Ardelyx, Inc. (Nasdaq: ARDX), a biopharmaceutical company founded

with a mission to discover, develop and commercialize innovative,

first-in-class medicines that meet significant unmet medical needs,

today reported financial results for the third quarter ended

September 30, 2024 and provided a business update.

“The continued strong performance of Ardelyx reported during the

third quarter demonstrates our ability to execute and deliver on

our goals, to focus on serving the patient and to build towards the

future,” said Mike Raab, president and chief executive officer of

Ardelyx. “IBSRELA continues to deliver consistent

quarter-over-quarter growth driven by strong fundamentals: an

attractive safety and efficacy profile, expanding awareness among

healthcare prescribers, a streamlined path to access and,

importantly, positive experiences among treated patients. In

addition, the unmet need among dialysis patients for another option

to help achieve and maintain target phosphorus levels is clear,

demonstrated by the continued strong demand and growth for XPHOZAH.

We remain committed to ensuring that this well-tolerated, effective

and differentiated medicine remains available to patients, despite

CMS’ planned change in Medicare Part D reimbursement in

early-January 2025, and we are confident that we have made

decisions that will best support our efforts to protect patient

access to XPHOZAH. Finally, we continue to thoughtfully strengthen

our balance sheet, providing us with capital to invest as we look

to expand our business.”

IBSRELA® (tenapanor) records

$40.6 million in net product sales

revenue in Q3 2024U.S.

net product sales revenue for IBSRELA during the third quarter of

2024 was $40.6 million, showing approximately 15%

quarter-over-quarter growth compared to the second quarter of 2024,

and significant growth compared to the $22.3 million in net product

sales revenue the company reported during the third quarter of

2023. The strong Q3 2024 performance reflects the continued growing

demand for IBSRELA, demonstrated by increases in new and refill

prescriptions as well as growth in new and repeat writing

healthcare providers.

Ardelyx currently expects full-year 2024 U.S. net product sales

revenue for IBSRELA to be between $145.0 and $150.0 million.

XPHOZAH® (tenapanor)

launch progresses, records

$51.5 million net product sales

revenue during Q3 2024A

strong XPHOZAH launch continues, with the company reporting

$51.5 million in net product sales revenue during the third

quarter of 2024, approximately 39% quarter-over-quarter growth

compared to the second quarter of 2024. The Q3 2024 performance

reinforces the significant unmet need among dialysis patients with

hyperphosphatemia.

Other Corporate Developments

- Today, the company announced that it amended its February 2022

loan agreement with investment affiliates managed by SLR Capital

Partners (SLR). The company drew $50 million at SOFR plus 4.02% in

October 2024, added the opportunity to draw an additional $50

million at the same interest rate, and extended the interest-only

period for existing and new tranches funded under the instrument to

July 1, 2028.

- The company had a significant presence at the 2024 Annual

Scientific Meeting for the American College of Gastroenterology

(ACG 2024) in Philadelphia from October 25-30, 2024. The company

presented two posters featuring data from the 2024 IBS in America

supplemental survey, sponsored by the company in collaboration with

Health Union, which was conducted to better understand the symptoms

and impact of IBS-C on the overall health and quality of life among

patients.

- The company had a significant presence at the 2024 Annual

American Society of Nephrology Kidney Week in San Diego from

October 23-27, 2024. The company presented two posters covering

additional data for XPHOZAH.

- In October, the company announced the publication of a review

article exploring the patient burden and therapeutic landscape of

IBS-C in the U.S. in Clinical and Experimental Gastroenterology.

The article is available online and can be found here.

- In August, the company announced the appointment of experienced

biopharma executive, Eric Foster, as Chief Commercial Officer.

- In July, the company announced the publication of two plain

language summaries from XPHOZAH clinical trials in Current Medical

Research and Opinion.

Third Quarter 2024

Financial Results

- Cash Position: As of September 30, 2024, the company had

total cash, cash equivalents and short-term investments of

$190.4 million, as compared to total cash, cash equivalents

and short-term investments of $184.3 million as of

December 31, 2023. In October, the company drew

$49.7 million in net proceeds under its term loan with SLR

Investment Corp.

- Revenue: Total revenue for the quarter ended September 30,

2024 was $98.2 million, compared to $56.4 million in total

revenue during the quarter ended September 30, 2023, driven by

increases in net product sales.

- IBSRELA U.S. net product sales revenue was $40.6 million,

compared to $22.3 million during the same period of 2023.

- XPHOZAH U.S. net product sales revenue was $51.5 million,

with no comparable revenue during the same period of 2023.

- Product supply revenue was $5.3 million, compared to

$2.1 million during the same period of 2023.

- Licensing revenue was $20 thousand, compared to

$32 million during the same period of 2023 related to $30

million milestone and license agreement amendment payments from

Kyowa Kirin following the approval of tenapanor for

hyperphosphatemia in Japan, as well as a $2.0 million milestone

payment from Fosun Pharma following the acceptance of the NDA for

tenapanor for hyperphosphatemia in China.

- Non-cash royalty revenue related to the sale of future

royalties was $0.8 million, with no comparable revenue during

the same period of 2023.

- R&D Expenses: Research and development expenses were

$15.3 million for the quarter ended September 30, 2024,

compared to $8.6 million for the quarter ended

September 30, 2023, primarily related to increased medical

engagement with the scientific communities in the areas of

gastroenterology and nephrology and pediatric clinical trials.

- SG&A Expenses: Selling, general and administrative expenses

were $65.0 million for the quarter ended September 30,

2024, an increase of $32.3 million compared to

$32.7 million for the quarter ended September 30, 2023.

The increase in selling, general and administrative expenses was

related to increased costs associated with the ongoing

commercialization of IBSRELA and XPHOZAH, primarily the expansion

of the IBSRELA field-based team which was completed during the

third quarter of 2024.

- Net Loss: Net loss for the quarter ended September 30,

2024 was $0.8 million, or $(0.00) per share, compared to net

income of $6.6 million, or $0.03 per share, for the quarter

ended September 30, 2023. The $0.8 million net loss for

the third quarter of 2024 included share-based compensation expense

of $9.1 million and non-cash interest expense related to the

sale of future royalties of $1.9 million.

Conference Call DetailsThe company will host a

conference call today, October 31, 2024, at 4:30 PM ET to

discuss today’s announcement. To participate in the conference

call, please dial (877) 346-6112 (domestic) or (848) 280-6350

(international) and ask to be joined into the Ardelyx call. A

webcast of the call can also be accessed by visiting the Investor

page of the company's website, https://ir.ardelyx.com/ and will be

available on the website for 30 days following the call.

IMPORTANT SAFETY INFORMATION (IBSRELA)

|

WARNING: RISK OF SERIOUS DEHYDRATION IN PEDIATRIC

PATIENTS |

|

|

|

|

| IBSRELA

is contraindicated in patients less than 6 years of age; in

nonclinical studies in young juvenile rats administration of

tenapanor caused deaths presumed to be due to dehydration. Avoid

use of IBSRELA in patients 6 years to less than 12 years of age.

The safety and effectiveness of IBSRELA have not been established

in patients less than 18 years of age. |

|

|

|

|

CONTRAINDICATIONS

- IBSRELA is contraindicated in patients less than 6 years of age

due to the risk of serious dehydration.

- IBSRELA is contraindicated in patients with known or suspected

mechanical gastrointestinal obstruction.

WARNINGS AND PRECAUTIONSRisk of Serious

Dehydration in Pediatric Patients

- IBSRELA is contraindicated in patients below 6 years of age.

The safety and effectiveness of IBSRELA in patients less than 18

years of age have not been established. In young juvenile rats

(less than 1 week old; approximate human age equivalent of less

than 2 years of age), decreased body weight and deaths occurred,

presumed to be due to dehydration, following oral administration of

tenapanor. There are no data available in older juvenile rats

(human age equivalent 2 years to less than 12 years).

- Avoid the use of IBSRELA in patients 6 years to less than 12

years of age. Although there are no data in older juvenile rats,

given the deaths in younger rats and the lack of clinical safety

and efficacy data in pediatric patients, avoid the use of IBSRELA

in patients 6 years to less than 12 years of age.

Diarrhea Diarrhea was the most common adverse

reaction in two randomized, double-blind, placebo-controlled trials

of IBS-C. Severe diarrhea was reported in 2.5% of IBSRELA-treated

patients. If severe diarrhea occurs, suspend dosing and rehydrate

patient.

MOST COMMON ADVERSE REACTIONS The most common

adverse reactions in IBSRELA-treated patients (incidence ≥2% and

greater than placebo) were: diarrhea (16% vs 4% placebo), abdominal

distension (3% vs <1%), flatulence (3% vs 1%) and dizziness (2%

vs <1%).

INDICATION IBSRELA (tenapanor) is indicated for

the treatment of Irritable Bowel Syndrome with Constipation (IBS-C)

in adults.

Please see full Prescribing Information, including Boxed

Warning, for additional risk information.

IMPORTANT SAFETY INFORMATION (XPHOZAH)

CONTRAINDICATIONSXPHOZAH is contraindicated

in:

- Pediatric patients under 6 years of age

- Patients with known or suspected mechanical gastrointestinal

obstruction

WARNINGS AND

PRECAUTIONSDiarrhea Patients may

experience severe diarrhea. Treatment with XPHOZAH should be

discontinued in patients who develop severe diarrhea.

MOST COMMON ADVERSE REACTIONS Diarrhea, which

occurred in 43-53% of patients, was the only adverse reaction

reported in at least 5% of XPHOZAH-treated patients with CKD on

dialysis across trials. The majority of diarrhea events in the

XPHOZAH-treated patients were reported to be mild-to-moderate in

severity and resolved over time, or with dose reduction. Diarrhea

was typically reported soon after initiation but could occur at any

time during treatment with XPHOZAH. Severe diarrhea was reported in

5% of XPHOZAH-treated patients in these trials.

INDICATION XPHOZAH (tenapanor), 30 mg BID, is

indicated to reduce serum phosphorus in adults with chronic kidney

disease (CKD) on dialysis as add-on therapy in patients who have an

inadequate response to phosphate binders or who are intolerant of

any dose of phosphate binder therapy.

For additional safety information, please see full Prescribing

Information.

About ArdelyxArdelyx was founded with a mission

to discover, develop and commercialize innovative, first-in-class

medicines that meet significant unmet medical needs. Ardelyx has

two commercial products approved in the United States, IBSRELA®

(tenapanor) and XPHOZAH® (tenapanor). Ardelyx has agreements for

the development and commercialization of tenapanor outside of the

U.S. Kyowa Kirin commercializes PHOZEVEL® (tenapanor) for

hyperphosphatemia in Japan. A New Drug Application for tenapanor

for hyperphosphatemia has been submitted in China with Fosun

Pharma. Knight Therapeutics commercializes IBSRELA in Canada. For

more information, please visit https://ardelyx.com/ and

connect with us on X (formerly known as Twitter), LinkedIn and

Facebook.

Forward Looking StatementsTo the extent that

statements contained in this press release are not descriptions of

historical facts regarding Ardelyx, they are forward-looking

statements reflecting the current beliefs and expectations of

management made pursuant to the safe harbor of the Private

Securities Reform Act of 1995, including Ardelyx’s current

expectation regarding opportunities for continued IBSRELA and

XPHOZAH adoption; projected U.S. net product sales revenue for

IBSRELA for full year 2024; the company’s ability to execute and

deliver on its goals and expand its business; and the company’s

ability to protect patient access to XPHOZAH. Such forward-looking

statements involve substantial risks and uncertainties that could

cause Ardelyx's future results, performance or achievements to

differ significantly from those expressed or implied by the

forward-looking statements. Such risks and uncertainties include,

among others, uncertainties associated with the development of,

regulatory process for, and commercialization of drugs in the U.S.

and internationally. Ardelyx undertakes no obligation to update or

revise any forward-looking statements. For a further description of

the risks and uncertainties that could cause actual results to

differ from those expressed in these forward-looking statements, as

well as risks relating to Ardelyx's business in general, please

refer to Ardelyx's Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on October 31, 2024, and

its future current and periodic reports to be filed with the

Securities and Exchange Commission.

Investor and Media Contacts: Caitlin

Lowieclowie@ardelyx.com

|

Ardelyx, Inc.Condensed Balance Sheets(In

thousands) |

|

|

| |

September 30, 2024 |

|

December 31, 2023 |

| |

(Unaudited) |

|

|

(1) |

|

|

Assets |

|

|

|

|

Cash and cash equivalents |

$ |

47,429 |

|

$ |

21,470 |

|

|

Investments |

|

142,973 |

|

|

162,829 |

|

|

Accounts receivable |

|

53,195 |

|

|

22,031 |

|

|

Prepaid commercial manufacturing |

|

16,663 |

|

|

18,925 |

|

|

Prepaid commercial manufacturing, non-current |

|

— |

|

|

4,235 |

|

|

Inventory, current |

|

11,378 |

|

|

12,448 |

|

|

Inventory, non-current |

|

73,780 |

|

|

37,039 |

|

|

Property and equipment, net |

|

1,028 |

|

|

1,009 |

|

|

Right-of-use assets |

|

3,625 |

|

|

5,589 |

|

|

Prepaid and other assets |

|

17,792 |

|

|

12,004 |

|

|

Total assets |

$ |

367,863 |

|

$ |

297,579 |

|

| |

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

Accounts payable |

$ |

15,824 |

|

$ |

11,138 |

|

|

Accrued compensation and benefits |

|

11,541 |

|

|

12,597 |

|

|

Current portion of operating lease liability |

|

2,567 |

|

|

4,435 |

|

|

Deferred revenue |

|

20,042 |

|

|

15,826 |

|

|

Accrued expenses and other liabilities |

|

33,295 |

|

|

15,041 |

|

|

Operating lease liability, net of current portion |

|

1,218 |

|

|

1,725 |

|

|

Long-term debt |

|

100,707 |

|

|

49,822 |

|

|

Deferred royalty obligation related to the sale of future

royalties |

|

24,372 |

|

|

20,179 |

|

|

Stockholders' equity |

|

158,297 |

|

|

166,816 |

|

|

Total liabilities and stockholders' equity |

$ |

367,863 |

|

$ |

297,579 |

|

(1) Derived from the audited financial statements included in

the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023.

|

Ardelyx, Inc.Condensed Statements of

Operations(Unaudited)(In thousands, except share

and per share amounts) |

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

| Product sales, net: |

|

|

|

|

|

|

|

|

IBSRELA |

$ |

40,638 |

|

|

$ |

22,285 |

|

|

$ |

104,444 |

|

|

$ |

51,949 |

|

|

XPHOZAH |

|

51,452 |

|

|

|

— |

|

|

|

103,749 |

|

|

|

— |

|

| Total product sales, net |

|

92,090 |

|

|

|

22,285 |

|

|

|

208,193 |

|

|

|

51,949 |

|

| Product supply revenue |

|

5,322 |

|

|

|

2,092 |

|

|

|

7,461 |

|

|

|

5,354 |

|

| Licensing revenue |

|

20 |

|

|

|

32,014 |

|

|

|

56 |

|

|

|

32,790 |

|

|

Non-cash royalty revenue related to the sale of future

royalties |

|

809 |

|

|

|

— |

|

|

|

1,776 |

|

|

|

— |

|

|

Total revenues |

|

98,241 |

|

|

|

56,391 |

|

|

|

217,486 |

|

|

|

90,093 |

|

| Cost of goods

sold: |

|

|

|

|

|

|

|

|

Cost of product sales |

|

1,715 |

|

|

|

644 |

|

|

|

4,133 |

|

|

|

1,508 |

|

|

Other cost of revenue |

|

14,013 |

|

|

|

7,048 |

|

|

|

28,159 |

|

|

|

11,210 |

|

|

Total cost of goods sold |

|

15,728 |

|

|

|

7,692 |

|

|

|

32,292 |

|

|

|

12,718 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

15,310 |

|

|

|

8,637 |

|

|

|

38,651 |

|

|

|

26,012 |

|

|

Selling, general and administrative |

|

64,970 |

|

|

|

32,664 |

|

|

|

182,618 |

|

|

|

86,653 |

|

|

Total operating expenses |

|

80,280 |

|

|

|

41,301 |

|

|

|

221,269 |

|

|

|

112,665 |

|

|

Income (loss) from operations |

|

2,233 |

|

|

|

7,398 |

|

|

|

(36,075 |

) |

|

|

(35,290 |

) |

|

Interest expense |

|

(3,357 |

) |

|

|

(1,107 |

) |

|

|

(9,039 |

) |

|

|

(3,210 |

) |

|

Non-cash interest expense related to the sale of future

royalties |

|

(1,924 |

) |

|

|

(922 |

) |

|

|

(5,202 |

) |

|

|

(2,859 |

) |

|

Other income, net |

|

2,282 |

|

|

|

1,460 |

|

|

|

6,766 |

|

|

|

4,308 |

|

| Income (loss) before

provision for income taxes |

|

(766 |

) |

|

|

6,829 |

|

|

|

(43,550 |

) |

|

|

(37,051 |

) |

| Provision for income

taxes |

|

43 |

|

|

|

200 |

|

|

|

231 |

|

|

|

214 |

|

| Net income

(loss) |

$ |

(809 |

) |

|

$ |

6,629 |

|

|

$ |

(43,781 |

) |

|

$ |

(37,265 |

) |

| Net income (loss) per

share of common stock - basic and diluted |

$ |

(0.00 |

) |

|

$ |

0.03 |

|

|

$ |

(0.19 |

) |

|

$ |

(0.17 |

) |

| Shares used in

computing net income (loss) per share - basic |

|

235,911,399 |

|

|

|

222,782,229 |

|

|

|

234,516,305 |

|

|

|

214,976,555 |

|

| Shares used in

computing net (loss) income per share - diluted |

|

235,911,399 |

|

|

|

227,894,335 |

|

|

|

234,516,305 |

|

|

|

214,976,555 |

|

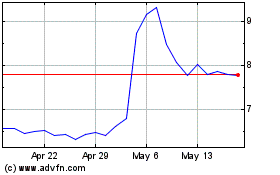

Ardelyx (NASDAQ:ARDX)

Historical Stock Chart

From Oct 2024 to Nov 2024

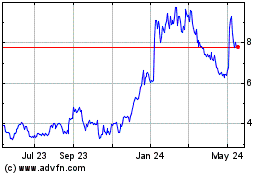

Ardelyx (NASDAQ:ARDX)

Historical Stock Chart

From Nov 2023 to Nov 2024