Biora Therapeutics, Inc. (Nasdaq: BIOR), the biotech company

reimagining therapeutic delivery, today provided a corporate update

and reported financial results for the third quarter ended

September 30, 2024. The company will not host a conference

call.

“We’ve made much faster progress than anticipated developing a

smaller BioJet device that is highly desired by pharma companies,”

said Adi Mohanty, Chief Executive Officer of Biora Therapeutics.

“We recently presented initial animal data on our 00-size, clinical

BioJet device. We were able to increase device capacity while

decreasing overall size, giving BioJet the largest payload capacity

of anything in the ingestible injectables category, and further

increasing the number of drugs that can be delivered.”

“The rapid development allowed us to reassess our partnering

strategy, making the decision to shift from a co-development model

to a focus on licensing the 00-size clinical BioJet device. We

expect to pursue licensing agreements within multiple verticals in

the near term, which we believe is preferable to a single

co-development partner for a period of time. There has been

tremendous interest from our pharma collaborators, both existing

and new parties, and our capacity for testing various molecules

during Q1 is starting to fill up. We continue to believe, based on

our extensive engagement with many pharma companies, that BioJet is

the category-leading technology for oral delivery of

macromolecules. We look forward to testing in a more advanced

animal model during Q4 and enabling progress into IND-enabling

studies,” stated Mr. Mohanty.

“Regarding our NaviCap platform, following a successful Phase 1

trial of BT-600, our team has concluded that the results may

support proceeding to a larger clinical trial in ulcerative colitis

patients, instead of the smaller Phase 1B trial we had been

planning. We are working to facilitate the proper regulatory

interactions to determine the next steps for this program,”

continued Mr. Mohanty.

“We are working with our noteholders and investors to

potentially increase the company’s capitalization with the goal of

maintaining our Nasdaq listing status after December 9. We

appreciate the support of many of these investors as they have

continued to provide funds to progress our programs, although their

commitment cannot be guaranteed going forward. We are actively

engaged with many parties regarding strategic alternatives and plan

to provide a more detailed update soon,” stated Mr. Mohanty.

Third Quarter 2024 and Recent Highlights

NaviCap™ Targeted Oral Delivery Platform and BT-600 in

ulcerative colitis

- Presented Phase 1 Clinical

Trial Data at ACG 2024. Biora presented a summary of the

Phase 1 clinical trial results for BT-600 at the American College

of Gastroenterology Annual Meeting, receiving a Presidential Poster

Award from ACG for high quality, novel research. The poster can be

viewed on the company’s website.

BioJet™ Systemic Oral Delivery Platform Preclinical

Development

- Smaller, 00-Size BioJet Clinical Device. Biora

recently announced a smaller version of the BioJet device based on

market research indicating strong patient preference for a smaller,

00-size capsule. The smaller device uses the same core technology

of internal, liquid jet injection that has been proven in over 30

animal studies to date.

- Payload capacity was increased while

decreasing the overall size of the device from a 000-size capsule

to a 00-size. The BioJet device now has a payload capacity of over

300 microliters, enabling delivery of upwards of 50 milligram

doses, even for molecules that are difficult to concentrate, such

as antibodies.

- The 00-size BioJet device is designed

to be more easily tested in non-human primates. It has also been

designed for compatibility with human clinical trial requirements

and ease of automated manufacturing, including sterile fill and

finish. Biora’s clinical and regulatory experience with the NaviCap

platform informed this work and helped to streamline BioJet

development.

- Biora has tested the trigger function

of the 00-size device on the bench as well as in animals, achieving

almost 100% device performance. The company is now conducting

further animal studies to confirm complete device function with a

test molecule.

Other Matters

- Recent Financings.

Biora partially drew down the facility put in place in August with

its lead investors and complemented this funding source with

approximately $4M in equity raises through registered direct and

ATM program routes.

- Nasdaq Compliance.

Biora received an extension to December 9 from Nasdaq to comply

with the market value of securities requirement. No further

extensions are available beyond that date. The company is in active

negotiations with its lead investors to increase the company’s

capitalization.

- Operating Expenses.

Biora recently realigned its resources to focus on its BioJet

program to ensure it can deliver in the short term the results

needed by large pharma collaborators to progress licensing and

partnering discussions. The company was able to reduce operating

expenses and effective operating cash burn by about 40%, to less

than $2.5 million per month on a going forward basis.

Anticipated Milestones

- Biora anticipates sharing data from

additional canine studies with the double-zero size BioJet device

during Q4 2024.

- Biora plans to perform studies of the

double-zero Biora device with its own molecules in non-human

primates during Q4 2024.

- The company anticipates announcing an

additional expanded collaboration agreement to test the double-zero

BioJet device in primates during Q4 2024.

- Testing of collaborators’ molecules in

primates is anticipated to begin in early 2025, with that round of

testing completed during Q1 2025.

Third Quarter 2024 Financial Results

Comparison of Three Months Ended September 30, 2024

and June 30, 2024

Operating expenses were $16.3 million for the three months ended

September 30, 2024, including $1.3 million in non-cash

stock-based compensation expenses, compared to $16.1 million for

the three months ended June 30, 2024, including $1.6 million in

non-cash stock-based compensation expenses.

Net loss was $18.4 million, including non-cash items of $4.0

million attributable to an extinguishment loss and the change in

fair value of warrant and derivative liabilities, and a gain from

discontinued operations of $3.8 million, while net loss per share

was $5.04 for the three months ended September 30, 2024,

compared to net income of $6.5 million, including non-cash items of

$22.8 million attributable to the change in fair value of warrant

and derivative liabilities, while diluted net loss per share was

$0.35 for the three months ended June 30, 2024.

Comparison of Three Months Ended September 30, 2024

and 2023

Operating expenses were $16.3 million for the three months ended

September 30, 2024, including $1.3 million in non-cash

stock-based compensation expenses, compared to $23.3 million for

the three months ended September 30, 2023, including $10.5

million in non-cash stock-based compensation expenses, primarily

attributable to a one-time charge of approximately $9.0 million

related to vesting of employees' restricted stock units (RSUs) in

2023.

Net loss was $18.4 million, net of non-cash items of $4.0

million attributable to the change in fair value of warrant and

derivative liabilities, and a gain from discontinued operations of

$3.8 million, while net loss per share was $5.04 for the three

months ended September 30, 2024, compared to a net loss of

$73.5 million, including non-cash items of $62.2 million

attributable to an inducement loss of $53.2 million and a one-time

stock-based compensation charge noted above, while net loss per

share was $48.89 for the three months ended September 30,

2023.

About Biora TherapeuticsBiora Therapeutics is a

clinical-stage biotech company developing two smart pill-based

therapeutics platforms: the NaviCap™ platform for colon-targeted

treatment of IBD, designed to improve patient outcomes through

treatment at the site of disease in the gastrointestinal tract, and

the BioJet™ platform for oral delivery of large molecules, designed

to replace injection with needle-free, oral

delivery.

For more information, visit bioratherapeutics.com or follow the

company on LinkedIn or Twitter.

Safe Harbor Statement or Forward-Looking

StatementsThis press release contains “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995, which

statements are subject to substantial risks and uncertainties and

are based on estimates and assumptions. All statements, other than

statements of historical facts included in this press release,

including statements concerning the progress and future

expectations and goals of our research and development, preclinical

and clinical trial activities, and partnering and collaboration

efforts with third parties, are forward-looking statements. In some

cases, you can identify forward-looking statements by terms such as

“envision,” “may,” “might,” “will,” “objective,” “intend,”

“should,” “could,” “can,” “would,” “expect,” “anticipate,”

“forward,” “believe,” “design,” “estimate,” “predict,” “projects,”

“projecting,” “potential,” “plan,” “goal(s),” “target,” or the

negative of these terms, and similar expressions intended to

identify forward-looking statements. These statements reflect our

plans, estimates, and expectations, as of the date of this press

release. These statements involve known and unknown risks,

uncertainties and other factors that could cause our actual results

to differ materially from the forward-looking statements expressed

or implied in this press release. Such risks, uncertainties, and

other factors include, among others, our ability to innovate in the

field of therapeutics, our ability to make future FDA filings and

initiate and execute clinical trials on expected timelines or at

all, our ability to obtain and maintain regulatory approval or

clearance of our products on expected timelines or at all, our

plans to research, develop, and commercialize new products, the

unpredictable relationship between preclinical study results and

clinical study results, our expectations regarding allowed patents

or intended grants to result in issued or granted patents, our

expectations regarding opportunities with current or future

pharmaceutical collaborators or partners, our need of and ability

to raise sufficient capital to achieve our business objectives or

continue our operations, our ability to maintain our listing on the

Nasdaq Global Market or other Nasdaq market by regaining compliance

by the December 9 deadline, the fact that delisting from the Nasdaq

Global Market is a “fundamental change” under the indentures for

our convertible notes triggering an obligation to offer to

repurchase the convertible notes, the fact that we do not have cash

sufficient to repurchase the notes if the noteholders accept such

an offer, and those risks described in “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in our Annual Report on Form 10-K for the

year ended December 31, 2023 filed with the Securities and Exchange

Commission (SEC) and other subsequent documents, including

Quarterly Reports on Form 10-Q, that we file with the SEC.

Biora Therapeutics expressly disclaims any obligation to update

any forward-looking statements whether as a result of new

information, future events or otherwise, except as required by

law.

Investor ContactChuck PadalaManaging Director,

LifeSci AdvisorsIR@bioratherapeutics.com(646) 627-8390

Media ContactLiz RobinsonCG

lifelrobinson@cglife.com

|

Biora Therapeutics, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(Unaudited) |

|

(In thousands, except share and per share

amounts) |

|

|

| |

|

Three Months Ended |

|

|

|

|

September 30,2024 |

|

|

June 302024 |

|

|

Revenues |

|

$ |

32 |

|

|

$ |

318 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

|

|

5,610 |

|

|

|

7,704 |

|

|

Selling, general and administrative |

|

|

10,649 |

|

|

|

8,400 |

|

|

Total operating expenses |

|

|

16,259 |

|

|

|

16,104 |

|

| Loss

from operations |

|

|

(16,227 |

) |

|

|

(15,786 |

) |

|

Interest expense, net |

|

|

(2,016 |

) |

|

|

(711 |

) |

|

Gain on warrant liabilities |

|

|

8,260 |

|

|

|

13,003 |

|

|

Other (expense) income, net |

|

|

(12,279 |

) |

|

|

9,892 |

|

|

(Loss) income before income taxes |

|

|

(22,262 |

) |

|

|

6,398 |

|

| Income

tax benefit |

|

|

(44 |

) |

|

|

(67 |

) |

|

(Loss) income from continuing operations |

|

|

(22,218 |

) |

|

|

6,465 |

|

|

Gain from discontinued operations |

|

|

3,816 |

|

|

|

— |

|

|

Net (loss) income |

|

$ |

(18,402 |

) |

|

$ |

6,465 |

|

| Net

(loss) gain per share from continuing operations: |

|

|

|

|

|

|

|

Basic |

|

$ |

(6.08 |

) |

|

$ |

1.81 |

|

|

Diluted |

|

$ |

(6.08 |

) |

|

$ |

(0.35 |

) |

| Net gain

per share from discontinued operations: |

|

|

|

|

|

|

|

Basic |

|

$ |

1.04 |

|

|

$ |

— |

|

|

Diluted |

|

$ |

1.04 |

|

|

$ |

— |

|

| Net

(loss) gain per share: |

|

|

|

|

|

|

|

Basic |

|

$ |

(5.04 |

) |

|

$ |

1.81 |

|

|

Diluted |

|

$ |

(5.04 |

) |

|

$ |

(0.35 |

) |

| Weighted

average shares outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

3,652,862 |

|

|

|

3,572,017 |

|

|

Diluted |

|

|

3,652,862 |

|

|

|

7,421,597 |

|

|

Biora Therapeutics, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(Unaudited) |

|

(In thousands, except share and per share

amounts) |

| |

| |

|

Three Months

EndedSeptember 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Revenues |

|

$ |

32 |

|

|

$ |

— |

|

|

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

|

|

5,610 |

|

|

|

10,547 |

|

|

Selling, general and administrative |

|

|

10,649 |

|

|

|

12,774 |

|

|

Total operating expenses |

|

|

16,259 |

|

|

|

23,321 |

|

| Loss

from operations |

|

|

(16,227 |

) |

|

|

(23,321 |

) |

|

Interest expense, net |

|

|

(2,016 |

) |

|

|

(2,592 |

) |

|

Gain on warrant liabilities |

|

|

8,260 |

|

|

|

4,568 |

|

|

Other expense, net |

|

|

(12,279 |

) |

|

|

(52,108 |

) |

|

Loss before income taxes |

|

|

(22,262 |

) |

|

|

(73,453 |

) |

| Income

tax (benefit) expense |

|

|

(44 |

) |

|

|

1 |

|

|

Loss from continuing operations |

|

|

(22,218 |

) |

|

|

(73,454 |

) |

|

Gain from discontinued operations |

|

|

3,816 |

|

|

|

— |

|

|

Net loss |

|

$ |

(18,402 |

) |

|

$ |

(73,454 |

) |

| Net loss

per share from continuing operations, basic and diluted |

|

$ |

(6.08 |

) |

|

$ |

(48.89 |

) |

| Net gain

per share from discontinued operations, basic and diluted |

|

$ |

1.04 |

|

|

$ |

— |

|

| Net loss

per share, basic and diluted |

|

$ |

(5.04 |

) |

|

$ |

(48.89 |

) |

| Weighted

average shares outstanding, basic and diluted |

|

|

3,652,862 |

|

|

|

1,502,473 |

|

|

Biora Therapeutics, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(Unaudited) |

|

(In thousands) |

|

|

|

|

|

September 30,2024 |

|

|

December 31,2023 |

|

|

|

|

|

|

|

(1) |

|

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash |

|

$ |

3,196 |

|

|

$ |

15,211 |

|

|

Income tax receivable |

|

|

868 |

|

|

|

830 |

|

|

Prepaid expenses and other current assets |

|

|

1,990 |

|

|

|

3,030 |

|

|

Total current assets |

|

|

6,054 |

|

|

|

19,071 |

|

| Property

and equipment, net |

|

|

1,175 |

|

|

|

1,156 |

|

|

Right-of-use assets |

|

|

1,011 |

|

|

|

1,614 |

|

| Other

assets |

|

|

193 |

|

|

|

3,302 |

|

|

Goodwill |

|

|

6,072 |

|

|

|

6,072 |

|

|

Total assets |

|

$ |

14,505 |

|

|

$ |

31,215 |

|

|

Liabilities and Stockholders' Deficit |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

6,916 |

|

|

$ |

2,843 |

|

|

Accrued expenses and other current liabilities |

|

|

21,404 |

|

|

|

17,319 |

|

|

Warrant liabilities |

|

|

18,688 |

|

|

|

40,834 |

|

|

Convertible notes, net |

|

|

4,527 |

|

|

|

— |

|

|

Senior secured convertible notes, net |

|

|

14,344 |

|

|

|

— |

|

|

Related party senior secured convertible notes, net - current

portion |

|

|

19,721 |

|

|

|

1,976 |

|

|

Derivative liabilities |

|

|

35,018 |

|

|

|

— |

|

|

Total current liabilities |

|

|

120,618 |

|

|

|

62,972 |

|

|

Convertible notes, net |

|

|

— |

|

|

|

9,966 |

|

| Senior

secured convertible notes, net |

|

|

— |

|

|

|

14,591 |

|

| Related

party senior secured convertible notes, net |

|

|

— |

|

|

|

19,179 |

|

|

Derivative liabilities |

|

|

— |

|

|

|

22,899 |

|

| Other

long-term liabilities |

|

|

516 |

|

|

|

3,029 |

|

|

Total liabilities |

|

$ |

121,134 |

|

|

$ |

132,636 |

|

|

Stockholders' deficit: |

|

|

|

|

|

|

|

Common stock |

|

|

3 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

|

879,530 |

|

|

|

868,613 |

|

|

Accumulated deficit |

|

|

(967,084 |

) |

|

|

(950,958 |

) |

|

Treasury stock |

|

|

(19,078 |

) |

|

|

(19,078 |

) |

|

Total stockholders' deficit |

|

|

(106,629 |

) |

|

|

(101,421 |

) |

|

Total liabilities and stockholders' deficit |

|

$ |

14,505 |

|

|

$ |

31,215 |

|

|

|

|

|

|

|

|

|

|

|

| (1) The condensed

consolidated balance sheet data as of December 31, 2023 has

been derived from the audited consolidated financial

statements |

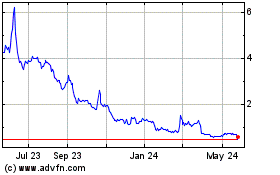

Biora Therapeutics (NASDAQ:BIOR)

Historical Stock Chart

From Jan 2025 to Feb 2025

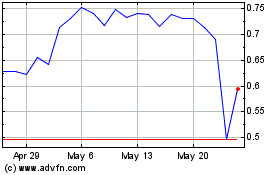

Biora Therapeutics (NASDAQ:BIOR)

Historical Stock Chart

From Feb 2024 to Feb 2025