QXO, Inc. (Nasdaq: QXO) today announced that it has made public a

proposal to the Board of Directors of Beacon Roofing Supply, Inc.

(Nasdaq: BECN) to acquire all outstanding shares of Beacon for

$124.25 per share in cash. The proposal implies a total transaction

value of approximately $11 billion and a 37% premium above Beacon’s

90-day unaffected volume-weighted average price of $91.02.

“Our all-cash offer provides compelling value. We believe Beacon

shareholders have a right to evaluate our proposal, despite the

attempt by Beacon’s Board of Directors to withhold it from them,”

said Brad Jacobs, chairman and chief executive officer of QXO.

Morgan Stanley & Co. LLC is acting as financial advisor to

QXO, and Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting

as legal counsel.

QXO sent the following letter to Beacon’s chairman today

regarding the proposal:

Attention: Stuart A. Randle, Chairman of the

BoardJanuary 15, 2025

Dear Stuart,

I am writing to reiterate our surprise at your

continued refusal to substantively engage with us on our offer to

acquire Beacon for $124.25 per share in cash, submitted to the

company in a letter on November 11, 2024. We presented a full and

compelling price that is very close to the highest end of our value

range. The Beacon Board of Directors appears to have priorities

that do not include capturing a compelling premium and creating

significant, immediate value for Beacon shareholders.

Despite your Board’s opposition, QXO today

remains committed to acquiring Beacon at $124.25 per share. We

know Beacon and have studied it closely. We have retained

consultants and financial and legal advisors, secured committed

financing, and are prepared to nominate directors to the Beacon

Board. We believe your shareholders have the right to evaluate our

proposal.

1. More than Five Months

of Anti-Shareholder Actions Designed to Frustrate a

Transaction

Since our initial virtual meeting with your CEO

in July of last year, Ihsan Essaid, QXO’s Chief Financial Officer,

and I have made numerous attempts to engage constructively with

Beacon to reach a deal. Our attempts to explore a transaction have

been met by delays, cancellations, and unreasonable preconditions,

notably a long-term “standstill” that would have prohibited us from

offering our proposal directly to your shareholders. And while you

told us in early December that you have put the company up for sale

by contacting other potential buyers, we have yet to receive a

counteroffer from you and are aware of no other interested

buyers.

Earlier this month, you finally suggested an

in-person meeting, but only after we informed you that we were

prepared to approach your shareholders directly. However, this

meeting was conditioned on an unusual, onerous standstill structure

that would require us to agree to a months-long delay before we

could actually present our proposal to your shareholders or even

inform them of it. We were surprised that you conditioned a meeting

on us agreeing not to tell your shareholders about a proposal to

acquire their company.

2. Our

$124.25 Offer is Extremely Compelling and Higher than Beacon’s

Shares Have Ever Traded

Our cash-certain proposal of $124.25 represents

a very high premium to Beacon’s historical multiple, unaffected

trading price, analyst targets and intrinsic value, and is

significantly higher than the stock’s current affected price.

Specifically, QXO’s proposal represents a:

-

26% premium to Beacon’s unaffected price of $98.75 per share (as of

November 15, 2024, the last trading day prior to the Wall Street

Journal report that QXO had made an offer to acquire Beacon);

-

37% premium to Beacon’s 90-day unaffected VWAP of $91.02 per

share;

-

17% premium to Beacon’s unaffected all-time high price of

$105.84;

-

14% premium to Beacon’s stock price of $108.85 on January 14, 2025,

which is affected by the Wall Street Journal report on November 18,

2024;

-

3.0x premium to Beacon’s unaffected three-year historical average

next-twelve-months enterprise value to EBITDA multiple of

8.1x.

3. Deteriorating

Operating Environment and Capital Markets Backdrop

As we recently highlighted to you, the

attractiveness of our offer has greatly improved for Beacon

shareholders since we made our proposal on November 11, 2024, as

the operating environment and capital markets have weakened,

increasing the risk to Beacon’s plan:

-

Interest rates have increased significantly since late November

(e.g., the yield on US ten-year bonds has increased by 61

bps);

- Peers

you include in your proxy are off substantially since November 11,

reflecting a consensus of growing uncertainty; the median stock

price among your proxy peers is down 10%, and the median building

products subset within this group is also down 10%; the S&P

1500 Trading Companies & Distributors Index cited in your proxy

is down 11%;

- Even

after the leak, Beacon shares have settled well below our offer

price to $108.85 as of January 14, 2025;

Despite the foregoing, QXO has not lowered its offer of $124.25

per share in cash.

4. Beacon Has Failed to

Optimize Value for Shareholders

- Beacon

has reported a revenue CAGR of 8% from 2019-2023, trailing all of

the building products peers from the group cited in your

proxy;

-

Consensus forecasts currently expect Beacon to fall short of key

elements of your Ambition 2025 plan. Notably, consensus calls for

2025 EBITDA margin of 9.8%, versus your plan’s target of 11%;

-

Beacon’s balance sheet lacks the capacity to pursue

transformational M&A;

- Beacon

does not have diversified operations and exposure to high-growth

categories that trade at higher multiples;

- As a

result, Beacon’s trading multiple has remained range-bound for the

better part of a decade, and its valuation trend has lagged peers.

Beacon’s unaffected EV/ NTM EBITDA multiple stood 4.1x below the

subset of building products peers in its proxy, a 30% discount.

This has widened out from an average 2.8x gap, representing a 23%

average discount over the preceding five years.

5. Strong

Proposal

Our proposal contains no financing contingency.

We have approximately $5 billion of cash on hand and have secured

financing commitments sufficient to pay 100% of the purchase

consideration, any required refinancing of Beacon’s debt, and

associated transaction fees and expenses. Your advisor, J.P.

Morgan, rightly indicated to our bankers that Beacon does not

question our ability to finance the acquisition.

As QXO does not currently have operations in

roofing, the transaction should not, in our opinion, give rise to

any significant antitrust or other regulatory issues.

6. Ready to Move

Quickly

We are prepared to move promptly to negotiate

definitive acquisition documentation. Your long history as a public

company provides us and your shareholders with the information

needed to form a view of intrinsic value. QXO stands ready to bring

an acquisition to fruition. We have retained Morgan Stanley as our

lead financial advisor; Paul, Weiss as our legal counsel; Innisfree

as our proxy solicitor; and Gladstone Place Partners as our

strategic communications firm.

7. Overview

of QXO

As you are well aware, QXO is a public company

with a business plan supported by our investors to acquire

businesses like Beacon. We have the full support of our Board of

Directors to pursue this transaction. Our leadership team has a

long track record of building businesses and accelerating growth

through investment in technology.

The teams I’ve led have built five

multibillion-dollar, publicly traded companies prior to QXO,

including XPO, Inc. (NYSE: XPO), one of the largest providers of

less-than-truckload services in North America; GXO Logistics, Inc.

(NYSE: GXO), the largest pure-play contract logistics provider in

the world; RXO, Inc. (NYSE: RXO), a leading tech-enabled freight

brokerage platform; United Rentals, Inc. (NYSE: URI), the world’s

largest equipment rental company; and United Waste Systems, Inc.,

the fifth largest waste management company in the U.S. at the time

of its sale. Each of these companies has a history of retaining and

attracting world-class talent, establishing advantages through

technology, and building scale through accretive M&A and

organic growth.

Our team is highly experienced, with a track

record of creating shareholder value and deep expertise in

operations, technology and M&A. Please refer to our website for

the biographies of our senior management team

(https://www.qxo.com/team).

8. Conclusion

QXO has proposed to acquire Beacon for $124.25

in cash per share, a compelling price for your shareholders that

delivers a significant, immediate premium. QXO has the necessary

financial resources, transaction experience and institutional

knowledge to consummate the proposed transaction expeditiously and

with a high level of certainty upon reaching a definitive

agreement. We are available to meet at short notice to get a deal

done. If that does not happen, we intend to let your shareholders

decide whether they want our compelling offer.

On behalf of QXO, thank you for your

consideration.

Sincerely,

Brad Jacobs

Chief Executive Officer

cc: Ihsan Essaid, Chief Financial Officer, QXO

Julian Francis, CEO, Beacon

About QXO

QXO provides technology solutions, primarily to clients in the

manufacturing, distribution and service sectors. The company

provides consulting and professional services, including

specialized programming, training and technical support, and

develops proprietary software. As a value-added reseller of

business application software, QXO offers solutions for accounting,

financial reporting, enterprise resource planning, warehouse

management systems, customer relationship management, business

intelligence and other applications. QXO plans to become a

tech-forward leader in the $800 billion building products

distribution industry. The company is targeting tens of billions of

dollars of annual revenue in the next decade through accretive

acquisitions and organic growth. Visit QXO.com for more

information.

Cautionary Statement Regarding Forward-Looking

Statements

The information herein contains forward-looking statements.

Statements that are not historical facts, including statements

about beliefs, expectations, targets and goals are forward-looking

statements. These statements are based on plans, estimates,

expectations and/or goals at the time the statements are made, and

readers should not place undue reliance on them. In some cases,

readers can identify forward-looking statements by the use of

forward-looking terms such as “may,” “will,” “should,” “expect,”

“opportunity,” “intend,” “plan,” “anticipate,” “believe,”

“estimate,” “predict,” “potential,” “target,” “goal,” or

“continue,” or the negative of these terms or other comparable

terms. Forward-looking statements involve inherent risks and

uncertainties and readers are cautioned that a number of important

factors could cause actual results to differ materially from those

contained in any such forward-looking statements. QXO, Inc. (“QXO”)

cautions that forward-looking statements should not be relied on as

predictions of future events, and these statements are not

guarantees of performance or results. Forward-looking statements

herein speak only as of the date each statement is made. Neither

QXO nor any participant in the proxy solicitation undertakes any

obligation to update any of these statements in light of new

information or future events, except to the extent required by

applicable law.

Certain Information Concerning the

Participants

QXO and the other participants intend to file a preliminary

proxy statement and accompanying WHITE universal proxy card with

the Securities and Exchange Commission (the “SEC”) to be used to

solicit proxies for, among other matters, the election of its slate

of director nominees at the 2025 annual meeting of stockholders of

Beacon Roofing Supply, Inc., a Delaware corporation (“Beacon”).

The participants in the proxy solicitation are anticipated to be

QXO, Brad Jacobs, Ihsan Essaid, Matt Fassler, Mark Manduca and the

individuals nominated by QXO (the “QXO Nominees”), however, the QXO

Nominees have not been determined as of the date of this

communication. As of the issuance of this communication, none of

the participants that have been identified beneficially own any

shares of Beacon common stock. Additional information regarding the

direct or indirect interests, by security holdings or otherwise, of

such participants will be included in one or more proxy statements

or other documents filed with the SEC if and when they become

available.

Important Information And Where To Find It

QXO strongly advises all stockholders of Beacon to read

the preliminary proxy statement, any amendments or supplements to

such proxy statement, and other proxy materials filed by QXO with

the SEC as they become available because they will contain

important information. Such proxy materials will be available at no

charge on the SEC’s website at www.sec.gov. In addition, the

participants in this proxy solicitation will provide copies of the

proxy statement, and other relevant documents, without charge, when

available, upon request. Requests for copies should be directed to

the participants’ proxy solicitor.

Media Contacts

Joe Checklerjoe.checkler@qxo.com203-609-9650

Steve Lipin/Lauren OdellGladstone Place Partners212-230-5930

Investor Contacts

Mark Manducamark.manduca@qxo.com203-321-3889

Scott Winter / Jonathan SalzbergerInnisfree M&A

Incorporated212-750-5833

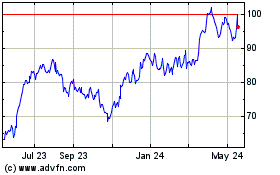

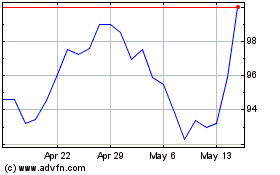

Beacon Roofing Supply (NASDAQ:BECN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Beacon Roofing Supply (NASDAQ:BECN)

Historical Stock Chart

From Jan 2024 to Jan 2025