Aspen Technology Forms Special Committee to Evaluate Non-Binding Acquisition Proposal from Emerson

November 20 2024 - 7:00AM

Business Wire

Aspen Technology, Inc. (NASDAQ:AZPN) (“AspenTech” or “the

Company”), a global leader in industrial software, today announced

that its Board of Directors has formed a special committee (the

“Special Committee”) composed of three independent directors to

consider the non-binding proposal from Emerson Electric Co.

(NYSE:EMR) (“Emerson”) received on November 5, 2024. Emerson and

its affiliates currently own 57.4% of the Company’s outstanding

common shares.

The Special Committee is composed of Board Chair Robert Whelan,

Jr., who will serve as Chair of the Special Committee, Arlen

Shenkman and David Henshall.

Qatalyst Partners and Citi are serving as independent financial

advisors to the Special Committee and Skadden, Arps, Slate, Meagher

& Flom LLP is serving as its legal counsel in connection with

its review and evaluation of the proposed transaction.

The Company reiterates that no action is required by its

shareholders at this time.

About Aspen Technology

Aspen Technology, Inc. (NASDAQ: AZPN) is a global software

leader helping industries at the forefront of the world’s dual

challenge meet the increasing demand for resources from a rapidly

growing population in a profitable and sustainable manner.

AspenTech solutions address complex environments where it is

critical to optimize the asset design, operation and maintenance

lifecycle. Through our unique combination of deep domain expertise

and innovation, customers in asset-intensive industries can run

their assets safer, greener, longer and faster to improve their

operational excellence. To learn more, visit AspenTech.com.

Additional Information and Where to Find it

No tender offer for the shares of the Company has commenced at

this time. This communication is for informational purposes only

and is neither an offer to purchase nor a solicitation of an offer

to sell shares of the Company, nor is it a substitute for any

tender offer materials that the Company or Emerson may file with

the U.S. Securities and Exchange Commission (the “SEC”). Subject to

further developments, a solicitation and an offer to buy shares of

the Company will be made only pursuant to an offer to purchase and

related materials that Emerson may file with the SEC. If Emerson

commences a tender offer for the outstanding shares of common stock

of the Company that Emerson does not already own, Emerson will file

a Tender Offer Statement on Schedule TO with the SEC, and the

Company will file a Solicitation/Recommendation Statement on

Schedule 14D-9 with the SEC with respect to the tender offer. THE

COMPANY’S STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ THE

SOLICITATION/RECOMMENDATION STATEMENT AND ANY OTHER RELEVANT TENDER

OFFER MATERIALS, IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION WHICH SHOULD BE READ CAREFULLY

BEFORE ANY DECISION IS MADE WITH RESPECT TO ANY TENDER OFFER. The

Solicitation/Recommendation Statement (if and when it becomes

available), as well as any other documents filed by the Company in

connection with any tender offer by Emerson, will be made available

for free at the SEC’s website at www.sec.gov. In addition, free

copies of these materials (if and when they become available) will

be made available by the Company by mail to Aspen Technology, Inc.,

20 Crosby Dr., Bedford, MA 01730, Attn: Investor Relations, by

email at IR@aspentech.com or on the Company’s internet website at

https://ir.aspentech.com.

Forward Looking Statements

This communication contains forward-looking statements related

to the Company, Emerson and the proposed acquisition by Emerson of

the outstanding shares of common stock of the Company that Emerson

does not already own, which involve substantial risks and

uncertainties. Forward-looking statements include any statements

containing the words “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “goal,” “may,” “might,” “plan,” “predict,” “project,”

“seek,” “target,” “potential,” “will,” “would,” “could,” “should,”

“continue” and similar expressions.

Forward-looking statements are subject to certain risks,

uncertainties, or other factors that are difficult to predict and

could cause actual events or results to differ materially from

those indicated in any such statements due to a number of risks and

uncertainties. Those risks and uncertainties that could cause the

actual results to differ from expectations contemplated by

forward-looking statements include, among other things:

uncertainties as to the timing of the proposed tender offer; the

risk that the Company may not agree to a transaction with Emerson;

the possibility that competing offers will be made; the effects of

the proposed transaction on relationships with employees,

customers, other business partners or governmental entities; and

other risks listed under the heading “Risk Factors” in the

Company’s periodic reports filed with the SEC, including Current

Reports on Form 8-K, Quarterly Reports on Form 10-Q, Annual Reports

on Form 10-K, as well as the Schedule 14D-9 that may be filed by

the Company and the Schedule TO and related tender offer documents

that may be filed by Emerson. You should not place undue reliance

on these statements. All forward-looking statements are based on

information currently available to the Company, and the Company

disclaims any obligation to update the information contained in

this communication as new information becomes available.

© 2024 Aspen Technology, Inc. AspenTech and the Aspen leaf logo

are trademarks of Aspen Technology, Inc. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120170468/en/

Media Contact Andrew Cole / Chris Kittredge FGS Global +1

212-687-8080 aspentech@fgsglobal.com

Investor Contact William Dyke Aspen Technology +1

781-221-5571 IR@aspentech.com

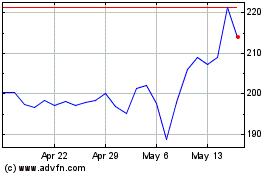

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

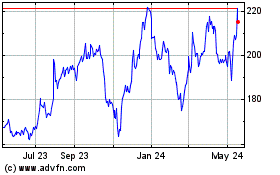

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Nov 2023 to Nov 2024