false

0001746109

0001746109

2025-01-21

2025-01-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) |

|

January 21, 2025 |

Bank First Corporation

(Exact name of registrant

as specified in its charter)

| Wisconsin |

001-38676 |

39-1435359 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 402

North 8th Street, Manitowoc,

WI |

|

54220 |

| (Address of principal executive offices) |

|

(Zip Code) |

| Registrant’s telephone number, including area code |

(920) 652-3100 |

N/A

(Former name or former address,

if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

Ticker symbol(s) |

Name

of each exchange on which registered |

| Common Stock, par value $0.01 per share |

BFC |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for company with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition. |

On January 21, 2025, Bank First Corporation (the

“Company”) announced its earnings for the quarter ended December 31, 2024. A copy of the press release is attached as Exhibit

99.1 to this Report on Form 8-K and is incorporated herein by reference.

Pursuant to General Instruction B.2 of Form 8-K,

the information in this Item 2.02 and Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed

to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise

subject to the liabilities under that Section. Furthermore, the information in this Item 2.02 and Exhibit 99.1 shall not be deemed to

be incorporated by reference into the filings of the Registrant under the Securities Act of 1933, as amended, or the Exchange Act.

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

BANK FIRST CORPORATION |

| |

|

| |

|

| Date: January 21, 2025 |

By: |

/s/ Kevin M. LeMahieu |

| |

|

Kevin M. LeMahieu |

| |

|

Chief Financial Officer |

Exhibit 99.1

NEWS

release |

|

P.O. Box

10, Manitowoc, WI 54221-0010

For further information, contact:

Kevin M LeMahieu, Chief Financial Officer

Phone: (920) 652-3200 / klemahieu@bankfirst.com

FOR IMMEDIATE RELEASE

Bank First Announces Net Income for the Fourth

Quarter of 2024

| · | Net income of $17.5 million and $65.6 million

for the three months and year ended December 31, 2024, respectively |

| | | |

| · | Earnings per common share of $1.75 and $6.50

for the three months and year ended December 31, 2024, respectively |

| | | |

| · | Annualized return on average assets of 1.60%

and 1.56% for the three months and year ended December 31, 2024, respectively |

| | | |

| · | Quarterly cash dividend of $0.45 per share

declared, matching the prior quarter and a 28.6% increase from the prior-year fourth quarter |

MANITOWOC, Wis, January 21,

2025 -- Bank First Corporation (NASDAQ: BFC) (“Bank First” or the “Bank”), the holding company for Bank

First, N.A., reported net income of $17.5 million, or $1.75 per share, for the fourth quarter of 2024, compared with net income of $34.9

million, or $3.39 per share, for the prior-year fourth quarter. For the year ended December 31, 2024, Bank First earned $65.6 million,

or $6.50 per share, compared to $74.5 million, or $7.28 per share for the full year of 2023.

Financial results for the

fourth quarter and full year of 2023 included several significant one-time transactions:

| · | The Bank sold 100% of its member interest in

UFS, LLC (“UFS”) in a transaction that closed on October 1, 2023, resulting in a pre-tax gain on sale of $38.9 million. |

| · | The Bank redeemed $8.3 million in debt securities

related to the Hometown Bancorp, Ltd. Capital Trust II (”Trust II”) during the fourth quarter of 2023 and informed holders

of securities of Hometown Bancorp, Ltd. Capital Trust I (“Trust I”) of its intent to redeem $4.1 million in debt securities

related to that trust on January 7, 2024. These redemptions led to the accelerated amortization of $1.4 million in fair value adjustments

assigned to these liabilities when they were acquired along with Hometown Bancorp Ltd. (“Hometown”) earlier in 2023. The impact

of this acceleration was recorded as an addition to interest expense for the fourth quarter of 2023. |

| · | The Bank sold available-for-sale US Treasury

securities with a par value of $50.0 million, resulting in a realized loss on sale totaling $7.8 million recorded during the fourth quarter

of 2023. These securities had an average yield of 1.36%. Proceeds of these sales were reinvested in a combination of short and long-term

investments with an average yield of 4.98%, increasing future interest income by over $1.8 million annually. |

| · | The Bank vacated the former corporate headquarters

of Hometown, moving this building to other real estate owned (“OREO”), and revalued four other OREO properties (all former

bank branches), leading to a combined loss on OREO valuations of $1.6 million during the fourth quarter of 2023. |

| · | The Bank closed a branch in Ashwaubenon during

the first quarter of 2024, concurrent with opening a new flagship location in its Green Bay market. Anticipating that the closed branch

would be moved to OREO in the first quarter of 2024 at an expected valuation significantly below its carrying value, the Bank impaired

its cost basis by $0.4 million. This impairment expense was included in “other noninterest expense” in the fourth quarter

and full year of 2023. |

After removing the impact

of these one-time transactions, as well as other one-time expenses related to acquisitions and gains and losses on sales of securities

and OREO, the Bank reported adjusted net income (non-GAAP) of $17.4 million, or $1.74 per share, for the fourth quarter of 2024, compared

with $14.8 million, or $1.44 per share, for the prior-year fourth quarter. For the year ended December 31, 2024, adjusted net income

(non-GAAP) totaled $65.0 million, or $6.45 per share, compared to $59.2 million, or $5.82 per share for the full year of 2023.

“We are pleased with

the financial results for 2024,” stated CEO Mike Molepske. “The Bank delivered a return on assets, a measure of both profitability

and efficiency, of 1.56%, marking the second consecutive year this metric exceeded 1.50%. Our consistently strong financial performance

is directly related to the tireless efforts of our team to remain true to our promise to be ‘a relationship-based bank that delivers

innovative solutions to the communities we serve.’”

Operating Results

Net interest income (“NII”)

during the fourth quarter of 2024 was $35.6 million, $0.3 million less than the previous quarter but $2.6 million higher than the fourth

quarter of 2023. The impact of net accretion and amortization of purchase accounting related to interest-bearing assets and liabilities

from past acquisitions (“purchase accounting”) increased NII by $0.8 million, or $0.06 per share after tax, during the fourth

quarter of 2024, compared to $1.7 million, or $0.13 per share after tax, during the previous quarter and $0.4 million, or $0.03 per share

after tax, during the fourth quarter of 2023. A previously purchased loan with remaining associated purchase accounting adjustments of

$0.6 million was fully repaid before maturity during the third quarter of 2024, leading to the elevated impact of purchase accounting

during the previous quarter. The redemptions of Trust I and Trust II, noted earlier in this release, reduced the impact of purchase accounting

during the fourth quarter of 2023.

Net interest margin (“NIM”)

was 3.61% for the fourth quarter of 2024, compared to 3.76% for the previous quarter and 3.53% for the fourth quarter of 2023. NII from

purchase accounting increased NIM by 0.08%, 0.17%, and 0.01% for each period, respectively. In addition to the volatility caused by purchase

accounting over recent quarters, a seasonal buildup of higher interest rate deposits through the fourth quarter of 2024 further hampered

NIM for that quarter. While the Bank makes a margin on these funds (approximately 0.35%), elevated levels in these products decreases

the Bank’s overall NIM. Even with the buildup of these deposits, cost of funds for the Bank declined 6 basis points quarter-over-quarter.

Bank First recorded a negative

provision for credit losses totaling $1.0 million during the fourth quarter of 2024, comparing favorably to no provision in the previous

quarter and a positive provision of $0.5 million during the fourth quarter of 2023. While the Bank’s overall credit quality has

remained consistently strong over all these periods, improvement in financial trends related to two relationships that were part of the

Hometown acquisition allowed for a reduction in specific reserves related to them, causing the decrease in overall required allowance

for credit losses related to the loan portfolio. Recoveries of previously charged-off loans exceeded currently charged-off loans by $0.4

million for the year ended December 31, 2024, compared to recoveries exceeding charge-offs by $0.1 million for the prior year.

Noninterest income was $4.5

million for the fourth quarter of 2024, compared to $4.9 million and $42.5 million for the prior quarter and fourth quarter of 2023, respectively.

Noninterest income during the fourth quarter of 2023 included the aforementioned gain on sale of UFS, totaling $38.9 million. Income provided

by the Bank’s investment in Ansay & Associates, LLC (“Ansay”) experienced a typical seasonal fourth-quarter

decline, down $1.0 million from the prior quarter but nearly matching the fourth quarter of 2023. Income from Ansay increased by $0.6

million, or 19.8%, for the full year of 2024 compared to 2023. The Bank experienced a minimal positive adjustment to its mortgage servicing

rights asset during the fourth quarter of 2024, comparing favorably to a negative valuation adjustment of $0.3 million and $0.1 million

during the prior quarter and prior-year fourth quarter, respectively. All other areas of noninterest income remained consistent with recent

quarterly results.

Noninterest expense was $19.3

million for the fourth quarter of 2024, compared to $20.1 million during the prior quarter and $28.9 million during the fourth quarter

of 2023. Noninterest expenses during the fourth quarter of 2023 included the aforementioned $7.8 million loss on the sale of securities,

$1.6 million loss on the sale and valuation adjustments of OREO, and $0.4 million impairment to the cost basis of a branch location. Data

processing expense continued its elevated trend during 2024 as the Bank incurred another $0.4 million in project-related expenses during

the current quarter as part of the Bank’s continued upgrade of its digital banking platform. All other areas of noninterest expense

have remained well-contained over the past five quarters as the Bank has worked efficiencies from recent acquisitions into its operations.

Balance Sheet

On December 31, 2024,

total assets were $4.50 billion, an increase of $273.2 million, or 6.5%, from December 31, 2023.

Total investment securities

available-for-sale and held-to-maturity were $333.8 million on December 31, 2024, increasing $88.3 million, or 36.0%, from December 31,

2023. The previously mentioned seasonal buildup of higher interest rate deposits during the fourth quarter of 2024 included many that

required collateralization by the Bank’s investment portfolio. In response to this heightened need for collateral, the Bank invested

$100.0 million into a 30-day US Treasury note which will mature before the end of January 2025.

Total loans were $3.52 billion

on December 31, 2024, up $174.2 million, or 5.2%, from December 31, 2023. Loans grew 5.3% on an annualized basis during the

fourth quarter of 2024.

Total deposits, nearly all

of which remain core deposits, were $3.66 billion on December 31, 2024, which is up $228.2 million, or 6.7%, from December 31,

2023. Total deposits grew 20.2% on an annualized basis during the fourth quarter of 2024, though much of this growth was in higher interest

earning seasonal deposits.

Asset Quality

Nonperforming assets on December 31,

2024, remained negligible, totaling $9.2 million compared to $11.9 million and $9.1 million at the end of the prior quarter and prior

year, respectively. Nonperforming assets to total assets ended the fourth quarter of 2024 at 0.21%, down from 0.28% at the end of the

prior quarter and matching the end of the prior year. OREO on December 31, 2024, consisted of one property valued at $0.7 million,

currently listed for sale, previously an operating branch location of an acquired institution.

Capital Position

Stockholders’ equity

totaled $639.7 million on December 31, 2024, an increase of $19.9 million from the end of 2023. Earnings of $65.6 million were offset

by dividends totaling $15.6 million and repurchases of BFC common stock totaling $31.2 million during 2024. The Bank’s book value

per common share totaled $63.89 on December 31, 2024, compared to $59.80 on December 31, 2023. Tangible book value per common

share (non-GAAP) totaled $44.28 on December 31, 2024, compared to $40.30 on December 31, 2023.

Dividend Declaration

Bank First’s Board of

Directors approved a quarterly cash dividend of $0.45 per common share, payable on April 9, 2025, to shareholders of record as of

March 26, 2025. This dividend matches the previous quarter’s dividend and represents a 28.6% increase over the dividend declared

one year earlier.

Bank First Corporation

provides financial services through its subsidiary, Bank First, N.A., which was incorporated in 1894. Bank First offers loan,

deposit, and treasury management products at its 26 banking locations in Wisconsin. The Bank has grown through both acquisitions

and de novo branch expansion. The Bank employs approximately 357 full-time equivalent staff and has assets of approximately $4.5 billion.

Insurance services are available through its bond with Ansay & Associates, LLC. Trust, investment

advisory, and other financial services are offered in collaboration with several regional partners. Further information about Bank First

Corporation is available by clicking the Shareholder Services tab at www.bankfirst.com.

# # #

Forward-Looking Statements:

Certain statements contained in this press release and in other recent filings may constitute forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements include, without limitation, statements relating to the timing, benefits, costs, and synergies of the

merger with Hometown, statements relating to our projected growth, anticipated future financial performance, financial condition, credit

quality, and management’s long-term performance goals, and statements relating to the anticipated effects on our business, financial

condition and results of operations from expected developments or events, our business, growth and strategies. These statements can generally

be identified by the use of the words and phrases “may,” “will,” “should,” “could,” “would,”

“goal,” “plan,” “potential,” “estimate,” “project,” “believe,”

“intend,” “anticipate,” “expect,” “target,” “aim,” “predict,”

“continue,” “seek,” “projection,” and other variations of such words and phrases and similar expressions.

These forward-looking statements

are not historical facts and are based upon current expectations, estimates, and projections, many of which, by their nature, are inherently

uncertain and beyond Bank First’s control. The inclusion of these forward-looking statements should not be regarded as a representation

by Bank First or any other person that such expectations, estimates, and projections will be achieved. Accordingly, Bank First cautions

shareholders and investors that any such forward-looking statements are not guarantees of future performance and are subject to risks,

assumptions, and uncertainties that are difficult to predict. Actual results may prove to be materially different from the results expressed

or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated

by the forward-looking statements including, without limitation, (1) business and economic conditions nationally, regionally and

in our target markets, particularly in Wisconsin and the geographic areas in which we operate, (2) changes in government interest

rate policies, (3) our ability to effectively manage problem credits, (4) the risks associated with Bank First’s pursuit

of future acquisitions, (5) Bank First’s ability to successful execute its various business strategies, including its ability

to execute on potential acquisition opportunities, and (6) general competitive, economic, political, and market conditions.

This communication contains

non-GAAP financial measures, such as non-GAAP adjusted net income, non-GAAP adjusted earnings per common share, adjusted earnings return

on assets, tangible book value per common share, and tangible common equity to tangible assets. Management believes such measures to be

helpful to management, investors and others in understanding Bank First's results of operations or financial position. When non-GAAP financial

measures are used, the comparable GAAP financial measures, as well as the reconciliation of the non-GAAP measures to the GAAP financial

measures, are provided. See " Non-GAAP Financial Measures" below. The non-GAAP net income measure and related reconciliation

provide information useful to investors in understanding the operating performance and trends of Bank First and also aid investors in

comparing Bank First's financial performance to the financial performance of peer banks. Management considers non-GAAP financial

ratios to be critical metrics with which to analyze and evaluate financial condition and capital strengths. While non-GAAP financial measures

are frequently used by stakeholders in the evaluation of a corporation, they have limitations as analytical tools and should not be considered

in isolation or as a substitute for analyses of results as reported under GAAP.

Further information regarding

Bank First and factors which could affect the forward-looking statements contained herein can be found in Bank First's Annual Report on

Form 10-K for the fiscal year ended December 31, 2023, and its other filings with the Securities and Exchange Commission (the

“SEC”). Many of these factors are beyond Bank First’s ability to control or predict. If one or more events related to

these or other risks or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially

from the forward-looking statements. Accordingly, shareholders and investors should not place undue reliance on any such forward-looking

statements. Any forward-looking statement speaks only as of the date of this press release, and Bank First undertakes no obligation to

publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except

as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for Bank First to predict their occurrence

or how they will affect the company.

Bank First Corporation

Consolidated Financial Summary (Unaudited)

| (In thousands, except share and per share data) | |

At or for the Three Months Ended | | |

At or for the Year Ended | |

| | |

| 12/31/2024 | | |

| 9/30/2024 | | |

| 6/30/2024 | | |

| 3/31/2024 | | |

| 12/31/2023 | | |

| 12/31/2024 | | |

| 12/31/2023 | |

| Results of Operations: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

$ | 53,754 | | |

$ | 54,032 | | |

$ | 49,347 | | |

$ | 49,272 | | |

$ | 48,663 | | |

$ | 206,405 | | |

$ | 182,483 | |

| Interest expense | |

| 18,193 | | |

| 18,149 | | |

| 16,340 | | |

| 15,923 | | |

| 15,747 | | |

| 68,605 | | |

| 49,003 | |

| Net interest income | |

| 35,561 | | |

| 35,883 | | |

| 33,007 | | |

| 33,349 | | |

| 32,916 | | |

| 137,800 | | |

| 133,480 | |

| Provision for credit losses | |

| (1,000 | ) | |

| - | | |

| - | | |

| 200 | | |

| 500 | | |

| (800 | ) | |

| 4,682 | |

| Net interest income after provision for credit losses | |

| 36,561 | | |

| 35,883 | | |

| 33,007 | | |

| 33,149 | | |

| 32,416 | | |

| 138,600 | | |

| 128,798 | |

| Noninterest income | |

| 4,513 | | |

| 4,893 | | |

| 5,877 | | |

| 4,397 | | |

| 42,458 | | |

| 19,680 | | |

| 58,115 | |

| Noninterest expense | |

| 19,286 | | |

| 20,100 | | |

| 19,057 | | |

| 20,324 | | |

| 28,862 | | |

| 78,767 | | |

| 88,119 | |

| Income before income tax expense | |

| 21,788 | | |

| 20,676 | | |

| 19,827 | | |

| 17,222 | | |

| 46,012 | | |

| 79,513 | | |

| 98,794 | |

| Income tax expense | |

| 4,248 | | |

| 4,124 | | |

| 3,768 | | |

| 1,810 | | |

| 11,114 | | |

| 13,950 | | |

| 24,280 | |

| Net income | |

$ | 17,540 | | |

$ | 16,552 | | |

$ | 16,059 | | |

$ | 15,412 | | |

$ | 34,898 | | |

$ | 65,563 | | |

$ | 74,514 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Earnings per common share (basic and diluted) | |

$ | 1.75 | | |

$ | 1.65 | | |

$ | 1.59 | | |

$ | 1.51 | | |

$ | 3.39 | | |

$ | 6.50 | | |

$ | 7.28 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common Shares: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Outstanding | |

| 10,012,088 | | |

| 10,011,428 | | |

| 10,031,350 | | |

| 10,129,190 | | |

| 10,365,131 | | |

| 10,012,088 | | |

| 10,365,131 | |

| Weighted average outstanding for the period | |

| 10,012,013 | | |

| 10,012,190 | | |

| 10,078,611 | | |

| 10,233,347 | | |

| 10,366,471 | | |

| 10,083,647 | | |

| 10,231,569 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Noninterest income / noninterest expense: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service charges | |

$ | 2,119 | | |

$ | 2,189 | | |

$ | 2,101 | | |

$ | 1,634 | | |

$ | 1,847 | | |

$ | 8,043 | | |

$ | 7,033 | |

| Income from Ansay | |

| 82 | | |

| 1,062 | | |

| 1,379 | | |

| 979 | | |

| 110 | | |

| 3,502 | | |

| 2,922 | |

| Income (loss) from UFS | |

| - | | |

| - | | |

| - | | |

| - | | |

| (179 | ) | |

| - | | |

| 2,265 | |

| Loan servicing income | |

| 744 | | |

| 733 | | |

| 735 | | |

| 726 | | |

| 741 | | |

| 2,938 | | |

| 2,860 | |

| Valuation adjustment on mortgage servicing rights | |

| 18 | | |

| (344 | ) | |

| 339 | | |

| (312 | ) | |

| (65 | ) | |

| (299 | ) | |

| 395 | |

| Net gain on sales of mortgage loans | |

| 424 | | |

| 377 | | |

| 277 | | |

| 219 | | |

| 273 | | |

| 1,297 | | |

| 897 | |

| Gain on sale of UFS | |

| - | | |

| - | | |

| - | | |

| - | | |

| 38,904 | | |

| - | | |

| 38,904 | |

| Other noninterest income | |

| 1,126 | | |

| 876 | | |

| 1,046 | | |

| 1,151 | | |

| 827 | | |

| 4,199 | | |

| 2,839 | |

| Total noninterest income | |

$ | 4,513 | | |

$ | 4,893 | | |

$ | 5,877 | | |

$ | 4,397 | | |

$ | 42,458 | | |

$ | 19,680 | | |

$ | 58,115 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Personnel expense | |

$ | 9,886 | | |

$ | 10,118 | | |

$ | 10,004 | | |

$ | 10,893 | | |

$ | 10,357 | | |

$ | 40,901 | | |

$ | 40,355 | |

| Occupancy, equipment and office | |

| 1,445 | | |

| 1,598 | | |

| 1,330 | | |

| 1,584 | | |

| 1,307 | | |

| 5,957 | | |

| 5,670 | |

| Data processing | |

| 2,687 | | |

| 2,502 | | |

| 2,114 | | |

| 2,389 | | |

| 1,900 | | |

| 9,692 | | |

| 8,011 | |

| Postage, stationery and supplies | |

| 229 | | |

| 213 | | |

| 205 | | |

| 238 | | |

| 236 | | |

| 885 | | |

| 1,084 | |

| Advertising | |

| 78 | | |

| 61 | | |

| 79 | | |

| 95 | | |

| 99 | | |

| 313 | | |

| 326 | |

| Charitable contributions | |

| 200 | | |

| 183 | | |

| 234 | | |

| 176 | | |

| 264 | | |

| 793 | | |

| 944 | |

| Outside service fees | |

| 1,630 | | |

| 1,598 | | |

| 1,889 | | |

| 1,293 | | |

| 1,363 | | |

| 6,410 | | |

| 6,350 | |

| Net loss (gain) on other real estate owned | |

| (186 | ) | |

| - | | |

| (461 | ) | |

| (47 | ) | |

| 1,591 | | |

| (694 | ) | |

| 2,133 | |

| Net loss on sales of securities | |

| - | | |

| - | | |

| - | | |

| 34 | | |

| 7,826 | | |

| 34 | | |

| 7,901 | |

| Amortization of intangibles | |

| 1,389 | | |

| 1,429 | | |

| 1,475 | | |

| 1,500 | | |

| 1,604 | | |

| 5,793 | | |

| 6,324 | |

| Other noninterest expense | |

| 1,928 | | |

| 2,398 | | |

| 2,188 | | |

| 2,169 | | |

| 2,315 | | |

| 8,683 | | |

| 9,021 | |

| Total noninterest expense | |

$ | 19,286 | | |

$ | 20,100 | | |

$ | 19,057 | | |

$ | 20,324 | | |

$ | 28,862 | | |

$ | 78,767 | | |

$ | 88,119 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Period-end balances: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 261,332 | | |

$ | 204,427 | | |

$ | 98,950 | | |

$ | 83,374 | | |

$ | 247,468 | | |

$ | 261,332 | | |

$ | 247,468 | |

| Investment securities available-for-sale, at fair value | |

| 223,061 | | |

| 128,438 | | |

| 127,977 | | |

| 138,420 | | |

| 142,197 | | |

| 223,061 | | |

| 142,197 | |

| Investment securities held-to-maturity, at cost | |

| 110,756 | | |

| 109,236 | | |

| 110,648 | | |

| 111,732 | | |

| 103,324 | | |

| 110,756 | | |

| 103,324 | |

| Loans | |

| 3,517,168 | | |

| 3,470,920 | | |

| 3,428,635 | | |

| 3,383,395 | | |

| 3,342,974 | | |

| 3,517,168 | | |

| 3,342,974 | |

| Allowance for credit losses - loans | |

| (44,151 | ) | |

| (45,212 | ) | |

| (45,118 | ) | |

| (44,378 | ) | |

| (43,609 | ) | |

| (44,151 | ) | |

| (43,609 | ) |

| Premises and equipment | |

| 71,108 | | |

| 69,710 | | |

| 68,633 | | |

| 69,621 | | |

| 69,891 | | |

| 71,108 | | |

| 69,891 | |

| Goodwill and core deposit intangible, net | |

| 196,309 | | |

| 197,698 | | |

| 199,127 | | |

| 200,602 | | |

| 202,102 | | |

| 196,309 | | |

| 202,102 | |

| Mortgage servicing rights | |

| 13,369 | | |

| 13,351 | | |

| 13,694 | | |

| 13,356 | | |

| 13,668 | | |

| 13,369 | | |

| 13,668 | |

| Other assets | |

| 146,108 | | |

| 145,930 | | |

| 143,274 | | |

| 143,802 | | |

| 143,827 | | |

| 146,108 | | |

| 143,827 | |

| Total assets | |

| 4,495,060 | | |

| 4,294,498 | | |

| 4,145,820 | | |

| 4,099,924 | | |

| 4,221,842 | | |

| 4,495,060 | | |

| 4,221,842 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing | |

| 2,636,193 | | |

| 2,463,083 | | |

| 2,424,096 | | |

| 2,425,550 | | |

| 2,382,185 | | |

| 2,636,193 | | |

| 2,382,185 | |

| Noninterest-bearing | |

| 1,024,880 | | |

| 1,021,658 | | |

| 975,845 | | |

| 990,489 | | |

| 1,050,735 | | |

| 1,024,880 | | |

| 1,050,735 | |

| Securities sold under repurchase agreements | |

| - | | |

| - | | |

| - | | |

| - | | |

| 75,747 | | |

| - | | |

| 75,747 | |

| Borrowings | |

| 147,372 | | |

| 147,346 | | |

| 102,321 | | |

| 47,295 | | |

| 51,394 | | |

| 147,372 | | |

| 51,394 | |

| Other liabilities | |

| 46,932 | | |

| 33,516 | | |

| 28,979 | | |

| 27,260 | | |

| 41,983 | | |

| 46,932 | | |

| 41,983 | |

| Total liabilities | |

| 3,855,377 | | |

| 3,665,603 | | |

| 3,531,241 | | |

| 3,490,594 | | |

| 3,602,044 | | |

| 3,855,377 | | |

| 3,602,044 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stockholders' equity | |

| 639,683 | | |

| 628,895 | | |

| 614,579 | | |

| 609,330 | | |

| 619,798 | | |

| 639,683 | | |

| 619,798 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Book value per common share | |

$ | 63.89 | | |

$ | 62.82 | | |

$ | 61.27 | | |

$ | 60.16 | | |

$ | 59.80 | | |

$ | 63.89 | | |

$ | 59.80 | |

| Tangible book value per common share (non-GAAP) | |

$ | 44.28 | | |

$ | 43.07 | | |

$ | 41.42 | | |

$ | 40.35 | | |

$ | 40.30 | | |

$ | 44.28 | | |

$ | 40.30 | |

| Average balances: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans | |

$ | 3,482,974 | | |

$ | 3,450,423 | | |

$ | 3,399,906 | | |

$ | 3,355,142 | | |

$ | 3,330,511 | | |

$ | 3,422,357 | | |

$ | 3,276,425 | |

| Interest-earning assets | |

| 3,962,690 | | |

| 3,833,968 | | |

| 3,696,099 | | |

| 3,741,498 | | |

| 3,738,589 | | |

| 3,809,056 | | |

| 3,655,138 | |

| Total assets | |

| 4,360,469 | | |

| 4,231,112 | | |

| 4,094,542 | | |

| 4,144,896 | | |

| 4,147,859 | | |

| 4,208,236 | | |

| 4,061,358 | |

| Deposits | |

| 3,545,694 | | |

| 3,435,172 | | |

| 3,401,828 | | |

| 3,446,145 | | |

| 3,406,028 | | |

| 3,457,391 | | |

| 3,383,841 | |

| Interest-bearing liabilities | |

| 2,655,609 | | |

| 2,583,382 | | |

| 2,466,726 | | |

| 2,512,304 | | |

| 2,426,870 | | |

| 2,554,860 | | |

| 2,402,757 | |

| Goodwill and other intangibles, net | |

| 196,966 | | |

| 198,493 | | |

| 199,959 | | |

| 201,408 | | |

| 202,933 | | |

| 199,199 | | |

| 193,611 | |

| Stockholders' equity | |

| 634,137 | | |

| 620,821 | | |

| 610,818 | | |

| 613,190 | | |

| 613,244 | | |

| 619,784 | | |

| 569,600 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial ratios: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Return on average assets * | |

| 1.60 | % | |

| 1.56 | % | |

| 1.58 | % | |

| 1.50 | % | |

| 3.34 | % | |

| 1.56 | % | |

| 1.83 | % |

| Return on average common equity * | |

| 11.00 | % | |

| 10.61 | % | |

| 10.57 | % | |

| 10.11 | % | |

| 22.58 | % | |

| 10.58 | % | |

| 13.08 | % |

| Average equity to average assets | |

| 14.54 | % | |

| 14.67 | % | |

| 14.92 | % | |

| 14.79 | % | |

| 14.78 | % | |

| 14.73 | % | |

| 14.02 | % |

| Stockholders' equity to assets | |

| 14.23 | % | |

| 14.64 | % | |

| 14.82 | % | |

| 14.86 | % | |

| 14.68 | % | |

| 14.23 | % | |

| 14.68 | % |

| Tangible equity to tangible assets (non-GAAP) | |

| 10.31 | % | |

| 10.53 | % | |

| 10.53 | % | |

| 10.48 | % | |

| 10.39 | % | |

| 10.31 | % | |

| 10.39 | % |

| Loan yield * | |

| 5.56 | % | |

| 5.73 | % | |

| 5.51 | % | |

| 5.41 | % | |

| 5.33 | % | |

| 5.55 | % | |

| 5.18 | % |

| Earning asset yield * | |

| 5.44 | % | |

| 5.64 | % | |

| 5.40 | % | |

| 5.33 | % | |

| 5.20 | % | |

| 5.45 | % | |

| 5.03 | % |

| Cost of funds * | |

| 2.73 | % | |

| 2.79 | % | |

| 2.66 | % | |

| 2.55 | % | |

| 2.57 | % | |

| 2.69 | % | |

| 2.04 | % |

| Net interest margin, taxable equivalent * | |

| 3.61 | % | |

| 3.76 | % | |

| 3.63 | % | |

| 3.62 | % | |

| 3.53 | % | |

| 3.65 | % | |

| 3.69 | % |

| Net loan charge-offs (recoveries) to average loans * | |

| 0.01 | % | |

| 0.04 | % | |

| -0.05 | % | |

| -0.07 | % | |

| 0.00 | % | |

| -0.01 | % | |

| 0.00 | % |

| Nonperforming loans to total loans | |

| 0.24 | % | |

| 0.32 | % | |

| 0.31 | % | |

| 0.29 | % | |

| 0.20 | % | |

| 0.24 | % | |

| 0.20 | % |

| Nonperforming assets to total assets | |

| 0.21 | % | |

| 0.28 | % | |

| 0.27 | % | |

| 0.31 | % | |

| 0.21 | % | |

| 0.21 | % | |

| 0.21 | % |

| Allowance for credit losses - loans to total loans | |

| 1.26 | % | |

| 1.30 | % | |

| 1.32 | % | |

| 1.31 | % | |

| 1.30 | % | |

| 1.26 | % | |

| 1.30 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP Financial Measures | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted net income reconciliation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (GAAP) | |

$ | 17,540 | | |

$ | 16,552 | | |

$ | 16,059 | | |

$ | 15,412 | | |

$ | 34,898 | | |

$ | 65,563 | | |

$ | 74,514 | |

| Acquisition related expenses | |

| - | | |

| - | | |

| - | | |

| - | | |

| 29 | | |

| - | | |

| 1,854 | |

| Severance from organizational restructure | |

| - | | |

| - | | |

| - | | |

| - | | |

| 359 | | |

| - | | |

| 359 | |

| Provision for credit losses related to acquisition | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,552 | |

| Fair value amortization on Trust Preferred redemption | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,382 | | |

| - | | |

| 1,382 | |

| Gain on sale of UFS | |

| - | | |

| - | | |

| - | | |

| - | | |

| (38,904 | ) | |

| - | | |

| (38,904 | ) |

| Losses (gains) on sales of securities and OREO valuations | |

| (186 | ) | |

| - | | |

| (461 | ) | |

| (13 | ) | |

| 9,780 | | |

| (660 | ) | |

| 10,397 | |

| Adjusted net income before income tax impact | |

| 17,354 | | |

| 16,552 | | |

| 15,598 | | |

| 15,399 | | |

| 7,544 | | |

| 64,903 | | |

| 53,154 | |

| Income tax impact of adjustments | |

| 39 | | |

| - | | |

| 97 | | |

| 3 | | |

| 7,248 | | |

| 139 | | |

| 6,036 | |

| Adjusted net income (non-GAAP) | |

$ | 17,393 | | |

$ | 16,552 | | |

$ | 15,695 | | |

$ | 15,402 | | |

$ | 14,792 | | |

$ | 65,042 | | |

$ | 59,190 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted earnings per share calculation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted net income (non-GAAP) | |

$ | 17,393 | | |

$ | 16,552 | | |

$ | 15,695 | | |

$ | 15,402 | | |

$ | 14,792 | | |

$ | 65,042 | | |

$ | 59,190 | |

| Weighted average common shares outstanding for the period | |

| 10,012,013 | | |

| 10,012,190 | | |

| 10,078,611 | | |

| 10,233,347 | | |

| 10,366,471 | | |

| 10,083,647 | | |

| 10,231,569 | |

| Adjusted earnings per share (non-GAAP) | |

$ | 1.74 | | |

$ | 1.65 | | |

$ | 1.56 | | |

$ | 1.51 | | |

$ | 1.44 | | |

$ | 6.45 | | |

$ | 5.82 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Annualized return of adjusted earnings on average assets calculation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted net income (non-GAAP) | |

$ | 17,393 | | |

$ | 16,552 | | |

$ | 15,695 | | |

$ | 15,402 | | |

$ | 14,792 | | |

$ | 65,042 | | |

$ | 59,190 | |

| Average total assets | |

$ | 4,360,469 | | |

$ | 4,231,112 | | |

$ | 4,094,542 | | |

$ | 4,144,896 | | |

$ | 4,147,859 | | |

$ | 4,208,236 | | |

$ | 4,061,358 | |

| Annualized return of adjusted earnings on average assets (non-GAAP) | |

| 1.60 | % | |

| 1.56 | % | |

| 1.54 | % | |

| 1.49 | % | |

| 1.41 | % | |

| 1.55 | % | |

| 1.46 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tangible assets reconciliation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total assets (GAAP) | |

$ | 4,495,060 | | |

$ | 4,294,498 | | |

$ | 4,145,820 | | |

$ | 4,099,924 | | |

$ | 4,221,842 | | |

$ | 4,495,060 | | |

$ | 4,221,842 | |

| Goodwill | |

| (175,106 | ) | |

| (175,106 | ) | |

| (175,106 | ) | |

| (175,106 | ) | |

| (175,106 | ) | |

| (175,106 | ) | |

| (175,106 | ) |

| Core deposit intangible, net of amortization | |

| (21,203 | ) | |

| (22,592 | ) | |

| (24,021 | ) | |

| (25,496 | ) | |

| (26,996 | ) | |

| (21,203 | ) | |

| (26,996 | ) |

| Tangible assets (non-GAAP) | |

$ | 4,298,751 | | |

$ | 4,096,800 | | |

$ | 3,946,693 | | |

$ | 3,899,322 | | |

$ | 4,019,740 | | |

$ | 4,298,751 | | |

$ | 4,019,740 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tangible common equity reconciliation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total stockholders’ equity (GAAP) | |

$ | 639,683 | | |

$ | 628,895 | | |

$ | 614,579 | | |

$ | 609,330 | | |

$ | 619,798 | | |

$ | 639,683 | | |

$ | 619,798 | |

| Goodwill | |

| (175,106 | ) | |

| (175,106 | ) | |

| (175,106 | ) | |

| (175,106 | ) | |

| (175,106 | ) | |

| (175,106 | ) | |

| (175,106 | ) |

| Core deposit intangible, net of amortization | |

| (21,203 | ) | |

| (22,592 | ) | |

| (24,021 | ) | |

| (25,496 | ) | |

| (26,996 | ) | |

| (21,203 | ) | |

| (26,996 | ) |

| Tangible common equity (non-GAAP) | |

$ | 443,374 | | |

$ | 431,197 | | |

$ | 415,452 | | |

$ | 408,728 | | |

$ | 417,696 | | |

$ | 443,374 | | |

$ | 417,696 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tangible book value per common share calculation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tangible common equity (non-GAAP) | |

$ | 443,374 | | |

$ | 431,197 | | |

$ | 415,452 | | |

$ | 408,728 | | |

$ | 417,696 | | |

$ | 443,374 | | |

$ | 417,696 | |

| Common shares outstanding at the end of the period | |

| 10,012,088 | | |

| 10,011,428 | | |

| 10,031,350 | | |

| 10,129,190 | | |

| 10,365,131 | | |

| 10,012,088 | | |

| 10,365,131 | |

| Tangible book value per common share (non-GAAP) | |

$ | 44.28 | | |

$ | 43.07 | | |

$ | 41.42 | | |

$ | 40.35 | | |

$ | 40.30 | | |

$ | 44.28 | | |

$ | 40.30 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tangible equity to tangible assets calculation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tangible common equity (non-GAAP) | |

$ | 443,374 | | |

$ | 431,197 | | |

$ | 415,452 | | |

$ | 408,728 | | |

$ | 417,696 | | |

$ | 443,374 | | |

$ | 417,696 | |

| Tangible assets (non-GAAP) | |

$ | 4,298,751 | | |

$ | 4,096,800 | | |

$ | 3,946,693 | | |

$ | 3,899,322 | | |

$ | 4,019,740 | | |

$ | 4,298,751 | | |

$ | 4,019,740 | |

| Tangible equity to tangible assets (non-GAAP) | |

| 10.31 | % | |

| 10.53 | % | |

| 10.53 | % | |

| 10.48 | % | |

| 10.39 | % | |

| 10.31 | % | |

| 10.39 | % |

* Components of the quarterly ratios were annualized.

Bank First Corporation

Average assets, liabilities and stockholders' equity, and average rates earned or paid

| | |

Three Months Ended | |

| | |

December 31, 2024 | | |

December 31, 2023 | |

| | |

Average

Balance | | |

Interest

Income/

Expenses (1) | | |

Rate Earned/

Paid (1) | | |

Average

Balance | | |

Interest

Income/

Expenses (1) | | |

Rate Earned/

Paid (1) | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(dollars in thousands) | |

| ASSETS | |

| | |

| | |

| | |

| | |

| | |

| |

| Interest-earning assets | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans (2) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable | |

$ | 3,361,895 | | |

| 187,480 | | |

| 5.58 | % | |

$ | 3,223,127 | | |

$ | 172,743 | | |

| 5.36 | % |

| Tax-exempt | |

| 121,079 | | |

| 6,115 | | |

| 5.05 | % | |

| 107,384 | | |

| 4,853 | | |

| 4.52 | % |

| Securities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable (available for sale) | |

| 116,580 | | |

| 5,920 | | |

| 5.08 | % | |

| 146,407 | | |

| 4,716 | | |

| 3.22 | % |

| Tax-exempt (available for sale) | |

| 33,092 | | |

| 1,124 | | |

| 3.40 | % | |

| 31,883 | | |

| 1,127 | | |

| 3.53 | % |

| Taxable (held to maturity) | |

| 114,484 | | |

| 4,227 | | |

| 3.69 | % | |

| 86,782 | | |

| 3,481 | | |

| 4.01 | % |

| Tax-exempt (held to maturity) | |

| 3,196 | | |

| 84 | | |

| 2.63 | % | |

| 4,152 | | |

| 109 | | |

| 2.63 | % |

| Cash and due from banks | |

| 212,364 | | |

| 10,433 | | |

| 4.91 | % | |

| 138,854 | | |

| 7,317 | | |

| 5.27 | % |

| Total interest-earning assets | |

| 3,962,690 | | |

| 215,383 | | |

| 5.44 | % | |

| 3,738,589 | | |

| 194,346 | | |

| 5.20 | % |

| Noninterest-earning assets | |

| 442,615 | | |

| | | |

| | | |

| 452,676 | | |

| | | |

| | |

| Allowance for credit losses - loans | |

| (44,836 | ) | |

| | | |

| | | |

| (43,406 | ) | |

| | | |

| | |

| Total assets | |

$ | 4,360,469 | | |

| | | |

| | | |

$ | 4,147,859 | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing deposits | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Checking accounts | |

$ | 403,854 | | |

$ | 10,524 | | |

| 2.61 | % | |

$ | 290,050 | | |

$ | 6,010 | | |

| 2.07 | % |

| Savings accounts | |

| 817,029 | | |

| 12,202 | | |

| 1.49 | % | |

| 815,261 | | |

| 11,055 | | |

| 1.36 | % |

| Money market accounts | |

| 633,964 | | |

| 15,168 | | |

| 2.39 | % | |

| 669,633 | | |

| 15,209 | | |

| 2.27 | % |

| Certificates of deposit | |

| 633,261 | | |

| 26,918 | | |

| 4.25 | % | |

| 561,888 | | |

| 20,038 | | |

| 3.57 | % |

| Brokered Deposits | |

| 20,085 | | |

| 816 | | |

| 4.06 | % | |

| 747 | | |

| 17 | | |

| 2.28 | % |

| Total interest-bearing deposits | |

| 2,508,193 | | |

| 65,628 | | |

| 2.62 | % | |

| 2,337,579 | | |

| 52,329 | | |

| 2.24 | % |

| Other borrowed funds | |

| 147,416 | | |

| 6,745 | | |

| 4.58 | % | |

| 89,291 | | |

| 10,148 | | |

| 11.37 | % |

| Total interest-bearing liabilities | |

| 2,655,609 | | |

| 72,373 | | |

| 2.73 | % | |

| 2,426,870 | | |

| 62,477 | | |

| 2.57 | % |

| Noninterest-bearing liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Demand Deposits | |

| 1,037,501 | | |

| | | |

| | | |

| 1,068,449 | | |

| | | |

| | |

| Other liabilities | |

| 33,222 | | |

| | | |

| | | |

| 39,296 | | |

| | | |

| | |

| Total Liabilities | |

| 3,726,332 | | |

| | | |

| | | |

| 3,534,615 | | |

| | | |

| | |

| Shareholders' equity | |

| 634,137 | | |

| | | |

| | | |

| 613,244 | | |

| | | |

| | |

| Total liabilities & shareholders' equity | |

$ | 4,360,469 | | |

| | | |

| | | |

$ | 4,147,859 | | |

| | | |

| | |

| Net interest income on a fully taxable | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| equivalent basis | |

| | | |

| 143,010 | | |

| | | |

| | | |

| 131,869 | | |

| | |

| Less taxable equivalent adjustment | |

| | | |

| (1,538 | ) | |

| | | |

| | | |

| (1,279 | ) | |

| | |

| Net interest income | |

| | | |

$ | 141,472 | | |

| | | |

| | | |

$ | 130,590 | | |

| | |

| Net interest spread (3) | |

| | | |

| | | |

| 2.71 | % | |

| | | |

| | | |

| 2.62 | % |

| Net interest margin (4) | |

| | | |

| | | |

| 3.61 | % | |

| | | |

| | | |

| 3.53 | % |

(1) Annualized on a fully taxable equivalent basis calculated using a federal tax rate of 21%.

(2) Nonaccrual loans are included in average amounts outstanding.

(3) Represents the difference

between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities.

(4) Represents net interest income on a fully tax equivalent basis as a percentage of average interest-earning assets.

Bank First Corporation

Average assets, liabilities and stockholders' equity, and average rates earned or paid

| | |

Year ended | |

| | |

December 31, 2024 | | |

December 31, 2023 | |

| | |

Average Balance | | |

Interest Income/ Expenses (1) | | |

Rate Earned/ Paid (1) | | |

Average Balance | | |

Interest Income/ Expenses (1) | | |

Rate Earned/ Paid (1) | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(dollars in thousands) | |

| ASSETS | |

| | |

| | |

| | |

| | |

| | |

| |

| Interest-earning assets | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans (2) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable | |

$ | 3,310,890 | | |

$ | 184,853 | | |

| 5.58 | % | |

$ | 3,172,468 | | |

$ | 165,113 | | |

| 5.20 | % |

| Tax-exempt | |

| 111,467 | | |

| 5,258 | | |

| 4.72 | % | |

| 103,957 | | |

| 4,686 | | |

| 4.51 | % |

| Securities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable (available for sale) | |

| 129,832 | | |

| 6,146 | | |

| 4.73 | % | |

| 185,867 | | |

| 5,851 | | |

| 3.15 | % |

| Tax-exempt (available for sale) | |

| 33,204 | | |

| 1,130 | | |

| 3.40 | % | |

| 36,690 | | |

| 1,195 | | |

| 3.26 | % |

| Taxable (held to maturity) | |

| 108,849 | | |

| 4,242 | | |

| 3.90 | % | |

| 71,908 | | |

| 2,678 | | |

| 3.72 | % |

| Tax-exempt (held to maturity) | |

| 3,435 | | |

| 90 | | |

| 2.62 | % | |

| 4,426 | | |

| 115 | | |

| 2.60 | % |

| Cash, due from banks and other | |

| 111,379 | | |

| 6,046 | | |

| 5.43 | % | |

| 79,822 | | |

| 4,104 | | |

| 5.14 | % |

| Total interest-earning assets | |

| 3,809,056 | | |

| 207,765 | | |

| 5.45 | % | |

| 3,655,138 | | |

| 183,742 | | |

| 5.03 | % |

| Noninterest-earning assets | |

| 443,691 | | |

| | | |

| | | |

| 447,934 | | |

| | | |

| | |

| Allowance for loan losses | |

| (44,511 | ) | |

| | | |

| | | |

| (41,714 | ) | |

| | | |

| | |

| Total assets | |

$ | 4,208,236 | | |

| | | |

| | | |

$ | 4,061,358 | | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing deposits | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Checking accounts | |

$ | 401,990 | | |

$ | 11,132 | | |

| 2.77 | % | |

$ | 293,568 | | |

$ | 5,363 | | |

| 1.83 | % |

| Savings accounts | |

| 816,410 | | |

| 12,240 | | |

| 1.50 | % | |

| 833,360 | | |

| 9,796 | | |

| 1.18 | % |

| Money market accounts | |

| 616,964 | | |

| 14,880 | | |

| 2.41 | % | |

| 665,988 | | |

| 12,722 | | |

| 1.91 | % |

| Certificates of deposit | |

| 613,593 | | |

| 25,613 | | |

| 4.17 | % | |

| 509,273 | | |

| 14,396 | | |

| 2.83 | % |

| Brokered Deposits | |

| 7,662 | | |

| 303 | | |

| 3.95 | % | |

| 3,184 | | |

| 90 | | |

| 2.83 | % |

| Total interest-bearing deposits | |

| 2,456,619 | | |

| 64,168 | | |

| 2.61 | % | |

| 2,305,373 | | |

| 42,367 | | |

| 1.84 | % |

| Other borrowed funds | |

| 98,241 | | |

| 4,437 | | |

| 4.52 | % | |

| 97,384 | | |

| 6,637 | | |

| 6.82 | % |

| Total interest-bearing liabilities | |

| 2,554,860 | | |

| 68,605 | | |

| 2.69 | % | |

| 2,402,757 | | |

| 49,004 | | |

| 2.04 | % |

| Noninterest-bearing liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Demand Deposits | |

| 1,000,772 | | |

| | | |

| | | |

| 1,078,468 | | |

| | | |

| | |

| Other liabilities | |

| 32,820 | | |

| | | |

| | | |

| 10,533 | | |

| | | |

| | |

| Total Liabilities | |

| 3,588,452 | | |

| | | |

| | | |

| 3,491,758 | | |

| | | |

| | |

| Stockholders' equity | |

| 619,784 | | |

| | | |

| | | |

| 569,600 | | |

| | | |

| | |

| Total liabilities & stockholders' equity | |

$ | 4,208,236 | | |

| | | |

| | | |

$ | 4,061,358 | | |

| | | |

| | |

Net interest income on a fully taxable

equivalent basis | |

| | | |

| 139,160 | | |

| | | |

| | | |

| 134,738 | | |

| | |

| Less taxable equivalent adjustment | |

| | | |

| (1,360 | ) | |

| | | |

| | | |

| (1,259 | ) | |

| | |

| Net interest income | |

| | | |

$ | 137,800 | | |

| | | |

| | | |

$ | 133,479 | | |

| | |

| Net interest spread (3) | |

| | | |

| | | |

| 2.77 | % | |

| | | |

| | | |

| 2.99 | % |

| Net interest margin (4) | |

| | | |

| | | |

| 3.65 | % | |

| | | |

| | | |

| 3.69 | % |

(1) Annualized on a fully taxable equivalent basis calculated using a federal tax rate of 21%.

(2) Nonaccrual loans are included in average amounts outstanding.

(3) Represents the difference

between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities.

(4) Represents net interest income on a fully tax equivalent basis as a percentage of average interest-earning assets.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

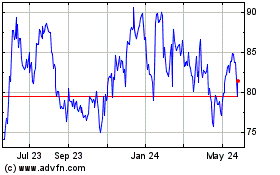

Bank First (NASDAQ:BFC)

Historical Stock Chart

From Dec 2024 to Jan 2025

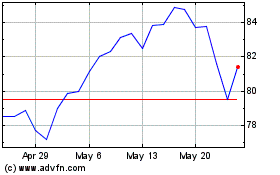

Bank First (NASDAQ:BFC)

Historical Stock Chart

From Jan 2024 to Jan 2025