Affinity Bancshares, Inc. Announces Payment of Special Cash Dividend of $1.50 Per Share

February 27 2025 - 5:00PM

Business Wire

Affinity Bancshares, Inc. (the “Company”) (Nasdaq: AFBI), the

holding company for Affinity Bank, today announced that its Board

of Directors has declared the payment of a special cash dividend.

The dividend of $1.50 per share will be paid on March 27, 2025 to

stockholders of record as of March 13, 2025.

Edward J. Cooney, President and Chief Executive Officer of the

Company, stated “We recorded a solid level of net income for the

year ended December 31, 2024, despite the expenses we incurred in

connection with the terminated transaction with Atlanta Postal

Credit Union, which reaffirms the Company’s stability and

resilience. This dividend reflects our desire to share our success

with our stockholders, as well as our ongoing commitment to

delivering stockholder value.”

About Affinity Bancshares,

Inc.

The Company is a Maryland corporation based in Covington,

Georgia. The Company’s banking subsidiary, Affinity Bank, opened in

1928 and currently operates a full-service office in Atlanta,

Georgia, two full-service offices in Covington, Georgia, and a loan

production office serving the Alpharetta and Cumming, Georgia

markets.

Forward-Looking

Statements

In addition to historical information, this release may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, which describe the future

plans, strategies and expectations of the Company. Forward-looking

statements can be identified by the use of words such as

“estimate,” “project,” “believe,” “intend,” “anticipate,” “assume,”

“plan,” “seek,” “expect,” “will,” “may,” “should,” “indicate,”

“would,” “contemplate,” “continue,” “target” and words of similar

meaning. Forward-looking statements are based on our current

beliefs and expectations and are inherently subject to significant

business, economic and competitive uncertainties and contingencies,

many of which are beyond our control. In addition, these

forward-looking statements are subject to assumptions with respect

to future business strategies and decisions that are subject to

change. Accordingly, you should not place undue reliance on such

statements. We are under no duty to and do not take any obligation

to update any forward-looking statements after the date of this

report. Factors which could have a material adverse effect on the

operations of the Company and its subsidiaries include, but are not

limited to, changes in general economic conditions, interest rates

and inflation; changes in asset quality; our ability to access

cost-effective funding; fluctuations in real estate values; changes

in laws or regulations; changes in liquidity, including the size

and composition of our deposit portfolio and the percentage of

uninsured deposits in the portfolio; changes in technology;

failures or breaches of our IT security systems; our ability to

introduce new products and services and capitalize on growth

opportunities; changes in the value of our goodwill and other

intangible assets; our ability to successfully integrate acquired

operations or assets; changes in accounting policies and practices;

our ability to retain key employees; and the effects of natural

disasters and geopolitical events, including terrorism, conflict

and acts of war. These risks and other uncertainties are further

discussed in the reports that the Company files with the Securities

and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227608901/en/

Edward J. Cooney Chief Executive Officer (678) 742-9990

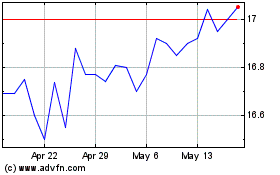

Affinity Bancshares (NASDAQ:AFBI)

Historical Stock Chart

From Feb 2025 to Mar 2025

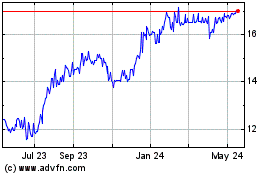

Affinity Bancshares (NASDAQ:AFBI)

Historical Stock Chart

From Mar 2024 to Mar 2025