AFC Gamma, Inc. (NASDAQ:AFCG) (“AFC Gamma”) today announced that

its Board of Directors has unanimously approved a plan to spin-off

its commercial real estate (“CRE”) portfolio into an independent,

publicly traded company that intends to elect REIT status, Sunrise

Realty Trust, Inc. (“SUNS”). The spin-off will result in two

pure-play debt capital providers – one focused solely on the

cannabis industry and a second on CRE in the southern United

States. AFC Gamma believes that the separation will allow both

companies to focus on their respective portfolios, articulate their

own clear investment thesis, and have the flexibility to tailor

their business strategies to best capture market opportunities

within their specialization. The separation is expected to be

completed in mid-2024.

Post separation, based on current portfolio information, it is

expected that the two companies will be comprised of the following,

with additional potential investments prior to separation:

|

AFC Gamma: |

SUNS: |

| •

Portfolio: 12 funded cannabis loans |

• Portfolio: 2 funded CRE loans |

|

• YTM: 21%(1) |

• YTM: 16%(1) |

|

• Assets: ~$330 million(2) |

• Assets: ~$115 million(2) |

“AFC Gamma’s Board and management team continuously evaluate

strategic options to best position the company to drive value for

shareholders. AFC Gamma has solidified its position as a leading

institutional lender to state-licensed cannabis operators, and we

believe now is the right time to spin off our traditional

commercial real estate operations into a standalone public

company,” said Daniel Neville, AFC Gamma’s Chief Executive Officer.

“As separate companies, we believe each business will be better

positioned to pursue tailored growth strategies. Furthermore, each

company will benefit from separate cost of capital and will be able

to attract an investor base ideally suited for the growth

opportunities of its industry.”

“Separating Sunrise Realty Trust, our commercial real estate

portfolio, from AFC Gamma sharpens both companies’ focus on each of

their strategic priorities and enhances their respective financial

flexibility,” said Leonard M. Tannenbaum, AFC Gamma’s Executive

Chairman. “This transaction also gives AFC Gamma shareholders

ownership of a separate company structured with the resources and

flexibility to maximize value.”

Separation of Sunrise Realty Trust, Inc.

(SUNS)SUNS will focus on originating CRE debt investments

and providing capital to high-quality borrowers and sponsors with

transitional business plans in the Southern U.S., collateralized by

CRE assets with opportunities for near-term value creation, as well

as recapitalization opportunities. SUNS’ target investment mix will

likely include high quality residential for rent and for-sale

condominiums, industrial, office, retail, hospitality, mixed-use

and specialty-use real estate. SUNS intends to create a diversified

investment portfolio, targeting investments in senior mortgage

loans, mezzanine loans, whole loans, B-notes and debt-like

preferred equity securities across CRE asset classes.

As two separate companies, AFC Gamma and SUNS each plan to have

some overlapping corporate management but will have distinct

investment teams and boards of directors comprised primarily of

independent directors. Upon completion of the spin-off, Brian

Sedrish, current Chief Executive Officer of Southern Realty Trust

Inc., is expected to lead SUNS as CEO. Following close, AFC Gamma

and SUNS will have different external managers.

Mr. Sedrish stated, “We believe that CRE debt markets today

present a significant opportunity to capitalize on market

dislocations precipitated by the rise in interest rates, declining

liquidity and a retrenchment of banks from CRE lending. With an

experienced management team that has a proven track record in CRE

credit and structured finance, we aim to successfully execute our

business strategy and generate compelling risk-adjusted returns and

long-term value for our shareholders.”

Details of the SeparationThe separation of the

CRE portfolio and the resulting spin-off will be completed in two

steps. First, AFC Gamma will contribute, and SUNS will accept and

assume, all the assets, liabilities and business related to AFC

Gamma’s commercial real estate lending business, as currently

conducted by SUNS, including the operations, properties, services

and activities of such business. Then, a pro-rata distribution of

SUNS’ common stock to AFC Gamma’s shareholders will occur (the

“distribution”). Upon completion of the transaction, SUNS’ common

stock is expected to be listed on the NASDAQ under the symbol

“SUNS.”

In addition, the company anticipates that AFC Gamma shareholders

as of the record date for the distribution will receive a special

cash dividend of $0.15 cents per common share.

SUNS plans to file a registration statement on Form 10 today,

February 22, 2024 with the Securities and Exchange Commission

(“SEC”) with respect to the shares of SUNS common stock being

distributed. Work to effect the separation and distribution is

underway and further details will be disclosed during the next

several months.

AFC Gamma shareholder approval is not required to approve the

distribution and effect the spin-off transaction, and shareholders

are not required to take any action to receive shares of SUNS

common stock. The planned separation and distribution is subject to

final approval by AFC Gamma’s Board of Directors, the Form 10

registration statement being declared effective by the SEC and

satisfaction of other conditions, as set forth in the separation

and distribution agreement.

AdvisorsO'Melveny & Myers LLP is serving as

legal counsel to AFC Gamma and SUNS in connection with the

spin-off.

Conference Call and WebcastAFC Gamma will host

a conference call today at 5:00 p.m. Eastern Time to discuss this

announcement. All interested parties are welcome to participate. A

presentation and the call will be available through a live audio

webcast at the Investor Relations section of AFC Gamma’s website at

www.afcgamma.com.

To participate via telephone, please register in advance at this

link. Upon registration, all telephone participants will receive a

confirmation email detailing how to join the conference call,

including the dial-in number along with a unique passcode and

registrant ID that can be used to access the call.

About Brian SedrishMr. Sedrish has over 20

years of leadership experience within real estate private equity,

focusing on institutional commercial real estate opportunities. He

was formerly a Managing Director and Portfolio Manager at Related

Fund Management (“RFM”) and the Head of Commercial Real Estate

Acquisitions Special Situations for Deutsche Bank. Mr. Sedrish has

held roles at Fortress Investment Group, Goldman Sachs and Lazard

Freres. He received an MBA from the Kellogg School of

Management at Northwestern, a Masters in Public Administration from

Harvard University and a B.A. in Economics from the University of

Michigan.

About AFC Gamma, Inc.AFC Gamma, Inc.

(NASDAQ:AFCG) is a publicly-traded, institutional lender that

originates, structures and underwrites loans secured by commercial

real estate and other types of financing solutions. AFC Gamma

targets direct lending and bridge loan opportunities typically

ranging from $5 million to $100 million across multiple real estate

sectors, with a specialization in lending to state-law compliant

cannabis operators. It is based in West Palm Beach, Florida.

Forward Looking StatementsThis release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 that reflect our current

views and projections with respect to, among other things, future

events and financial performance. Words such as “believes,”

“expects,” “will,” “intends,” “plans,” “guidance,” “estimates,”

“projects,” “anticipates,” and “future” or similar expressions are

intended to identify forward-looking statements. These

forward-looking statements, including statements about our future

growth and strategies for such growth, are subject to the inherent

uncertainties in predicting future results and conditions and are

not guarantees of future performance, conditions or results.

Certain factors, including the ability of our manager to locate

suitable loan opportunities for us, monitor and actively manage our

loan portfolio and implement our investment strategy; the demand

for cannabis cultivation and processing facilities; management’s

current estimate of expected credit losses and current expected

credit loss reserve and other factors could cause actual results

and performance to differ materially from those projected in these

forward-looking statements. Additionally, these forward-looking

statements are based upon current estimates and assumptions and

include statements regarding AFC Gamma’s plans to spin-off all of

the outstanding shares of SUNS to AFC Gamma’s shareholders, the

spin-off enabling each company’s management to more effectively

pursue its own distinct investment priorities and strategies, the

spin-off permitting AFC Gamma to allocate its financial resources

to meet the unique needs of its business, which will allow it to

specialize on its distinct strategic priorities and to more

effectively pursue its distinct capital allocation and portfolio

management strategies, the spin-off allowing each company to more

effectively articulate a clear investment thesis to attract a

long-term investor base suited to their business and providing

investors with a distinct and targeted investment opportunity and

the spin-off enhancing access to financing to support the SUNS

business, which will no longer be subject to the current regulatory

environment with respect to lending to cannabis industry operators.

While AFC Gamma believes these forward-looking statements are

reasonable, undue reliance should not be placed on any such

forward-looking statements, which are based on information

available to us on the date of this release. These forward-looking

statements are subject to various risks and uncertainties, many of

which are difficult to predict that could cause actual results to

differ materially from current expectations and assumptions from

those set forth or implied by any forward-looking statements.

Readers should carefully review AFC Gamma’s financial statements

and the notes thereto, as well as the sections entitled “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” of AFC Gamma’s Annual Report

on Form 10-K for the year ended December 31, 2022 and of AFC

Gamma’s Quarterly Reports on Form 10-Q for the quarterly periods

ended March 31, 2023, June 30, 2023 and September 30, 2023, and the

other documents AFC Gamma files from time to time with the SEC.

These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

The information in this release is provided only as of the date of

this release, and we undertake no obligation to update any

forward-looking statements contained in this release on account of

new information, future events, or otherwise, except as required by

law.

(1) Estimated YTM calculations require management to make

estimates and assumptions, including, but not limited to, the

timing and amounts of loan draws on delayed draw loans, the timing

collectability of exit fees, the probability and timing of

prepayments and the probability of contingent features occurring.

For example, our credit agreements with certain borrowers contain

provisions pursuant to which certain PIK interest rates and fees

earned by us under such credit agreements will decrease upon the

satisfaction of certain specified criteria, which we believe may

improve the risk profile of the applicable borrower. To be

conservative, we have not assumed any prepayment penalties or early

payoffs in our estimated YTM calculation. Estimated YTM is based on

current management estimates and assumptions, which may change.

Actual results could differ from those estimates and

assumptions.(2) Based on September 30, 2023 balance sheet, numbers

are approximate as if AFC Gamma and Sunrise Realty Trust were

separated today.

INVESTOR CONTACT:

Robyn

Tannenbaum561-510-2293ir@afcgamma.com www.afcgamma.com

MEDIA CONTACT:

Collected StrategiesJim Golden / Jack Kelleher / Taylor

Koeddingafcg-cs@collectedstrategies.com

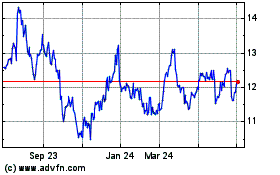

Advanced Flower Capital (NASDAQ:AFCG)

Historical Stock Chart

From Oct 2024 to Nov 2024

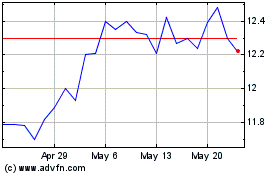

Advanced Flower Capital (NASDAQ:AFCG)

Historical Stock Chart

From Nov 2023 to Nov 2024