As

filed with the Securities and Exchange Commission on September 23, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

APPLIED

DIGITAL CORPORATION

(Exact

name of registrant as specified in its charter)

| Nevada |

|

7374 |

|

95-4863690 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

3811

Turtle Creek Blvd., Suite 2100

Dallas,

Texas 75219

(214)

427-1704

(Address,

including zip code, and telephone number, including

area

code, of registrant’s principal executive offices)

Wes

Cummins

Chief

Executive Officer

Applied

Digital Corporation

3811

Turtle Creek Blvd., Suite 2100

Dallas,

Texas 75219

(214)

427-1704

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Steven

E. Siesser, Esq.

Lowenstein

Sandler LLP

1251

Avenue of the Americas

New

York, New York 10020

Telephone:

(212) 204-8688

Approximate

date of commencement of proposed sale to the public:

From

time to time after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

|

SUBJECT

TO COMPLETION |

|

DATED

SEPTEMBER 23, 2024 |

Up

to 2,500,000

Series

E-1 Redeemable Preferred Stock

This

is an offering by Applied Digital Corporation (the “Company”) of up to 2,500,000 shares of our Series E-1 Redeemable Preferred

Stock, par value $0.001 per share (“Series E-1 Preferred Stock”), at a price per share of $25.00 per share (the “Offering”).

We will pay cumulative dividends on the Series E-1 Preferred Stock at a fixed annual rate of 9% per annum of the stated value of $25.00

per share (the “Stated Value”) of the Series E-1 Preferred Stock per year (computed on the basis of a 360-day year consisting

of twelve 30-day months). Each holder of shares of Series E-1 Preferred Stock is entitled to redeem any portion of the outstanding shares

of Series E-1 Preferred Stock held by such holder at any time, subject to certain early redemption fees. Such redemptions may be settled

in either cash or common stock of the Company, par value $0.001 (the “Common Stock”), at the Company’s option, subject

to certain limitations on the number of shares of Common Stock that may be used for such payments without the approval of the Company’s

stockholders, if applicable; provided that no such shares of Series E-1

Preferred Stock may be redeemed for Common Stock prior to the first anniversary of the date of its issuance. The Company may, at its

option, redeem shares of Series E-1 Preferred Stock on or after the second anniversary of the date on which such shares of Series E-1

Preferred Stock have been issued upon not less than 10 calendar days nor more than 90 calendar days written notice to the holders prior

to the date fixed for redemption thereof, subject to certain limitations on the number of shares of Common Stock that may be used for

such payments without the Company’s stockholders’ consent, if appliable. The Company intends to rely on the exemption provided

by Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities Act”), for the issuance of any shares of Common

Stock for which the Series E-1 Preferred Stock may be redeemed.

There

is currently no public market for our Series E-1 Preferred Stock. We do not intend to apply for listing of the Series E-1 Preferred Stock

on a national securities exchange or over the counter market.

The

dealer manager of this Offering is Preferred Capital Securities, LLC (“PCS” or the “Dealer Manager”). The Dealer

Manager is not required to sell any specific number or dollar amount of the Series E-1 Preferred Stock but will use its “reasonable

best efforts” to sell the Series E-1 Preferred Stock offered. The minimum permitted purchase is generally $5,000 but purchases

of less than $5,000 may be made in our sole discretion. We may terminate this Offering at any time.

| | |

Per share of Series E-1 Preferred Stock | | |

Maximum Offering Before Expenses | |

| Public Offering Price | |

$ | 25.00 | | |

$ | 62,500,000 | |

| Selling Commission(1)(2)(3) | |

$ | 1.50 | | |

$ | 3,750,000 | |

| | |

| | | |

| | |

| Dealer Manager fee(1)(2)(3) | |

$ | 0.50 | | |

$ | 1,250,000 | |

| Proceeds to Applied Digital Corporation(3)(4) | |

$ | 23.00 | | |

$ | 57,500,000 | |

(1)

We will pay a selling commission of up to 6% of the Stated Value of the Series E-1 Preferred Stock and a dealer manager fee equal to

2% of the Stated Value of the Series E-1 Preferred Stock. The selling commission and the dealer manager fee are payable by us to our

Dealer Manager. Reductions in selling commissions on sales of Series E-1 Preferred Stock will be reflected in reduced public offering

prices as described in the “Plan of Distribution” section of this prospectus and the net proceeds to us will not be

impacted by such reductions. We or our affiliates also may provide permissible forms of non-cash compensation to registered representatives

of our Dealer Manager and the participating broker-dealers. The value of such items will be considered underwriting compensation in connection

with this offering, and, if incurred by our Dealer Manager, the corresponding payments of our dealer manager fee will be reduced by the

aggregate value of such items. The combined selling commission, dealer manager fee and cash and non-cash underwriting compensation as

described in “The Offering - Other Expenses” for this Offering will not exceed 8% of the aggregate gross proceeds

of this Offering, subject to FINRA’s 8% underwriting compensation cap. See “Plan of Distribution.”

(2)

We expect our Dealer Manager to authorize third-party broker-dealers that are members of FINRA, which we refer to as participating broker-dealers,

to sell our Series E-1 Preferred Stock, pursuant to the terms of a Selected Dealer Agreement, a form of which is filed with this registration

statement as Exhibit 10.72. In addition to the selling commissions, our Dealer Manager may reallow a portion of its dealer manager

fee to participating broker-dealers as a marketing fee as described further in “Plan of Distribution.”

(3)

Assumes all shares sold were subject to maximum selling commission and dealer manager fee applicable to Series E-1 Preferred Stock.

(4)

We expect that our own Offering Expenses, as defined in “The Offering - Offering Expenses” and including legal, accounting,

printing, mailing, registration qualification and associated securities offering filing costs and expenses, will through the course of

the Offering, be an aggregate of approximately $124,600, but for purposes of illustrating the proceeds to the Company based on

the maximum investment, such Offering Expenses are not reflected. As further described in “The Offering - Offering Expenses.”

Offering Expenses will not exceed the greater of $700,000 or 3.5% of gross offering proceeds. However, our Board of Directors (the “Board”)

may, in its discretion, authorize the Company to incur Offering Expenses in excess of such amounts.

We

will sell the Series E-1 Preferred Stock through Depository Trust Company (“DTC”) settlement (“DTC Settlement”)

or through Direct Registration System settlement (“DRS Settlement”). See the section entitled “Plan of Distribution”

in this prospectus for a description of these settlement methods. All monies collected for subscription through DRS Settlement will be

held in a separate escrowed bank account at UMB Bank, N.A., which is serving as the escrow agent (the “Escrow Agent”). Investors

will pay the full purchase price for their Series E-1 Preferred Stock to the Escrow Agent (as set forth in the subscription agreement),

to be held in trust for the investors’ benefit pending release to us as described herein.

Delivery

of the Series E-1 Preferred Stock will be made from time to time, if at all, on or prior to . Delivery of the Common Stock will be made

from time to time, if at all, upon redemption of the Series E-1 Preferred Stock as further described in this prospectus.

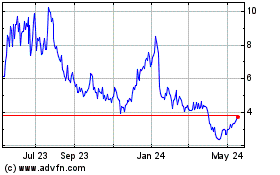

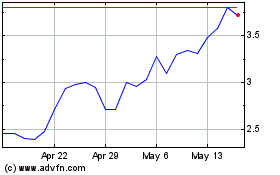

Our

Common Stock is listed on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “APLD.” On September 20,

2024, the last reported sale price of our Common Stock as reported on Nasdaq was $6.02.

You

should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information

by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the risks and uncertainties described in the section captioned “Risk Factors” contained in this prospectus

and in our Annual Report on Form 10-K for the fiscal year ended May 31, 2024, filed with the SEC, on August 30, 2024 and the other

filings we make with the SEC from time to time, which are incorporated by reference herein in their entirety, together with other information

in this prospectus and the information incorporated by reference herein.

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

Preferred

Capital Securities

As

Dealer Manager

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

ABOUT THIS PROSPECTUS

This

prospectus forms part of a registration statement that we filed with the SEC, and that includes exhibits that provide more detail of

the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with

the additional information described under the headings “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” before making your investment decision.

You

should rely only on the information provided in this prospectus or in a prospectus supplement or any free writing prospectuses or amendments

thereto. We have not authorized anyone else to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. You should assume that the information in this prospectus is accurate only as of the date hereof.

Our business, financial condition, results of operations and prospects may have changed since that date.

We

are not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale of these securities

is not permitted. We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction

where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession

of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities as to distribution

of the prospectus outside of the United States.

PROSPECTUS SUMMARY

This

summary highlights information contained elsewhere in this prospectus and the documents incorporated by reference herein. This summary

does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire

prospectus carefully, including the section entitled “Risk Factors” beginning on page S-11, our consolidated financial statements

and the related notes and the other information incorporated by reference into this prospectus before making an investment decision.

Our

Business

We

are a United States (“U.S.”) designer, developer, and operator of next-generation digital infrastructure across North America.

We provide digital infrastructure solutions and cloud services to the rapidly growing industries of High-Performance Computing (“HPC”)

and Artificial Intelligence (“AI”). We operate in three distinct business segments, including, Blockchain datacenter hosting

(the “Datacenter Hosting Business”), cloud services, through a wholly owned subsidiary (the “Cloud Services Business”)

and HPC datacenter hosting (the “HPC Hosting Business”), as further discussed below.

We

completed our initial public offering in April 2022 and our Common Stock began trading on Nasdaq on April 13, 2022. In November 2022,

we changed our name from Applied Blockchain, Inc. to Applied Digital Corporation.

Datacenter

Hosting Business

Our

Data Center Hosting Business provides energized infrastructure services to crypto mining customers. Our custom-designed datacenters allow

customers to rent space based on their power requirements. We currently serve seven crypto-mining customers, all of which have entered

into contracts with us ranging from three to five years. This business segment accounts for the majority of the revenue we generate from

our operations (approximately 83% for the fiscal year ended May 31, 2024).

We

currently operate sites in Jamestown and Ellendale, North Dakota, with a total hosting capacity of approximately 286 MW:

| ● | Jamestown,

North Dakota: 106 MW facility. |

| | | |

| ● | Ellendale,

North Dakota: 180 MW facility. |

In

March 2021, we executed a strategy planning and portfolio advisory services agreement (the “Services Agreement”) with GMR

Limited, a British Virgin Island limited liability company (“GMR”), Xsquared Holding Limited, a British Virgin Island limited

liability company (“SparkPool”) and Valuefinder, a British Virgin Islands limited liability company (“Valuefinder”

and, together with GMR and SparkPool, the “Service Provider(s)”). Under the Services Agreement, the Service Providers agreed

to provide crypto asset mining management and analysis and assist us in securing difficult-to-obtain mining equipment. Under the terms

of the Services Agreement, we issued 7,440,148 shares of our Common Stock to each of GMR and SparkPool and 3,156,426 shares of our Common

Stock to Valuefinder. In June 2022, SparkPool ceased all operations and forfeited 4,965,432 shares of our Common Stock back to us.

In

March 2022, we decided to terminate our crypto mining operations, shifting our focus and our business strategy to developing the HPC

Hosting Business and our other two business segments (including the Datacenter Hosting Business). Each Service Provider advised us concerning

the design and buildout of our hosting operations. We continue to partner with GMR, and other providers as they remain our strategic

equity investors. Our partners have strong relationships across the cryptocurrency ecosystem, which we may leverage to identify leads

for the expansion of our operations and business segments.

Compared

to our previous mining operations, co-hosting revenues are less subject to volatility related to the underlying crypto-asset markets.

We have a contractual ceiling for our energy costs through our Amended and Restated Electric Service Agreement, entered into in September

2023 with a utility in the upper Midwest (the “Electric Service Agreement”). One of the main benefits of the Electric Service

Agreement is the low cost of power for mining. Even before the recently imposed crypto mining restrictions in China, power capacity available

for Bitcoin mining was scarce, especially at scalable sites with over 100 MW of potential capacity. This scarcity of mining power allows

us to realize attractive hosting rates in the current market. The Electric Service Agreement has also enabled us to launch our hosting

business with long-term customer contracts.

In

March 2024, we announced that we entered into a definitive agreement to sell our 200 MW campus in Garden City, TX, to Mara Garden City

LLC, a Delaware limited liability company and subsidiary of Marathon Digital Holdings (Nasdaq: MARA). We completed the sale transaction

on April 1, 2024.

Cloud

Services Business

We

officially launched our Cloud Services Business in May 2023. We operate our Cloud Services Business through our wholly owned subsidiary,

Applied Digital Cloud Corporation (“Applied Digital Cloud”), which provides cloud services to customers, such as AI and machine

learning developers. Our Cloud Services Business specializes in providing GPU computing solutions to empower customers in executing critical

workloads related to AI, machine learning (“ML”), rendering, and other HPC tasks. Our managed hosting cloud service allows

customers to sign service contracts, utilizing our Company-provided equipment for seamless and cost-effective operations.

We

are rolling out multiple GPU clusters, each comprising 1,024 GPUs, which are available for lease by our customers. Additionally, we have

secured contracts with colocation service providers to ensure secure space and energy for our hosting services. Our strategy is to utilize

a blend of third-party colocation and our own HPC datacenters to deliver Cloud services to our customers.

We

currently rely on a few major suppliers for our products in this business segment: NVIDIA Corp. (“NVIDIA”), Super Micro Computer

Inc. (“Super Micro”), Hewlett Packard Enterprise (“HPE”) and Dell Technologies Inc. (“Dell”). In

May 2023, we partnered with Super Micro, a renowned provider of Application-Optimized Total IT Solutions. Together, we aim to deliver

the Company’s Cloud service to our customers. Super Micro’s high-performance server and storage solutions are designed to

address a wide range of computational-intensive workloads. Their next-generation GPU servers are incredibly power-efficient, which is

vital for datacenters as the power requirements for large-scale AI models continue to increase. Optimizing the Total Cost of Ownership

(“TCO”) and Total Cost to Environment (“TCE”) is critical for datacenter operators to ensure sustainable operations.

In

June 2023, we announced a partnership with HPE, a global company specializing in edge-to-cloud technology. As part of this collaboration,

HPE will provide its powerful and energy-efficient supercomputers to support large-scale AI through our cloud service. HPE has been supportive

in core design considerations and engineering of Company-owned facilities which will support Applied Digital Cloud’s infrastructure.

In addition, we have supply agreements with Dell for delivery of AI and GPU servers.

By

May 31, 2024, the Company had received and deployed a total of 6,144 GPUs; 4,096 GPUs were actively recognizing revenue and 2,048 GPUs

were pending customer acceptance to start revenue recognition. The Cloud Services Business currently serves two customers and accounted

for approximately 17% of our revenue in fiscal year 2024. As we ramp up operations in this business segment, we expect to acquire and

deploy additional GPUs, increase revenue from the Cloud Services Business and increase the percentage of our revenue produced by our

Cloud Services Business.

HPC

Hosting Business

Our

HPC Hosting Business specializes in designing, constructing, and managing datacenters tailored to support HPC applications, including

AI.

The

Company is currently building two HPC focused data centers. The first facility, which is nearing completion, is a 7.5 MW facility in

Jamestown, ND location adjacent to the Company’s 106 MW Data center hosting facility. The Company also broke ground on a 100 MW

HPC data center in project in Ellendale, ND, on land located adjacent to its existing 180 MW Data center hosting facility. These separate

and unique buildings, designed and purpose-built for GPUs, will sit separate from the Company’s current buildings and host more

traditional HPC applications, such as natural language processing, machine learning, and additional HPC developments.

The

Company has entered into exclusivity and executed a letter of intent with a US-based hyperscaler for a 400 MW capacity lease, inclusive

of our current 100 MW facility and two forthcoming buildings in Ellendale, North Dakota. On July 26, 2024, the Company extended the initial

exclusivity period under the previously announced letter of intent with the U.S. based hyperscaler for leasing the HPC Ellendale Facility.

The Company is in advanced discussions with traditional financing counterparties for this investment-grade tenant.

We

anticipate that this business segment will begin generating meaningful revenues once the HPC Ellendale Facility becomes operational,

which is expected in calendar year 2025.

Recent

Developments

Series

E-1 Preferred Stock

On

September 23, 2024, we entered into a Dealer Manager Agreement with the Dealer Manager hereunder pursuant to which the Dealer

Manager agreed to serve as the Company’s agent and dealer manager for this Offering of up to 2,500,000 shares of our Series E-1

Preferred Stock, to be offered and sold pursuant to the registration statement of which this prospectus is a part.

Series

E Preferred Stock and Series E-1 Preferred Stock

On

May 16, 2024, we entered into a Dealer Manager Agreement with the Dealer Manager hereunder pursuant to which the Dealer Manager agreed

to serve as the Company’s agent and dealer manager for an offering (the “Series E Offering”) of up to 2,000,000

shares of our Series E Redeemable Preferred Stock, par value $0.001 (the “Series E Preferred Stock”) (the “Series E

Dealer Manager Agreement”). The Company has closed on several offerings of its Series E Redeemable Preferred Stock, par value $0.001

per share (the “Series E Preferred Stock”), subsequent to May 31, 2024. As of the date of this prospectus, we sold 301,673

shares of Series E Preferred Stock for net proceeds of approximately $6.9 million in total. The Series E Dealer Manager Agreement was

terminated upon the termination of the Series E Preferred Stock offering on August 9, 2024.

Series F Preferred Stock

On August 29,

2024, the Company entered into a securities purchase agreement (the “Series F Purchase Agreement”) with YA II PN, LTD. (“YA

Fund”) for the private placement (the “Series F Offering”) of 53,191 shares of Series F Convertible Preferred Stock

of the Company, par value $0.001 per share (the “Series F Preferred Stock”), including 3,191 shares representing an original

issue discount of 6%. The transaction closed on August 30, 2024, for total net proceeds to the Company of $50.0 million.

Each outstanding

share of Series F Preferred Stock is entitled to receive, in preference to our Common Stock, cumulative dividends (“Preferential

Dividends”), payable quarterly in arrears, at an annual rate of 9.0% of $1,000.00 per share of Series F Preferred Stock (the “Series

F Stated Value”). At our discretion, the Preferential Dividends shall be payable either in cash or in kind or accrue and compound

in an amount equal to 8.0% multiplied by the Series F Stated Value. In addition, each holder of Series F Preferred Stock will be entitled

to receive dividends equal to, on an as-converted to shares of our Common Stock basis, and in the same form as, dividends actually paid

on shares of our Common Stock when, as, and if such dividends are paid on shares our Common Stock. The Series F Preferred Stock will

initially be non-convertible and will only become convertible upon, and subject to, the receipt of shareholder approval. If shareholder

approval is not obtained for any reason, the Series F Preferred Stock will remain non-convertible. The Company filed the Certificate

of Designation of the Series F Preferred Stock with the Secretary of State of the State of Nevada on August 30, 2024.

The Company and

YA Fund also entered into a registration rights agreement (the “Series F Registration Rights Agreement”), pursuant to which

the Company agreed to prepare and file with the SEC a Registration Statement on Form S-1,

registering the resale of the shares, within 45 days of signing the Series F Registration Rights Agreement (subject to certain

exceptions).

Additionally,

in connection with the Series F Offering, the Company agreed to eliminate the $16.0 million per month conversion limitation that exists

in the aggregate across the YA Notes.

SEPA

On August 28, 2024, the Company entered into a

Standby Equity Purchase Agreement with YA Fund, as amended on August 29, 2024 (the “SEPA”). Pursuant to the SEPA, subject

to certain conditions and limitations, the Company has the option, but not the obligation, to sell to YA Fund, and YA Fund must subscribe

for, an aggregate amount of up to $250.0 million of Common Stock, at the Company’s request any time during the commitment period

commencing on September 30, 2024, and terminating on the first day of the month next following the 36-month anniversary of September

30, 2024. The shares of Common Stock issuable pursuant to the SEPA will be offered and sold pursuant to Section 4(a)(2) of the Securities

Act.

In connection

with the execution of the SEPA, the Company agreed to pay a structuring fee (in cash) to YA Fund in the amount of $25,000. Additionally,

the Company agreed to pay a commitment fee of $2,125,000 to YA Fund, payable on the effective date of the SEPA, in the form of the issuance

of 456,287 shares of Common Stock (the “Commitment Shares”), representing $2,125,000 divided by the average of the daily

VWAPs of the Common Stock during the three trading days immediately prior to the date of the SEPA.

Pursuant to the

SEPA, the Company agreed to file a registration statement with the SEC for the resale under the Securities Act by YA Fund of the Common

Stock issued under the SEPA, including the Commitment Shares. The Company shall not have the ability to request any advances under the

SEPA until such resale registration statement is declared effective by the SEC.

CIM

Arrangement

On

June 7, 2024, APLD Holdings 2 LLC (“APLD Holdings”), a subsidiary of the Company, entered into a promissory note (the “CIM

Promissory Note”) with CIM APLD Lender Holdings, LLC (the “CIM Lender”). The CIM Promissory Note provides for an initial

borrowing of $15 million, which was drawn on June 7, 2024, and subsequent borrowings of up to $110 million, which will be available subject

to the satisfaction of certain conditions as outlined in the CIM Promissory Note. In addition to the initial borrowing, the CIM Promissory

Note includes an accordion feature that allows for up to an additional $75 million of borrowings. Principal amounts repaid under the

CIM Promissory Note will not be available for reborrowing. As partial consideration for the CIM Promissory Note, the Company agreed to

issue to the CIM Lender warrants to purchase up to an aggregate of 9,265,366 shares of Common Stock. The warrants were issuable in two

tranches, (i) for the purchase of up to 6,300,449 shares of Common Stock (the “Initial Warrant”), and (ii) for the purchase

of up to 2,964,917 shares of Common Stock (the “Warrant”). The Initial Warrant was issued on June 17, 2024.

On

August 11, 2024, we and the CIM Lender entered into a waiver agreement (the “Waiver Agreement”), whereby the CIM Lender agreed

to waive the satisfaction of certain conditions for the subsequent borrowings, allowing us to draw an additional $20 million (net of

original discount and fees) of borrowings under the CIM Promissory Note. As partial consideration for the Waiver Agreement, we issued

the Warrant to the CIM Lender. As of the date of this prospectus, the total balance outstanding under the CIM Promissory Note is approximately

$105 million.

Yorkville

Amendments

In

connection with the CIM Promissory Note, we also entered into a Consent, Waiver and First Amendment to Prepaid Advance Agreements (the

“Consent”) with YA Fund. In exchange for YA Fund’s consent to the

transaction with the CIM Lender, we agreed to issue an aggregate of 100,000 shares of Common Stock to YA Fund and to conditionally lower

the floor price from $3.00 to $2.00 so long as the daily VWAP is less than $3.00 per share of Common Stock for five out of seven trading

days. We further agreed to deliver a security agreement whereby our subsidiary, Applied Digital Cloud Corporation, would grant a springing

lien on substantially all of its assets subject to customary carve-outs to secure the promissory notes issued in favor of YA Fund. Pursuant

to the Consent, YA Fund also consented to future project-level financing at the HPC Ellendale Facility.

In

addition, pursuant to the terms of the Consent, the Prepaid Advance Agreement entered into between the Company and YA Fund on March 27,

2024 (the “March PPA”) and the Prepaid Advance Agreement entered into between the Company and YA Fund on May 24, 2024 (the

“May PPA” and, together with the March PPA, the “Prepaid Advance Agreements”) were amended to provide for prepayment

of the convertible unsecured promissory note in the amount of up to $42.1 million issued pursuant to the May PPA (the “May Note”

and together with the two convertible unsecured promissory notes in the amount of up to $50 million issued pursuant to the March PPA

(the “Initial YA Notes”), the “YA Notes”), in pro rata weekly installments of $2.5 million in cash or (at YA

Fund’s sole election) $5.0 million in Common Stock, commencing on July 8, 2024, for so long as either the Registration Statement

on Form S-3 filed by the Company on April 15, 2024 or the Registration Statement on Form S-1 filed by the Company on May 31, 2024 (the

“May Registration Statement”) is ineffective, or if the SEC does not declare the May Registration Statement effective by

such date. If elected to be paid in Common Stock, such shares would be issued at 95% of the lowest daily VWAP during the five trading

day period immediately preceding the prepayment date. As of the date of this prospectus, the

aggregate principal amount outstanding under the Initial YA Notes is $6.2 million and the May Note is no longer outstanding.

In

connection with the Series F Offering (as defined below), the Company entered into a Second Amendment (“Amendment No. 2”)

and a Third Amendment (“Amendment No. 3”) to the March PPA and the May PPA. Pursuant to the terms of Amendment No. 2, the

March PPA and the May PPA, and the Optional Redemption provisions set forth in the YA Notes, were amended such that the Company may only

redeem early a portion or all amounts outstanding under the YA Notes in cash after January 1, 2025. Pursuant to Amendment No. 3, the

March PPA and the May PPA were amended to eliminate the $16.0 million per month conversion limitation that exists in the aggregate across

the YA Notes.

Increase

In Authorized Shares

On

June 11, 2024, we filed a Certificate of Amendment (the “Certificate of Amendment”) to our Second Amended and Restated Articles

of Incorporation, as amended (the “Articles of Incorporation”). Pursuant to the Certificate of Amendment, the number of authorized

shares of Common Stock was increased to 300,000,000. The Certificate of Amendment became effective upon filing on June 11, 2024.

At-the-Market

Sales Agreement

On

July 9, 2024, we entered into a Sales Agreement with B. Riley Securities, Inc., BTIG, LLC, Lake Street Capital Markets, LLC, Northland

Securities, Inc. and Roth Capital Partners, LLC (the “Sales Agreement”). Up to $125,000,000 of shares of our Common Stock

may be issued if and when sold pursuant to the Sales Agreement. As of the date of this prospectus, approximately 2.9 million shares of

our Common Stock have been issued and sold under the Sales Agreement for approximate proceeds to us of $16.4 million.

Garden

City Release of Escrow Funds

On

July 30, 2024, we announced that the conditional approval requirements related to the release of the escrowed funds from the sale of

our Garden City hosting facility have been met. As of the date of this prospectus, we have received the remaining $25 million of the

purchase price, previously held in escrow pending such conditional approval.

PIPE

On

September 5, 2024, the Company entered into a securities purchase agreement (the “PIPE Purchase Agreement”) with the purchasers

named therein (the “PIPE Purchasers”), for the private placement of 49,382,720 shares of the Company’s Common Stock,

at a purchase price of $3.24 per share, representing the last closing price of the Common Stock on Nasdaq on September 4, 2024. The private

placement closed on September 9, 2024, with aggregate gross proceeds to the Company of approximately $160 million, before deducting offering

expenses.

The

Company and the PIPE Purchasers also entered into a registration rights agreement (the “PIPE Registration Rights Agreement”),

pursuant to which the Company agreed to prepare and file with the SEC a Registration Statement on Form S-1, registering the resale of

the shares, within 30 days of signing the PIPE Registration Rights Agreement (subject to certain exceptions).

Corporate

Information

Our

executive office is located at 3811 Turtle Creek Blvd., Suite 2100, Dallas, Texas 75219, and our phone number is (214) 427-1704. Our

principal website address is www.applieddigital.com.

We

make available free of charge through the Investor Relations link on our website access to press releases and investor presentations,

as well as all materials that we file electronically with the SEC, including our annual report on Form 10-K, quarterly reports on Form

10-Q, current reports on Form 8-K and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange

Act as soon as reasonably practicable after electronically filing such materials with, or furnishing them to, the SEC. In addition, the

SEC maintains an Internet website, www.sec.gov, that contains reports, proxy and information statements and other information that we

file electronically with the SEC. Information contained in, or accessible through, our website does not constitute part of this prospectus

or the registration statement of which it forms a part and inclusions of our website address in this prospectus or the registration statement

are inactive textual references only. You should not rely on any such information in making your decision whether to purchase our securities.

We

are a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and may rely on exemptions from certain disclosure

requirements that are available to smaller reporting companies under the Exchange Act.

THE

OFFERING

The

following summary contains the principal terms of this Offering. The summary is not intended to be complete. You should read the full

text and more specific details contained elsewhere in this prospectus.

| Offered

Securities |

|

Up

to 2,500,000 shares of Series E-1 Preferred Stock. |

| |

|

|

| Maximum

Common Stock that may be issued upon Redemption of our Series E-1 Preferred Stock |

|

25,475,751

shares of Common Stock. |

| |

|

|

| Common

Stock to be outstanding after maximum Redemption of our Series E Preferred Stock |

|

239,987,197 shares

of Common Stock, assuming the issuance of 25,475,751 shares of Common Stock issuable upon maximum redemption of the Series

E-1 Preferred Stock in this Offering which is equal to 19.99% of the number of shares outstanding shares of Common Stock

immediately prior to the commencement of the Series E Offering. The Company does not intend to issue more than 19.99% of the number

of shares of our outstanding shares of Common Stock immediately prior to the commencement of the Series E Offering upon redemption

of the Series E-1 Preferred Stock in this Offering. The actual number of shares of our Common Stock issued will vary depending

on the value of our shares of Common Stock from time to time, if and when, shares of the Series E-1 Preferred Stock are redeemed and

whether the Company determines to pay any particular redemption in cash or Common Stock. See “Risk Factors - Substantial

blocks of our Common Stock may be sold into the market as a result of the conversion of outstanding Series F Preferred Stock, the

SEPA, the Sales Agreement and the March PPA” on page S-14 of this prospectus. |

| |

|

|

| Dealer

Manager |

|

The

dealer manager of this Offering is Preferred Capital Securities, LLC (“PCS” or the “Dealer Manager”). The

Dealer Manager is not required to sell any specific number or dollar amount of the Series E-1 Preferred Stock, but will use its “best

efforts” to sell the Series E-1 Preferred Stock offered. Our Dealer Manager may reallow a portion of its dealer manager fee

to participating broker-dealers as a marketing fee as described further in “Plan of Distribution.” |

| |

|

|

| Stated

Value |

|

$25.00

per share |

| |

|

|

| Ranking |

|

The

Series E-1 Preferred Stock ranks, with respect to the payment of dividends and rights upon our liquidation, dissolution or winding

up of our affairs: (i) prior or senior to all classes or series of our Common Stock and any other class or series of equity securities,

if the holders of Series E-1 Preferred Stock are entitled to the receipt of dividends or of amounts distributable upon liquidation,

dissolution or winding up in preference or priority to the holders of shares of such class or series; (ii) on a parity with the Series

E Preferred Stock and the Series F Preferred Stock, in proportion to their respective amounts of accrued and unpaid dividends per

share or liquidation preferences; (iii) on a parity with other classes or series of our equity securities issued in the future if,

pursuant to the specific terms of such class or series of equity securities, the holders of such class or series of equity securities

and the holders of Series E-1 Preferred Stock are entitled to the receipt of dividends and of amounts distributable upon liquidation,

dissolution or winding up in proportion to their respective amounts of accrued and unpaid dividends per share or liquidation preferences,

without preference or priority of one over the other; (iv) junior to any class or series of our equity securities if, pursuant to

the specific terms of such class or series, the holders of such class or series are entitled to the receipt of dividends or amounts

distributable upon liquidation, dissolution or winding up in preference or priority to the holders of the Series E-1 Preferred Stock

(none of which are currently outstanding); and (v) junior to all our existing and future debt indebtedness. |

| Maturity |

|

Shares

of the Series E-1 Preferred Stock have no stated maturity. Shares of the Series E-1 Preferred Stock will remain outstanding indefinitely

unless they are redeemed or repurchased by the Company. The Company is not required to set apart for payment funds to redeem the

Series E-1 Preferred Stock and may pay for any redemption of the Series E-1 Preferred Stock in cash or shares of Common Stock; provided,

however, that no Holder Optional Redemption

(as defined below) with respect to any share of Series E-1 Preferred Stock may be redeemed for Common Stock prior to the first anniversary

of the date of its issuance, and (iii) the Company shall not exercise the Company Optional Redemption (as defined below) with respect

to any share of Series E-1 Preferred Stock prior to the second anniversary of the date of its issuance (the “Redemption Eligibility

Date”). |

| |

|

|

| Dividends |

|

Holders

of the Series E-1 Preferred Stock shall be entitled to receive a cumulative dividend at a fixed annual rate of 9% per annum of the

Stated Value of the Series E-1 Preferred Stock per year (computed on the basis of a 360-day year consisting of twelve 30-day months).

Dividends will be declared and accrued monthly. Such dividends shall be payable upon Board approval, which may not be monthly, out

of legally available funds in cash. The Series E-1 Preferred Stock shall rank on parity with the Series E Preferred Stock and the

Series F Preferred Stock with respect to the right to receive payment of any dividends in proportion to their respective amounts

of accrued and unpaid dividends per share. Unless full cumulative dividends on our shares of Series E-1 Preferred Stock for all past

dividend periods have been paid (or set apart for payment), we will not declare or pay dividends with respect to any shares of our

Common Stock or other stock ranking junior to the Series E-1 Preferred Stock for any period. |

| |

|

|

| Liquidation

Preference |

|

Subject

to the liquidation preference stated in the ranking section above, the Series E-1 Preferred Stock will be entitled to be paid out

of the funds and assets available for distribution, an amount per share equal to the Stated Value, plus an amount per share that

is issuable as the result of accrued or unpaid dividends. After payment to the holders of the Series E-1 Preferred Stock, and to

the holders of shares of any other class or series of capital stock ranking senior to or on a parity with the Series E-1 Preferred

Stock, including, without limitation, the Series E Preferred Stock and Series F Preferred Stock, the remaining funds and assets available

for distribution to Company stockholders shall be distributed among the holders of shares of Common Stock, pro rata based on the

number of shares of Common Stock held by each such holder. |

| Holder

Optional Redemption |

|

Each

holder of shares of Series E-1 Preferred Stock is entitled to redeem any portion of the outstanding

Series E-1 Preferred Stock held by such holder (a “Holder Optional Redemption”)

at any time.

At

the option of the Company, a Holder Optional Redemption may be redeemed in either cash or our Common Stock; provided, however, that

(i) if required by Rule 5635(d) of The Nasdaq Stock Market, the aggregate number of shares of Common Stock issuable to holders of

Series E-1 Preferred Stock for dividends and redemption shall not exceed 19.99% of the outstanding shares of Common Stock (the

“Redemption Share Cap”), unless approval by our stockholders is obtained to exceed the Redemption Share Cap, and

(ii) no Holder Optional Redemption with respect to any share of Series E-1 Preferred Stock may be redeemed for Common Stock prior

to the first anniversary of the date of its issuance.

The

Company will settle any Holder Optional Redemption the Company determines to redeem in cash by paying the holder the Settlement Amount

(as defined below). The “Settlement Amount” means (A) the Stated Value, plus (B) unpaid dividends accrued to, but not

including, the Holder Redemption Exercise Date (as defined below), minus (C) the Holder Optional Redemption Fee (as defined below)

applicable on the respective Holder Redemption Deadline (as defined below). The Company will settle any Holder Optional Redemption

the Company determines to redeem with Common Stock, subject to the Redemption Share Cap, if applicable, by delivering to the holder

a number of shares of our Common Stock equal to (1) the Settlement Amount divided by (2) the closing price per share of our Common

Stock on Nasdaq on the last trading day prior to the Holder Redemption Exercise Date (as defined below).

Holders

of Series E-1 Preferred Stock may elect to redeem their shares of Series E-1 Preferred Stock at any time by delivering to Preferred

Shareholder Services, LLC (“PSS”), an affiliate of the Dealer Manager, a notice of redemption (the “Holder Redemption

Notice”). See “Plan of Distribution – Operations” for further information regarding the non-distribution

services to be provided by PSS. A Holder Redemption Notice will be effective as of the last business day of the month after a Holder

Redemption Notice is duly received by PSS (such date, a “Holder Redemption Deadline”). Any Holder Redemption Notice received

after 5:00 p.m. Eastern time on a Holder Redemption Deadline will be effective as of the next Holder Redemption Deadline. For all

shares of Series E-1 Preferred Stock duly submitted for redemption on or before a Holder Redemption Deadline, we, in our sole discretion,

shall determine the Settlement Amount on any business day after such Holder Redemption Deadline but before the next Holder Redemption

Deadline (such date, the “Holder Redemption Exercise Date”). The Company may, in our sole discretion, permit a holder

to revoke their Holder Redemption Notice at any time prior to 5:00 pm, Eastern time, on the business day immediately preceding the

Holder Redemption Exercise Date. Please also see Holder Optional Redemption Fee below. |

| |

|

|

| Company

Optional Redemption |

|

Subject

to the restrictions described herein and unless prohibited by Nevada law, a share of Series E-1 Preferred Stock may be redeemed at

our option (the “Company Optional Redemption”) on or after the Redemption Eligibility Date upon not less than 10 calendar

days nor more than 90 calendar days written notice (the date upon which such written notice is provided to holders, the “Company

Optional Redemption Notice Exercise Date”) to the holders prior to the date fixed for redemption thereof, at a redemption price

of 100% of the Stated Value of the shares of Series E-1 Preferred Stock to be redeemed plus accrued but unpaid dividends (at a rate

equal to (1) the Settlement Amount divided by (2) the closing price of shares of our Common Stock on Nasdaq, or other national securities

exchange on which the Common Stock is listed, on the last trading day prior to the Company Optional Redemption Notice Exercise Date).

In the Company’s sole and absolute discretion, the Company may determine to fulfill a Company Optional Redemption in either

cash or with fully paid and non-assessable shares of our Common Stock, subject to the Redemption Share Cap, if applicable. If the

Company exercises the Company Optional Redemption for less than all of the outstanding shares of Series E-1 Preferred Stock, then

shares of Series E-1 Preferred Stock shall be selected for redemption on a pro rata basis or by lot across holders of the series

of Series E-1 Preferred Stock selected for redemption. |

| Holder

Optional Redemption Fee |

|

A

share of Series E-1 Preferred Stock is subject to an early redemption fee if it is redeemed

by its holder within three years of its issuance (the “Holder Optional Redemption Fee”).

The amount of the fee equals a percentage of the Stated Value disclosed herein based on the

year in which the redemption occurs after the Series E-1 Preferred Stock is issued as follows:

|

| |

|

● |

Prior

to the first anniversary of the issuance of such Series E-1 Preferred Stock: 9% of the Stated Value disclosed herein, which equals

$2.25 per share of Series E-1 Preferred Stock; |

| |

|

|

|

| |

|

● |

On

or after the first anniversary but prior to the second anniversary: 7% of the Stated Value disclosed herein, which equals $1.75 per

share of Series E-1 Preferred Stock; |

| |

|

|

|

| |

|

● |

On

or after the second anniversary but prior to the third anniversary: 5% of the Stated Value disclosed herein, which equals $1.25 per

share of Series E-1 Preferred Stock; and |

| |

|

|

|

| |

|

● |

On

or after the third anniversary: 0%. |

| |

|

The

Company is permitted to waive the Holder Optional Redemption Fee. Although the Company has retained the right to waive the Holder

Optional Redemption Fee in the manner described above, we are not required to establish any such waivers and we may never establish

any such waivers. |

| |

|

|

| Optional

Redemption Following Death of a Holder |

|

Subject

to restrictions, beginning on the date of original issuance and ending on December 31st of the year in which the third

anniversary of the date of issuance occurs, we will redeem shares of Series E-1 Preferred Stock of a beneficial owner who is a natural

person (including a natural person who holds shares of Series E-1 Preferred Stock through an Individual Retirement Account or in

a personal or estate planning trust) upon his or her death at the written request of the beneficial owner’s estate (such date

the requested is received by us, the “Optional Redemption Following Death of a Holder Notice Date”) at a redemption price

equal to the Settlement Amount without application of the Holder Optional Redemption Fee. In our sole and absolute discretion, we

may determine to fulfill such redemption in either cash or with fully paid and non-assessable shares of our Common Stock (at a rate

equal to (1) the Settlement Amount divided by (2) the closing price of shares of our Common Stock on Nasdaq, or other national securities

exchange on which the Common Stock is listed, on the last trading day prior to the Optional Redemption Following Death of a Holder

Notice Date), subject to the Redemption Share Cap, if applicable. |

| Voting

Rights |

|

Holders

of our Series E-1 Preferred Stock do not have any Company voting rights. |

| |

|

|

| Listing

of Series E-1 Preferred Stock |

|

The

Company does not intend to apply for listing of the Series E-1 Preferred Stock on any national securities exchange or over the counter

market. |

| |

|

|

| Use

of Proceeds |

|

We

intend to use the net proceeds from this Offering for working capital and general corporate purpose. See “Use of Proceeds”

in this prospectus beginning on page S-16. |

| |

|

|

| Selling

Commissions |

|

Up

to 6% of the Stated Value of each share of Series E-1 Preferred Stock sold in the Offering will be paid by the Company to the Dealer

Manager and reallowed to participating broker-dealers. Payment of the selling commissions by the Company may be reduced or waived

in certain circumstances. See “Plan of Distribution.” |

| |

|

|

| Dealer

Manager Fee |

|

Up

to 2% of the Stated Value of each share of Series E-1 Preferred Stock sold in the Offering will be paid by the Company to the Dealer

Manager and reallowed to participating broker-dealers. Payment of the dealer manager fee by the Company may be reduced or waived

in certain circumstances. Further, a portion of the dealer manager fee may be reallowed to participating broker-dealers as a marketing

fee. See “Plan of Distribution.” |

| |

|

|

| Other

Expenses |

|

The

Company, the Dealer Manager, a participating broker dealer, or other financial intermediary

may incur other costs and expenses that are considered underwriting compensation (“Other

Expenses”) associated with the sale, or the facilitation of the marketing, of shares

of Series E-1 Preferred Stock. These expenses may include:

|

| |

|

● |

travel

and entertainment expenses, including those of the wholesalers; |

| |

|

|

|

| |

|

● |

expenses

incurred in coordinating broker-dealer seminars and meetings; |

| |

|

|

|

| |

|

● |

certain

wholesaling activities and wholesaling expense reimbursements paid by PCS or its affiliates to other entities; |

| |

|

|

|

| |

|

● |

the

national and regional sales conferences of our participating broker-dealers; |

| |

|

|

|

| |

|

● |

training

and education meetings for registered representatives of our participating broker dealers; |

| |

|

|

|

| |

|

● |

certain

legal expenses of the Dealer Manager associated with the required FINRA filing of the proposed underwriting terms and arrangements; |

| |

|

|

|

| |

|

● |

technology

fees paid to certain participating broker-dealers so that they can maintain the technology necessary to adequately service the investors

to whom they sold Series E-1 Preferred Stock; |

| |

|

|

|

| |

|

● |

due

diligence expenses although only reasonable out-of-pocket due diligence expenses that are detailed on an itemized invoice will be

reimbursed to a participating broker-dealer; and |

| |

|

|

|

| |

|

● |

permissible

forms of non-cash compensation to registered representatives of our participating broker-dealers, such as logo apparel items and

gifts that do not exceed an aggregate value of $100 per annum per registered representative and that are not pre-conditioned on achievement

of a sales target (including, but not limited to, seasonal gifts). |

| |

|

Other

Expenses are considered underwriting compensations and will be reimbursed by us or if incurred by our Dealer Manager, the corresponding

payments of the dealer manager fee may be reduced by the aggregate value of such compensation. However, in no event will all forms of

underwriting compensation in this offering exceed 8% of gross Offering proceeds. |

| Offering

Expenses |

|

The

Company will pay Offering Expenses which are not considered underwriting compensation under

FINRA Rule 5110 (“Offering Expenses”), directly or by reimbursing the Dealer

Manager and/or a participating financial intermediary for Offering Expenses, in an amount

which, in the aggregate, will not exceed the greater of: $700,000 and 3.5% of the gross

proceeds of the Offering (the “Maximum Offering Expenses”). The Company will

not pay or reimburse Offering Expenses in excess of the then applicable Maximum Offering

Expenses without advance approval by the Company’s Board.

Offering

Expenses include the following:

|

| |

|

● |

expenses

and taxes related to the filing, registration and qualification, as necessary, of the sale of the shares of Series E-1 Preferred

Stock under federal and state laws and FINRA rules, including taxes and fees and accountants’ and attorneys’ fees; |

| |

|

|

|

| |

|

● |

expenses

for printing and amending registration statements or supplementing prospectuses; |

| |

|

|

|

| |

|

● |

mailing

and distributing costs; |

| |

|

|

|

| |

|

● |

all

advertising and marketing expenses (including actual costs incurred for travel, meals and lodging for our employees to attend retail

seminars hosted by broker-dealers or bona fide training or educational meetings hosted by us; |

| |

|

|

|

| |

|

● |

charges

of transfer agents, registrars and experts and fees; |

| |

|

|

|

| |

|

● |

expenses

in connection with non-offering issuer support services relating to the Series E-1 Preferred Stock; and |

| |

|

|

|

| |

|

● |

expenses

for establishing servicing arrangements for new shareholder accounts. |

| Material

Tax Considerations |

|

You

should consult your tax advisors concerning the U.S. federal income tax consequences of owning our Series E-1 Preferred Stock in

light of your own specific situation, as well as consequences arising under the laws of any other taxing jurisdiction. |

| |

|

|

| Transfer

Agent |

|

Computershare

Trust Company, N.A. (the “Transfer Agent”) |

| |

|

|

| Nasdaq

Symbol |

|

“APLD.” |

| |

|

|

| Risk

Factors |

|

An

investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-11 of this

prospectus. In addition, before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties

described in the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year

ended May 31, 2024, filed with the SEC on August 30, 2024, and other filings we make with the SEC from time to time, which are incorporated

by reference herein in their entirety, together with other information in this prospectus and the information incorporated by reference

herein. |

The

number of shares of Common Stock to be outstanding upon maximum redemption of the Series E-1 Preferred Stock is based on 214,511,446

shares of our Common Stock outstanding as of September 20, 2024 and excludes the following, each as of September 20, 2024:

| |

● |

14,883,085

shares of Common Stock reserved for future issuance under the Applied Blockchain, Inc. 2022 Incentive Plan, as amended; |

| |

|

|

| |

● |

652,964

shares of Common Stock reserved for future issuance under the Applied Blockchain, Inc. 2022 Non-Employee Director Stock Plan, as

amended; |

| |

|

|

| |

● |

204,168

shares of Common Stock reserved for issuance under restricted stock unit awards to certain consultants; |

| |

|

|

| |

● |

5,032,802

shares of Common Stock held in treasury; |

| |

|

|

| |

● |

12,265,366

shares of Common Stock reserved for issuance upon exercise of outstanding warrants; |

| |

|

|

| |

● |

1,698,327

shares of Common Stock reserved for issuance upon the maximum redemption of the Series E Preferred Stock; |

| |

|

|

| |

● |

9,769,640

shares of Common Stock reserved for issuance upon the conversion of the Initial YA Notes; |

| |

|

|

| |

● |

24,471,329

shares of Common Stock reserved for issuance under the SEPA; and |

| |

|

|

| |

● |

7,598,714

shares of Common Stock reserved for issuance upon the conversion of the Series F Preferred Stock; and |

| |

|

|

| |

● |

Up

to 18,039,867 shares of our Common Stock to be issued if and when sold pursuant to the Sales Agreement (assuming a

public offering price of $6.02 per share, which was the closing price of our Common Stock on Nasdaq on September 20, 2024).

The actual number of shares issued will vary depending on the prices at which the shares of Common Stock are sold from time. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the risks and uncertainties described below and the risks and uncertainties in the section captioned “Risk Factors”

contained in our Annual Report on Form 10-K for the fiscal year ended May 31, 2024, filed with the SEC on August 30, 2024, and our other

filings that we make with the SEC from time to time, which are incorporated by reference herein in their entirety, together with other

information in this prospectus and the information incorporated by reference herein. If any of these risks actually occurs, our business,

financial condition, results of operations or cash flow could suffer materially. In such an event, the trading price of our shares of

Common Stock could decline, and you might lose all or part of your investment.

Risks

Related to This Offering

The

Series E-1 Preferred Stock is subordinated in right of payment to our existing and future debt, and your interests could be diluted by

the issuance of additional preferred stock, including additional shares of Series E-1 Preferred Stock, and by other transactions.

The

Series E-1 Preferred Stock ranks on parity with the Series E Preferred Stock and Series F Preferred Stock and is subordinated in right

of payment to all of our existing and future debt. We are currently authorized to issue 5,000,000 shares of preferred stock at $0.001

par value per share (the “Preferred Stock”), in one or more series. As of the date of this prospectus, 2,120,578 shares

of Preferred Stock have been issued and retired, 354,864 shares of Preferred Stock are outstanding and 1,698,327 shares of Preferred

Stock remain available and authorized for issuance. Other than disclosed in this prospectus, the terms of the Series E-1 Preferred Stock

do not restrict our ability to authorize or issue shares of a class or series of preferred stock with rights to distributions or upon

liquidation that are on parity with or senior to the Series E-1 Preferred Stock or to incur additional indebtedness. The issuance of

additional preferred stock on parity with or senior to the Series E-1 Preferred Stock would dilute the interests of the holders of the

Series E-1 Preferred Stock, and any issuance of preferred stock senior to the Series E-1 Preferred Stock or of additional indebtedness

could affect our ability to pay dividends on, redeem, or pay the liquidation preference on the Series E-1 Preferred Stock. Additionally,

none of the provisions relating to the Series E-1 Preferred Stock relate to or limit our indebtedness or afford the holders of the Series

E-1 Preferred Stock protection in the event of a highly leveraged or other transaction, including a merger or the sale, lease or conveyance

of all or substantially all our assets or business, that might adversely affect the holders of the Series E-1 Preferred Stock.

Our

management team may invest or spend the proceeds of this Offering in ways with which you may not agree or in ways which may not yield

a significant return.

Our

management will have broad discretion over the use of proceeds from this Offering, including for any of the purposes described in the

section entitled “Use of Proceeds,” and you will not have the opportunity, as part of your investment decision, to assess

whether the proceeds are being used appropriately. However, we have not determined the specific allocation of any net proceeds among

these potential uses, and the ultimate use of the net proceeds may vary from the currently intended uses. The net proceeds may be used

for corporate purposes that do not increase our operating results or enhance the value of our Series E-1 Preferred Stock.

Dividends

on the Series E-1 Preferred Stock are accrued monthly, but payment of such dividends is discretionary. We cannot guarantee that we will

be able to pay dividends in the future or what the actual dividends will be for any future period.

Future

dividends on our Series E-1 Preferred Stock will be declared and accrued monthly. Such dividends shall be payable upon Board approval,

which may not be monthly, out of legally available funds in cash. The Board’s determination of the time of payment of such dividends

will depend on, among other things, our results of operations, cash flow from operations, financial condition and capital requirements,

any debt service requirements, the availability of legally available funds and any other factors our Board deems relevant. Accordingly,

we cannot guarantee that we will be able to pay cash dividends on our Series E-1 Preferred Stock or what the actual dividends will be

for any future period. However, until we pay (or set apart for payment) the full cumulative dividends on the Series E-1 Preferred Stock

for all past dividend periods, our ability to make dividends and other distributions on our Common Stock (including redemptions) will

be limited by the terms of the Series E-1 Preferred Stock.

In

the event you exercise your option to redeem Series E-1 Preferred Stock, our ability to redeem such shares of Series E-1 Preferred Stock

may be subject to certain restrictions and limits.

Our

ability to redeem shares of Series E-1 Preferred Stock may be limited by our available funds, ability to issue the full amount of shares

of Common Stock, and applicable federal and Nevada law.

Pursuant

to the Certificate of Designations, Powers, Preferences and Rights of Series E-1 Redeemable Preferred Stock (the “Certificate of

Designations”), each holder of shares of Series E-1 Preferred Stock will be entitled to redeem any portion of the outstanding Series

E-1 Preferred Stock held by such holder. Such redemption may, at our option, be in cash or in Common Stock, provided that (i) if required

by Rule 5635(d) of The Nasdaq Stock Market, the aggregate number of shares of Common Stock issuable to holders of Series E-1 Preferred

Stock for dividends and redemption shall not exceed the Redemption Share Cap, unless approval by our stockholders is obtained to exceed

the Redemption Share Cap, and (ii) no such Series E-1 Preferred Stock may be redeemed for Common Stock prior to the first anniversary

of the date of its issuance. However, our ability to redeem shares of Series E-1 Preferred Stock for cash may be limited to the extent

we do not have sufficient funds available.

In

addition, applicable Nevada law provides that no distribution (including dividends on, or redemption or repurchases of, shares of capital

stock) may be made if, after giving effect to such distribution, the corporation would not be able to pay its debts as they become due

in the usual course of business, or, except as specifically permitted by the company’s articles of incorporation, the company’s

total assets would be less than the sum of its total liabilities plus the amount that would be needed at the time of a dissolution to

satisfy the preferential rights of stockholders whose preferential rights are superior to those receiving the distribution. Accordingly,

we generally may not make a distribution on the Series E-1 Preferred Stock or redeem shares of Series E-1 Preferred Stock if, after giving

effect to the distribution or redemption, we would not be able to pay our debts as they become due in the usual course of business or

our total assets would be less than the sum of our total liabilities plus, unless the terms of such class or series provide otherwise,

the amount that would be needed to satisfy the preferential rights upon dissolution of the holders of shares of any class or series of

preferred stock then outstanding, if any, with preferences senior to those of the Series E-1 Preferred Stock. There can be no guarantee

that we will have sufficient funds available to meet these obligations.

Further,

on August 16, 2022, the Inflation Reduction Act of 2022 was signed into federal law. The IR Act provides for, among other things, a new

U.S. federal 1% excise tax (the “Excise Tax”) on certain repurchases of stock by publicly traded U.S. domestic corporations

and certain U.S. domestic subsidiaries of publicly traded foreign corporations occurring on or after January 1, 2023. The Excise Tax

is imposed on the repurchasing corporation itself, not its stockholders from which shares are repurchased. Depending on the number of

shares of our Series E-1 Preferred Stock we sell and the number of holders of Series E-1 Preferred Stock who redeem their stock, the

Excise Tax could also be applicable to the Company and adversely affect the cash we have available for redemption of the Series E-1 Preferred

Stock and our operations.

Additionally,

our ability to issue common stock in the event of a redemption may be limited by our ability to enter into “Variable Rate Transactions.”

If a redemption constitutes a “Variable Rate Transaction” under the terms of the Prepaid Advance Agreements, we may need

to seek a waiver from YA Fund before we could issue any shares of Common Stock.

The

Series E-1 Preferred Stock has not been rated.

The

Series E-1 Preferred Stock has not been rated by any nationally recognized statistical rating organization, which may negatively affect

its value and your ability to sell such shares. No assurance can be given, however, that one or more rating agencies might not independently

determine to issue such a rating or that such a rating, if issued, would not adversely affect the value of the Series E-1 Preferred Stock.

In addition, we may elect in the future to obtain a rating of the Series E-1 Preferred Stock, which could adversely impact the value

of the Series E-1 Preferred Stock. Ratings only reflect the views of the rating agency or agencies issuing the ratings and such ratings

could be revised downward or withdrawn entirely at the discretion of the issuing rating agency if in its judgment circumstances so warrant.

Any such downward revision or withdrawal of a rating could have an adverse effect on the value of the Series E-1 Preferred Stock.

Shares

of Series E-1 Preferred Stock may be redeemed for shares of Common Stock, which rank junior to the Series E-1 Preferred Stock with respect

to dividends and upon liquidation, dissolution or winding up of our affairs.

We

may opt to redeem Series E-1 Preferred Stock with shares of our Common Stock in our sole and absolute discretion. The rights of the holders

of shares of Series E-1 Preferred Stock rank senior to the rights of the holders of shares of our Common Stock as to dividends and payments

upon liquidation, dissolution or winding up of our affairs. Unless full cumulative dividends on our shares of Series E-1 Preferred Stock

for all past dividend periods have been paid (or set apart for payment), we will not declare or pay dividends with respect to any shares

of our Common Stock or other stock ranking junior to the Series E-1 Preferred Stock for any period. Upon liquidation, dissolution or

winding up of our affairs, the holders of shares of the Series E-1 Preferred Stock are entitled to receive a liquidation preference of

the Stated Value, plus all accrued but unpaid dividends, prior and in preference to any distribution to the holders of shares of our

Common Stock or any other class of our equity securities junior to the Series E-1 Preferred Stock. If we redeem your shares of Series

E-1 Preferred Stock for Common Stock, you will be subject to the risks of ownership of Common Stock. Ownership of the Series E-1 Preferred

Stock will not give you the rights of holders of our Common Stock. Until and unless you receive shares of our Common Stock upon redemption,

you will have only those rights applicable to holders of the Series E-1 Preferred Stock.

The

Series E-1 Preferred Stock will bear a risk of early redemption by us.

We

will have the right to redeem, at our option, the outstanding shares of Series E-1 Preferred Stock, in whole or in part through a Company

Optional Redemption, on or after to the Redemption Eligibility Date. It is likely that we would choose to exercise our Company Optional

Redemption when prevailing interest rates have declined, which would adversely affect your ability to reinvest your proceeds from the

redemption in a comparable investment with an equal or greater yield to the yield on the Series E-1 Preferred Stock had the Series E-1

Preferred Stock not been redeemed. We may elect to exercise our partial redemption right on multiple occasions.

The

amount of your liquidation preference is fixed and you will have no right to receive any greater payment regardless of the circumstances.

The

payment due upon any voluntary or involuntary liquidation, dissolution or winding up of our affairs is fixed. Upon any liquidation, dissolution

or winding up of our affairs, and after payment of the liquidating distribution has been made in full to the holders of Series E-1 Preferred

Stock, you will have no right or claim to, or to receive, our remaining assets.

We

established the offering price and other terms for the Series E-1 Preferred Stock pursuant to discussions between us and our Dealer Manager;

as a result, the actual value of your investment may be substantially less than what you pay.

The

offering price and net offering proceeds for the Series E-1 Preferred Stock and the related selling commissions and dealer manager fees

have been determined pursuant to discussions between us and our Dealer Manager, based upon our financial condition and the perceived

demand. Because the offering price is not based upon any independent valuation, such as the amount that a firm-commitment underwriter

is willing to pay for the securities to be issued, the offering price may not be indicative of the price that you would receive upon