UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number 001-39001

Blue

Hat Interactive Entertainment Technology

(Translation of registrant’s

name into English)

7th Floor, Building C, No. 1010 Anling Road

Huli District, Xiamen, China 361009

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒

Form 40-F ☐

Entry into a Material Definitive Agreement

On August 29, 2024, Blue Hat Interactive Entertainment

Technology (“BHAT” or the “Company”) issued a press release announcing that on August 28, 2024, the Company has

entered into a purchase agreement (the “Purchase Agreement”) with Macau Rongxin Precious Metals Technology Co., Ltd. (“Macau

Rongxin”), a company registered in Macau with registration number: 86918(SO), pursuant to which Macau Rongxin has delivered to BHAT

1,000-kilogram (approximately 2,204.62 pounds) of gold. This Purchase Agreement and delivery follow the framework agreement BHAT and Macau

Rongxin signed on October 26, 2023.

The purchase price of the gold Macau Rongxin delivered

to BHAT is approximately $66.49 per gram, for a total purchase price of approximately $66.49 million. The Company is paying the purchase

price to Macau Rongxin in cash, over multiple installments. The Company expects to use the purchased gold in the development and expansion

of its gold supply chain business, providing gold to refineries, wholesalers, and retailers.

The closing of the purchase of gold according to the

Purchase Agreement is subject to the satisfaction or waiver of certain customary closing conditions, including BHAT’s testing of

the quality of the gold delivered. The Purchase Agreement contains customary representations, warranties and covenants of the parties.

Forward Looking Statements

This communication contains forward looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward looking statements generally relate to future events or the Company’s future financial or operating performance.

In some cases, you can identify forward looking statements because they contain words such as “may,” “will,” “should,”

“expects,” “plans,” “anticipates,” “going to,” “could,” “intends,”

“target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,”

“potential” or “continue” or the negative of these words or other similar terms or expressions that concern the

Company’s expectations, strategy, priorities, plans or intentions. Forward-looking statements in this communication include, but

are not limited to, the potential closing of the transaction described in this communication, the timing of such closing, the potential

use of the proceeds, and the growth prospects of the Company. Such statements are based upon management’s current expectations and

current market and operating conditions, and relate to events that involve known or unknown risks, uncertainties and other factors, all

of which are difficult to predict and many of which are beyond the Company’s control, which may cause the Company’s actual

results, performance or achievements to differ materially from those in the forward-looking statements. The forward looking statements

contained in this communication are also subject to other risks and uncertainties, including those more fully described in the Company’s

filings with the Securities and Exchange Commission (“SEC”), including in the Company’s Form 20-F for the year ended

December 31, 2023, and in its subsequent filings with the SEC, copies of which are available on our website and on the SEC’s website

at www.sec.gov. All information contained in this communication is based on information available to the Company as of the date hereof,

and the Company disclaims any obligation to update any such information, except as required by law.

This Form 6-K and Exhibit 99.1 to this Form 6-K shall

be deemed to be filed with the Securities and Exchange Commission and incorporated by reference into the Company’s registration

statement on Form F-3 (File No. 333-274893), and shall be a part thereof, to the extent not superseded by documents or reports subsequently

filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 11, 2024

| |

BLUE

HAT INTERACTIVE ENTERTAINMENT TECHNOLOGY |

| |

|

| |

By: |

/s/

Xiaodong Chen |

| |

|

Name:

Xiaodong Chen |

| |

|

Title:

Chief Executive Officer |

| |

|

|

Exhibit 10.1

Sales Agreement

Party A (seller):

Address:

Contact Person:

Contact phone

number:

Party B (purchaser):

Address:

Contact Person:

Contact phone

number:

According to the provisions of

the Civil Code of the People’s Republic of China and relevant laws and regulations, Party A and Party B, based on the principles

of voluntariness, equality and fairness, and through friendly consultation between the two parties, have reached the following agreement

on the purchase of gold products from Party B to Party A, and have entered into the present agreement for mutual observance.

I. List of products purchased and sold

As mutually confirmed by Party

A and Party B, the details of the gold products purchased by Party B are as follows:

| Product |

fineness |

Weight (grams) |

Unit price (yuan/gram) |

Amount of goods (dollars) |

| gold bullion |

99.99% |

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| Total amount of goods: ¥ ,(Upper case) RMB yuan |

II.

Payment for goods and settlement of payments

1.

Total amount of goods

Party A and Party B confirm that the total

amount of the payment for this shipment is: ¥ (Upper case: RMB yuan)

。

2. Delivery and payment of goods

Party B shall pay the payment for

the goods to Party A in accordance with this Agreement, and the payment methods include but are not limited to stocks, accounts receivable

and so on.

After Party B receives the goods

delivered by Party A, Party B shall inspect the specification, weight and color of the goods, and Party B’s acceptance confirmation

shall be deemed to have completed the delivery of the goods after acceptance.

III. Designation of bank accounts by the parties

1. Party A’s account information

Bank account name:

Bank account number:

Account opening bank:

2. Party B’s account information

Bank account name:

Bank account number:

Account opening bank:

IV. Product acceptance

When Party A delivers the goods,

Party B accepts the gold products in accordance with this agreement. If there is any objection, it should be raised before signing the

acceptance, and after Party B signs the acceptance, it is regarded as the products are accepted. If Party B refuses to accept the goods

without reasonable reasons, it is regarded as Party B’s default. The total amount of goods and the total amount of payment shall

be subject to the actual acceptance. If A and B disagree on the color and weight of the delivered goods, it is agreed that the National

Jewelry and Jade Quality Supervision and Inspection Center will do a third-party inspection on the samples jointly designated by A and

B, and the report issued by the inspection department shall be the final test result.

V. Changes

to the agreement

During the term of the agreement,

if either party undergoes a change of circumstances (including, but not limited to, merger, demerger, reorganization of assets, change

of major shareholders or de facto controllers, deterioration of business conditions, change of ability to pay, etc.), the counterparty

shall have the right to request it to provide the appropriate written materials for clarification, and may, depending on the circumstances,

change the content of the agreement and enter into a supplemental agreement.

VI. Dispute resolution

Both parties in the process of

fulfillment of the agreement, such as the occurrence of disputes, can be resolved through consultation, the consultation fails, either

party can be sued in the people’s court in the location of the Party.

VII. validity

clause and others

1、This

agreement shall come into effect on the date when the legal representatives of A and B sign and stamp the official seal.

2、This

Agreement shall be executed in duplicate, one for each party, and shall have the same legal effect.

3、The

correspondence, faxes, telephone recordings, email records, microblogging records and related “warehouse receipt”, “gold

product acceptance confirmation”, etc. confirmed by both parties will be regarded as part of this agreement and have the effect

of the agreement.

4、Understanding

matters, both parties may sign a separate supplemental agreement by consensus; the supplemental agreement has the same legal effect as

this agreement.

(No text below)

Attachment: Confirmation of Acceptance

of Gold Products

Party A (stamp):

Legal representative (signature):

Date of signing:

Party B (stamp):

Legal representative (signature):

Date of signing:

Attachment:

Gold Product Acceptance Confirmation

To:

We have received the gold products

delivered by you according to the “No.”, the color of which is: , the total amount of kilograms (capitalized: kilograms).

We have counted and inspected the

above gold products delivered by your company, and their varieties, colors, specifications, quantities, packaging, etc. are in full compliance

with the agreement.

The aforesaid gold products were

delivered to us by your company on , .

| We hereby confirm. |

|

| |

Company (official stamp): |

| |

|

| |

|

| |

Legal representative (signature and stamp): |

| |

|

| |

Handler: |

| |

Date: |

4/4

EXHIBIT 99.1

Blue Hat Announced Execution of $66.49 Million Gold

Acquisition

Hong Kong, August 29th, 2024 —

Blue Hat Interactive Entertainment Technology (“BHAT” or the “Company”) (NASDAQ: BHAT) announced the execution

of a 1,000-kilogram (approximately 2,204.62 pounds) gold delivery, officially marking the launch of its gold supply chain business. This

delivery follows the framework agreement signed in October 2023 with Macau Rongxin Precious Metals Technology Co., Ltd. (“Macau

Rongxin”), a company registered in Macau with registration number: 86918(SO).

The spot price for gold at the time of the October

2023 framework agreement was approximately $61.14 per gram, while the spot price for gold as of August 28, 2024 is approximately $80.61

per gram. The purchase price of the gold delivered to BHAT is approximately $66.49 per gram, for a total purchase price of approximately$66.49

million. This acquisition is a strategic move to develop a gold supply chain business. BHAT plans to leverage this gold in gold supply

chain business, providing gold to refineries, wholesalers, and retailers, thereby generating revenue and establishing a robust presence

in the gold business.

Chen Xiaodong, CEO of BHAT, commented, “The

completion of this significant gold delivery represents a crucial advancement for BHAT in the bulk commodity trading sector. This milestone

not only underscores our commitment to expanding our presence in the international market but also strengthens our financial position.

We anticipate that this success will drive further growth and unlock additional opportunities for the Company.”

The Company believes that the proceeds from this delivery

will enhance its financial flexibility, enabling further expansion within the precious metals market. BHAT remains focused on innovation

and operational efficiency as it continues to explore new market opportunities to bolster its competitive standing.

Forward-Looking Statements:

This release contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions

concerning future events or future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking

statements, which are only predictions and speak only as of the date hereof. In evaluating such statements, prospective investors should

review carefully various risks and uncertainties identified in this release and matters set in the Company’s SEC filings, including

its Annual Report on Form 20-F. These risks and uncertainties could cause the Company’s actual results to differ materially from

those indicated in the forward-looking statements.

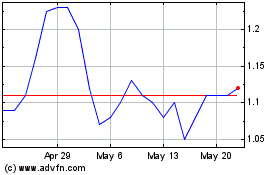

Blue Hat Interactive Ent... (NASDAQ:BHAT)

Historical Stock Chart

From Mar 2025 to Apr 2025

Blue Hat Interactive Ent... (NASDAQ:BHAT)

Historical Stock Chart

From Apr 2024 to Apr 2025