0001517022FALSE00015170222024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 7, 2024

_____________________

AKEBIA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

_____________________

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-36352 | | 20-8756903 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

| | |

245 First Street Cambridge, Massachusetts | | 02142 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (617) 871-2098

N/A

(Former name or former address, if changed since last report)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading

symbol(s) | | Name of each exchange

on which registered |

| Common Stock, par value $0.00001 per share | | AKBA | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2024, Akebia Therapeutics, Inc. issued a press release announcing its financial results for the quarter ended September 30, 2024 and recent business highlights. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (“Report”) and is incorporated herein by reference.

The information in this Report (including Item 2.02 and Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

Exhibit No. | | Description |

99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | AKEBIA THERAPEUTICS, INC. |

| | |

Date: November 7, 2024 | By: | /s/ John P. Butler |

| | Name: John P. Butler |

| | Title: President and Chief Executive Officer |

Akebia Therapeutics Reports Third Quarter 2024 Financial Results

and Recent Business Highlights

•Vafseo® (vadadustat) on track for U.S. market availability expected in January 2025

•Over 300,000 patients, representing approximately 60% of dialysis patient lives in the U.S., now covered under dialysis provider contracts for Vafseo

•Vafseo granted TDAPA reimbursement and issued a Level II Healthcare Common Procedure Coding System code

•Akebia to Host Conference Call at 8:00 a.m. ET on November 7

CAMBRIDGE, Mass.—November 7, 2024—Akebia Therapeutics®, Inc. (Nasdaq: AKBA), a biopharmaceutical company with the purpose to better the lives of people impacted by kidney disease, today reported financial results for the third quarter ended September 30, 2024, and recent business highlights. During the quarter, Akebia continued to execute on the commercial launch of Vafseo® (vadadustat) to prepare for U.S. market availability expected in January 2025.

“Our entire organization has been diligently executing across multiple fronts on launch readiness activities as we approach Vafseo U.S. market availability expected in January. Importantly, approximately 60 percent of patients on dialysis are now covered under dialysis organization and group purchasing organization contracts for Vafseo,” said John P. Butler, Chief Executive Officer of Akebia. “We expect to enter into contracts with additional dialysis providers to increase coverage over the remainder of 2024 while continuing our efforts to drive demand for Vafseo from prescribers. We also recently partnered with U.S. Renal Care (USRC) to initiate a collaborative trial evaluating mortality and hospitalization outcomes for dialysis patients taking Vafseo to further add to Vafseo’s body of clinical evidence, and separately presented six posters with Vafseo clinical data at the recent American Society of Nephrology (ASN) Kidney Week conference. Taken together, these initiatives are intended to continue to support a strong launch and move toward establishing Vafseo as the new oral standard of care for dialysis patients with anemia.”

Progress on Key Vafseo Business Initiatives

•Akebia has entered into commercial supply contracts for Vafseo with dialysis organizations treating over 300,000 patients, which represents approximately 60% of dialysis patients in the U.S. Recent commercial supply contracts include agreements with one of the leading dialysis organizations serving more than 200,000 dialysis patients, USRC which serves more than 36,000 patients and Renal Purchasing Group, a specialty group purchasing organization that serves many of the independent and small dialysis organizations.

•In October 2024, the Center for Medicare & Medicaid Services determined that Vafseo met the criteria for Transitional Drug Add-On Payment Adjustment (TDAPA) reimbursement, which will begin on January 1, 2025. Akebia also received a Level II Healthcare Common Procedure Coding System code for Vafseo that will be utilized by dialysis organizations to help process health insurance claims for Medicare enrollees upon launch.

•In October 2024, Akebia had a strong presence at the ASN Kidney Week conference, hosting commercial and medical affairs booths, and a product theatre, as well as presenting seven

scientific posters at the conference. The event was well-attended with significant participation from the nephrology community serving to help Akebia further educate the physician community and to drive prescriber demand in advance of Vafseo market availability.

•In September 2024, Akebia and USRC initiated the Vafseo Outcomes In-Center Experience (VOICE) trial. The trial will randomize patients to treatment with oral Vafseo 300 mg tablets administered three times per week or standard of care erythropoiesis-stimulating agents and will be powered to demonstrate non-inferiority for all-cause mortality and superiority for a 10% reduction in all-cause hospitalization.

Financial Results

•Revenues: Total revenues were $37.4 million in the third quarter of 2024 compared to $42.0 million for the third quarter of 2023, comprised of the following components:

▪Auryxia® (ferric citrate) net product revenues were $35.6 million in the third quarter of 2024 as compared to $40.1 million in the third quarter of 2023. This decrease was driven by a reduction in volume partially offset by price increases and execution of our contracting strategy with third party payors. Akebia continues to enter into commercial supply contracts for Auryxia, which is expected to be added to the bundled payment for dialysis services in January 2025.

▪License, collaboration and other revenues were $1.8 million in the third quarter of 2024 compared to $1.9 million in the third quarter of 2023.

•Cost of Goods Sold: Cost of goods sold (COGS) was $14.2 million in the third quarter of 2024 compared to $18.0 million in the third quarter of 2023. This decrease was driven by a $3.7 million benefit due to our ability to commercially sell inventory previously written-down as excess inventory, as well as lower year-over-year sales volume. Akebia continues to carry a non-cash intangible amortization charge of $9.0 million per quarter in COGS through the fourth quarter of 2024.

•Research & Development Expenses: Research and development expenses were $8.5 million in the third quarter of 2024 compared to $13.3 million in the third quarter of 2023. This decrease was driven by the completion of activities related to certain clinical trials, lower headcount related costs and decreased professional service and consulting expense.

•Selling, General & Administrative Expenses: Selling, general and administrative expenses were $26.5 million in the third quarter of 2024 compared to $22.7 million in the third quarter of 2023. This increase was driven by higher costs incurred in connection with preparatory activities related to Vafseo product availability in the U.S., which is expected in January 2025.

•Net Loss: Net loss was $20.0 million in the third quarter of 2024 compared to $14.5 million in the third quarter of 2023. The increase in net loss included $4.4 million in non-cash interest expense related to the settlement royalty liability in connection with the Vifor Termination and Settlement Agreement that Akebia signed in July 2024.

•Cash Position: Cash and cash equivalents as of September 30, 2024 were approximately $34.0 million. Akebia expects its existing cash resources and cash from operations will be sufficient to fund its current operating plan, including the U.S. Vafseo launch, for at least two years.

Conference Call

Akebia will host a conference call on Thursday, November 7 at 8:00 a.m. Eastern Time to discuss third quarter 2024 earnings. To access the call, please register by clicking on this Registration Link, and you will be provided with dial in details. To avoid delays and ensure timely connection, we encourage dialing into the conference call 15 minutes ahead of the scheduled start time.

A live webcast of the conference call will be available via the “Investors” section of Akebia's website at: https://ir.akebia.com/. An online archive of the webcast can be accessed via the Investors section of Akebia's website at https://ir.akebia.com approximately two hours after the event.

About Akebia Therapeutics

Akebia Therapeutics, Inc. is a fully integrated biopharmaceutical company with the purpose to better the lives of people impacted by kidney disease. Akebia was founded in 2007 and is headquartered in Cambridge, Massachusetts. For more information, please visit our website at www.akebia.com, which does not form a part of this release.

About Vafseo® (vadadustat) tablets

Vafseo® (vadadustat) tablets is a once-daily oral hypoxia-inducible factor prolyl hydroxylase inhibitor that activates the physiologic response to hypoxia to stimulate endogenous production of erythropoietin, increasing hemoglobin and red blood cell production to manage anemia. Vafseo is approved for use in 37 countries.

INDICATION

VAFSEO is indicated for the treatment of anemia due to chronic kidney disease (CKD) in adults who have been receiving dialysis for at least three months.

Limitations of Use

•VAFSEO has not been shown to improve quality of life, fatigue, or patient well-being.

•VAFSEO is not indicated for use:

◦As a substitute for red blood cell transfusions in patients who require immediate correction of anemia.

◦In patients with anemia due to CKD not on dialysis.

IMPORTANT SAFETY INFORMATION about VAFSEO (vadadustat) tablets

WARNING: INCREASED RISK OF DEATH, MYOCARDIAL INFARCTION, STROKE, VENOUS THROMBOEMBOLISM, and THROMBOSIS OF VASCULAR ACCESS.

VAFSEO increases the risk of thrombotic vascular events, including major adverse cardiovascular events (MACE).

Targeting a hemoglobin level greater than 11 g/dL is expected to further increase the risk of death and arterial and venous thrombotic events, as occurs with erythropoietin stimulating agents (ESAs), which also increase erythropoietin levels.

No trial has identified a hemoglobin target level, dose of VAFSEO, or dosing strategy that does not increase these risks.

Use the lowest dose of VAFSEO sufficient to reduce the need for red blood cell transfusions.

CONTRAINDICATIONS

•Known hypersensitivity to VAFSEO or any of its components

•Uncontrolled hypertension

WARNINGS AND PRECAUTIONS

•Increased Risk of Death, Myocardial Infarction (MI), Stroke, Venous Thromboembolism, and Thrombosis of Vascular Access

A rise in hemoglobin (Hb) levels greater than 1 g/dL over 2 weeks can increase these risks. Avoid

in patients with a history of MI, cerebrovascular event, or acute coronary syndrome within the 3

months prior to starting VAFSEO. Targeting a Hb level of greater than 11 g/dL is expected to

further increase the risk of death and arterial and venous thrombotic events. Use the lowest

effective dose to reduce the need for red blood cell (RBC) transfusions. Adhere to dosing and Hb

monitoring recommendations to avoid excessive erythropoiesis.

•Hepatotoxicity

Hepatocellular injury attributed to VAFSEO was reported in less than 1% of patients, including

one severe case with jaundice. Elevated serum ALT, AST, and bilirubin levels were observed

in 1.8%, 1.8%, and 0.3% of CKD patients treated with VAFSEO, respectively. Measure ALT,

AST, and bilirubin before treatment and monthly for the first 6 months, then as clinically

indicated. Discontinue VAFSEO if ALT or AST is persistently elevated or accompanied by elevated

bilirubin. Not recommended in patients with cirrhosis or active, acute liver disease.

•Hypertension

Worsening of hypertension was reported in 14% of VAFSEO and 17% of darbepoetin alfa

patients. Serious worsening of hypertension was reported in 2.7% of VAFSEO and 3% of

darbepoetin alfa patients. Cases of hypertensive crisis, including hypertensive encephalopathy

and seizures, have also been reported in patients receiving VAFSEO. Monitor blood pressure. Adjust anti-hypertensive therapy as needed.

•Seizures

Seizures occurred in 1.6% of VAFSEO and 1.6% of darbepoetin alfa patients. Monitor for new-

onset seizures, premonitory symptoms, or change in seizure frequency.

•Gastrointestinal (GI) Erosion

Gastric or esophageal erosions occurred in 6.4% of VAFSEO and 5.3% of darbepoetin alfa

patients. Serious GI erosions, including GI bleeding and the need for RBC transfusions, were

reported in 3.4% of VAFSEO and 3.3% of darbepoetin alfa patients. Consider this risk in patients

at increased risk of GI erosion. Advise patients about signs of erosions and GI bleeding and urge

them to seek prompt medical care if present.

•Serious Adverse Reactions in Patients with Anemia Due to CKD and Not on Dialysis

The safety of VAFSEO has not been established for the treatment of anemia due to CKD in adults

not on dialysis and its use is not recommended in this setting. In large clinical trials in adults with

anemia of CKD who were not on dialysis, an increased risk of mortality, stroke, MI, serious acute

kidney injury, serious hepatic injury, and serious GI erosions was observed in patients treated

with VAFSEO compared to darbepoetin alfa.

•Malignancy

VAFSEO has not been studied and is not recommended in patients with active malignancies.

Malignancies were observed in 2.2% of VAFSEO and 3.0% of darbepoetin alfa patients. No

evidence of increased carcinogenicity was observed in animal studies.

ADVERSE REACTIONS

•The most common adverse reactions (occurring at ≥ 10%) were hypertension and diarrhea.

DRUG INTERACTIONS

•Iron supplements and iron-containing phosphate binders: Administer VAFSEO at least 1 hour before products containing iron.

•Non-iron-containing phosphate binders: Administer VAFSEO at least 1 hour before or 2 hours after non-iron-containing phosphate binders.

•BCRP substrates: Monitor for signs of substrate adverse reactions and consider dose reduction.

•Statins: Monitor for statin-related adverse reactions. Limit the daily dose of simvastatin to 20 mg and rosuvastatin to 5 mg.

USE IN SPECIFIC POPULATIONS

•Pregnancy: May cause fetal harm.

•Lactation: Breastfeeding not recommended until two days after the final dose.

•Hepatic Impairment: Not recommended in patients with cirrhosis or active, acute liver disease.

Please note that this information is not comprehensive. Please click here for the Full Prescribing Information, including BOXED WARNING and Medication Guide.

Forward-Looking Statements

Statements in this press release regarding Akebia Therapeutics, Inc.'s ("Akebia's") strategy, plans, prospects, expectations, beliefs, intentions and goals are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, as amended, and include, but are not limited to, statements regarding: Akebia’s expectations as to the timing of the market availability of Vafseo; Akebia’s plans with respect to its commercial launch of Vafseo, including Akebia’s expectations to enter into contracts with additional dialysis providers to increase coverage over the remainder of 2024 and continue to drive demand for Vafseo from prescribers; Akebia’s expectations regarding the trial with USRC to evaluate mortality and hospitalization outcomes for dialysis patients taking Vafseo, including the ability to further add to Vafseo’s body of clinical evidence; Akebia’s plans to establish Vafseo as the new oral standard of care for dialysis patients with anemia; Akebia’s expectations regarding the VOICE trial, including the ability to demonstrate non-inferiority for all-cause mortality and superiority for a 10% reduction in all-cause hospitalization; Akebia’s efforts to enter into commercial supply contracts for Auryxia and its expectations that Auryxia will be added to the bundled payment for dialysis services in January 2025; Akebia's expectations that its existing cash resources and cash from operations will be sufficient to fund its current operating plan, including the U.S. Vafseo launch, for at least two years; and Akebia's expectations about Auryxia revenue in 2024 and assumptions related thereto.

The terms "intend," "believe," "plan," "goal," "potential," "anticipate, "estimate," "expect," "future," "will," "continue," derivatives of these words, and similar references are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results, performance or experience may differ materially from those expressed or implied by any forward-looking statement as a result of various risks, uncertainties and other factors, including, but not limited to, risks associated with: whether Vafseo will be commercially available when expected; the potential demand and market potential and acceptance of, as well as coverage and reimbursement related to, Auryxia® and Vafseo, including estimates regarding the potential market opportunity; the competitive landscape for Auryxia and Vafseo, including potential generic entrants; the ability of Akebia

to attract and retain qualified personnel; Akebia's ability to implement cost avoidance measures and reduce operating expenses; decisions made by health authorities, such as the FDA, with respect to regulatory filings; the potential therapeutic benefits, safety profile, and effectiveness of Vafseo; the results of preclinical and clinical research; the direct or indirect impact of the COVID-19 pandemic on the markets and communities in which Akebia and its partners, collaborators, vendors and customers operate; manufacturing, supply chain and quality matters and any recalls, write-downs, impairments or other related consequences or potential consequences; and early termination of any of Akebia's collaborations. Other risks and uncertainties include those identified under the heading "Risk Factors" in Akebia's Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, and other filings that Akebia may make with the U.S. Securities and Exchange Commission in the future. These forward-looking statements (except as otherwise noted) speak only as of the date of this press release, and, except as required by law, Akebia does not undertake, and specifically disclaims, any obligation to update any forward-looking statements contained in this press release.

Akebia Therapeutics® and Vafseo® are registered trademarks of Akebia Therapeutics, Inc. and its affiliates.

Akebia Therapeutics Contact

Mercedes Carrasco

mcarrasco@akebia.com

| | | | | | | | | | | |

| AKEBIA THERAPEUTICS, INC. |

| Unaudited Condensed Consolidated Statements of Operations |

|

| Three Months Ended September 30, |

| (in thousands, except per share data) | 2024 | | 2023 |

| Revenues | | | |

| Product revenue, net | $ | 35,592 | | | $ | 40,118 | |

| License, collaboration and other revenue | 1,836 | | | 1,928 | |

| Total revenues | 37,428 | | | 42,046 | |

| Cost of goods sold | | | |

| Cost of product and other revenue | 5,150 | | | 8,998 | |

| Amortization of intangible asset | 9,011 | | | 9,011 | |

| Total cost of goods sold | 14,161 | | | 18,009 | |

| Operating expenses | | | |

| Research and development | 8,487 | | | 13,330 | |

| Selling, general and administrative | 26,516 | | | 22,710 | |

| License | 769 | | | 864 | |

| Restructuring | — | | | 169 | |

| Total operating expenses | 35,772 | | | 37,073 | |

| Loss from operations | (12,505) | | | (13,036) | |

| Other expense, net | (6,678) | | | (1,453) | |

| Change in fair value of warrant liability | (856) | | | — | |

| | | |

| Loss on termination of lease | — | | | — | |

| Net loss | $ | (20,039) | | | $ | (14,489) | |

| | | |

| Net loss per share - basic and diluted | $(0.10) | | $(0.08) |

| Weighted-average number of common shares - basic and diluted | 210,348,459 | | 188,306,350 |

| | | | | | | | | | | |

| Unaudited Selected Balance Sheet Data |

|

| (in thousands) | September 30, 2024 | | December 31, 2023 |

| Cash and cash equivalents | $ | 34,019 | | | $ | 42,925 | |

| Working capital | $ | 34,411 | | | $ | 18,279 | |

| Total assets | $ | 207,142 | | | $ | 241,703 | |

| Total stockholders’ (deficit) equity | $ | (50,402) | | | $ | (30,584) | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

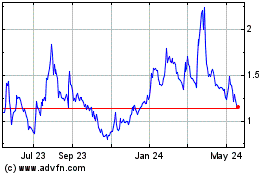

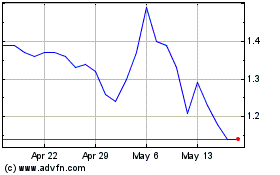

Akebia Therapeutics (NASDAQ:AKBA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Akebia Therapeutics (NASDAQ:AKBA)

Historical Stock Chart

From Nov 2023 to Nov 2024