Alpha and Omega Semiconductor Limited (“AOS”) (NASDAQ: AOSL)

today reported financial results for the fiscal second quarter of

2025 ended December 31, 2024.

The results for the fiscal second quarter of 2025 ended December

31, 2024 were as follows:

GAAP Financial

Comparison

Quarterly

(in millions, except percentage

and per share data)

(unaudited)

Three Months Ended

December 31,

2024

September 30,

2024

December 31,

2023

Revenue

$

173.2

$

181.9

$

165.3

Gross Margin

23.1

%

24.5

%

26.6

%

Operating Loss

$

(5.9

)

$

(0.3

)

$

(1.1

)

Net Loss

$

(6.6

)

$

(2.5

)

$

(2.9

)

Net Loss Per Share - Diluted

$

(0.23

)

$

(0.09

)

$

(0.10

)

Non-GAAP Financial

Comparison

Quarterly

(in millions, except percentage

and per share data)

(unaudited)

Three Months Ended

December 31,

2024

September 30,

2024

December 31,

2023

Revenue

$

173.2

$

181.9

$

165.3

Non-GAAP Gross Margin

24.2

%

25.5

%

28.0

%

Non-GAAP Operating Income

$

3.0

$

7.8

$

8.4

Non-GAAP Net Income

$

2.7

$

6.4

$

7.2

Non-GAAP Net Income Per Share -

Diluted

$

0.09

$

0.21

$

0.24

The non-GAAP financial measures in the schedule above and under

the section “Financial Results for Fiscal Q2 Ended December 31,

2024” below exclude the effect of share-based compensation

expenses, amortization of purchased intangible, legal costs related

to government investigation, equity method investment loss from

equity investee, and income tax effect of non-GAAP adjustments in

each of the periods presented. A detailed reconciliation of GAAP

and non-GAAP financial measures is included at the end of this

press release.

Financial Results for Fiscal Q2 Ended December 31,

2024

- Revenue was $173.2 million, a decrease of 4.8% from the prior

quarter and an increase of 4.8% from the same quarter last

year.

- GAAP gross margin was 23.1%, down from 24.5% in the prior

quarter and down from 26.6% in the same quarter last year.

- Non-GAAP gross margin was 24.2%, down from 25.5% in the prior

quarter and down from 28.0% in the same quarter last year.

- GAAP operating expenses were $45.9 million, up from $44.8

million in the prior quarter and up from $45.1 million in the same

quarter last year.

- Non-GAAP operating expenses were $39.0 million, up from $38.5

million from last quarter and up from $37.9 million in the same

quarter last year.

- GAAP operating loss was $5.9 million, up $0.3 million of

operating loss in the prior quarter and up from $1.1 million of

operating loss in the same quarter last year.

- Non-GAAP operating income was $3.0 million as compared to $7.8

million of operating income for the prior quarter and $8.4 million

of operating income for the same quarter last year.

- GAAP net loss per diluted share was $0.23, compared to $0.09

net loss per share for the prior quarter, and $0.10 net loss per

share for the same quarter a year ago.

- Non-GAAP net income per share was $0.09, compared to $0.21 net

income per share for the prior quarter and $0.24 net income per

share for the same quarter a year ago.

- Consolidated cash flow provided by operating activities was

$14.1 million, as compared to $11.0 million of cash flow provided

by operating activities in the prior quarter.

- The Company closed the quarter with $182.6 million of cash and

cash equivalents.

AOS Chief Executive Officer Stephen Chang commented, “Our fiscal

Q2 results were in-line with our revenue and EPS guidance driven by

seasonal declines in each of our major segments. We saw strength in

Communications and Industrial segments, with notable sequential

growth in graphics cards, quick chargers, PC desktops and power

tools.”

Mr. Chang concluded, “We expect a typical seasonal decline in

the March quarter primarily in markets for battery PCM in

smartphones and quick chargers. While visibility is limited for the

remainder of calendar year 2025, we are well positioned for growth

driven by our strategic focus to ‘go deeper’ with total solutions,

expanding our addressable markets and achieving higher BOM content

and market share.”

Business Outlook for Fiscal Q3 Ending March 31, 2025

The following statements are based on management’s current

expectations. These statements are forward-looking, and actual

results may differ materially. AOS undertakes no obligation to

update these statements.

Our expectations for the fiscal third quarter of year 2025 are

as follows:

- Revenue to be approximately $158 million, plus or minus $10

million.

- GAAP gross margin to be 21.5%, plus or minus 1%. We anticipate

non-GAAP gross margin to be 22.5%, plus or minus 1%. The expected

quarter-over-quarter decline is largely due to the decrease in

license and engineering service revenue and, to a lesser extent,

the anticipated increase in manufacturing costs during the Lunar

New Year period.

- GAAP operating expenses to be in the range of $46.5 million,

plus or minus $1 million. Non-GAAP operating expenses are expected

to be in the range of $39.5 million, plus or minus $1 million.

- Interest expense to be approximately equal to interest income,

and

- Income tax expense to be in the range of $1.1 million to $1.3

million.

Conference Call and Webcast

AOS plans to hold an investor teleconference and live webcast to

discuss the financial results for the fiscal second quarter ended

December 31, 2024 today, February 5, 2025 at 2:00 p.m. PT / 5:00

p.m. ET. To listen to the live conference call, please dial +1

(833) 470-1428 or +1 (404) 975-4839 if dialing from outside the

United States and Canada. The access code is 034315. A live webcast

of the call will also be available in the "Events &

Presentations" section of the company’s investor relations website,

http://investor.aosmd.com. The webcast replay will be available for

seven days after the live call on the same website. In addition, a

copy of the script of management’s prepared remarks and a live

webcast of the call will also be available in the "Events &

Presentations" section of the company’s investor relations website,

http://investor.aosmd.com.

Forward-Looking Statements

This press release contains forward-looking statements that are

based on current expectations, estimates, forecasts and projections

of future performance based on management’s judgment, beliefs,

current trends, and anticipated product performance. These

forward-looking statements include, without limitation, market

trends in the semiconductor industry and growth in calendar year

2025, our ability to outperform market, seasonality of our

business, our ability to pursue new opportunities, our projected

amount of revenue, gross margin, operating income (loss), income

tax expenses, net income (loss), and share-based compensation

expenses, non-GAAP gross margin, non-GAAP operating expenses,

income tax expenses, our ability to grow our sales and market

share, and other information under the section entitled “Business

Outlook for Fiscal Q3 Ending March 31, 2025.” Forward-looking

statements involve risks and uncertainties that may cause actual

results to differ materially from those contained in the

forward-looking statements. These factors include, but are not

limited to, the state of semiconductor industry and seasonality of

our markets; decline of PC markets; our lack of control over the

joint venture in China; difficulties and challenges in executing

our diversification strategy into different market segments;

ordering pattern from distributors and seasonality; changes in

regulatory environment and government investigation; our ability to

introduce or develop new and enhanced products that achieve market

acceptance; government policies on our business operations in

China; the actual product performance in volume production; the

quality and reliability of our product, our ability to achieve

design wins; the general business and economic conditions; our

ability to maintain factory utilization at a desirable level; and

other risks as described in our SEC filings, including our Annual

Report on Form 10-K for the fiscal year ended June 30, 2024 filed

by AOS with the SEC and other periodic reports we filed with the

SEC. Other unknown or unpredictable factors or underlying

assumptions subsequently proving to be incorrect could cause actual

results to differ materially from those in the forward-looking

statements. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

future results, level of activity, performance, or achievements.

You should not place undue reliance on these forward-looking

statements. All information provided in this press release is as of

today’s date, unless otherwise stated, and AOS undertakes no duty

to update such information, except as required under applicable

law.

Use of Non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements

presented on a basis consistent with U.S. GAAP, we disclose certain

non-GAAP financial measures for our historical performance,

including non-GAAP gross profit, gross margin, operating expenses,

operating income (loss), net income (loss), diluted earnings per

share (“EPS”) and EBITDAS. These supplemental measures exclude,

among other items, share-based compensation expenses, legal and

professional fees related to government investigation, amortization

of purchased intangible, income tax effect of non-GAAP adjustments

and equity method investment loss from equity investee. We also

disclose certain non-GAAP financial measures in our guidance for

the next quarter, including non-GAAP gross margin and operating

expenses. We believe that these historical and forecast non-GAAP

financial measures provide useful information to both management

and investors by excluding certain items and expenses that are not

indicative of our core operating results or do not reflect our

normal business operations. In addition, our management uses

non-GAAP measures to compare our performance relative to forecasts

and to benchmark our performance externally against competitors.

Our use of non-GAAP financial measures has certain limitations in

that such non-GAAP financial measures may not be directly

comparable to those reported by other companies. For example, the

terms used in this press release, such as non-GAAP net income

(loss) or non-GAAP operating expenses, do not have a standardized

meaning. Other companies may use the same or similarly named

measures, but exclude different items, which may not provide

investors with a comparable view of our performance in relation to

other companies. In addition, we included the amount of income tax

effect of non-GAAP adjustments in the non-GAAP net income (loss) of

reconciliation table for all periods presented as the management

believes that such non-GAAP presentation provides useful

information to investors, even though the amounts are not

significant. We seek to compensate for the limitation of our

non-GAAP presentation by providing a detailed reconciliation of the

non-GAAP financial measures to the most directly comparable U.S.

GAAP measures both in the text in this press release and in the

tables attached hereto. Investors are encouraged to review the

related U.S. GAAP financial measures and the reconciliation of

these non-GAAP financial measures to their most directly comparable

U.S. GAAP financial measures.

About Alpha and Omega Semiconductor

Alpha and Omega Semiconductor Limited, or AOS, is a designer,

developer, and global supplier of a broad range of discrete power

devices, wide band gap power devices, power management ICs, and

modules, including a wide portfolio of Power MOSFET, SiC, IGBT,

IPM, TVS, HV Gate Drivers, Power IC, and Digital Power products.

AOS has developed extensive intellectual property and technical

knowledge that encompasses the latest advancements in the power

semiconductor industry, which enables us to introduce innovative

products to address the increasingly complex power requirements of

advanced electronics. AOS differentiates itself by integrating its

Discrete and IC semiconductor process technology, product design,

and advanced packaging know-how to develop high-performance power

management solutions. AOS’ portfolio of products targets

high-volume applications, including portable computers, flat-panel

TVs, LED lighting, smartphones, battery packs, consumer and

industrial motor controls, automotive electronics, and power

supplies for TVs, computers, servers, and telecommunications

equipment. For more information, please visit www.aosmd.com.

The following unaudited condensed consolidated financial

statements are prepared in accordance with U.S. GAAP.

Alpha and Omega Semiconductor

Limited

Condensed Consolidated

Statements of Operations

(in thousands, except

percentages and per share amounts)

(unaudited)

Three Months Ended

Six Months Ended

December 31,

2024

September 30,

2024

December 31,

2023

December 31,

2024

December 31,

2023

Revenue

$

173,156

$

181,887

$

165,285

$

355,043

$

345,918

Cost of goods sold

133,145

137,361

121,284

270,506

250,992

Gross profit

40,011

44,526

44,001

84,537

94,926

Gross margin

23.1

%

24.5

%

26.6

%

23.8

%

27.4

%

Operating expenses:

Research and development

23,968

22,478

22,919

46,446

45,032

Selling, general and administrative

21,951

22,300

22,216

44,251

41,647

Total operating expenses

45,919

44,778

45,135

90,697

86,679

Operating income (loss)

(5,908

)

(252

)

(1,134

)

(6,160

)

8,247

Other income (loss), net

663

(650

)

(472

)

13

(446

)

Interest income

1,135

1,265

1,323

2,400

2,644

Interest expenses

(701

)

(812

)

(1,049

)

(1,513

)

(2,141

)

Net income (loss) before income taxes and

loss from equity method investment

(4,811

)

(449

)

(1,332

)

(5,260

)

8,304

Income tax expense

1,242

1,040

894

2,282

2,032

Net income (loss) before loss from equity

method investment

(6,053

)

(1,489

)

(2,226

)

(7,542

)

6,272

Equity method investment loss from equity

investee

(561

)

(1,007

)

(697

)

(1,568

)

(3,409

)

Net income (loss)

$

(6,614

)

$

(2,496

)

$

(2,923

)

$

(9,110

)

$

2,863

Net income (loss) per common share

Basic

$

(0.23

)

$

(0.09

)

$

(0.10

)

$

(0.31

)

$

0.10

Diluted

$

(0.23

)

$

(0.09

)

$

(0.10

)

$

(0.31

)

$

0.10

Weighted average number of common shares

used to compute net income (loss) per share

Basic

29,163

29,004

27,939

29,083

27,816

Diluted

29,163

29,004

27,939

29,083

29,830

Alpha and Omega Semiconductor

Limited

Condensed Consolidated Balance

Sheets

(in thousands, except par

value per share)

(unaudited)

December 31, 2024

June 30, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

182,592

$

175,127

Restricted cash

206

413

Accounts receivable, net

19,879

12,546

Inventories

183,733

195,750

Contract assets

8,451

—

Other current assets

15,433

14,165

Total current assets

410,294

398,001

Property, plant and equipment, net

317,793

336,619

Operating lease right-of-use assets

23,317

25,050

Intangible assets, net

1,893

3,516

Equity method investment

357,941

356,039

Deferred income tax assets

540

549

Other long-term assets

22,166

25,239

Total assets

$

1,133,944

$

1,145,013

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

40,816

$

45,084

Accrued liabilities

71,392

72,371

Payable related to equity investee,

net

18,137

13,682

Income taxes payable

2,943

2,798

Short-term debt

11,742

11,635

Deferred revenue

—

2,591

Finance lease liabilities

970

935

Operating lease liabilities

5,032

5,137

Total current liabilities

151,032

154,233

Long-term debt

20,826

26,724

Income taxes payable - long-term

3,724

3,591

Deferred income tax liabilities

26,754

26,416

Finance lease liabilities - long-term

1,787

2,282

Operating lease liabilities -

long-term

18,851

20,499

Other long-term liabilities

8,390

19,661

Total liabilities

231,364

253,406

Shareholders' Equity:

Preferred shares, par value $0.002 per

share:

Authorized: 10,000 shares; issued and

outstanding: none at December 31, 2024 and June 30, 2024

—

—

Common shares, par value $0.002 per

share:

Authorized: 100,000 shares; issued and

outstanding: 36,367 shares and 29,232 shares, respectively at

December 31, 2024 and 36,107 shares and 28,969 shares, respectively

at June 30, 2024

73

72

Treasury shares at cost: 7,135 shares at

December 31, 2024 and 7,138 shares at June 30, 2024

(79,192

)

(79,213

)

Additional paid-in capital

370,494

353,109

Accumulated other comprehensive loss

(10,722

)

(13,419

)

Retained earnings

621,927

631,058

Total shareholders' equity

902,580

891,607

Total liabilities and shareholders'

equity

$

1,133,944

$

1,145,013

Alpha and Omega Semiconductor

Limited

Selected Cash Flow

Information

( in thousands,

unaudited)

Six Months Ended December

31,

2024

2023

Net cash provided by (used in) operating

activities

$

25,126

$

(9,628

)

Net cash used in investing activities

(14,100

)

(21,431

)

Net cash used in financing activities

(3,732

)

(2,146

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(36

)

80

Net increase (decrease) in cash, cash

equivalents and restricted cash

7,258

(33,125

)

Cash, cash equivalents and restricted cash

at beginning of period

175,540

195,603

Cash, cash equivalents and restricted cash

at end of period

$

182,798

$

162,478

Alpha and Omega Semiconductor

Limited

Reconciliation of Condensed

Consolidated GAAP Financial Measures to Non-GAAP Financial

Measures

(in thousands, except

percentages and per share data)

(unaudited)

Three Months Ended

Six Months Ended

December 31,

2024

September 30,

2024

December 31,

2023

December 31,

2024

December 31,

2023

GAAP gross profit

$

40,011

$

44,526

$

44,001

84,537

$

94,926

Share-based compensation

1,123

1,015

1,504

2,138

1,716

Amortization of purchased intangible

811

812

812

1,623

1,624

Non-GAAP gross profit

$

41,945

$

46,353

$

46,317

$

88,298

$

98,266

Non-GAAP gross margin as a % of

revenue

24.2

%

25.5

%

28.0

%

24.9

%

28.4

%

GAAP operating expense

$

45,919

$

44,778

$

45,135

$

90,697

$

86,679

Share-based compensation

6,827

5,887

7,187

12,714

7,893

Legal costs related to government

investigation

114

347

16

461

68

Non-GAAP operating expense

$

38,978

$

38,544

$

37,932

$

77,522

$

78,718

GAAP operating income (loss)

$

(5,908

)

$

(252

)

$

(1,134

)

$

(6,160

)

$

8,247

Share-based compensation

7,950

6,902

8,691

14,852

9,609

Amortization of purchased intangible

811

812

812

1,623

1,624

Legal costs related to government

investigation

114

347

16

461

68

Non-GAAP operating income

$

2,967

$

7,809

$

8,385

$

10,776

$

19,548

Non-GAAP operating margin as a % of

revenue

1.7

%

4.3

%

5.1

%

3.0

%

5.7

%

GAAP net income (loss)

$

(6,614

)

$

(2,496

)

$

(2,923

)

$

(9,110

)

$

2,863

Share-based compensation

7,950

6,902

8,691

14,852

9,609

Amortization of purchased intangible

811

812

812

1,623

1,624

Equity method investment loss from equity

investee

561

1,007

697

1,568

3,409

Legal costs related to government

investigation

114

347

16

461

68

Income tax effect of non-GAAP

adjustments

(83

)

(151

)

(96

)

(234

)

(502

)

Non-GAAP net income

$

2,739

$

6,421

$

7,197

$

9,160

$

17,071

Non-GAAP net margin as a % of revenue

1.6

%

3.5

%

4.4

%

2.6

%

4.9

%

GAAP net income (loss)

$

(6,614

)

$

(2,496

)

$

(2,923

)

$

(9,110

)

$

2,863

Share-based compensation

7,950

6,902

8,691

14,852

9,609

Amortization and depreciation

14,128

14,562

13,573

28,690

26,524

Equity method investment loss from equity

investee

561

1,007

697

1,568

3,409

Interest income

(1,135

)

(1,265

)

(1,323

)

(2,400

)

(2,644

)

Interest expenses

701

812

1,049

1,513

2,141

Income tax expense

1,242

1,040

894

2,282

2,032

EBITDAS

$

16,833

$

20,562

$

20,658

$

37,395

$

43,934

GAAP diluted net income (loss) per

share

$

(0.21

)

$

(0.08

)

$

(0.10

)

$

(0.29

)

$

0.10

Share-based compensation

0.25

0.22

0.29

0.47

0.32

Amortization of purchased intangible

0.03

0.03

0.03

0.05

0.05

Equity method investment loss from equity

investee

0.02

0.03

0.02

0.05

0.11

Legal costs related to government

investigation

0.00

0.01

0.00

0.02

0.00

Income tax effect of non-GAAP

adjustments

(0.00

)

(0.00

)

(0.00

)

(0.01

)

(0.01

)

Non-GAAP diluted net income per share

$

0.09

$

0.21

$

0.24

$

0.29

$

0.57

Weighted average number of common shares

used to compute GAAP diluted net income (loss) per share

29,163

29,004

27,939

29,083

29,830

Weighted average number of common shares

used to compute Non-GAAP diluted net income per share

31,411

31,169

29,874

31,290

29,830

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203520224/en/

Investor and media inquiries:

The Blueshirt Group Gary Dvorchak, CFA In US +1 (323) 240-5796

In China +86 (138) 1079-1480 gary@blueshirtgroup.co

The Blueshirt Group Steven Pelayo +1 (360) 808-5154

steven@blueshirtgroup.co

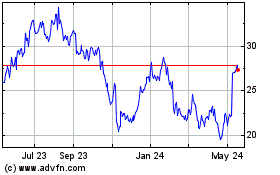

Alpha and Omega Semicond... (NASDAQ:AOSL)

Historical Stock Chart

From Jan 2025 to Feb 2025

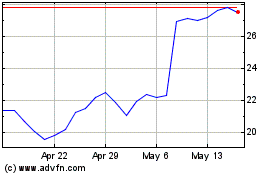

Alpha and Omega Semicond... (NASDAQ:AOSL)

Historical Stock Chart

From Feb 2024 to Feb 2025