Amalgamated Financial Corp. (“Amalgamated”, the “Company”, or the

“Bank”) (Nasdaq: AMAL) today announced that its Board of Directors

has approved a new authorization for the repurchase of up to $40

million of the Company’s Class A common stock. The new

authorization replaces the previous share repurchase authorization,

which had approximately $18.7 million remaining as of December 31,

2024.

Priscilla Sims Brown, President and Chief

Executive Officer, commented, “We have begun the year with momentum

across the Bank as our political deposit balances begin to rebuild

following the recent election cycle conclusion and our new business

production pipeline continues to grow. With this noted, we believe

our current share price does not reflect this momentum nor the

opportunity that we see ahead to further grow the Bank. As a

result, this new repurchase authorization is particularly

timely.”

The new repurchase authorization does not

have an expiration date and may, without prior notice, be extended,

modified, amended, suspended or discontinued at any time at the

Company’s discretion and does not commit the Company to repurchase

shares of its common stock. The actual timing, number and value of

the shares to be purchased under the program will be determined by

the Company’s management at its discretion and will depend on a

number of factors, including the performance of the Company’s stock

price, the Company’s ongoing capital planning considerations,

general market and other conditions and applicable legal

requirements.

About Amalgamated Financial

Corp.

Amalgamated Financial Corp. is a Delaware public

benefit corporation and a bank holding company engaged in

commercial banking and financial services through its wholly-owned

subsidiary, Amalgamated Bank. Amalgamated Bank is a New York-based

full-service commercial bank and a chartered trust company with a

combined network of five branches across New York City, Washington

D.C., and San Francisco, and a commercial office in Boston.

Amalgamated Bank was formed in 1923 as Amalgamated Bank of New York

by the Amalgamated Clothing Workers of America, one of the

country's oldest labor unions. Amalgamated Bank provides commercial

banking and trust services nationally and offers a full range of

products and services to both commercial and retail customers.

Amalgamated Bank is a proud member of the Global Alliance for

Banking on Values and is a certified B Corporation®. As of December

31, 2024, our total assets were $8.3 billion, total net loans were

$4.6 billion, and total deposits were $7.2 billion. Additionally,

as of December 31, 2024, our trust business held $35.0 billion in

assets under custody and $14.6 billion in assets under

management.

Forward-Looking Statements

Statements included in this press release that

are not historical in nature are intended to be, and are hereby

identified as, forward-looking statements within the meaning of the

Private Securities Litigation Reform Act, Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are not statements of historical or current fact nor are

they assurances of future performance and generally can be

identified by the use of forward-looking terminology, such as

“may,” “approximately,” “will,” “anticipate,” “should,” “would,”

“believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,”

“possible,” and “intend,” or the negative thereof as well as other

similar words and expressions of the future. Forward-looking

statements are subject to risks, uncertainties and assumptions that

are difficult to predict as to timing, extent, likelihood and

degree of occurrence, which could cause our actual results to

differ materially from those anticipated in or by such statements.

Potential risks and uncertainties include, but are not limited to,

the following: 1. uncertain conditions in the banking industry and

in national, regional and local economies in our core markets,

which may have an adverse impact on our business, operations and

financial performance; 2. deterioration in the financial condition

of borrowers resulting in significant increases in loan losses and

provisions for those losses; 3. deposit outflows and subsequent

declines in liquidity caused by factors that could include lack of

confidence in the banking system, a deterioration in market

conditions or the financial condition of depositors; 4. changes in

our deposits, including an increase in uninsured deposits; 5. our

ability to maintain sufficient liquidity to meet our deposit and

debt obligations as they come due, which may require that we sell

investment securities at a loss, negatively impacting our net

income, earnings and capital; 6. unfavorable conditions in the

capital markets, which may cause declines in our stock price and

the value of our investments; 7. negative economic and political

conditions that adversely affect the general economy, housing

prices, the real estate market, the job market, consumer

confidence, the financial condition of our borrowers and consumer

spending habits, which may affect, among other things, the level of

non-performing assets, charge-offs and provision expense; 8.

fluctuations or unanticipated changes in the interest rate

environment including changes in net interest margin or changes in

the yield curve that affect investments, loans or deposits; 9. the

general decline in the real estate and lending markets,

particularly in commercial real estate in our market areas, and the

effects of the enactment of or changes to rent-control and other

similar regulations on multi-family housing; 10. changes in

legislation, regulation, public policies, or administrative

practices impacting the banking industry, including increased

minimum capital requirements and other regulation in the aftermath

of recent bank failures; 11. the outcome of any legal proceedings

that may be instituted against us; 12. our inability to achieve

organic loan and deposit growth and the composition of that growth;

13. the composition of our loan portfolio, including any

concentration in industries or sectors that may experience

unanticipated or anticipated adverse conditions greater than other

industries or sectors in the national or local economies in which

we operate; 14. inaccuracy of the assumptions and estimates we make

and policies that we implement in establishing our allowance for

credit losses; 15. changes in loan underwriting, credit review or

loss reserve policies associated with economic conditions,

examination conclusions, or regulatory developments; 16. any matter

that would cause us to conclude that there was impairment of any

asset, including intangible assets; 17. limitations on our ability

to declare and pay dividends; 18. the impact of competition with

other financial institutions, including pricing pressures and the

resulting impact on our results, including as a result of

compression to net interest margin; 19. increased competition for

experienced members of the workforce including executives in the

banking industry; 20. a failure in or breach of our operational or

security systems or infrastructure, or those of third party vendors

or other service providers, including as a result of unauthorized

access, computer viruses, phishing schemes, spam attacks, human

error, natural disasters, power loss and other security breaches;

21. increased regulatory scrutiny and exposure from the use of “big

data” techniques, machine learning, and artificial intelligence;

22. downgrade in our credit rating; 23. “greenwashing claims”

against us and our Environmental, Social and Governance (“ESG”)

products and increased scrutiny and political opposition to ESG and

Diversity, Equity and Inclusion (“DEI”) practices; 24. any

unanticipated or greater than anticipated adverse conditions

(including the possibility of earthquakes, wildfires, and other

natural disasters) affecting the markets in which we operate; 25.

physical and transitional risks related to climate change as they

impact our business and the businesses that we finance; 26. future

repurchase of our shares through our common stock repurchase

program; and 27. descriptions of assumptions underlying or relating

to any of the foregoing. Additional factors which could affect the

forward-looking statements can be found in our Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on

Form 8-K filed with the SEC and available on the SEC’s website at

www.sec.gov/. We disclaim any obligation to update or revise any

forward-looking statements contained in this presentation, which

speak only as of the date hereof, or to update the reasons why

actual results could differ from those contained in or implied by

such statements, whether as a result of new information, future

events or otherwise, except as required by law.

Investor Contact:Jamie LillisSolebury Strategic

Communicationsshareholderrelations@amalgamatedbank.com

800-895-4172

Source: Amalgamated Financial Corp.

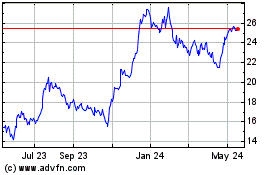

Amalgamated Financial (NASDAQ:AMAL)

Historical Stock Chart

From Feb 2025 to Mar 2025

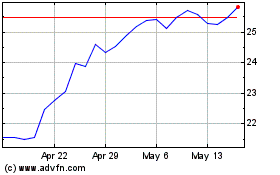

Amalgamated Financial (NASDAQ:AMAL)

Historical Stock Chart

From Mar 2024 to Mar 2025