false

0001398805

false

false

false

false

false

0001398805

2024-05-21

2024-05-21

0001398805

us-gaap:CommonStockMember

2024-05-21

2024-05-21

0001398805

BEEM:WarrantsMember

2024-05-21

2024-05-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

May 21, 2024

BEAM

GLOBAL

(Exact Name of Registrant as Specified in Charter)

| Nevada |

|

000-53204 |

|

26-1342810 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 5660 Eastgate Drive, San Diego, CA |

92121 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (858) 799-4583

___________________________________________________

(Former name or Former Address, if Changed Since

Last Report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant to Section 12(b) of the Act:

| |

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

BEEM |

|

NASDAQ Capital Market |

| Warrants |

|

BEEMW |

|

NASDAQ Capital Market |

| Item 2.02. |

Results of Operations and Financial Condition. |

On May 21, 2024, Beam Global

(the “Company”) issued a press release announcing financial results for its quarter ending March 31, 2024. A copy of the press

release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished

in this Form 8-K and the press release attached as Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2)

of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the press release attached as Exhibit

99.1 shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether

made before or after the date hereof, regardless of any general incorporation language in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BEAM GLOBAL |

| |

|

|

| |

|

|

| Dated: May 21, 2024 |

By: |

/s/ Lisa A. Potok |

| |

Name: |

Lisa A. Potok |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Beam Global Announces Record First Quarter 2024

Operating Results

Conference Call Tuesday May 21, 2024 at 4:30

p.m. ET

SAN DIEGO, CA – May 21, 2024 – Beam

Global, (Nasdaq: BEEM), (the “Company”), the leading provider of innovative

and sustainable infrastructure solutions for the electrification of transportation and energy security, today announced its first quarter

results for the period ended March 31, 2024.

Q1 2024 Financial and Recent Company Highlights

| · | Record

first quarter revenue of $14.6 million, 12% increase over Q1 2023 |

| · | Record

gross profit with 10.2% gross margin |

| · | Backlog

of $20 million on March 31, 2024; pipeline of over $160 million |

| · | Debt

free and $100 million line of credit available and unused |

| · | 310%

increase in Q1 EV charging new orders from business/commercial sector over Q1 2023 |

| · | $7.4

million order from the U.S. Army for 88 off-grid EV ARC™ systems |

| · | $4.8

million order from U.S. Department of Homeland Security for EV ARC™ systems |

| · | $1.7

million order from the North Carolina Department of Adult Correction for sustainable EV charging infrastructure products |

| · | $1.2

million in orders from leading European market telecommunications provider |

| · | Awarded

first European government supplier agreement on the UK’s Crown Commercial Service, the main purchasing vehicle for UK government

entities |

| · | $1.0

million order from United Kingdom Ministry of Defense for EV ARC™ systems |

| · | Federal

Railroad Administration orders EV ARC™ charging systems |

| · | U.S.

National Park Service deploys EV ARC™ systems at the National Mall |

| · | Awarded

European Patent for Thermal Management Technology that Makes Lithium-ion Batteries Safer |

| · | Awarded

U.S. Patent for Wireless / Inductive Electric Vehicle Charging Powered by Renewable Energy |

| · | Commenced

fabrication of EV Standard™ beta products |

“First quarter revenues of $14.6 million marked our highest first

quarter revenues in the company’s history. Gross profits were also the highest ever with a gross margin of over 10%, and we see continued

upside going forward through the work we have done to reduce direct costs, increase production efficiencies and price increases,”

said Desmond Wheatley, CEO of Beam Global. “Bookings were in-line with our expectations given our normal seasonality patterns, particularly

in Europe. Our sales pipeline is robust and we are working on the most significant opportunities in our history, particularly through

Beam Europe. As we noted during the quarter, winning the UK’s equivalent of our federal GSA contract was a significant milestone

for Beam Europe, resulting in our first million-dollar EV ARC contract in Europe from the British Army. Product development was highly

active in the quarter with new patents won and announced, and we saw significant progress on EV Standard, which we intend to rebrand later

this year. Finally, we have taken initial steps towards the development of an entirely new product which we hope to launch in 2024,

which will further augment our strategy to diversify revenue and profit opportunities in expanded markets with more product offerings.

We are excited about what we’ve done and more excited about what we believe we will accomplish in the future.”

First Quarter 2024 Financial Summary

Revenues

For the first quarter of 2024, Beam Global reported record first quarter

revenues of $14.6 million, a 12% increase over the same period in 2023. The revenue growth is partially attributable to an increase in

federal orders and the acquisition of Amiga to create Beam Europe LLC.

Gross Profit

Gross profit for the quarter ended March 31, 2024, was a record $1.5

million, or 10% of sales, compared to a gross profit of $5 thousand, or .04% of sales in the first quarter of the prior year. The improvement

in gross margin is primarily because of cost reductions implemented in late 2023 as a result of engineering improvements to the EV ARCTM.

Our gross profits were negatively impacted by $0.2 million for non-cash intangible amortization included in our costs of goods sold.

Operating Expenses

Total operating expenses were $4.5 million, or 31% of revenues, for

the quarter ended March 31, 2024, compared to $3.8 million, or 30% of revenues, for the same quarter in the prior year. The $0.7 million

increase is mostly attributable to a $0.4 million increase in consultant costs related to the integration of our new ERP accounting software,

sales and marketing, government relations and engineering design support, $0.3 million for operating expenses pertaining to our new Beam

Europe operations, partially offset by $0.1 million reduction for favorable change in the present value factor of our contingent consideration

related to the earnout for the Amiga acquisition.

Net Loss

Net loss was $3.0 million, or 21% of revenue for the first quarter

of 2024, compared to $3.8 million, or 29% of revenue, for the same period in 2023, an improvement of 8% year over year. The first quarter

net loss included non-cash expense items such as depreciation, intellectual property amortization and non-cash compensation expense of

$1.1 million in 2024 and $0.9 million in 2023. 2024 net loss excluding noncash items was $1.9 million or 18% of revenues.

Cash and Working Capital

On March 31, 2024, we had cash of $5.0 million, compared to $10.4 million

at December 31, 2023. The cash decrease was primarily due to cash payments for the acquisition of Amiga as well as operating cash used

to increase inventory. Our working capital decreased from $23.8 million to $17.8 million from December 31, 2023 to March 31, 2024.

Conference Call May 21, 2024 at 4:30 p.m. ET

Management will host a conference call on Tuesday May 21, 2024 at 4:30

p.m. ET to review financial results and provide an update on corporate developments. Following management’s formal remarks, there

will be a question-and-answer session.

Participants can register for the conference through the following

link:

https://dpregister.com/sreg/10189455/fc91e69e73

Please note that registered participants will receive their call in

number upon registration.

Those without internet access or unable to pre-register may call in

by calling:

PARTICIPANT CALL IN (TOLL FREE): 1-844-739-3880

PARTICIPANT INTERNATIONAL CALL IN: 1-412-317-5716

Please ask to join the Beam Global call.

A webcast archive is available at the above URL for one year following

the call.

About Beam Global

Beam Global is a clean technology innovator which develops and manufactures sustainable infrastructure products and technologies. We operate

at the nexus of clean energy and transportation with a focus on sustainable energy infrastructure, rapidly deployed and scalable EV charging

solutions, safe energy storage and vital energy security. With operations in the U.S. and Europe, Beam Global develops, patents,

designs, engineers and manufactures unique and advanced clean technology solutions that power transportation, provide secure sources of

electricity, save time and money and protect the environment. Headquartered in San Diego with facilities in Chicago, Belgrade and

Kraljevo, Beam Global has a deep patent portfolio and is listed on Nasdaq under the symbols BEEM. For more information visit BeamForAll.com, LinkedIn, YouTube and X

(formerly Twitter).

Forward-Looking Statements

This Beam Global Press Release contains forward-looking statements

including but not limited to statements about the Company’s belief about its future profitability. All statements in this Press

Release other than statements of historical facts are forward-looking statements. Forward-looking statements are generally accompanied

by terms or phrases such as “estimate,” “project,” “predict,” “believe,” “expect,”

“anticipate,” “target,” “plan,” “intend,” “seek,” “goal,” “will,”

“should,” “may,” or other words and similar expressions that convey the uncertainty of future events or results.

These statements relate to future events or future results of operations, including, but not limited to the following statements: statements

regarding the acquisition of Amiga, its expected benefits, and the anticipated future financial performance as a result of the acquisition. These

statements are only predictions and involve known and unknown risks, uncertainties and other factors, which may cause Beam Global's actual

results to be materially different from these forward-looking statements. Except to the extent required by law, Beam Global expressly

disclaims any obligation to update any forward-looking statements.

# # #

Investor Relations:

Core IR

+1 516-222-2560

IR@BeamForAll.com

Media Contact:

Skyya PR

+1 651-335-0585

Press@BeamForAll.com

Beam Global

Condensed Consolidated Balance Sheets

(In thousands, except share and

per share data)

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 4,962 | | |

$ | 10,393 | |

| Accounts receivable, net of allowance for credit losses of $112 and $447 | |

| 20,139 | | |

| 15,943 | |

| Prepaid expenses and other current assets | |

| 2,216 | | |

| 2,453 | |

| Inventory, net | |

| 11,474 | | |

| 11,933 | |

| Total current assets | |

| 38,791 | | |

| 40,722 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 15,597 | | |

| 16,513 | |

| Operating lease right of use assets | |

| 2,249 | | |

| 1,026 | |

| Goodwill | |

| 10,150 | | |

| 10,270 | |

| Intangible assets, net | |

| 8,769 | | |

| 9,050 | |

| Deposits | |

| 98 | | |

| 62 | |

| Total assets | |

$ | 75,654 | | |

$ | 77,643 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 10,778 | | |

$ | 9,732 | |

| Accrued expenses | |

| 3,812 | | |

| 2,737 | |

| Sales tax payable | |

| 211 | | |

| 209 | |

| Deferred revenue, current | |

| 1,007 | | |

| 828 | |

| Note payable, current | |

| 45 | | |

| 40 | |

| Deferred consideration, current | |

| – | | |

| 2,713 | |

| Contingent consideration, current | |

| 4,330 | | |

| – | |

| Operating lease liabilities, current | |

| 851 | | |

| 615 | |

| Total current liabilities | |

| 21,034 | | |

| 16,874 | |

| | |

| | | |

| | |

| Deferred revenue, noncurrent | |

| 470 | | |

| 402 | |

| Note payable, noncurrent | |

| 178 | | |

| 160 | |

| Contingent consideration, noncurrent | |

| 248 | | |

| 4,725 | |

| Other liabilities, noncurrent | |

| 3,716 | | |

| 3,787 | |

| Deferred tax liabilities, noncurrent | |

| 1,662 | | |

| 1,698 | |

| Operating lease liabilities, noncurrent | |

| 1,444 | | |

| 455 | |

| Total liabilities | |

| 28,752 | | |

| 28,101 | |

| | |

| | | |

| | |

| Stockholders' equity | |

| | | |

| | |

| Preferred stock, $0.001 par value, 10,000,000 authorized, none outstanding as of March 31, 2024 and December 31, 2023. | |

| – | | |

| – | |

| Common stock, $0.001 par value, 350,000,000 shares authorized, 14,438,270 and 14,398,243 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively. | |

| 14 | | |

| 14 | |

| Additional paid-in-capital | |

| 142,991 | | |

| 142,265 | |

| Accumulated deficit | |

| (96,398 | ) | |

| (93,361 | ) |

| Accumulated Other Comprehensive Income (AOCI) | |

| 295 | | |

| 624 | |

| | |

| | | |

| | |

| Total stockholders' equity | |

| 46,902 | | |

| 49,542 | |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity | |

$ | 75,654 | | |

$ | 77,643 | |

Beam Global

Condensed Consolidated Statements of Operations

and Comprehensive Loss

(Unaudited, in thousands except per share data)

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | 14,561 | | |

$ | 13,020 | |

| | |

| | | |

| | |

| Cost of revenues | |

| 13,082 | | |

| 13,015 | |

| | |

| | | |

| | |

| Gross profit | |

| 1,479 | | |

| 5 | |

| | |

| | | |

| | |

| Operating expenses | |

| 4,527 | | |

| 3,846 | |

| | |

| | | |

| | |

| Loss from operations | |

| (3,048 | ) | |

| (3,841 | ) |

| | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | |

| Interest income | |

| 71 | | |

| 1 | |

| Other (expense) income | |

| (56 | ) | |

| 10 | |

| Interest expense | |

| (4 | ) | |

| – | |

| Other income | |

| 11 | | |

| 11 | |

| | |

| | | |

| | |

| Loss before income tax expense | |

| (3,037 | ) | |

| (3,830 | ) |

| | |

| | | |

| | |

| Income tax expense | |

| – | | |

| 1 | |

| | |

| | | |

| | |

| Net loss | |

$ | (3,037 | ) | |

$ | (3,831 | ) |

| | |

| | | |

| | |

| Net foreign currency translation adjustments | |

| (329 | ) | |

| – | |

| Total Comprehensive Loss | |

$ | (3,366 | ) | |

$ | (3,831 | ) |

| | |

| | | |

| | |

| Net loss per share - basic | |

$ | (0.21 | ) | |

$ | (0.38 | ) |

| Net loss per share - diluted | |

$ | (0.21 | ) | |

$ | (0.38 | ) |

| | |

| | | |

| | |

| Weighted average shares outstanding - basic | |

| 14,422 | | |

| 10,214 | |

| Weighted average shares outstanding - diluted | |

| 14,422 | | |

| 10,214 | |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BEEM_WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

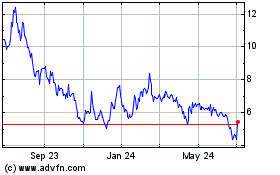

Beam Global (NASDAQ:BEEM)

Historical Stock Chart

From May 2024 to Jun 2024

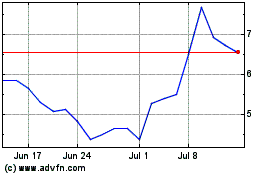

Beam Global (NASDAQ:BEEM)

Historical Stock Chart

From Jun 2023 to Jun 2024