0001822523false00018225232024-11-132024-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2024

ADVANCED FLOWER CAPITAL INC.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Maryland | 001-39995 | 85-1807125 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

477 S. Rosemary Ave., Suite 301

West Palm Beach, FL, 33401

(Address of principal executive offices, including zip code)

561-510-2390

(Registrant’s telephone number, including area code)

AFC GAMMA, INC.

525 Okeechobee Blvd., Suite 1650

West Palm Beach, FL 33401

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | AFCG | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 13, 2024, Advanced Flower Capital Inc. (f/k/a AFC Gamma, Inc.) issued a press release announcing its financial and operational results for the quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information contained in Item 2.02 of this Current Report, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Press Release issued by Advanced Flower Capital Inc. on November 13, 2024. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ADVANCED FLOWER CAPITAL INC. |

| | |

| By: | /s/ Brandon Hetzel |

| | Brandon Hetzel |

| | Chief Financial Officer and Treasurer |

Date: November 13, 2024 | | |

Advanced Flower Capital Inc. Announces Financial Results for Third Quarter 2024

Third quarter 2024 GAAP net income of $1.4 million or $0.06 per basic weighted average common share and

Distributable Earnings(1) of $7.2 million or $0.35 per basic weighted average common share

Paid first post-spin dividend of $0.33 per common share for third quarter 2024

WEST PALM BEACH, FL, November 13, 2024 (GLOBE NEWSWIRE) – Advanced Flower Capital Inc. (f/k/a AFC Gamma, Inc.) (NASDAQ:AFCG) (“Advanced Flower Capital”, “AFC” or the “Company”) today announced its results for the quarter ended September 30, 2024.

AFC reported generally accepted accounting principles (“GAAP”) net income of $1.4 million or $0.06 per basic weighted average common share and Distributable Earnings of $7.2 million or $0.35 per basic weighted average common share for the third quarter of 2024.

“We are pleased with the strong quarter, driven by our continued focus on active portfolio management and origination. One of my top priorities when I joined AFC was to reinvigorate our origination engine, and I am proud to announce that we have surpassed our 2024 target of $100 million in new originations. This achievement highlights our ability to identify and support high-quality operators in key markets, and we look forward to continuing to build on this momentum as we close out the year,” said Daniel Neville, the Company’s Chief Executive Officer.

Common Stock Dividend

On October 15, 2024, the Company paid a regular cash dividend of $0.33 per common share for the third quarter of 2024. AFC distributed an aggregate of $7.2 million in dividends, or $0.33 per common share, compared to Distributable Earnings of $0.35 per basic weighted average common share for such period.

Additional Information

Advanced Flower Capital issued a presentation of its third quarter 2024 results, titled “Third Quarter 2024 Earnings Presentation,” which can be viewed at advancedflowercapital.com under the Investor Relations section. The Company also filed its Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, with the Securities and Exchange Commission on November 13, 2024.

AFC routinely posts important information for investors on its website, advancedflowercapital.com. The Company intends to use this webpage as a means of disclosing material information, for complying with our disclosure obligations under Regulation FD and to post and update investor presentations and similar materials on a regular basis. AFC encourages investors, analysts, the media and others interested in AFC to monitor the Investors section of its website, in addition to following its press releases, SEC filings, public conference calls, presentations, webcasts and other information posted from time to time on the website. To sign-up for email-notifications, please visit the “Email Alerts” section of the website under the “IR Resources” section.

1 Distributable Earnings is a non-GAAP financial measure. See the “Non-GAAP Metrics” section of this release for a reconciliation of GAAP Net Income to Distributable Earnings.

Conference Call & Discussion of Financial Results

Advanced Flower Capital will host a conference call at 10:00 am (Eastern Time) on Wednesday, November 13, 2024, to discuss its quarterly financial results. All interested parties are welcome to participate. The call will be available through a live audio webcast at the Investor Relations section of AFC’s website found here: AFC -- Investor Relations. To participate via telephone, please register in advance at this link. Upon registration, all telephone participants will receive a confirmation email detailing how to join the conference call, including the dial-in number along with a unique passcode and registrant ID that can be used to access the call. The complete webcast will be archived for 90 days on the Investor Relations section of AFC’s website.

About Advanced Flower Capital

Advanced Flower Capital Inc. (Nasdaq: AFCG) is a leading commercial mortgage REIT that provides institutional loans to state law compliant cannabis operators in the U.S. Through the management team’s deep network and significant credit and cannabis expertise, AFC originates, structures, underwrites and manages loans ranging from $10 million to over $100 million, typically secured by quality real estate assets, license value and cash flows. It is based in West Palm Beach, Florida.

Non-GAAP Metrics

In addition to using certain financial metrics prepared in accordance with GAAP to evaluate our performance, we also use Distributable Earnings to evaluate our performance excluding the effects of certain transactions and GAAP adjustments we believe are not necessarily indicative of our current loan activity and operations. Distributable Earnings is a measure that is not prepared in accordance with GAAP. Distributable Earnings and the other capitalized terms not defined in this section have the meanings ascribed to such terms in our most-recently filed Quarterly Report on Form 10-Q. We use this non-GAAP financial measure both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that this non-GAAP financial measure and the information it provides is useful to investors since this measure permits investors and shareholders to assess the overall performance of our business using the same tools that our management uses to evaluate our past performance and prospects for future performance.

The determination of Distributable Earnings is substantially similar to the determination of Core Earnings under our Management Agreement, provided that Core Earnings is a component of the calculation of any Incentive Compensation earned under the Management Agreement for the applicable time period, and thus Core Earnings is calculated without giving effect to Incentive Compensation expense, while the calculation of Distributable Earnings accounts for any Incentive Compensation earned for such time period.

We define Distributable Earnings as, for a specified period, the net income (loss) computed in accordance with GAAP, excluding (i) stock-based compensation expense, (ii) depreciation and amortization, (iii) any unrealized gains, losses or other non-cash items recorded in net income (loss) for the period, regardless of whether such items are included in other comprehensive income or loss, or in net income (loss); provided that Distributable Earnings does not exclude, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with PIK interest and zero coupon securities), accrued income that we have not yet received in cash, (iv) (decrease) increase in provision for current expected credit losses, (v) taxable REIT (as defined below) subsidiary (“TRS”) (income) loss, net of any dividends received from TRS and (vi) one-time events pursuant to changes in GAAP and certain non-cash charges, in each case after discussions between our Manager and our independent directors and after approval by a majority of such independent directors.

We believe providing Distributable Earnings on a supplemental basis to our net income as determined in accordance with GAAP is helpful to shareholders in assessing the overall performance of our business. As a real estate investment trust (“REIT”), we are required to distribute at least 90% of our annual REIT taxable income, subject to certain adjustments, and to pay tax at regular corporate rates to the extent that we annually distribute less than 100% of such taxable income. Given these requirements and our belief that dividends are generally one of the principal reasons that shareholders invest in our common stock, we generally intend to attempt to pay dividends to our shareholders in an amount at least equal to such REIT taxable income, if and to the extent authorized by our Board of Directors. Distributable Earnings is one of many factors considered by our Board of Directors in authorizing dividends and, while not a direct measure of net taxable income, over time, the measure can be considered a useful indicator of our dividends.

Distributable Earnings is a non-GAAP financial measure and should not be considered as a substitute for GAAP net income. We caution readers that our methodology for calculating Distributable Earnings may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, our reported Distributable Earnings may not be comparable to similar measures presented by other REITs.

The following table provides a reconciliation of GAAP Net income to Distributable Earnings:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

September 30, | | Nine months ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Net income | $ | 1,383,734 | | $ | 7,979,875 | | $ | 17,775,739 | | $ | 30,140,482 |

| Adjustments to net income: | | | | | | | |

| Stock-based compensation expense | 218,643 | | 294,014 | | 1,131,208 | | 705,361 |

| Depreciation and amortization | — | | — | | — | | — |

| Unrealized (gains) losses or other non-cash items | 4,621,702 | | (787,799) | | 9,655,396 | | 1,152,810 |

| Increase (decrease) in provision for current expected credit losses2 | 181,370 | | 1,053,398 | | (1,077,196) | | 149,637 |

| TRS (income) loss, net of dividends | 840,556 | | 1,399,920 | | 1,147,554 | | (716,684) |

| One-time events pursuant to changes in GAAP and certain non-cash charges | — | | — | | — | | — |

| Distributable earnings | $ | 7,246,005 | | $ | 9,939,408 | | $ | 28,632,701 | | $ | 31,431,606 |

| Basic weighted average shares of common stock outstanding | 20,684,149 | | 20,324,125 | | 20,493,375 | | 20,315,162 |

| Distributable earnings per basic weighted average share | $ | 0.35 | | $ | 0.49 | | $ | 1.40 | | $ | 1.55 |

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect our current views and projections with respect to, among other things, future events and financial performance. Words such as “believes,” “expects,” “will,” “intends,” “plans,” “guidance,” “estimates,” “projects,” “anticipates,” and “future” or similar expressions are intended to identify forward-looking statements. These forward-looking statements, including statements about our future growth and strategies for such growth, are subject to the inherent uncertainties in predicting future results and conditions and are not guarantees of future performance, conditions or results. Certain factors, including the ability of our manager to locate suitable loan opportunities for us, monitor and actively manage our loan portfolio and implement our investment strategy; the demand for cannabis cultivation and processing facilities and dispensaries; management’s current estimate of expected credit losses and current expected credit loss reserve and other factors could cause actual results and performance to differ materially from those projected in these forward-looking statements. More information on these risks and other potential factors that could affect our business and financial results is included in AFC’s filings with the SEC, including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of AFC’s most recently filed periodic reports on Form 10-K, Form 10-Q and subsequent filings. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect AFC. We do not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

2 The provision for current expected credit losses above includes approximately zero and $71.9 thousand for the three and nine months ended September 30, 2024, respectively, and zero for the three and nine months ended September 30, 2023, respectively, which is included in the net income from discontinued operations, net of tax financial statement line on the consolidated statement of operations.

Investor Relations

INVESTOR CONTACT:

Robyn Tannenbaum

(561) 510-2293

ir@advancedflowercapital.com

MEDIA CONTACT:

Profile Advisors

Rich Myers

(347) 774-1125

rmyers@profileadvisors.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

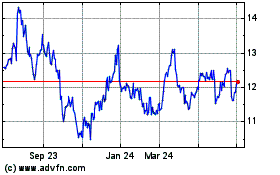

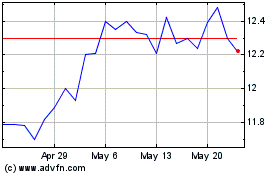

Advanced Flower Capital (NASDAQ:AFCG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Advanced Flower Capital (NASDAQ:AFCG)

Historical Stock Chart

From Dec 2023 to Dec 2024