false

--12-31

2024

Q1

0001398805

3037000

3831000

3026000

619000

0001398805

2024-01-01

2024-03-31

0001398805

2024-05-16

0001398805

2024-03-31

0001398805

2023-12-31

0001398805

2023-01-01

2023-03-31

0001398805

us-gaap:CommonStockMember

2022-12-31

0001398805

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001398805

us-gaap:RetainedEarningsMember

2022-12-31

0001398805

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001398805

2022-12-31

0001398805

us-gaap:CommonStockMember

2023-12-31

0001398805

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001398805

us-gaap:RetainedEarningsMember

2023-12-31

0001398805

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001398805

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001398805

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001398805

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001398805

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001398805

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001398805

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001398805

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001398805

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-03-31

0001398805

us-gaap:CommonStockMember

2023-03-31

0001398805

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001398805

us-gaap:RetainedEarningsMember

2023-03-31

0001398805

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001398805

2023-03-31

0001398805

us-gaap:CommonStockMember

2024-03-31

0001398805

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001398805

us-gaap:RetainedEarningsMember

2024-03-31

0001398805

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

BEEM:FederalStateAndLocalGovernmentMember

2024-01-01

2024-03-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

BEEM:CommercialCustomersMember

2024-01-01

2024-03-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

BEEM:Customer1Member

2024-01-01

2024-03-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

BEEM:Customer2Member

2024-01-01

2024-03-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

us-gaap:OtherCustomerMember

2024-01-01

2024-03-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

BEEM:Customer1Member

2024-01-01

2024-03-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

BEEM:Customer2Member

2024-01-01

2024-03-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

BEEM:Customer3Member

2024-01-01

2024-03-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

BEEM:Customer1Member

2023-01-01

2023-12-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

BEEM:Customer2Member

2023-01-01

2023-12-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

BEEM:Customer3Member

2023-01-01

2023-12-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

BEEM:Customer4Member

2023-01-01

2023-12-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

BEEM:StateAndLocalGovernmentMember

2024-01-01

2024-03-31

0001398805

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

BEEM:StateAndLocalGovernmentMember

2023-01-01

2023-03-31

0001398805

BEEM:OptionsMember

2024-01-01

2024-03-31

0001398805

BEEM:WarrantsMember

2024-01-01

2024-03-31

0001398805

BEEM:OptionsMember

2023-01-01

2023-03-31

0001398805

BEEM:WarrantsMember

2023-01-01

2023-03-31

0001398805

us-gaap:FairValueInputsLevel1Member

2023-12-31

0001398805

us-gaap:FairValueInputsLevel2Member

2023-12-31

0001398805

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001398805

us-gaap:FairValueInputsLevel1Member

2024-01-01

2024-03-31

0001398805

us-gaap:FairValueInputsLevel2Member

2024-01-01

2024-03-31

0001398805

us-gaap:FairValueInputsLevel3Member

2024-01-01

2024-03-31

0001398805

us-gaap:FairValueInputsLevel1Member

2024-03-31

0001398805

us-gaap:FairValueInputsLevel2Member

2024-03-31

0001398805

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001398805

BEEM:BRileyCapitalMember

BEEM:CommonStockPurchaseAgreementMember

2024-01-01

2024-03-31

0001398805

BEEM:WarrantsMember

2024-01-01

2024-03-31

0001398805

BEEM:WarrantsMember

2023-01-01

2023-03-31

0001398805

BEEM:WarrantsMember

2024-03-31

0001398805

BEEM:AmigaMember

BEEM:TrancheOneMember

2023-10-20

0001398805

BEEM:AmigaMember

BEEM:TrancheTwoMember

2023-10-20

0001398805

BEEM:AmigaMember

BEEM:TrancheOneMember

2023-10-19

2023-10-20

0001398805

BEEM:TrancheTwoMember

BEEM:AmigaMember

2023-10-19

2023-10-20

0001398805

BEEM:AmigaMember

2024-01-01

2024-03-31

0001398805

us-gaap:OfficeEquipmentMember

2024-03-31

0001398805

us-gaap:OfficeEquipmentMember

2023-12-31

0001398805

us-gaap:ComputerEquipmentMember

2024-03-31

0001398805

us-gaap:ComputerEquipmentMember

2023-12-31

0001398805

us-gaap:LeaseholdImprovementsMember

2024-03-31

0001398805

us-gaap:LeaseholdImprovementsMember

2023-12-31

0001398805

BEEM:AutosMember

2024-03-31

0001398805

BEEM:AutosMember

2023-12-31

0001398805

us-gaap:MachineryAndEquipmentMember

2024-03-31

0001398805

us-gaap:MachineryAndEquipmentMember

2023-12-31

0001398805

us-gaap:DevelopedTechnologyRightsMember

2023-12-31

0001398805

us-gaap:TradeNamesMember

2023-12-31

0001398805

us-gaap:CustomerRelationshipsMember

2023-12-31

0001398805

BEEM:BacklogMember

2023-12-31

0001398805

us-gaap:PatentsMember

2023-12-31

0001398805

us-gaap:DevelopedTechnologyRightsMember

2024-03-31

0001398805

us-gaap:TradeNamesMember

2024-03-31

0001398805

us-gaap:CustomerRelationshipsMember

2024-03-31

0001398805

BEEM:BacklogMember

2024-03-31

0001398805

us-gaap:PatentsMember

2024-03-31

0001398805

BEEM:AmigaMember

2024-03-31

0001398805

BEEM:TwoNewTrucksMember

2023-05-01

2023-05-31

0001398805

BEEM:TwoNewTrucksMember

2023-05-31

0001398805

BEEM:ForkLiftMember

2024-01-01

2024-03-31

0001398805

BEEM:ForkLiftMember

2024-03-31

0001398805

BEEM:BRileyPurchaseAgreementMember

2022-09-01

2022-09-30

0001398805

BEEM:BRileyPurchaseAgreementMember

2023-04-01

2023-04-30

0001398805

BEEM:BRileyPurchaseAgreementMember

2024-01-01

2024-03-31

0001398805

us-gaap:StockOptionMember

2024-01-01

2024-03-31

0001398805

us-gaap:StockOptionMember

2023-01-01

2023-03-31

0001398805

us-gaap:StockOptionMember

2024-03-31

0001398805

srt:ChiefExecutiveOfficerMember

us-gaap:RestrictedStockUnitsRSUMember

2022-11-01

2022-11-30

0001398805

srt:ChiefExecutiveOfficerMember

BEEM:PerformanceStockUnitsMember

2022-11-01

2022-11-30

0001398805

BEEM:PerformanceStockUnitsMember

2024-01-01

2024-03-31

0001398805

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-03-31

0001398805

BEEM:RSUsAndPSUsMember

2024-01-01

2024-03-31

0001398805

BEEM:RSUsAndPSUsMember

2024-03-31

0001398805

us-gaap:RestrictedStockMember

2024-01-01

2024-03-31

0001398805

us-gaap:RestrictedStockMember

2023-01-01

2023-03-31

0001398805

BEEM:ConsultantMember

BEEM:InvestorRelationsServicesMember

us-gaap:WarrantMember

2024-01-01

2024-03-31

0001398805

us-gaap:WarrantMember

2024-01-01

2024-03-31

0001398805

us-gaap:WarrantMember

2024-03-31

0001398805

us-gaap:StockOptionMember

2023-12-31

0001398805

srt:MinimumMember

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-03-31

0001398805

srt:MaximumMember

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-03-31

0001398805

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-03-31

0001398805

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-03-31

0001398805

us-gaap:RestrictedStockMember

2023-12-31

0001398805

us-gaap:RestrictedStockMember

2024-03-31

0001398805

us-gaap:WarrantMember

2023-12-31

0001398805

us-gaap:ProductMember

2024-01-01

2024-03-31

0001398805

us-gaap:ProductMember

2023-01-01

2023-03-31

0001398805

us-gaap:MaintenanceMember

2024-01-01

2024-03-31

0001398805

us-gaap:MaintenanceMember

2023-01-01

2023-03-31

0001398805

BEEM:ProfessionalServicesMember

2024-01-01

2024-03-31

0001398805

BEEM:ProfessionalServicesMember

2023-01-01

2023-03-31

0001398805

us-gaap:ShippingAndHandlingMember

2024-01-01

2024-03-31

0001398805

us-gaap:ShippingAndHandlingMember

2023-01-01

2023-03-31

0001398805

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

BEEM:CaliforniaCustomersMember

2024-01-01

2024-03-31

0001398805

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

BEEM:CaliforniaCustomersMember

2023-01-01

2023-03-31

0001398805

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

BEEM:InternationalSalesMember

2024-01-01

2024-03-31

0001398805

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

BEEM:InternationalSalesMember

2023-01-01

2023-03-31

0001398805

BEEM:ProductDepositsMember

2024-03-31

0001398805

BEEM:ProductDepositsMember

2023-12-31

0001398805

BEEM:MaintenanceFeesMember

2024-03-31

0001398805

BEEM:MaintenanceFeesMember

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:EUR

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Period ended March 31, 2024

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________________

to ________________

Commission File Number 001-38868

Beam Global

(Exact name of Registrant as specified in its charter)

| Nevada |

26-1342810 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

5660 Eastgate Dr.

San Diego, California |

92121 |

| (Address of principal executive offices) |

(Zip Code) |

(858) 799-4583

(Registrant’s telephone number, including

area code)

_____________________________________________

(Former name, former address and formal fiscal

year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange in which registered |

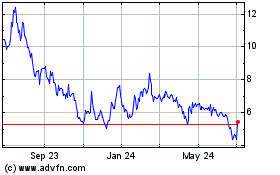

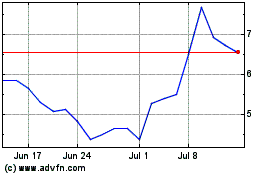

| Common stock, $0.001 par value |

BEEM |

Nasdaq Capital Market |

| |

|

|

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company

under Rule 12b-2 of the Exchange Act. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated Filer ☒ |

Smaller reporting company ☒ |

| Emerging growth company ☐ |

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

No ☒

The number of registrant's shares of common stock,

$0.001 par value outstanding as of May 16, 2024 was 14,537,451.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Beam Global

Condensed Consolidated Balance Sheets

(In thousands, except share and

per share data)

| | |

| | | |

| | |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 4,962 | | |

$ | 10,393 | |

| Accounts receivable, net of allowance for credit losses of $112 and $447 | |

| 20,139 | | |

| 15,943 | |

| Prepaid expenses and other current assets | |

| 2,216 | | |

| 2,453 | |

| Inventory, net | |

| 11,474 | | |

| 11,933 | |

| Total current assets | |

| 38,791 | | |

| 40,722 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 15,597 | | |

| 16,513 | |

| Operating lease right of use assets | |

| 2,249 | | |

| 1,026 | |

| Goodwill | |

| 10,150 | | |

| 10,270 | |

| Intangible assets, net | |

| 8,769 | | |

| 9,050 | |

| Deposits | |

| 98 | | |

| 62 | |

| Total assets | |

$ | 75,654 | | |

$ | 77,643 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 10,778 | | |

$ | 9,732 | |

| Accrued expenses | |

| 3,812 | | |

| 2,737 | |

| Sales tax payable | |

| 211 | | |

| 209 | |

| Deferred revenue, current | |

| 1,007 | | |

| 828 | |

| Note payable, current | |

| 45 | | |

| 40 | |

| Deferred consideration, current | |

| – | | |

| 2,713 | |

| Contingent consideration, current | |

| 4,330 | | |

| – | |

| Operating lease liabilities, current | |

| 851 | | |

| 615 | |

| Total current liabilities | |

| 21,034 | | |

| 16,874 | |

| | |

| | | |

| | |

| Deferred revenue, noncurrent | |

| 470 | | |

| 402 | |

| Note payable, noncurrent | |

| 178 | | |

| 160 | |

| Contingent consideration, noncurrent | |

| 248 | | |

| 4,725 | |

| Other liabilities, noncurrent | |

| 3,716 | | |

| 3,787 | |

| Deferred tax liabilities, noncurrent | |

| 1,662 | | |

| 1,698 | |

| Operating lease liabilities, noncurrent | |

| 1,444 | | |

| 455 | |

| Total liabilities | |

| 28,752 | | |

| 28,101 | |

| | |

| | | |

| | |

| Stockholders' equity | |

| | | |

| | |

| Preferred stock, $0.001 par value, 10,000,000 authorized, none outstanding as of March 31, 2024 and December 31, 2023. | |

| – | | |

| – | |

| Common stock, $0.001 par value, 350,000,000 shares authorized, 14,438,270 and 14,398,243 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively. | |

| 14 | | |

| 14 | |

| Additional paid-in-capital | |

| 142,991 | | |

| 142,265 | |

| Accumulated deficit | |

| (96,398 | ) | |

| (93,361 | ) |

| Accumulated Other Comprehensive Income (AOCI) | |

| 295 | | |

| 624 | |

| | |

| | | |

| | |

| Total stockholders' equity | |

| 46,902 | | |

| 49,542 | |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity | |

$ | 75,654 | | |

$ | 77,643 | |

The accompanying unaudited notes are an integral

part of these unaudited condensed consolidated financial statements

Beam Global

Condensed Consolidated Statement of Operations

and Comprehensive Loss

(Unaudited, in thousands except per share data)

| | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | 14,561 | | |

$ | 13,020 | |

| | |

| | | |

| | |

| Cost of revenues | |

| 13,082 | | |

| 13,015 | |

| | |

| | | |

| | |

| Gross profit | |

| 1,479 | | |

| 5 | |

| | |

| | | |

| | |

| Operating expenses | |

| 4,527 | | |

| 3,846 | |

| | |

| | | |

| | |

| Loss from operations | |

| (3,048 | ) | |

| (3,841 | ) |

| | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | |

| Interest income | |

| 71 | | |

| 1 | |

| Other (expense) income | |

| (56 | ) | |

| 10 | |

| Interest expense | |

| (4 | ) | |

| – | |

| Other income | |

| 11 | | |

| 11 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Income tax expense | |

| – | | |

| 1 | |

| | |

| | | |

| | |

| Net loss | |

$ | (3,037 | ) | |

$ | (3,831 | ) |

| | |

| | | |

| | |

| Net foreign currency translation adjustments | |

| (329 | ) | |

| – | |

| Total Comprehensive Loss | |

$ | (3,366 | ) | |

$ | (3,831 | ) |

| | |

| | | |

| | |

| Net loss per share - basic | |

$ | (0.21 | ) | |

$ | (0.38 | ) |

| Net loss per share - diluted | |

$ | (0.21 | ) | |

$ | (0.38 | ) |

| | |

| | | |

| | |

| Weighted average shares outstanding - basic | |

| 14,422 | | |

| 10,214 | |

| Weighted average shares outstanding - diluted | |

| 14,422 | | |

| 10,214 | |

The accompanying unaudited notes are an integral

part of these unaudited condensed consolidated financial statements

Beam Global

Consolidated Statements of Changes in Stockholders’

Equity

(Unaudited, in thousands)

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Common Stock | | |

Additional Paid-in | | |

Accumulated | | |

Accumulated Other Comprehensive | | |

Total Stockholders' | |

| | |

Stock | | |

Amount | | |

Capital | | |

Deficit | | |

Income | | |

Equity | |

| Balance at December 31, 2022 | |

| 10,178 | | |

$ | 10 | | |

$ | 100,498 | | |

$ | (77,301 | ) | |

$ | 0 | | |

$ | 23,207 | |

| Stock issued for director services - vested | |

| 6 | | |

| – | | |

| 76 | | |

| – | | |

| – | | |

| 76 | |

| Stock issued to (released from) escrow account - unvested | |

| (6 | ) | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Stock-based compensation to consultants | |

| 6 | | |

| – | | |

| 1,704 | | |

| – | | |

| – | | |

| 1,704 | |

| Employee stock-based compensation expense | |

| – | | |

| – | | |

| 438 | | |

| – | | |

| – | | |

| 438 | |

| Warrants exercised for cash | |

| 16 | | |

| – | | |

| 100 | | |

| – | | |

| – | | |

| 100 | |

| Sale of stock under Committed Equity Facility | |

| 38 | | |

| – | | |

| 158 | | |

| – | | |

| – | | |

| 158 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (3,831 | ) | |

| – | | |

| (3,831 | ) |

| Balance at March 31, 2023 | |

| 10,238 | | |

$ | 10 | | |

$ | 102,974 | | |

$ | (81,132 | ) | |

$ | 0 | | |

$ | 21,852 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at December 31, 2023 | |

| 14,398 | | |

$ | 14 | | |

$ | 142,265 | | |

$ | (93,361 | ) | |

$ | 624 | | |

$ | 49,542 | |

| Stock issued for director services - vested | |

| 0 | | |

| – | | |

| 6 | | |

| – | | |

| – | | |

| 6 | |

| Stock issued to (released from) escrow account - unvested | |

| (0 | ) | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Stock-based compensation to consultants | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Employee stock-based compensation expense | |

| – | | |

| – | | |

| 468 | | |

| – | | |

| – | | |

| 468 | |

| Warrants exercised for cash | |

| 40 | | |

| – | | |

| 252 | | |

| – | | |

| – | | |

| 252 | |

| Impact of foreign currency translation | |

| – | | |

| – | | |

| – | | |

| – | | |

| (329 | ) | |

| (329 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (3,037 | ) | |

| – | | |

| (3,037 | ) |

| Balance at March 31, 2024 | |

| 14,438 | | |

$ | 14 | | |

$ | 142,991 | | |

$ | (96,398 | ) | |

$ | 295 | | |

$ | 46,902 | |

The accompanying unaudited notes are an integral

part of these unaudited condensed consolidated financial statements

Beam Global

Condensed Consolidated Statements of Cash Flows

(Unaudited, in thousands)

| | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Operating Activities: | |

| | | |

| | |

| Net loss | |

$ | (3,037 | ) | |

$ | (3,831 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 930 | | |

| 332 | |

| Provision on credit losses | |

| (336 | ) | |

| – | |

| Common stock issued for services | |

| – | | |

| 76 | |

| Change in fair value of contingent consideration liabilities | |

| (147 | ) | |

| (13 | ) |

| Employee stock-based compensation | |

| 554 | | |

| 438 | |

| Disposal of property and equipment | |

| 27 | | |

| – | |

| Abandoned patent costs | |

| 36 | | |

| – | |

| Stock Compensation expense for non-employees | |

| – | | |

| 14 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| (Increase) decrease in: | |

| | | |

| | |

| Accounts receivable | |

| (3,901 | ) | |

| (2,453 | ) |

| Prepaid expenses and other current assets | |

| 151 | | |

| 390 | |

| Operating lease right of use asset | |

| – | | |

| – | |

| Inventory | |

| 425 | | |

| (414 | ) |

| Deposits | |

| (36 | ) | |

| – | |

| Increase (decrease) in: | |

| | | |

| | |

| Accounts payable | |

| 956 | | |

| 4,235 | |

| Accrued expenses | |

| 1,082 | | |

| 932 | |

| Operating lease liability | |

| – | | |

| – | |

| Sales tax payable | |

| 2 | | |

| (20 | ) |

| Deferred revenue | |

| 258 | | |

| (305 | ) |

| Other long term liabilities | |

| 10 | | |

| – | |

| Net cash used in operating activities | |

| (3,026 | ) | |

| (619 | ) |

| | |

| | | |

| | |

| Investing Activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| (104 | ) | |

| (314 | ) |

| Payment of Deferred Consideration | |

| (2,713 | ) | |

| – | |

| Funding of patent costs | |

| – | | |

| (16 | ) |

| Net cash used in investing activities | |

| (2,817 | ) | |

| (330 | ) |

| | |

| | | |

| | |

| Financing Activities: | |

| | | |

| | |

| Proceeds from sale of common stock under committed equity facility, net of offering costs | |

| – | | |

| 158 | |

| Proceeds from warrant exercises | |

| 252 | | |

| 100 | |

| Borrowings of note payable | |

| 25 | | |

| – | |

| Net cash used in financing activities | |

| 277 | | |

| 258 | |

| | |

| | | |

| | |

| Effect of exchange rate changes | |

| 135 | | |

| – | |

| | |

| | | |

| | |

| Net decrease in cash | |

| (5,431 | ) | |

| (691 | ) |

| Cash at beginning of period | |

| 10,393 | | |

| 1,681 | |

| Cash at end of period | |

$ | 4,962 | | |

$ | 990 | |

| | |

| | | |

| | |

| Supplemental Disclosure of Cash Flow Information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 4 | | |

$ | – | |

| Cash paid for taxes | |

$ | – | | |

$ | 1 | |

| | |

| | | |

| | |

| Supplemental Disclosure of Non-Cash Investing and Financing Activities: | |

| | | |

| | |

| Purchase of property and equipment by incurring current liabilities | |

$ | 104 | | |

$ | 21 | |

| Right-of-use assets obtained in exchange for lease liabilities | |

$ | 1,223 | | |

$ | – | |

| Issuance of stock for Committed Equity Line | |

$ | – | | |

$ | 140 | |

| Warrants issued for services to non-employee | |

$ | – | | |

$ | 1,609 | |

| Shares issued for services to non-employee | |

$ | – | | |

$ | 95 | |

The accompanying unaudited notes are an integral

part of these unaudited condensed consolidated financial statements

BEAM GLOBAL

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(Unaudited)

| 1. |

NATURE OF OPERATIONS, BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Nature of Operations

Beam is a clean technology

innovator based in San Diego, California; Broadview, Illinois and Kraljevo, Serbia. We develop, design, engineer, manufacture and sell

high-quality, renewably energized infrastructure products for electric vehicle (“EV”) charging, outdoor media and branding,

and energy security and disaster preparedness as well as safe and compact, highly energy-dense battery solutions. Beam’s products

enable vital and highly valuable energy production in locations where it is either too expensive or too impactful to connect to the utility

grid, or where the requirements for electrical power are so important that grid failures, like blackouts, are intolerable. Beam’s

energy storage products provide high energy density in a safe, compact and bespoke form-factors ideal for the rapidly increasing numbers

of mobile and stationary equipment and products which require electrical energy without being connected to the electrical grid.

Beam’s products and

proprietary technology solutions target four markets that are experiencing significant growth with annual global spending in the billions

of dollars:

| |

· |

electric vehicle (EV) charging infrastructure; |

| |

|

|

| |

· |

energy storage solutions; |

| |

|

|

| |

· |

energy security and disaster preparedness; and |

| |

|

|

| |

· |

outdoor media advertising. |

Basis of Presentation

The interim unaudited condensed

consolidated financial statements included herein have been prepared in accordance with accounting principles generally accepted in the

United States (“GAAP”) for interim financial statements and are in the form prescribed by the Securities and Exchange Commission

in instructions to Form 10-Q and Rule 10-01 of Regulation S-X. In management’s opinion, all adjustments (consisting of normal recurring

adjustments and reclassifications) necessary to present fairly our results of operations and cash flows for the three months ending March

31, 2024 and 2023, and our financial position as of March 31, 2024, have been made. The results of operations for such interim periods

are not necessarily indicative of the operating results to be expected for the full year.

Certain information and disclosures

normally included in the notes to the annual financial statements have been condensed or omitted from these interim financial statements.

Accordingly, these interim unaudited condensed consolidated financial statements should be read in conjunction with the financial statements

and notes thereto for the year ended December 31, 2023. The December 31, 2023 balance sheet is derived from those statements.

Use of Estimates

The preparation of financial

statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the

date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could

differ from those estimates. Significant estimates in the accompanying financial statements include the allowance for credit losses (CECL),

valuation of inventory and standard cost allocations, depreciable lives of property and equipment, valuation of contingent consideration

liability, valuation of intangible assets, estimates of loss contingencies, estimates of the valuation of lease liabilities and the related

right of use assets, valuation of share-based costs, and the valuation allowance on deferred tax assets.

Recent Accounting Pronouncements

In October 2023, the FASB

issued ASU 2023-06, “Disclosure Improvements” (“ASU 2023-06”), which amends the disclosure or presentation requirements

related to various subtopics in the FASB Accounting Standards Codification (the “Codification”). The ASU was issued in response

to the SEC’s disclosure update and simplification initiative issued in August 2018. The effective date for the amendments for each

topic will be the date on which the SEC’s removal of that related disclosure from Regulation S-X or Regulation S-K becomes effective,

with early adoptions prohibited.

In December 2023, the FASB

issued ASU No. 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures” (“ASU 2023-09”).

ASU 2023-09 requires disaggregated information about a company’s effective tax rate reconciliation and information on income taxes

paid. This standard is effective for Beam beginning with our annual financial statements for the fiscal year ending December 31, 2025.

Early adoption is permitted. The Company is currently evaluating the impact that the updated standard will have on our consolidated financial

statements.

Concentrations

Credit Risk

Financial instruments that

potentially subject us to concentrations of credit risk consist of cash and accounts receivable.

The Company maintains its

cash in banks and financial institutions that at times may exceed federally insured limits. The Company has not experienced any losses

in such accounts from inception through March 31, 2024. As of March 31, 2024, approximately $4.8 million of the Company’s cash deposits

were greater than the federally insured limits.

Major Customers

The Company continually assesses

the financial strength of its customers. We are not aware of any material credit risks associated with our customers. 84% of our first

quarter revenues were derived from pre-funded federal, state and local government programs, and the remaining 16% were derived from commercial

customers that we believe have good credit or, alternatively, favorable payment terms which minimizes our credit risk with respect to

such customers. For the three months ended March 31, 2024, two customers accounted for 30% and 18% of total revenues, with no other single

customer accounting for more than 10% of total revenues. At March 31, 2024, accounts receivable from three customers accounted for 22%,

18% and 14% of total accounts receivable with no other single customer accounting for more than 10% of the accounts receivable balance.

At December 31, 2023, accounts receivable from four customers accounted for 11%, 10%, 10% and 10% of total accounts receivable each with

no other single customer accounting for more than 10% of the accounts receivable balance. For the three months ended March 31, 2024 and

2023, the Company’s sales to federal, state and local governments represented 84% and 86% of revenues, respectively.

Fair Value Measurement

The Company follows the authoritative guidance that

establishes a formal framework for measuring fair values of assets and liabilities in the consolidated financial statements that are already

required by generally accepted accounting principles to be measured at fair value. The guidance defines fair value as the price that would

be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement

date (exit price). The transaction is based on a hypothetical transaction in the principal or most advantageous market considered from

the perspective of the market participant that holds the asset or owes the liability.

The Company utilizes market data or assumptions that

market participants who are independent, knowledgeable, and willing and able to transact would use in pricing the asset or liability,

including assumptions about risk and the risks inherent in the inputs to the valuation technique. These inputs can be readily observable,

market corroborated or generally unobservable. The Company attempts to utilize valuation techniques that maximize the use of observable

inputs and minimize the use of unobservable inputs.

The Company is able to classify fair value balances

based on the observability of those inputs. The guidance establishes a formal fair value hierarchy based on the inputs used to measure

fair value. The hierarchy gives the highest priority to Level 1 measurements and the lowest priority to level 3 measurements, and accordingly,

Level 1 measurement should be used whenever possible.

The hierarchy is broken down into three levels based

on the reliability of inputs as follows:

Level 1 – Quoted prices in active markets for

identical assets or liabilities or published net asset value for alternative investments with characteristics similar to a mutual fund.

Level 2 – Inputs other than quoted prices included

within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 – Unobservable inputs for the asset or

liability.

The methods used may produce a fair value

calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while management

believes its valuation methods are appropriate, the fair value of certain financial instruments could result in a difference fair

value measurement at the reporting date. There were no changes in the Company’s valuation methodologies from the prior

year.

For purpose of this disclosure, the carrying amounts

for financial assets and liabilities such as cash and cash equivalents, accounts receivable – trade, other prepaid expenses and

current assets, accounts payable and other current liabilities, all approximate fair value due to their short-term nature as of March

31, 2024. The Company had Level 3 liabilities as of March 31, 2024. There were no transfers between levels during the reporting period.

| Fair value of contingent consideration | |

Level 1 | | |

Level 2 | | |

Level 3 | |

| Contingent Consideration as of December 31, 2023 | |

$ | – | | |

$ | – | | |

$ | 4,725 | |

| Additions | |

| – | | |

| – | | |

| – | |

| Change in fair value | |

| – | | |

| – | | |

| (147 | ) |

| Contingent Consideration as of March 31, 2024 | |

$ | – | | |

$ | – | | |

$ | 4,578 | |

Significant Accounting Policies

During the three months ended

March 31, 2024, there were no changes to our significant accounting policies as described in our Annual Report on Form 10-K for the year

ended December 31, 2023.

Net Loss Per Share

Basic net loss per share is

computed by dividing the net loss by the weighted average number of shares of common stock outstanding during the periods presented. Diluted

net loss per share of common stock is computed using the weighted average number of common stock outstanding for the period, and, if dilutive,

potential common stock outstanding during the period. Potential common stock outstanding consists of shares of common stock issuable upon

the exercise of stock options, stock warrants, or other common stock equivalents. Potentially common stock outstanding are excluded from

the computation if their effect is anti-dilutive.

Options to purchase 592,658

shares of common stock and warrants to purchase 570,718 shares of common stock were outstanding at March 31, 2024. Options to purchase

346,758 common shares and warrants to purchase 624,306 shares of common stock were outstanding at March 31, 2023. These options and warrants

were not included in the computation of diluted loss per share for the three months ended March 31, 2024 and 2023 because the effects

would have been anti-dilutive. These options and warrants may dilute future earnings per share.

Segments

The Company assesses its segment

reporting based on how it internally manages and reports the results of its business to its chief operating decision maker. Management

reviews financial results, manages the business and allocates resources on an aggregate basis. Therefore, financial results are reported

in a single operating segment.

The Company had net losses

of $3.0 million

(which includes $1.1 million of non-cash

expenses) and $3.8

million (which includes $0.9 million

of non-cash expenses) and net cash used in operating activities of $3.0 million and $0.6 million for the three months ended March 31,

2024 and 2023, respectively. At March 31, 2024, the Company had a cash balance of $5.0

million and working capital of $17.8 million. Based

on the Company’s current operating plan and the available working capital that can be converted to cash, particularly the accounts

receivable balance of approximately $20.1 million

the Company believes that it has the ability to fund its operations and meet contractual obligations for at least twelve months from

the date of this report.

In 2022, the Company entered

into a Common Stock Purchase Agreement and Registration Rights Agreement with B. Riley Principal Capital II, LLC (“B. Riley”)

under which the Company has the right, but not the obligation, to sell up to $30.0 million worth of shares, but in any event, no more

than 2.0 million shares of its common stock over a period of 24 months in its sole discretion (see note 11 for further information). The

Company has issued 199,469 shares for $2.5 million since 2022 under this agreement. There is $27.5 million worth of shares of common stock

remaining under this facility available to sell through Q4 2024.

The Company’s outstanding

warrants generated $0.3 million and $0.1 million of proceeds during each of the three months ended March 31, 2024 and 2023, respectively.

Warrants to purchase 370,718 shares of common stock which were issued in our 2019 public offering expired on April 18, 2024. Excluding

the warrants issued in our 2019 public offering which recently expired, the Company has a warrant outstanding to purchase up to 200,000

shares of our common stock at an exercise price equal to $17.00 per share that expires in March 2028 that could potentially generate an

additional $3.4 million of proceeds, conditioned upon the market price of our common stock and the warrant holder’s ability and

decision to exercise them.

In March 2023, the Company

entered into a supply chain line of credit agreement with OCI Group for up to $100 million to further support our working capital requirements.

Subject to the terms of the agreement, OCI Group will make available to the Company funding based on amounts owed to the Company by its

customers.

The Company believes that

it will become profitable in the next few years as our revenues continue to grow, we improve our gross margins and we leverage our overhead

costs, but we expect to continue to incur losses for a period of time. If necessary, the Company may raise additional capital to finance

its future operations through equity or debt financings. There is no guarantee that profitable operations will be achieved, or that additional

capital or debt financing will be available on a timely basis, on favorable terms, or at all, and such funding, if raised, may not be

sufficient to meet our obligations or enable us to continue to implement our long-term business strategy. In addition, obtaining

additional funding or entering into other strategic transactions could result in significant dilution to our stockholders.

Amiga DOO Kraljevo

On

October 20, 2023, the Company acquired Amiga DOO Kraljevo (“Amiga”), pursuant to a Share Sale and Purchase Agreement dated

October 6, 2023 (the “Purchase Agreement”) by and among the Company and the owners of Amiga (the “Sellers”). Pursuant

to the terms of the Purchase Agreement, the Company acquired all the equity stock of Amiga from the Sellers in exchange for cash and common

stock. With respect to the cash portion of the purchase price, the Company paid to the Sellers 4.6 million euros ($4.9 million) at closing

and an additional 2.5 million euros ($2.7 million) was deferred on December 31, 2023, and paid on January 2, 2024. With respect to the

equity portion of the purchase price, the Company issued to the Sellers 293,675 shares of our common stock upon closing and an additional

158,132 shares before December 31, 2023.

The Sellers are eligible to earn

additional shares of the Company’s common stock if Amiga meets certain revenue milestones for the years ended December 31, 2024

and 2025 (the “Earnout Consideration”). The Earnout Consideration that Sellers are eligible to receive is equal to two times

the amount of revenue of Amiga (“Amiga Net Revenue”) that is greater than specific revenue targets for each of the years ended

December 31, 2024 and 2025. The Earnout Consideration will be paid in the Company’s stock for each annual target period and will

be calculated based on the volume weighted average price of Beam’s common stock for the thirty trading days prior to the end of

the applicable measurement period. In no event and under no circumstances will the Company issue to the Sellers an amount of the Company’s

common stock that exceeds 19.99% of the total outstanding common stock of the Company immediately prior to the closing. An estimate of

the fair value of the contingent consideration has been recorded in the opening balance sheet. Additionally, if within five years

of the closing date of the acquisition Amiga receives a final award in specific legal proceedings in excess of EUR 3.8 million, the amount

exceeding EUR 3.8 million is payable to the Sellers. This is not currently considered probable and therefore no accrual has been established.

On February 16, 2024, the Company and the Sellers entered into an amendment to the Purchase Agreement

to remove the requirement that the Sellers shall be providing services to Amiga as a condition to receive the Earnout Consideration. During

the three months ended March 31, 2024, the Company recorded $0.1 million of income related to the fair value adjustment of the liability

for Earnout Consideration.

Amiga,

located in Serbia, is engaged in the manufacture and distribution of steel structures with integrated electronics, such as streetlights,

cell towers, and ski lift towers. We expect the acquisition of Amiga to assist in introducing our products to Europe, increasing

and diversifying our revenues, enhancing our manufacturing and engineering capabilities, accelerating the development of EV Standard™

and other products both in Europe and the US, adding new customer segments in both Europe and the US, increasing barriers to entry for

future competition, and advancing Beam’s position as a leader in the green economy.

The acquisition was accounted

for as a business combination in accordance with Accounting Standards Codification (ASC) 805, Business Combinations. Goodwill represents

the premium the Company paid over net fair value of tangible and intangible assets acquired.

On November 7, 2023, Amiga changed

its name to Beam Europe LLC.

Pro Forma Financial Information

The following pro forma financial

information summarizes the combined results of operations of Beam Global and Amiga as if the companies had been combined as of the beginning

of the three months ended March 31, 2023 (in thousands):

| Schedule of pro forma financial information | |

| | |

| | |

March 31, | |

| | |

2023 | |

| Revenues | |

$ | 14,425 | |

| Net Loss | |

$ | (4,298 | ) |

The pro forma financial information

is presented for information purposes only and is not indicative of the results of operations that would have been achieved had the acquisition

been completed at the beginning of the three months ended March 31, 2023. In addition, the unaudited pro forma financial information is

not a projection of future results of operations of the combined company, nor does it reflect the expected realization of any synergies

or cost savings associated with the acquisition. The unaudited pro forma financial information includes adjustments to reflect the incremental

amortization expense of the identifiable intangible assets and transaction costs.

The statement of operations, in the table above,

for the three months ended March 31, 2023 includes revenues of $1.4 million and loss from operations of $0.5 million from the acquired

Amiga business.

Inventory consists of the following (in thousands):

| Schedule of inventory | |

| | | |

| | |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Finished goods | |

$ | 5,101 | | |

$ | 1,953 | |

| Work in process | |

| 447 | | |

| 2,006 | |

| Raw materials | |

| 5,926 | | |

| 7,974 | |

| Total inventory, net | |

$ | 11,474 | | |

$ | 11,933 | |

| 5. |

PROPERTY AND EQUIPMENT |

Property and equipment consist

of the following (in thousands):

| Schedule of property and equipment | |

| | | |

| | |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Office furniture and equipment | |

$ | 227 | | |

$ | 227 | |

| Computer equipment and software | |

| 244 | | |

| 248 | |

| Land, buildings and leasehold improvements | |

| 7,771 | | |

| 7,935 | |

| Autos | |

| 649 | | |

| 616 | |

| Machinery and equipment | |

| 9,073 | | |

| 9,200 | |

| Total property and equipment | |

| 17,964 | | |

| 18,226 | |

| Less accumulated depreciation | |

| (2,367 | ) | |

| (1,713 | ) |

| Property and Equipment, net | |

$ | 15,597 | | |

$ | 16,513 | |

Depreciation expense

during the three months ended March 31, 2024 and March 31, 2023 was $0.7

million and $0.1

million, respectively.

The intangible assets consist of the following

(in thousands):

| Schedule of intangible assets | |

| | | |

| | | |

| | | |

| | |

| | |

December 31, 2023 | |

| | |

Gross Carrying Amount | | |

Accumulated Amortization | | |

Net Carrying Amount | | |

Weighted-average Amortization Period (yrs) | |

| Developed technology | |

$ | 8,074 | | |

$ | (1,346 | ) | |

$ | 6,728 | | |

| 11 | |

| Trade name | |

| 1,756 | | |

| (322 | ) | |

| 1,434 | | |

| 10 | |

| Customer relationships | |

| 444 | | |

| (110 | ) | |

| 334 | | |

| 13 | |

| Backlog | |

| 185 | | |

| (185 | ) | |

| – | | |

| 1 | |

| Patents | |

| 611 | | |

| (57 | ) | |

| 554 | | |

| 20 | |

| Intangible assets | |

$ | 11,070 | | |

$ | (2,020 | ) | |

$ | 9,050 | | |

| | |

| | |

March 31, 2024 | |

| | |

Gross Carrying Amount | | |

Accumulated Amortization | | |

Net Carrying Amount | | |

Weighted-average Amortization Period (yrs) | |

| Developed technology | |

$ | 8,074 | | |

$ | (1,529 | ) | |

$ | 6,545 | | |

| 11 | |

| Trade name | |

| 1,756 | | |

| (366 | ) | |

| 1,390 | | |

| 10 | |

| Customer relationships | |

| 444 | | |

| (122 | ) | |

| 322 | | |

| 13 | |

| Backlog | |

| 185 | | |

| (185 | ) | |

| – | | |

| 1 | |

| Patents | |

| 573 | | |

| (61 | ) | |

| 512 | | |

| 20 | |

| Intangible assets | |

$ | 11,032 | | |

$ | (2,263 | ) | |

$ | 8,769 | | |

| | |

Amortization expense

during the three months ended March 31, 2024 and March 31, 2023 was $0.2

million and $0.3

million, respectively.

The major components of accrued expenses

are summarized as follows (in thousands):

| Schedule of accrued expenses | |

| | | |

| | |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Accrued Expenses: | |

| | | |

| | |

| Accrued vacation | |

$ | 255 | | |

$ | 246 | |

| Accrued salaries and bonus | |

| 1,382 | | |

| 1,086 | |

| Vendor accruals | |

| 75 | | |

| 50 | |

| Accrued warranty | |

| 19 | | |

| 27 | |

| Customer prepayments | |

| 950 | | |

| – | |

| Other accrued expense | |

| 1,132 | | |

| 1,328 | |

| Total accrued expenses | |

$ | 3,813 | | |

$ | 2,737 | |

| | |

| | | |

| | |

| Other Long-Term Liabilities: | |

| | | |

| | |

| Long-term deferred tax liability | |

$ | 1,662 | | |

$ | 1,698 | |

| Acquired long-term liability | |

| 3,716 | | |

| 3,787 | |

| Total long-term liabilities | |

$ | 5,378 | | |

$ | 5,485 | |

Acquired long-term liability of $3.8 million consists

of a restructuring debt settlement from the acquisition of Amiga. The debt restructuring was entered into in 2021 for a nine year term

with six years and nine months remaining at March 31, 2024. Payments are due quarterly as a percent of the remaining balance due.

In May 2023, the Company

purchased two new trucks and financed the purchase through an auto loan. The loan has a term of 60 months, requires monthly payments

of approximately $4

thousand, and bears interest at a rate of 7.55

percent per year. Payment on the loan began in July 2023, and the loan has a short-term balance of $40

thousand. In March 2024, the Company purchased a forklift and financed the purchase through an auto loan. The loan has a term of 60

months, requires monthly payments of approximately $661,

and bears interest at a rate of 6.54

percent per year. Payment on the loan began in February 2024, and the loan has a short-term balance of $6

thousand.

| 9. |

COMMITMENTS AND CONTINGENCIES |

Legal Matters:

From time to time, we may

be involved in litigation relating to claims arising out of our operations in the normal course of business. As of March 31, 2024, there

were no pending or threatened lawsuits that could reasonably be expected to have a material effect on the results of our operations.

Other Commitments:

The Company enters into various

contracts or agreements in the normal course of business whereby such contracts or agreements may contain commitments. Since inception,

the Company entered into agreements to act as a reseller for certain vendors; joint development contracts with third parties; referral

agreements where the Company would pay a referral fee to the referrer for business generated; sales agent agreements whereby sales agents

would receive a fee equal to a percentage of revenues generated by the agent; business development agreements and strategic alliance agreements

where both parties agree to cooperate and provide business opportunities to each other and in some instances, provide for a right of first

refusal with respect to certain projects of the other parties; agreements with vendors where the vendor may provide marketing, investor

relations, public relations, software licenses, technical consulting or subcontractor services, vendor arrangements with non-binding minimum

purchasing provisions, and financial advisory agreements where the financial advisor would receive a fee and/or commission for raising

capital for the Company.

There was no Federal income

tax expense for the three months ended March 31, 2024 or 2023 due to the Company’s net losses. Income tax expense represents the

minimum state taxes due. As a result of the Company’s history of incurring operating losses, a full valuation allowance has been

established to offset all deferred tax assets as of March 31, 2024 and no benefit has been provided for the quarter-to-date loss. On a

quarterly basis, the company evaluates the positive and negative evidence to assess whether the more likely than not criteria have been

satisfied in determining whether there will be further adjustments to the valuation allowance.

Committed Equity Facility

On

September 2, 2022, the Company entered into a Common Stock Purchase Agreement (the “Purchase Agreement”) with B. Riley.

Pursuant to the Purchase Agreement, the Company has the right, in its sole discretion, to sell to B. Riley up to $30.0 million, but

in any event, a maximum of 2.0 million shares of the Company’s common stock at 97% of the volume weighted average price of the

Company’s common stock, as calculated in accordance with the Purchase Agreement, over a period of 24 months subject to certain

limitations and conditions contained in the Purchase Agreement. Sales and timing of any sales are solely at the election of the

Company, and the Company is under no obligation to sell any common stock to B. Riley under the Purchase Agreement. As consideration

for B. Riley’s commitment to purchase shares of the Company’s common stock the Company issued B. Riley 10,484

shares of its common stock in both September 2022 and April 2023.

The

Company incurred an aggregate cost of approximately $0.5 million in connection with the Purchase Agreement, including the fair value of

the shares of common stock issued to B. Riley, which were recorded as equity on the Balance Sheet and offset proceeds from the sale of

the Company’s common stock under the Purchase Agreement.

The

Company has issued 199,469 shares under the Purchase Agreement for $2.5 million in proceeds, of which $0.5 million was offset by the offering

costs as of March 31, 2024.

Stock Options

Option activity for the three months ended March

31, 2024 is as follows:

| Schedule of option activity | |

| | | |

| | |

| | |

| | |

Weighted | |

| | |

| | |

Average | |

| | |

Number of | | |

Exercise | |

| | |

Options | | |

Price | |

| Outstanding at December 31, 2023 | |

| 481,858 | | |

$ | 10.41 | |

| Granted | |

| 113,000 | | |

| 6.10 | |

| Forfeited | |

| (2,200 | ) | |

| 10.74 | |

| Outstanding at March 31, 2024 | |

| 592,658 | | |

$ | 8.48 | |

The fair value of each option

is estimated on the date of grant using the Black-Scholes option-pricing model using the assumptions in the table below and we assumed

there would not be dividends paid during the life of the options granted during the three months ended March 31, 2024 and 2023:

| Schedule of assumptions for options granted |

|

|

|

|

| |

|

Three months ended March 31, |

| |

|

2024 |

|

2023 |

| Expected volatility |

|

90.28% - 90.37% |

|

94.51% |

| Expected term |

|

7 Years |

|

7 Years |

| Risk-free interest rate |

|

4.01% - 4.25% |

|

3.55% |

| Weighted-average FV |

|

$4.88 |

|

$14.28 |

The Company’s stock

option compensation expense was $0.2 million for the three months ended March 31, 2024, and $0.1 million for the three months ended March

31, 2023. There was $1.6 million of total unrecognized compensation costs related to outstanding stock options at March 31, 2024 which

will be recognized over 3.0 years. Total intrinsic value of options outstanding and options exercisable were $0.4 million and $0.2 million,

respectively, as of March 31, 2024. The number of shares of common stock underlying stock options vested and unvested as of March 31,

2024 were 351,788 and 240,870, respectively.

Restricted Stock Units

In November 2022, the Company

granted 142,500 restricted stock units (“RSUs”) and up to 142,500 performance stock units (“PSU”) to its Chief

Executive Officer (“CEO”). For the RSUs, 50% vested upon the grant date, 25% vested

on February 1, 2024 and 25% will vest on February 1, 2025. The number of shares that will be earned under the PSUs will be determined

based on the achievement of specific performance metrics during the three-years ending December 31, 2024.

There was no activity during

the three months ended March 31, 2024. 142,500 PSUs and 71,250 RSUs remain outstanding as of March 31, 2024, with weighted-average grant-date

fair values of $13.05 each.

Stock compensation expense

related to the RSUs and PSUs was $0.3 million during the three months ended March 31, 2024, with $1.1 million in unrecognized stock compensation

expense remaining to be recognized over 1.0 years as of March 31, 2024.

Restricted Stock Awards

The Company issues restricted

stock to the members of its board of directors as compensation for such members’ services. Such grants generally vest ratably over

four quarters. The Company also previously issued restricted stock awards to its CEO, for which generally 50% of the shares granted vest

ratably over four quarters and the remaining 50% vest ratably over twelve quarters. The common stock related to these awards are issued

to an escrow account on the date of grant and released to the grantee upon vesting. The fair value is determined based on the closing

stock price of the Company’s common stock on the date granted and the related expense is recognized ratably over the vesting period.

A summary of activity of the restricted stock

awards for the three months ended March 31, 2024 is as follows:

| Schedule of restricted stock awards | |

| | | |

| | |

| Nonvested at December 31, 2023 | |

| 1,238 | | |

$ | 20.17 | |

| Vested | |

| (310 | ) | |

| 20.17 | |

| Nonvested at March 31, 2024 | |

| 928 | | |

$ | 20.17 | |

Stock compensation expense

related to restricted stock awards was $37 thousand and $0.1 million during each of the three months ended March 31, 2024 and 2023 respectively.

As of March 31, 2024, there

were unvested shares of common stock representing $18 thousand of unrecognized restricted stock grant expense which will be recognized

over 1 year.

Warrants

In 2023, the Company issued

warrants to purchase up to 200,000 shares of the Company’s common stock at a price per share equal to $17.00 to a consultant for

investor relations services to be provided over a five-year period. The warrants were immediately exercisable but are subject to repurchase

by the Company until the required service is provided. The fair value of such warrants was $8.05 per share or $1.6 million on the date

of grant using the Black-Scholes option-pricing model. This model incorporated certain assumptions for inputs including a risk-free market

interest rate of 3.86%, expected dividend yield of the underlying common stock of 0%, expected life of 2.5 years and expected volatility

in the market value of the underlying common stock based on our historical volatility of 99.6%. The fair value of the warrants was recorded

to prepaid expenses and other current assets to be recognized over the service period. During the three months ended March 31, 2024, $0.3

million was recorded as expense and $1.3 million of cost has not been recognized and will be recognized over the next 4.0 years.

A summary of activity of warrants outstanding

for the three months ended March 31, 2024 is as follows:

| Schedule of warrants outstanding | |

| | | |

| | |

| | |

Number of Warrants | | |

Weighted Average Exercise Price | |

| Outstanding at December 31, 2023 | |

| 610,745 | | |

$ | 9.80 | |

| Granted | |

| – | | |

| – | |

| Exercised | |

| (40,027 | ) | |

| 6.30 | |

| Outstanding at March 31, 2024 | |

| 570,718 | | |

$ | 10.05 | |

| Exercisable at March 31, 2024 | |

| 570,718 | | |

$ | 10.05 | |

Exercisable warrants as of

March 31, 2024 have a weighted average remaining contractual life of 1.44 years. The intrinsic value of the exercisable shares of the

warrants at March 31, 2024 was $0.2 million. . Warrants to purchase 370,718 shares of common stock at an exercise price equal to $6.30

which were issued in our 2019 public offering expired on April 18, 2024.

For each of the identified

periods, revenues can be categorized into the following (in thousands):

| Schedule of revenues | |

| | | |

| | |

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Product sales | |

$ | 13,570 | | |

$ | 12,811 | |

| Maintenance fees | |

| 27 | | |

| 16 | |

| Professional services | |

| 65 | | |

| 36 | |

| Shipping and handling | |

| 978 | | |

| 216 | |

| Discounts and allowances | |

| (80 | ) | |

| (59 | ) |

| Total revenues | |

$ | 14,561 | | |

$ | 13,020 | |

During the three months ended

March 31, 2024 and 2023, 27% and 60% of revenues were derived from customers located in California, respectively. In addition, 11% and

10% of revenues in the three months ended March 31, 2024 and 2023 were international sales, respectively.

At March 31, 2024 and December

31, 2023, deferred revenue was $1.5 million and $1.2 million, respectively. These amounts consisted mainly of customer deposits in the

amount of $0.9 million and $0.7 million for March 31, 2024 and December 31, 2023, respectively and prepaid multi-year maintenance plans

for previously sold products which account for $0.6 million and $0.5 million for March 31, 2024 and December 31, 2023, respectively, and

pertain to services to be provided through 2031.

Management has evaluated events that have occurred subsequent to the date of these condensed consolidated financial statements and has determined that no such reportable subsequent events exist through March 31, 2024. Based upon this review, the Company did not identify any subsequent events that would have required adjustment or disclosure in the financial statements.

Item 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

This report contains forward-looking

statements that are based on current expectations, estimates, forecasts, and projections about us, the industry in which we operate and

other matters, as well as management's beliefs and assumptions and other statements regarding matters that are not historical facts. These

statements include, in particular, statements about our plans, strategies and prospects. For example, when we use words such as “projects,”

“expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “should,” “would,” “could,” “will,” “opportunity,”

“potential” or “may,” and variations of such words or other words that convey uncertainty of future events or

outcomes, we are making forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934, as amended.

These forward-looking statements

are subject to numerous assumptions, risks and uncertainties that may cause the Company’s actual results to be materially different

from any future results expressed or implied by the Company in those statements. The most important factors that could prevent the Company

from achieving its stated goals include, but are not limited to, the following:

| |

(a) |

volatility or decline of the Company’s stock price, or absence of stock price appreciation; |

| |

|

|

| |

(b) |

fluctuation in quarterly results; |

| |

|

|

| |

(c) |

failure of the Company to earn revenues or profits; |

| |

|

|

| |

(d) |

inadequate capital to continue or expand its business, and the inability to raise additional capital or financing to implement its business plans; |

| |

|

|

| |

(e) |

reductions in demand for the Company’s products and services, whether because of competition, general industry conditions, loss of tax incentives for solar power, technological obsolescence or other reasons; |

| |

|

|

| |

(f) |

litigation with or legal claims and allegations by outside parties; |

| |

|

|

| |

(g) |

insufficient revenues to cover operating costs, resulting in persistent losses; |

| |

|

|

| |

(h) |

rapid and significant changes to costs of raw materials from government tariffs or other market factors; |

| |

|

|

| |

(i) |

failure to realize the anticipated benefits of any acquisition or difficulties in integrating any acquisition with the Company and its operations; |

| |

|

|

| |

(j) |

the preceding and other factors discussed in Part I, Item 1A, “Risk Factors,” and other reports we may file with the Securities and Exchange Commission from time to time; and |

| |

|

|

| |

(k) |

the factors set forth in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

New factors emerge from time

to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained

in any forward-looking statements. Because factors referred to elsewhere in this report on Form 10-Q and in our Annual Report on Form

10-K for the year ended December 31, 2023 (sometimes referred to as the “2023 Form 10-K”) that we previously filed with the

Securities and Exchange Commission, including without limitation the “Risk Factors” section in the 2023 Form 10-K, could cause

actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us, you should not place

undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made,

and except as may be required by applicable law, we undertake no obligation to release publicly the results of any revisions to these

forward-looking statements or to reflect events or circumstances arising after the date of this report on Form 10-Q.

Overview

Beam Global develops, manufactures,

and sells high-quality, renewably energized infrastructure products for electric vehicle charging infrastructure, energy storage, energy

security, disaster preparedness and outdoor media.

The Company has five product

lines that incorporate our proprietary technology for producing a unique alternative to grid-tied charging, having a built-in renewable

energy source in the form of attached solar panels and/or light wind generator to produce power and battery storage to store the power.

These products are rapidly deployable and attractively designed and include:

| |

- |

EV ARC™ Electric Vehicle Autonomous Renewable Charger – a patented, rapidly deployed, infrastructure product that uses integrated solar power and battery storage to provide a mounting asset and a source of power for factory installed electric vehicle charging stations of any brand. The electronics are elevated to the underside of the sun-tracking solar array making the unit flood-proof up to nine and a half feet and allowing adequate space to park a vehicle on the engineered ballast and traction pad which gives the product stability and a certified wind rating of 160 miles per hour. |

| |

- |

Solar Tree® DCFC – Patented off-grid, renewably energized and rapidly deployed, single-column mounted smart generation and energy storage system with the capability to provide a 150kW DC fast charge to one or more electric vehicles or larger vehicles. |

| |

- |

EV ARC™ DCFC – DC Fast Charging system for charging EVs comprised of four interconnected EV ARC™ systems and a 50kW DC fast charger. |

| |

- |

EV-Standard™ – patent issued on December 31, 2019 and currently under development. A lamp standard, EV charging and emergency power product which uses an existing streetlamp’s foundation and a combination of solar, wind, grid connection and onboard energy storage to provide curbside charging. |

| |

- |

UAV ARC™ - patent issued on November 24, 2020 and currently under development. An off-grid, renewably energized and rapidly deployed product and network used to charge aerial drone (UAV) fleets. |

We believe that there is a

clear need for a rapidly deployable and highly scalable EV charging infrastructure, and that our products fulfill that requirement. Unlike

grid-tied installations which require general and electrical contractors, engineers, consultants, digging trenches, permitting, pouring

concrete, wiring, and ongoing utility bills, the EV ARC™ system can be deployed in minutes, not months, and is powered by renewable

energy so there is no utility bill. We are agnostic as to the EV charging service equipment or provider and integrate best of breed solutions

based upon our customer’s requirements. For example, our EV ARC™ and Solar Tree® products have been deployed with Chargepoint,

Blink, Enel X, Electrify America and other high quality EV charging solutions. We can make recommendations to customers, or we can comply

with their specifications and/or existing charger networks. Our products replace the infrastructure required to support EV chargers, not

the chargers themselves. We do not sell EV charging, rather we sell products which enable it.

We believe our chief differentiators

for our electric vehicle charging infrastructure products are:

| |

· |

our patented, renewable energy products dramatically reduce the cost, time and complexity of the installation and operation of EV charging infrastructure and outdoor media platforms when compared to traditional, utility grid tied alternatives; |

| |

|

|

| |

· |

our proprietary and patented energy storage solutions; |

| |

|

|

| |

· |

our first-to-market advantage with EV charging infrastructure products which are renewably energized, rapidly deployed and require no construction or electrical work on site; |

| |

|

|

| |

· |

our products’ capability to operate during grid outages and to provide a source of EV charging and emergency power rather than becoming inoperable during times of emergency or other grid interruptions; and |

| |

|

|

| |

· |

our ability to continuously create new and patentable marketable inventions by integrating our proprietary technology and parts, and other commonly available engineered components, which create a further barrier to entry for our competition; |

| |

|

|

| |

· |

our international operations in two of the three largest automotive markets in the world today. |

With the acquisition of All