0001921865false00019218652024-06-102024-06-10iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 10, 2024

ASP ISOTOPES INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 001-41555 | | 87-2618235 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1101 Pennsylvania Avenue NW, Suite 300 Washington, DC | | 20004 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (202) 756-2245

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Ticker symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.01 | | ASPI | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Chief Financial Officer Transition

On June 10, 2024, the Board of Directors (the “Board”) of ASP Isotopes Inc. (the “Company”) appointed Heather Kiessling as the Chief Financial Officer of the Company, effective as of July 1, 2024 or such earlier date as may be agreed by the Company and Ms. Kiessling (the “Start Date”). Ms. Kiessling will succeed Robert Ainscow, who has served as Chief Financial Officer and Chief Operating Officer since April 2024 and as Interim Chief Financial Officer since September 2021. Mr. Ainscow will resign as the Company’s Chief Financial Officer as of the Start Date and will continue in his role as Chief Operating Officer.

Ms. Kiessling, age 59, most recently served as Managing Director at Danforth Advisors LLC, a life science financial strategy consultancy and has been a consultant since October 2015, and was providing consulting and advisory services to the Company under the terms of the Company’s consulting agreement with Danforth Advisors since November 2021. Prior to joining Danforth Advisors, Ms. Kiessling held finance leadership roles at Cytonome/ST, LLC and AutoImmune Inc. Ms. Kiessling is a CPA and holds a B.A. in management science from University of California, San Diego, and an M.B.A. with a focus in finance and accounting from University of Michigan Graduate School of Business

On June 12, 2024, in connection with her appointment as Chief Financial Officer effective as of the Start Date, the Company entered into an executive employment agreement with Ms. Kiessling, pursuant to which Ms. Kiessling is entitled to a base salary of $400,000 per annum (subject to annual adjustments by the board of directors) and a target annual discretionary bonus equal to 50% of her annual base salary. Annual bonuses will be paid in a mixture of cash and common stock, as determined by the compensation committee. The employment agreement also provides that Ms. Kiessling will be awarded an initial grant of 400,000 shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), pursuant to the Company’s 2024 Inducement Equity Incentive Plan (the “Inducement Equity Plan”), which shall vest (subject to compliance with the applicable vesting conditions) in eight equal semi-annual installments over a four-year period beginning on the six-month anniversary of the Start Date. The award of 400,000 shares of restricted stock was granted as an inducement material to Ms. Kiessling becoming an employee of the Company, in accordance with Nasdaq Listing Rule 5635(c)(4). Ms. Kiessling will also be eligible to receive annual equity-based awards pursuant to the Company’s 2022 Equity Incentive Plan.

Ms. Kiessling’s employment agreement has an initial term of one year and will automatically renew for successive one-year periods unless either party provides notice of non-renewal at least three months prior to expiration of the then-current term. Ms. Kiessling is also entitled to certain severance benefits under her employment agreement. Upon a termination of Ms. Kiessling’s employment for any reason other than due to her voluntary resignation without good reason and which does not occur in connection with a change in control or termination by the Company for Cause, Ms. Kiessling will receive reimbursement of COBRA premiums for up to an 18-month period. Upon a termination of Ms. Kiessling’s employment due to her death, disability, or termination without cause after the initial one-year term, resignation for good reason, or resignation in connection with a change in control the vesting and exercisability of all equity awards held by Ms. Kiessling shall immediately accelerate, so that all such equity awards shall be fully vested and exercisable as of the date of her termination. Additionally, upon such termination any stock options (as well as any other exercisable equity awards) which Ms. Kiessling may receive will remain exercisable until the earlier of one year after Ms. Kiessling’s termination or the original maximum permitted term of the equity award. In the event Ms. Kiessling is terminated without cause after the initial one-year term, she shall be entitled to receive her regular salary plus all benefits for a period of 120 days after her last day of employment and continued coverage, at the Company’s expense, under all benefits plans in which she was a participant immediately prior to her last date of employment with the Company.

The foregoing description of Ms. Kiessling’s employment agreement does not purport to be complete and is qualified in its entirety by reference to the full text, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2024.

In connection with her appointment as Chief Financial Officer, Ms. Kiessling will enter into the Company’s standard form of indemnification agreement, a copy of which has been incorporated by reference as Exhibit 10.4 to the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on April 10, 2024.

There are no arrangements or understandings between Ms. Kiessling and any other person pursuant to which she was selected as an officer of the Company. There are no family relationships between Ms. Kiessling and any of the executive officers or directors of the Company. There is no information that is required to be disclosed with respect to Ms. Kiessling pursuant to Item 404(a) of Regulation S-K.

2024 Inducement Equity Incentive Plan

On June 10, 2024, upon recommendation of the Compensation Committee of the Company’s Board, the Board approved and adopted the Inducement Equity Plan, and subject to the adjustment provisions of the Inducement Equity Plan, reserved 2,500,000 shares of Common Stock for issuance of equity awards under the Inducement Equity Plan.

The Inducement Equity Plan was approved and adopted without stockholder approval pursuant to Nasdaq Listing Rule 5635(c)(4). The Inducement Equity Plan provides for grants of stock options, stock appreciation rights, restricted stock, restricted stock units, performance awards (consisting of performance shares or performance units) and other cash-based or stock-based awards (each, an “Inducement Award”). In addition, the Board also approved and adopted forms of Notice of Grant of Restricted Stock and Restricted Stock Agreement, and Notice of Grant of Stock Option and Stock Option Agreement for use with the Inducement Equity Plan. The terms and conditions of the Inducement Equity Plan are intended to comply with the Nasdaq inducement award rules.

In accordance with Nasdaq Listing Rule 5635(c)(4), the only persons eligible to receive grants of Inducement Awards are individuals who were not previously employees or directors of the Company (or following a bona fide period of non-employment), as an inducement material to the individuals’ entry into employment with the Company.

The above description of the Inducement Equity Plan and forms of award agreement thereunder is not complete and is qualified in its entirety by reference to the text of the Inducement Equity Plan and its forms of award agreement, complete copies of which are filed herewith as Exhibit 10.1 and are incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On June 13, 2024, the Company issued a press release announcing the appointment of Heather Kiessling as Chief Financial Officer. A copy of the press release is furnished as Exhibit 99.1 hereto

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ASP ISOTOPES INC. | |

| | |

Date: June 13, 2024 | By: | /s/ Paul Mann | |

| Name: | Paul Mann | |

| Title: | Chief Executive Officer | |

nullnull

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

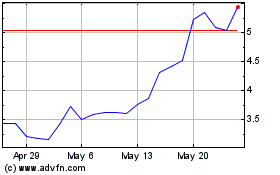

ASP Isotopes (NASDAQ:ASPI)

Historical Stock Chart

From May 2024 to Jun 2024

ASP Isotopes (NASDAQ:ASPI)

Historical Stock Chart

From Jun 2023 to Jun 2024