain forward looking statements

that involve significant risks and uncertainties. All statements other than statements of historical fact contained in this prospectus

and any accompanying prospectus supplement and the documents incorporated by reference herein, including statements regarding future events,

our future financial performance, business strategy, and plans and objectives of management for future operations, are forward-looking

statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,”

“can,” “continue,” “could,” “estimates,” “expects,” “intends,”

“may,” “plans,” “potential,” “predicts,” “should,” or “will” or

the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have

a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown

risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus

and the documents incorporated by reference herein, which may cause our or our industry’s actual results, levels of activity, performance

or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a highly regulated, very competitive,

and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can

we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual

results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking

statements largely on our current expectations and assumptions about future events and financial trends that we believe may affect our

financial condition, results of operations, business strategy, short term and long term business operations, and financial needs. These

forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from

those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited

to, those discussed in this prospectus, and in particular, the risks discussed below and under the heading “Risk Factors”

and those discussed in other documents we file with the SEC which are incorporated by reference herein. This prospectus, and any accompanying

prospectus or prospectus supplement, should be read in conjunction with the consolidated financial statements for the fiscal years ended

December 31, 2023 and 2022 and related notes, which are incorporated by reference herein.

We undertake no obligation

to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. In light of

the significant risks, uncertainties and assumptions that accompany forward-looking statements, the forward-looking events and circumstances

discussed in this prospectus and any accompanying prospectus or prospectus supplement may not occur and actual results could differ materially

and adversely from those anticipated or implied in the forward-looking statement.

You should not place undue

reliance on any forward-looking statement, each of which applies only as of the date of this prospectus, or any accompanying prospectus

or any prospectus supplement. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking

statements after the date of this prospectus to conform our statements to actual results or changed expectations.

Any forward-looking statement

you read in this prospectus, any accompanying prospectus, or any prospectus supplement or any document incorporated by reference reflects

our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our

operations, operating results, growth strategy and liquidity. You should not place undue reliance on these forward-looking statements

because such statements speak only as to the date when made. We assume no obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking

statements, even if new information becomes available in the future, except as otherwise required by applicable law. You are advised,

however, to consult any further disclosures we make on related subjects in our reports on Forms 10-Q, 8-K and 10-K filed with the SEC.

You should understand that it is not possible to predict or identify all risk factors. Consequently, you should not consider any such

list to be a complete set of all potential risks or uncertainties.

Prospectus

Summary

This summary highlights

selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider

before investing in our Company. You should carefully read the entire prospectus, including all documents incorporated by reference herein.

In particular, attention should be directed to our “Risk Factors” and the financial statements and related notes thereto contained

herein or otherwise incorporated by reference hereto, before making an investment decision.

As used herein, and any

amendment or supplement hereto, unless otherwise indicated, “we,” “us,” “our,” the “Company,”

or “Aclarion” means Aclarion, Inc.

Overview

We are a healthcare technology

company that leverages Magnetic Resonance Spectroscopy (“MRS”), and a proprietary biomarker to optimize clinical treatments.

Our technology addresses the $134.5B U.S. low back and neck pain market, which according to a 2020 JAMA (Journal of the American Medical

Association) article is now the most costly healthcare condition in the United States. We are currently utilizing Artificial Intelligence

(“AI”) to assist in quality control processes that flag spectroscopy data indicative of a poor MRS study. The use of AI in

this application is early in its development cycle and is expected to evolve with further research and development. We are also researching

the application of AI and machine learning platforms to analyze both the raw spectroscopy data and the post-processed signal to evaluate

whether AI platforms can more efficiently and more effectively associate MRS data with clinical outcomes. The use of AI in this application

is aspirational and we intend this type of AI research and development to be an ongoing process applied not only to the various treatment

paths associated with back pain, such as conservative therapies, regenerative and cell therapies and surgical intervention, but also to

potentially expand into other clinical explorations involving the diagnosis of brain, breast and prostate tumors.

We are addressing this market

by initially focusing on improving the outcomes of surgical interventions to treat low back pain and have limited sales to date. In this

initial application, our technology is intended to assist surgeons in determining the optimal surgical procedure for a patient undergoing

surgery for pain isolated to their lumbar spine (the “lumbar spine” is comprised of the five (5) lower vertebrae, L-1 to L-5).

We then intend to add additional applications of our technology targeting the management of large segments of low back pain patients from

the point of initial Magnetic Resonance Imaging (“MRI”) through to episode resolution. We believe this will expand the use

of our technology to low back pain patients undergoing conservative therapies such as physical therapy or biologic and cell therapies

aimed at regenerating the lumbar discs. We plan to expand the application of our technology beyond the lumbar spine to address neck pain

populations in addition to low back pain populations. To expand the application of our technology for use in neck pain populations, we

will need to overcome technical changes associated with securing adequate MRS data from the cervical disc, which is significantly smaller

than the lumbar disc, and there can be no assurance we will be able to overcome these challenges.

The core technology we employ

is MRS. The patient experience when undergoing an MRS exam is exactly like that of a standard MRI, with the exception of an additional

3-5 minutes for each disc undergoing a spectroscopy exam. Whereas a standard MRI produces a signal that is converted into anatomical images,

an MRS produces a signal that is converted into a waveform that identifies the chemical composition of tissues. Just like with standard

MRI’s, the data from spectroscopy is useless without technologies that can process the data. We have developed proprietary signal

processing software that transforms spectroscopy data into clear biomarkers. These biomarkers, which are exclusively licensed from the

Regents of University of California, San Francisco (“UCSF”), are the key data inputs for our proprietary algorithms that,

when applied, determine if an intervertebral disc is consistent with pain. Our patent portfolio includes 22 U.S. Patents, 17 Foreign Patents,

6 pending U.S. patent applications, and 7 pending Foreign patent applications, including patents and patent applications exclusively licensed

from Regents of the University of California.

We believe one of the biggest

issues driving the cost of treating low back and neck pain patients to the top of the list for healthcare spending is that there is no

objective, cost effective and noninvasive diagnostics to reliably identify the source of a patient’s pain. We believe the poor surgical

outcomes for Discogenic Low Back Pain (“DLBP”) are largely due to difficulties in reliably and accurately diagnosing the specific

spinal discs that are causing pain. The current primary diagnostic standard is the MRI, which is useful for showing abnormal structures

and tissue dehydration, but, we believe, cannot reliably identify specific discs that are causing pain. To diagnose specific discs that

are causing pain, a needle-based Provocation Discogram test (“PD Test”) has been developed. PD Tests have been shown to be

highly accurate when performed properly. However, a PD Test is invasive, subjective and unpleasant for the patient as the patient needs

to be awake in order to tell the physician if the pain the physician is purposefully causing in the disc is the same as the pain the patient

feels when they are experiencing a back pain episode. In addition, recent evidence has shown that the action of inserting a needle into

a normal disc during a discogram procedure leads to an increased rate of degeneration in these previously normal discs. Based on the limitations

and concerns of the PD Test, we believe there is a significant need for an objective, accurate, personalized and noninvasive diagnostic

test that can reliably determine if an individual disc is a pain generator. By providing physicians information about whether a disc has

the chemical and structural makeup consistent with pain or not, we believe the treatment plan for each patient will lead to more efficient

and targeted care that, will in turn, result in lower costs and healthier patient outcomes.

We have taken the first steps

to demonstrate the potential use of our technology in helping to improve the outcome of surgical intervention for DLBP patients by publishing

a clinical study (Gornet et al) in the European Spine Journal in April 2019. The study illustrated that when all discs identified as consistent

with pain by our technology were included in a surgical treatment, 97% of the patients met the criteria for “clinical improvement”.

This compared to only 54% of patients meeting the criteria for clinical improvement if a disc that our technology identified as consistent

with pain, was not included in the surgical treatment.

The results of this clinical

study led the CPT committee to approve four Category III codes for our technology in January 2021. The NIH also included our technology

as one of the handful of technologies selected to participate in their $150 million Back Pain Consortium (BACPAC) Research Program, an

NIH translational, patient-centered effort to address the need for effective and personalized therapies for chronic low back pain.

In April 2023, we have advanced

the evidence of our technology with a peer-reviewed journal article detailing the Gornet 2-year outcomes, published in the European Spine

Journal. The 2-year outcomes were durable with 1-year outcomes previously published in 2019. At 2-years follow-up, 85% of patients improved

when disc(s) identified as consistent with pain by our technology were included in a surgical treatment, compared to only 63% of patients

when disc(s) identified as consistent with pain were not treated or disc(s) identified as consistent without pain were treated.

Emerging Growth Company under the JOBS Act

As a company with less than

$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business

Startups Act of 2012, or the JOBS Act. As an emerging growth company, we have elected to take advantage of reduced reporting requirements

and are relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging

growth company:

| · | We may present only two years of audited financial statements and only two years of related Management’s

Discussion and Analysis of Financial Condition and Results of Operations; |

| | | |

| · | We are exempt from the requirement to obtain an attestation and report from our auditors on whether we

maintained effective internal control over financial reporting under the Sarbanes-Oxley Act; |

| | | |

| · | We are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| | | |

| · | We are not required to give our stockholders non-binding advisory votes on executive compensation or golden

parachute arrangements. |

We may take advantage of

these provisions until December 31, 2026 (the last day of the fiscal year following the fifth anniversary of our initial public offering)

if we continue to be an emerging growth company. We would cease to be an emerging growth company if we have more than $1.235 billion in

annual revenue, have more than $700 million in market value of our shares held by non-affiliates or issue more than $1.0 billion of non-convertible

debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have elected to provide

two years of audited financial statements. Additionally, we have elected to take advantage of the extended transition period provided

in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting

standards that have different effective dates for public and private companies until the earlier of the date we (i) are no longer

an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in Section 7(a)(2)(B)

of the Securities Act.

Corporate Information

We

were formed under the name Nocimed, LLC, a limited liability company in January 2008, under the laws of the State of Delaware. In February

2015, Nocimed, LLC was converted into Nocimed, Inc. a Delaware corporation. On December 3, 2021, we changed our name to Aclarion, Inc.

Our principal executive offices are located at 8181 Arista Place, Suite 100, Broomfield, Colorado 80021. Our main telephone number is

(833) 275-2266. Our internet website is www.aclarion.com. The information contained in, or that can be accessed through, our website is

not incorporated by reference and is not a part of this prospectus.

Risk

Factors

Investing in our securities

is highly speculative and involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully

consider the risk factors we describe in any accompanying prospectus or any future prospectus supplement, as well as in any related free

writing prospectus for a specific offering of securities, and the risk factors incorporated by reference into this prospectus, any accompanying

prospectus or such prospectus supplement. You should also carefully consider other information contained and incorporated by reference

in this prospectus and any applicable prospectus supplement, including our financial statements and the related notes thereto incorporated

by reference in this prospectus. The risks and uncertainties described in the applicable prospectus supplement and our other filings with

the SEC incorporated by reference herein are not the only ones we face. Additional risks and uncertainties not presently known to us or

that we currently consider immaterial may also adversely affect us. If any of the described risks occur, our business, financial condition

or results of operations could be materially harmed. In such case, the value of our securities could decline and you may lose all or part

of your investment.

Use

of Proceeds

Unless otherwise indicated

in a prospectus supplement, we intend to use the net proceeds from these sales to fund market development and clinical evidence,

product development and quality, and general and administration support, retire outstanding debt, and other general corporate purposes.

We may set forth additional information concerning our expected use of net proceeds from sales of securities in the applicable prospectus

supplement relating to the specific offering.

Dividend

Policy

We have never paid or declared

any cash dividends on our common stock, and we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

We intend to retain all available funds and any future earnings to fund the development and expansion of our business. Any future determination

to pay dividends will be at the discretion of our board of directors and will depend upon a number of factors, including our results of

operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors

our board of directors deems relevant. Our future ability to pay cash dividends on our stock may also be limited by the terms of any future

debt or preferred securities or future credit facility.

Plan

of Distribution

We may sell the securities

from time to time to or through underwriters or dealers, through agents, or directly to one or more purchasers. A distribution of the

securities offered by this prospectus may also be effected through the issuance of derivative securities, including without limitation,

warrants, rights to purchase and subscriptions. In addition, the manner in which we may sell some or all of the securities covered by

this prospectus includes, without limitation, through:

| · | a block trade in which a broker-dealer will attempt to sell as agent, but may position or resell a portion

of the block, as principal, in order to facilitate the transaction; |

| | | |

| · | purchases by a broker-dealer, as principal, and resale by the broker-dealer for its account; or |

| | | |

| · | ordinary brokerage transactions and transactions in which a broker solicits purchasers. |

A prospectus supplement or

supplements with respect to each series of securities will describe the terms of the offering, including, to the extent applicable:

| · | the terms of the offering; |

| | | |

| · | the name or names of the underwriters or agents and the amounts of securities underwritten or purchased

by each of them, if any; |

| | | |

| · | the public offering price or purchase price of the securities or other consideration therefor, and the

proceeds to be received by us from the sale; |

| | | |

| · | any delayed delivery requirements; |

| | | |

| · | any over-allotment options under which underwriters may purchase additional securities from us; |

| | | |

| · | any underwriting discounts or agency fees and other items constituting underwriters’ or agents’

compensation; |

| | | |

| · | any discounts or concessions allowed or re-allowed or paid to dealers; and |

| | | |

| · | any securities exchange or market on which the securities may be listed. |

The offer and sale of the

securities described in this prospectus by us, the underwriters or the third parties described above may be effected from time to time

in one or more transactions, including privately negotiated transactions, either:

| · | at a fixed price or prices, which may be changed; |

| | | |

| · | in an “at the market” offering within the meaning of Rule 415(a)(4) of the Securities Act

of 1933, as amended, or the Securities Act; |

| | | |

| · | at prices related to such prevailing market prices; or |

| | | |

| · | at negotiated prices. |

Only underwriters named in

the prospectus supplement will be underwriters of the securities offered by the prospectus supplement.

Underwriters and Agents; Direct Sales

If underwriters are used

in a sale, they will acquire the offered securities for their own account and may resell the offered securities from time to time in one

or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time

of sale. We may offer the securities to the public through underwriting syndicates represented by managing underwriters or by underwriters

without a syndicate.

Unless the prospectus supplement

states otherwise, the obligations of the underwriters to purchase the securities will be subject to the conditions set forth in the applicable

underwriting agreement. Subject to certain conditions, the underwriters will be obligated to purchase all of the securities offered by

the prospectus supplement, other than securities covered by any over-allotment option. Any public offering price and any discounts or

concessions allowed or re-allowed or paid to dealers may change from time to time. We may use underwriters with whom we have a material

relationship. We will describe in the prospectus supplement, naming the underwriter, the nature of any such relationship.

We may sell securities directly

or through agents we designate from time to time. We will name any agent involved in the offering and sale of securities, and we will

describe any commissions we will pay the agent in the prospectus supplement. Unless the prospectus supplement states otherwise, our agent

will act on a best-efforts basis for the period of its appointment.

We may authorize agents or

underwriters to solicit offers by certain types of institutional investors to purchase securities from us at the public offering price

set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in

the future. We will describe the conditions to these contracts and the commissions we must pay for solicitation of these contracts in

the prospectus supplement.

Dealers

We may sell the offered securities

to dealers as principals. The dealer may then resell such securities to the public either at varying prices to be determined by the dealer

or at a fixed offering price agreed to with us at the time of resale.

Institutional Purchasers

We may authorize agents,

dealers or underwriters to solicit certain institutional investors to purchase offered securities on a delayed delivery basis pursuant

to delayed delivery contracts providing for payment and delivery on a specified future date. The applicable prospectus supplement or other

offering materials, as the case may be, will provide the details of any such arrangement, including the offering price and commissions

payable on the solicitations.

We will enter into such delayed

contracts only with institutional purchasers that we approve. These institutions may include commercial and savings banks, insurance companies,

pension funds, investment companies and educational and charitable institutions.

Indemnification; Other Relationships

We may provide agents, underwriters,

dealers and remarketing firms with indemnification against certain civil liabilities, including liabilities under the Securities Act,

or contribution with respect to payments that the agents or underwriters may make with respect to these liabilities. Agents, underwriters,

dealers and remarketing firms, and their affiliates, may engage in transactions with, or perform services for, us in the ordinary course

of business. This includes commercial banking and investment banking transactions.

Market-Making; Stabilization and Other Transactions

There is currently no market

for any of the offered securities, other than our common stock, which is quoted on the Nasdaq Capital Market. If the offered securities

are traded after their initial issuance, they may trade at a discount from their initial offering price, depending upon prevailing interest

rates, the market for similar securities and other factors. While it is possible that an underwriter could inform us that it intends to

make a market in the offered securities, such underwriter would not be obligated to do so, and any such market-making could be discontinued

at any time without notice. Therefore, no assurance can be given as to whether an active trading market will develop for the offered securities.

We have no current plans for listing of the debt securities, preferred stock, warrants or subscription rights on any securities exchange

or quotation system; any such listing with respect to any particular debt securities, preferred stock, warrants or subscription rights

will be described in the applicable prospectus supplement or other offering materials, as the case may be.

Any underwriter may engage

in over-allotment, stabilizing transactions, short-covering transactions and penalty bids in accordance with Regulation M under the Securities

Exchange Act of 1934, as amended, or the Exchange Act. Over-allotment involves sales in excess of the offering size, which create a short

position. Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified

maximum price. Syndicate-covering or other short-covering transactions involve purchases of the securities, either through exercise of

the over-allotment option or in the open market after the distribution is completed, to cover short positions. Penalty bids permit the

underwriters to reclaim a selling concession from a dealer when the securities originally sold by the dealer are purchased in a stabilizing

or covering transaction to cover short positions. Those activities may cause the price of the securities to be higher than it would otherwise

be. If commenced, the underwriters may discontinue any of the activities at any time.

Any underwriters or agents

that are qualified market makers on the Nasdaq Capital Market may engage in passive market making transactions in our common stock on

the Nasdaq Capital Market in accordance with Regulation M under the Exchange Act, during the business day prior to the pricing of the

offering, before the commencement of offers or sales of our common stock. Passive market makers must comply with applicable volume and

price limitations and must be identified as passive market makers. In general, a passive market maker must display its bid at a price

not in excess of the highest independent bid for such security; if all independent bids are lowered below the passive market maker’s

bid, however, the passive market maker’s bid must then be lowered when certain purchase limits are exceeded. Passive market making

may stabilize the market price of the securities at a level above that which might otherwise prevail in the open market and, if commenced,

may be discontinued at any time.

Fees and Commissions

If 5% or more of the net

proceeds of any offering of securities made under this prospectus will be received by a FINRA member participating in the offering or

affiliates or associated persons of such FINRA member, the offering will be conducted in accordance with FINRA Rule 5121.

Description

of Securities We May Offer

General

This prospectus describes

the general terms of our capital stock. The following description is not complete and may not contain all the information you should consider

before investing in our capital stock. For a more detailed description of these securities, you should read the applicable provisions

of Delaware law and our certificate of incorporation, as amended, referred to herein as our certificate of incorporation, and our amended

and restated bylaws, referred to herein as our bylaws. When we offer to sell a particular series of these securities, we will describe

the specific terms of the series in a supplement to this prospectus. Accordingly, for a description of the terms of any series of securities,

you must refer to both the prospectus supplement relating to that series and the description of the securities described in this prospectus.

To the extent the information contained in the prospectus supplement differs from this summary description, you should rely on the information

in the prospectus supplement.

The total number of shares

of capital stock we are authorized to issue is 220,000,000 shares, of which (1) 200,000,000 shares are common stock, par value $0.00001

per share (or common stock) and (2) 20,000,000 shares are preferred stock, par value $0.00001 per share (or preferred stock), which

may, at the sole discretion of our board of directors be issued in one or more series.

We, directly or through agents,

dealers or underwriters designated from time to time, may offer, issue and sell, together or separately, up to $50,000,000 in the aggregate

of:

| · | common stock; |

| | | |

| · | preferred stock; |

| | | |

| · | warrants to purchase common stock, preferred stock, debt securities, other securities or any combination

of those securities; |

| | | |

| · | subscription rights to purchase common stock, preferred stock, debt securities, other securities or any

combination of those securities; |

| | | |

| · | secured or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness

which may be senior debt securities, senior subordinated debt securities or subordinated debt securities, each of which may be convertible

into equity securities; or |

| | | |

| · | units comprised of, or other combinations of, the foregoing securities. |

We may issue the debt securities

as exchangeable for or convertible into shares of common stock, preferred stock or other securities that may be sold by us pursuant to

this prospectus or any combination of the foregoing. The preferred stock may also be exchangeable for and/or convertible into shares of

common stock, another series of preferred stock or other securities that may be sold by us pursuant to this prospectus or any combination

of the foregoing. When a particular series of securities is offered, a supplement to this prospectus will be delivered with this prospectus,

which will set forth the terms of the offering and sale of the offered securities.

Common Stock

The holders of our common

stock are entitled to one vote for each share held on all matters submitted to a vote of the stockholders. The holders of our common stock

do not have any cumulative voting rights. Holders of our common stock are entitled to receive ratably any dividends declared by our board

of directors out of funds legally available for that purpose, subject to any preferential dividend rights of any outstanding preferred

stock. Our common stock has no preemptive rights, conversion rights or other subscription rights or redemption or sinking fund provisions.

In the event of our liquidation,

dissolution or winding up, holders of our common stock will be entitled to share ratably in all assets remaining after payment of all

debts and other liabilities and any liquidation preference of any outstanding preferred stock. Each outstanding share of common stock

is duly and validly issued, fully paid and non-assessable.

Market, Symbol and Transfer Agent

Our common stock is listed

for trading on the Nasdaq Capital Market under the symbol “ACON”. The transfer agent and registrar for our common stock is

VStock Transfer, LLC.

Preferred stock

Our board will have the authority,

without further action by our stockholders, to issue up to 20,000,000 shares of preferred stock in one or more series and to fix the rights,

preferences, privileges and restrictions thereof. These rights, preferences and privileges could include dividend rights, conversion rights,

voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting, or the designation

of, such series, any or all of which may be greater than the rights of common stock. The issuance of our preferred stock could adversely

affect the voting power of holders of common stock and the likelihood that such holders will receive dividend payments and payments upon

our liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing a change in control

of our company or other corporate action.

Anti-Takeover Effects of Delaware Law and Provisions

of our Charter and our Bylaws

Certain provisions of the

DGCL and of our charter and our bylaws could have the effect of delaying, deferring or preventing another party from acquiring control

of us and encouraging persons considering unsolicited tender offers or other unilateral takeover proposals to negotiate with our board

of directors rather than pursue non-negotiated takeover attempts. These provisions include the items described below.

Delaware Anti-Takeover Statute

We are subject to the provisions

of Section 203 of the DGCL. In general, Section 203 prohibits a publicly held Delaware corporation from engaging in a “business

combination” with an “interested stockholder” for a three-year period following the time that this stockholder becomes

an interested stockholder, unless the business combination is approved in a prescribed manner. Under Section 203, a business combination

between a corporation and an interested stockholder is prohibited unless it satisfies one of the following conditions:

| · | before the stockholder became interested, our Board approved either the business combination or the transaction

which resulted in the stockholder becoming an interested stockholder; |

| | | |

| · | upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder,

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced,

excluding for purposes of determining the voting stock outstanding, shares owned by persons who are directors and also officers, and employee

stock plans, in some instances, but not the outstanding voting stock owned by the interested stockholder; or |

| | | |

| · | at or after the time the stockholder became interested, the business combination was approved by our Board

and authorized at an annual or special meeting of the stockholders by the affirmative vote of at least two-thirds of the outstanding voting

stock which is not owned by the interested stockholder. |

Section 203 defines a business

combination to include:

| · | any merger or consolidation involving the corporation and the interested stockholder; |

| | | |

| · | any sale, transfer, lease, pledge, exchange, mortgage or other disposition involving the interested stockholder

of 10% or more of the assets of the corporation; |

| | | |

| · | subject to exceptions, any transaction that results in the issuance or transfer by the corporation of

any stock of the corporation to the interested stockholder; or |

| | | |

| · | the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or

other financial benefits provided by or through the corporation. |

In general, Section 203 defines

an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and

any entity or person affiliated with or controlling or controlled by the entity or person.

Board Composition and Filling Vacancies

Our charter provides that

stockholders may remove directors only for cause and only by the affirmative vote of the holders of at least two-thirds of our outstanding

common stock. Our charter and bylaws authorize only our board of directors to fill vacant directorships, including newly created seats.

In addition, the number of directors constituting our board of directors may only be set by a resolution adopted by a majority vote of

our entire board of directors. These provisions would prevent a stockholder from increasing the size of our board of directors and then

gaining control of our board of directors by filling the resulting vacancies with its own nominees. This makes it more difficult to change

the composition of our board of directors but promotes continuity of management.

No Written Consent of Stockholders

Our charter and bylaws provides

that all stockholder actions are required to be taken by a vote of the stockholders at an annual or special meeting, and that stockholders

may not take any action by written consent in lieu of a meeting. This limit may lengthen the amount of time required to take stockholder

actions and would prevent the amendment of our bylaws or removal of directors by our stockholders without holding a meeting of stockholders.

Meetings of Stockholders

Our charter and bylaws provide

that only a majority of the members of our Board then in office, our Executive Chairman or our Chief Executive Officer may call special

meetings of stockholders and only those matters set forth in the notice of the special meeting may be considered or acted upon at a special

meeting of stockholders.

Advance Notice Requirements

Our bylaws provide advance

notice procedures for stockholders seeking to bring matters before our annual meeting of stockholders or to nominate candidates for election

as directors at our annual meeting of stockholders. Our bylaws also specify certain requirements regarding the form and content of a stockholder’s

notice. These provisions might preclude our stockholders from bringing matters before our annual meeting of stockholders or from making

nominations for directors at our annual meeting of stockholders if the proper procedures are not followed. We expect that these provisions

might also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate

of directors or otherwise attempting to obtain control of our company.

Amendment to our Charter and Bylaws

The DGCL, provides, generally,

that the affirmative vote of a majority of the shares entitled to vote on any matter is required to amend a corporation’s certificate

of incorporation or bylaws, unless a corporation’s certificate of incorporation or bylaws, as the case may be, requires a greater

percentage. Our bylaws may be amended or repealed by a majority vote of our board of directors or the affirmative vote of the holders

of at least two-thirds of the votes that all our stockholders would be entitled to cast in an annual election of directors. In addition,

the affirmative vote of the holders of at least two-thirds of the votes that all our stockholders would be entitled to cast in an election

of directors is required to amend or repeal or to adopt certain provisions of our charter.

Undesignated preferred stock

Our charter provides for 20,000,000

authorized shares of preferred stock. The existence of authorized but unissued shares of preferred stock may enable our board to discourage

an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise. For example, if in the due exercise

of its fiduciary obligations, our board of directors were to determine that a takeover proposal is not in the best interests of our stockholders,

our board could cause shares of convertible preferred stock to be issued without stockholder approval in one or more private offerings

or other transactions that might dilute the voting or other rights of the proposed acquirer or insurgent stockholder or stockholder group.

In this regard, our charter grants our board broad power to establish the rights and preferences of authorized and unissued shares of

preferred stock. The issuance of shares of preferred stock could decrease the amount of earnings and assets available for distribution

to holders of shares of common stock. The issuance may also adversely affect the rights and powers, including voting rights, of these

holders and may have the effect of delaying, deterring or preventing a change in control of us.

Choice of Forum

Our charter provides that

the Court of Chancery of the State of Delaware is the exclusive forum for the following types of actions or proceedings: any derivative

action or proceeding brought on behalf of us, any action asserting a claim of breach of a fiduciary duty owed by any of our directors,

officers or other employees to us or our stockholders, any action asserting a claim against us arising pursuant to any provision of the

DGCL or our certificate of incorporation or bylaws, or any action asserting a claim against us governed by the internal affairs doctrine.

Our charter also provides that unless we consent in writing to the selection of an alternative forum, the federal district courts of the

United States of America shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the

Securities Act. Despite the fact that the certificate of incorporation provides for this exclusive forum provision to be applicable to

the fullest extent permitted by applicable law, Section 27 of the Exchange Act, creates exclusive federal jurisdiction over all suits

brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder and Section 22 of the Securities

Act, creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the

Securities Act or the rules and regulations thereunder. As a result, this provision of our certificate of incorporation would not apply

to claims brought to enforce a duty or liability created by the Exchange Act, or any other claim for which the federal courts have exclusive

jurisdiction. However, there is uncertainty as to whether a Delaware court would enforce the exclusive federal forum provisions for Securities

Act claims and that investors cannot waive compliance with the federal securities laws and rules and regulations thereunder.

Unless we consent in writing

to the selection of an alternative forum, the federal district courts of the United States of America shall be the exclusive forum for

the resolution of any complaint asserting a cause of action arising under the Securities Act.

Warrants

We may issue warrants to

purchase our securities or other rights, including rights to receive payment in cash or securities based on the value, rate or price of

one or more specified commodities, currencies, securities or indices, or any combination of the foregoing. Warrants may be issued independently

or together with any other securities that may be sold by us pursuant to this prospectus or any combination of the foregoing and may be

attached to, or separate from, such securities. To the extent warrants that we issue are to be publicly-traded, each series of such warrants

will be issued under a separate warrant agreement to be entered into between us and a warrant agent.

We will file as exhibits

to the registration statement of which this prospectus is a part, or will incorporate by reference from a current report on Form 8-K that

we file with the SEC, forms of the warrant and warrant agreement, if any. The prospectus supplement relating to any warrants that we may

offer will contain the specific terms of the warrants and a description of the material provisions of the applicable warrant agreement,

if any. These terms may include the following:

| · | the title of the warrants; |

| | | |

| · | the price or prices at which the warrants will be issued; |

| | | |

| · | the designation, amount and terms of the securities or other rights for which the warrants are exercisable; |

| | | |

| · | the designation and terms of the other securities, if any, with which the warrants are to be issued and

the number of warrants issued with each other security; |

| | | |

| · | the aggregate number of warrants; |

| | | |

| · | any provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants

or the exercise price of the warrants; |

| | | |

| · | the price or prices at which the securities or other rights purchasable upon exercise of the warrants

may be purchased; |

| | | |

| · | if applicable, the date on and after which the warrants and the securities or other rights purchasable

upon exercise of the warrants will be separately transferable; |

| · | a discussion of any material U.S. federal income tax considerations applicable to the exercise of the

warrants; |

| | | |

| · | the date on which the right to exercise the warrants will commence, and the date on which the right will

expire; |

| | | |

| · | the maximum or minimum number of warrants that may be exercised at any time; |

| | | |

| · | information with respect to book-entry procedures, if any; and |

| | | |

| · | any other terms of the warrants, including terms, procedures and limitations relating to the exchange

and exercise of the warrants. |

Exercise of Warrants.

Each warrant will entitle the holder of warrants to purchase the amount of securities or other rights, at the exercise price stated or

determinable in the prospectus supplement for the warrants. Warrants may be exercised at any time up to the close of business on the expiration

date shown in the applicable prospectus supplement, unless otherwise specified in such prospectus supplement. After the close of business

on the expiration date, if applicable, unexercised warrants will become void. Warrants may be exercised in the manner described in the

applicable prospectus supplement. When the warrant holder makes the payment and properly completes and signs the warrant certificate at

the corporate trust office of the warrant agent, if any, or any other office indicated in the prospectus supplement, we will, as soon

as possible, forward the securities or other rights that the warrant holder has purchased. If the warrant holder exercises less than all

of the warrants represented by the warrant certificate, we will issue a new warrant certificate for the remaining warrants.

Subscription Rights

We may issue rights to purchase

our securities. The rights may or may not be transferable by the persons purchasing or receiving the rights. In connection with any rights

offering, we may enter into a standby underwriting or other arrangement with one or more underwriters or other persons pursuant to which

such underwriters or other persons would purchase any offered securities remaining unsubscribed for after such rights offering. In connection

with a rights offering to holders of our capital stock a prospectus supplement will be distributed to such holders on the record date

for receiving rights in the rights offering set by us.

We will file as exhibits

to the registration statement of which this prospectus is a part, or will incorporate by reference from a current report on Form 8-K that

we file with the SEC, forms of the subscription rights, standby underwriting agreement or other agreements, if any. The prospectus supplement

relating to any rights that we offer will include specific terms relating to the offering, including, among other matters:

| · | the date of determining the security holders entitled to the rights distribution; |

| | | |

| · | the aggregate number of rights issued and the aggregate amount of securities purchasable upon exercise

of the rights; |

| | | |

| · | the exercise price; |

| | | |

| · | the conditions to completion of the rights offering; |

| | | |

| · | the date on which the right to exercise the rights will commence and the date on which the rights will

expire; and |

| | | |

| · | any applicable federal income tax considerations. |

Each right would entitle

the holder of the rights to purchase the principal amount of securities at the exercise price set forth in the applicable prospectus supplement.

Rights may be exercised at any time up to the close of business on the expiration date for the rights provided in the applicable prospectus

supplement. After the close of business on the expiration date, all unexercised rights will become void.

Holders may exercise rights

as described in the applicable prospectus supplement. Upon receipt of payment and the rights certificate properly completed and duly executed

at the corporate trust office of the rights agent, if any, or any other office indicated in the prospectus supplement, we will, as soon

as practicable, forward the securities purchasable upon exercise of the rights. If less than all of the rights issued in any rights offering

are exercised, we may offer any unsubscribed securities directly to persons other than stockholders, to or through agents, underwriters

or dealers or through a combination of such methods, including pursuant to standby underwriting arrangements, as described in the applicable

prospectus supplement.

Debt Securities

As used in this prospectus,

the term “debt securities” means the debentures, notes, bonds and other evidences of indebtedness that we may issue from time

to time. The debt securities will either be senior debt securities, senior subordinated debt or subordinated debt securities. We may also

issue convertible debt securities. Debt securities may be issued under an indenture (which we refer to herein as an Indenture), which

are contracts entered into between us and a trustee to be named therein. The Indenture has been filed as an exhibit to the registration

statement of which this prospectus forms a part. We may issue debt securities and incur additional indebtedness other than through the

offering of debt securities pursuant to this prospectus. It is likely that convertible debt securities will not be issued under an Indenture.

The debt securities may be

fully and unconditionally guaranteed on a secured or unsecured senior or subordinated basis by one or more guarantors, if any. The obligations

of any guarantor under its guarantee will be limited as necessary to prevent that guarantee from constituting a fraudulent conveyance

under applicable law. In the event that any series of debt securities will be subordinated to other indebtedness that we have outstanding

or may incur, the terms of the subordination will be set forth in the prospectus supplement relating to the subordinated debt securities.

We may issue debt securities

from time to time in one or more series, in each case with the same or various maturities, at par or at a discount. Unless indicated in

a prospectus supplement, we may issue additional debt securities of a particular series without the consent of the holders of the debt

securities of such series outstanding at the time of the issuance. Any such additional debt securities, together with all other outstanding

debt securities of that series, will constitute a single series of debt securities under the applicable Indenture and will be equal in

ranking.

Should an Indenture relate

to unsecured indebtedness, in the event of a bankruptcy or other liquidation event involving a distribution of assets to satisfy our outstanding

indebtedness or an event of default under a loan agreement relating to secured indebtedness of our company or its subsidiaries, the holders

of such secured indebtedness, if any, would be entitled to receive payment of principal and interest prior to payments on the unsecured

indebtedness issued under an Indenture.

Each prospectus supplement

will describe the terms relating to the specific series of debt securities. These terms will include some or all of the following:

| · | the title of debt securities and whether the debt securities are senior or subordinated; |

| | | |

| · | any limit on the aggregate principal amount of debt securities of such series; |

| | | |

| · | the percentage of the principal amount at which the debt securities of any series will be issued; |

| | | |

| · | the ability to issue additional debt securities of the same series; |

| | | |

| · | the purchase price for the debt securities and the denominations of the debt securities; |

| · | the specific designation of the series of debt securities being offered; |

| | | |

| · | the maturity date or dates of the debt securities and the date or dates upon which the debt securities

are payable and the rate or rates at which the debt securities of the series shall bear interest, if any, which may be fixed or variable,

or the method by which such rate shall be determined; |

| | | |

| · | the basis for calculating interest; |

| | | |

| · | the date or dates from which any interest will accrue or the method by which such date or dates will be

determined; |

| | | |

| · | the duration of any deferral period, including the period during which interest payment periods may be

extended; |

| | | |

| · | whether the amount of payments of principal of (and premium, if any) or interest on the debt securities

may be determined with reference to any index, formula or other method, such as one or more currencies, commodities, equity indices or

other indices, and the manner of determining the amount of such payments; |

| | | |

| · | the dates on which we will pay interest on the debt securities and the regular record date for determining

who is entitled to the interest payable on any interest payment date; |

| | | |

| · | the place or places where the principal of (and premium, if any) and interest on the debt securities will

be payable, where any securities may be surrendered for registration of transfer, exchange or conversion, as applicable, and notices and

demands may be delivered to or upon us pursuant to the applicable Indenture; |

| | | |

| · | the rate or rates of amortization of the debt securities; |

| | | |

| · | any terms for the attachment to the debt securities of warrants, options or other rights to purchase or

sell our securities; |

| | | |

| · | if the debt securities will be secured by any collateral and, if so, a general description of the collateral

and the terms and provisions of such collateral security, pledge or other agreements; |

| | | |

| · | if we possess the option to do so, the periods within which and the prices at which we may redeem the

debt securities, in whole or in part, pursuant to optional redemption provisions, and the other terms and conditions of any such provisions; |

| | | |

| · | our obligation or discretion, if any, to redeem, repay or purchase debt securities by making periodic

payments to a sinking fund or through an analogous provision or at the option of holders of the debt securities, and the period or periods

within which and the price or prices at which we will redeem, repay or purchase the debt securities, in whole or in part, pursuant to

such obligation, and the other terms and conditions of such obligation; |

| | | |

| · | the terms and conditions, if any, regarding the option or mandatory conversion or exchange of debt securities; |

| | | |

| · | the period or periods within which, the price or prices at which and the terms and conditions upon which

any debt securities of the series may be redeemed, in whole or in part at our option and, if other than by a board resolution, the manner

in which any election by us to redeem the debt securities shall be evidenced; |

| | | |

| · | any restriction or condition on the transferability of the debt securities of a particular series; |

| · | the portion, or methods of determining the portion, of the principal amount of the debt securities which

we must pay upon the acceleration of the maturity of the debt securities in connection with any event of default; |

| | | |

| · | the currency or currencies in which the debt securities will be denominated and in which principal, any

premium and any interest will or may be payable or a description of any units based on or relating to a currency or currencies in which

the debt securities will be denominated; |

| | | |

| · | provisions, if any, granting special rights to holders of the debt securities upon the occurrence of specified

events; |

| | | |

| · | any deletions from, modifications of or additions to the events of default or our covenants with respect

to the applicable series of debt securities, and whether or not such events of default or covenants are consistent with those contained

in the applicable Indenture; |

| | | |

| · | any limitation on our ability to incur debt, redeem stock, sell our assets or other restrictions; |

| | | |

| · | the application, if any, of the terms of the applicable Indenture relating to defeasance and covenant

defeasance (which terms are described below) to the debt securities; |

| | | |

| · | what subordination provisions will apply to the debt securities; |

| | | |

| · | the terms, if any, upon which the holders may convert or exchange the debt securities into or for our

securities or property; |

| | | |

| · | whether we are issuing the debt securities in whole or in part in global form; |

| | | |

| · | any change in the right of the trustee or the requisite holders of debt securities to declare the principal

amount thereof due and payable because of an event of default; |

| | | |

| · | the depositary for global or certificated debt securities, if any; |

| | | |

| · | any material federal income tax consequences applicable to the debt securities, including any debt securities

denominated and made payable, as described in the prospectus supplements, in foreign currencies, or units based on or related to foreign

currencies; |

| | | |

| · | any right we may have to satisfy, discharge and defease our obligations under the debt securities, or

terminate or eliminate restrictive covenants or events of default in the Indentures, by depositing money or U.S. government obligations

with the trustee of the Indentures; |

| | | |